444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia health insurance market represents a complex and evolving landscape that combines mandatory state insurance with voluntary private coverage options. This comprehensive healthcare financing system serves over 146 million citizens across the vast Russian Federation, making it one of the largest health insurance markets in Eastern Europe. The market operates through a dual structure featuring the Mandatory Health Insurance (MHI) system alongside a growing private health insurance sector that caters to premium healthcare services.

Market dynamics in Russia’s health insurance sector are characterized by significant government involvement, with the state-funded system covering basic medical services for the entire population. However, the private segment has been experiencing robust growth at approximately 8.5% annually, driven by increasing consumer awareness and demand for enhanced healthcare services. The market encompasses various insurance products including individual policies, corporate group coverage, and specialized medical insurance for specific demographics.

Digital transformation has become a key driver in the Russian health insurance market, with insurers investing heavily in technology platforms to improve service delivery and claims processing. The integration of telemedicine services and digital health monitoring has gained particular momentum, especially following recent global health challenges. This technological evolution has contributed to improved customer satisfaction rates reaching approximately 72% across major insurance providers.

The Russia health insurance market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks designed to provide healthcare financing and coverage to Russian citizens and residents. This market encompasses both mandatory government-sponsored insurance programs and voluntary private insurance offerings that supplement basic healthcare coverage with premium services and enhanced medical care options.

Fundamental components of this market include risk assessment mechanisms, premium collection systems, healthcare provider networks, and claims management processes. The market operates under strict regulatory oversight from the Russian Ministry of Health and the Central Bank of Russia, ensuring compliance with national healthcare policies and financial stability requirements. Insurance providers range from large state-affiliated organizations to private commercial insurers offering specialized coverage products.

Coverage scope within the Russian health insurance market extends beyond basic medical services to include preventive care, emergency treatment, specialized therapies, and increasingly, digital health services. The market serves diverse customer segments including individual consumers, corporate clients, and government entities, each with specific coverage requirements and service expectations.

Strategic positioning of the Russia health insurance market reflects a mature yet evolving sector that balances universal healthcare access with growing demand for premium medical services. The market demonstrates strong fundamentals with consistent growth in private insurance adoption, reaching approximately 15.2% of the population holding supplementary private coverage. This growth trajectory is supported by increasing disposable income levels and heightened health awareness among Russian consumers.

Key market characteristics include the dominance of the mandatory health insurance system, which provides universal coverage, alongside a dynamic private sector that offers value-added services. Major insurance providers have been expanding their service portfolios to include wellness programs, preventive care initiatives, and digital health solutions. The market has shown remarkable resilience and adaptability, particularly in response to changing healthcare delivery models and consumer preferences.

Competitive landscape features a mix of established state-affiliated insurers and innovative private companies competing on service quality, coverage breadth, and technological capabilities. The market has witnessed significant consolidation activities, with larger players acquiring smaller regional insurers to expand their geographical reach and service capabilities. This consolidation trend has contributed to improved operational efficiency and enhanced customer service standards across the industry.

Primary market insights reveal several critical trends shaping the Russia health insurance landscape. The following key observations provide strategic understanding of market dynamics:

Economic prosperity serves as a fundamental driver for the Russia health insurance market, with rising disposable income levels enabling more consumers to invest in supplementary health coverage. The growing middle class demonstrates increasing willingness to pay for premium healthcare services, driving demand for comprehensive insurance products that offer enhanced medical care options and reduced waiting times for specialized treatments.

Demographic transitions significantly influence market dynamics, particularly the aging population trend that increases healthcare utilization rates. Russia’s demographic profile shows a growing proportion of elderly citizens requiring more frequent and specialized medical care, creating sustained demand for comprehensive health insurance coverage. This demographic shift has prompted insurers to develop age-specific products and services tailored to senior healthcare needs.

Healthcare infrastructure development across Russia has created opportunities for insurance market expansion. Government investments in medical facilities, equipment modernization, and healthcare professional training have improved service quality and accessibility. These improvements make health insurance more attractive to consumers who can access better healthcare services through their coverage, driving market growth and product diversification.

Technological advancement in healthcare delivery has become a significant market driver, with telemedicine, digital diagnostics, and remote monitoring services gaining popularity. Insurance providers are adapting their coverage models to include these innovative healthcare solutions, attracting tech-savvy consumers who value convenient and efficient medical services. The integration of artificial intelligence and data analytics in healthcare has also improved risk assessment and personalized insurance offerings.

Economic volatility presents significant challenges for the Russia health insurance market, with currency fluctuations and economic sanctions affecting consumer purchasing power and insurance affordability. Economic uncertainties can lead to reduced discretionary spending on voluntary health insurance, particularly among middle-income households who may prioritize essential expenses over supplementary healthcare coverage during challenging economic periods.

Regulatory complexity creates operational challenges for insurance providers, with frequent policy changes and compliance requirements increasing administrative costs and operational complexity. The evolving regulatory landscape requires continuous adaptation of business processes and systems, potentially limiting market entry for smaller players and increasing barriers to innovation in product development and service delivery.

Healthcare system limitations in certain regions constrain market growth potential, particularly in rural and remote areas where medical infrastructure remains underdeveloped. Limited healthcare provider networks and specialized medical services in these regions reduce the value proposition of health insurance, limiting market penetration and growth opportunities for insurance companies seeking nationwide expansion.

Consumer skepticism regarding private health insurance value remains a market restraint, with some consumers questioning the necessity of supplementary coverage given the existence of the mandatory health insurance system. This skepticism is often reinforced by negative experiences with claims processing or limited understanding of insurance benefits, requiring significant educational efforts and transparent communication from insurance providers.

Digital health integration presents substantial opportunities for Russia health insurance market expansion, with growing consumer acceptance of telemedicine and remote healthcare services. Insurance providers can capitalize on this trend by developing comprehensive digital health platforms that combine insurance coverage with convenient healthcare access, creating differentiated value propositions that attract modern consumers seeking integrated health solutions.

Corporate wellness programs represent a significant growth opportunity as Russian companies increasingly recognize the importance of employee health and productivity. Insurance providers can develop specialized corporate packages that include preventive care, wellness initiatives, and occupational health services, tapping into the growing corporate social responsibility trend and employer demand for comprehensive employee benefits.

Specialized coverage segments offer opportunities for market differentiation and premium pricing, including coverage for specific medical conditions, alternative medicine, mental health services, and medical tourism. These niche markets allow insurance providers to develop expertise in specialized areas while serving underserved customer segments with tailored products and services.

Regional expansion opportunities exist in underserved markets where health insurance penetration remains low but economic development is accelerating. Insurance providers can establish strategic partnerships with regional healthcare providers and leverage technology to deliver cost-effective insurance solutions to emerging markets, expanding their customer base and market presence.

Competitive intensity in the Russia health insurance market has increased significantly as providers compete for market share through service innovation, pricing strategies, and customer experience improvements. This competition has led to enhanced product offerings, improved claims processing efficiency, and expanded healthcare provider networks, ultimately benefiting consumers through better service quality and more comprehensive coverage options.

Regulatory influence continues to shape market dynamics through policy reforms aimed at improving healthcare accessibility and quality while maintaining system sustainability. Recent regulatory changes have focused on standardizing insurance products, improving transparency in pricing and coverage terms, and enhancing consumer protection measures. These regulatory developments create both opportunities and challenges for market participants.

Technology disruption is transforming traditional insurance operations through automation, artificial intelligence, and data analytics applications. Insurance providers are leveraging these technologies to improve risk assessment accuracy, streamline claims processing, and develop personalized insurance products. The adoption of blockchain technology for secure data management and smart contracts for automated claims processing represents emerging technological trends.

Consumer behavior evolution reflects changing expectations regarding healthcare access, service quality, and insurance value. Modern consumers demand transparent pricing, quick claims resolution, and comprehensive coverage options that align with their lifestyle preferences. This behavioral shift has prompted insurance providers to redesign their service delivery models and invest in customer relationship management systems.

Comprehensive analysis of the Russia health insurance market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves direct engagement with industry stakeholders including insurance providers, healthcare professionals, regulatory officials, and consumers through structured interviews, surveys, and focus group discussions. This primary data collection provides firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses extensive analysis of industry reports, government publications, regulatory documents, and academic studies related to the Russian healthcare and insurance sectors. This research approach includes examination of historical market data, regulatory changes, and industry developments to identify patterns and trends that influence market dynamics. Financial analysis of major insurance providers provides insights into market performance and competitive positioning.

Data validation processes ensure research accuracy through cross-referencing multiple sources and employing statistical analysis techniques to verify findings. Market data is triangulated using different research approaches to confirm trends and projections. Expert interviews with industry professionals provide qualitative insights that complement quantitative data analysis, creating a comprehensive understanding of market dynamics.

Analytical frameworks applied in this research include SWOT analysis, Porter’s Five Forces model, and market segmentation analysis to provide structured insights into market competitiveness and growth potential. These analytical tools help identify key success factors, market entry barriers, and strategic opportunities for industry participants.

Moscow and St. Petersburg represent the most developed health insurance markets in Russia, accounting for approximately 45% of total private health insurance premiums despite representing a smaller portion of the national population. These metropolitan areas demonstrate high insurance penetration rates, sophisticated healthcare infrastructure, and strong consumer purchasing power that supports premium insurance products and services.

Central Federal District beyond Moscow shows moderate health insurance market development with growing demand for private coverage among urban populations. This region benefits from proximity to the capital and relatively developed healthcare infrastructure, creating opportunities for insurance market expansion. Regional centers like Voronezh and Yaroslavl demonstrate increasing insurance adoption rates as economic development accelerates.

Siberian Federal District presents mixed market conditions with strong insurance demand in major cities like Novosibirsk and Yekaterinburg, while rural areas remain underserved. The region’s vast geography and dispersed population create challenges for insurance providers in terms of service delivery and cost management. However, natural resource industries provide opportunities for corporate health insurance programs.

Far Eastern Federal District shows emerging market potential driven by government development initiatives and growing economic activity. The region’s strategic importance for Russia’s economic development has attracted investment in healthcare infrastructure, creating opportunities for insurance market growth. However, the region’s remote location and harsh climate conditions present unique challenges for healthcare delivery and insurance operations.

Market leadership in the Russia health insurance sector is characterized by a mix of large state-affiliated insurers and dynamic private companies competing across different market segments. The competitive landscape reflects the market’s dual nature, with mandatory health insurance dominated by government entities while private voluntary insurance shows more diverse competitive dynamics.

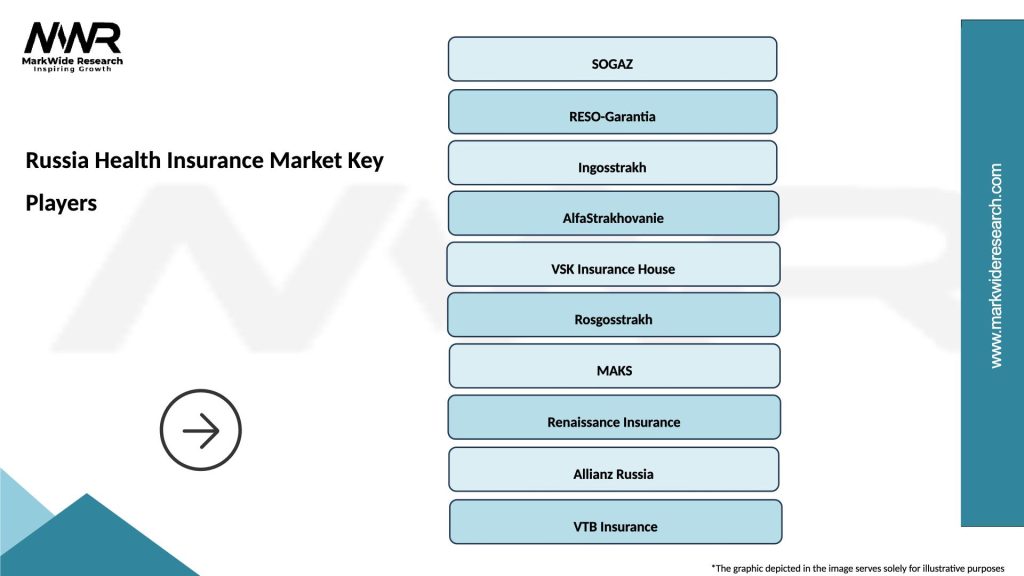

Major market participants include:

Competitive strategies focus on service differentiation, technology integration, and strategic partnerships with healthcare providers. Leading insurers invest heavily in digital platforms, customer service capabilities, and specialized medical programs to maintain competitive advantages. Market consolidation continues as larger players acquire smaller regional insurers to expand market reach and operational efficiency.

By Coverage Type:

By Service Type:

By Demographics:

Mandatory Health Insurance category maintains its position as the foundation of Russia’s healthcare financing system, providing universal coverage that ensures basic medical services accessibility for all citizens. This category demonstrates stability and predictable growth patterns aligned with population demographics and government healthcare spending. The system’s comprehensive coverage includes primary care, emergency services, and essential medical treatments, creating a safety net that supports the entire healthcare ecosystem.

Voluntary Private Insurance category shows the most dynamic growth patterns, with increasing consumer adoption driven by rising income levels and healthcare quality expectations. This segment offers significant opportunities for product innovation, service differentiation, and premium pricing strategies. Private insurers in this category focus on value-added services such as concierge medicine, international treatment options, and wellness programs that appeal to affluent consumers.

Corporate Health Insurance category represents a strategic growth area with approximately 23% annual expansion as Russian companies increasingly recognize employee health benefits as competitive advantages in talent acquisition and retention. This category benefits from stable premium payments, lower administrative costs per covered individual, and opportunities for customized coverage programs that align with specific industry needs and corporate wellness initiatives.

Digital Health Insurance category emerges as an innovative segment combining traditional insurance coverage with technology-enabled healthcare services. This category includes telemedicine coverage, digital health monitoring, and AI-powered health assessment tools that appeal to tech-savvy consumers seeking convenient and efficient healthcare access. The category shows strong growth potential as digital health adoption accelerates across Russia.

Insurance Providers benefit from diverse revenue opportunities across multiple market segments, enabling risk diversification and sustainable business growth. The market’s dual structure provides stability through mandatory insurance participation while offering growth potential through voluntary coverage expansion. Providers can leverage technology investments to improve operational efficiency and develop innovative products that command premium pricing.

Healthcare Providers gain from improved payment certainty and reduced administrative burden through streamlined insurance reimbursement processes. Insurance partnerships enable healthcare providers to expand their patient base, invest in advanced medical equipment, and offer specialized services that might not be economically viable without insurance coverage support. These partnerships also facilitate quality improvement initiatives and patient outcome optimization.

Consumers benefit from enhanced healthcare access, financial protection against medical expenses, and improved service quality through competitive market dynamics. Insurance coverage provides peace of mind and enables proactive healthcare management through preventive care coverage and wellness programs. Consumers also benefit from expanded healthcare options and reduced out-of-pocket expenses for medical treatments.

Government Stakeholders benefit from private sector participation that supplements public healthcare funding and improves overall system efficiency. The private insurance market reduces pressure on government healthcare budgets while maintaining universal coverage principles. Government benefits include improved healthcare outcomes, increased tax revenue from insurance industry growth, and enhanced public health through expanded coverage options.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital health integration represents the most significant trend transforming the Russia health insurance market, with insurers investing heavily in telemedicine platforms, mobile health applications, and AI-powered health assessment tools. This trend has accelerated dramatically, with digital service adoption increasing by approximately 60% among insurance providers. The integration of wearable health devices and remote monitoring systems enables insurers to offer personalized coverage and preventive care programs.

Preventive care emphasis has become a central trend as insurers recognize the cost benefits of early health intervention and wellness programs. Insurance providers are expanding coverage for preventive services, health screenings, and lifestyle management programs. This trend aligns with growing consumer health consciousness and government public health initiatives, creating opportunities for innovative wellness-focused insurance products.

Corporate wellness programs show increasing sophistication as employers seek comprehensive health benefit packages to attract and retain talent. These programs now include mental health support, fitness programs, nutritional counseling, and stress management services. The trend toward holistic employee wellness creates opportunities for insurers to develop integrated health and wellness solutions that address diverse employee needs.

Personalized insurance products are emerging as insurers leverage data analytics and artificial intelligence to develop customized coverage options based on individual health profiles and risk factors. This trend enables more accurate pricing, improved customer satisfaction, and better health outcomes through targeted interventions and personalized care recommendations.

Regulatory modernization initiatives have introduced new standards for insurance product transparency, claims processing efficiency, and consumer protection measures. Recent regulatory developments include streamlined licensing procedures for insurance providers, standardized coverage terminology, and enhanced dispute resolution mechanisms. These changes aim to improve market competitiveness while protecting consumer interests and maintaining system stability.

Technology partnerships between insurance providers and healthcare technology companies have accelerated, creating innovative service delivery models and operational efficiencies. Major insurers have established strategic alliances with telemedicine platforms, health data analytics companies, and digital health startups to enhance their service capabilities and market competitiveness.

Market consolidation activities have intensified as larger insurance providers acquire smaller regional companies to expand geographical coverage and operational scale. These consolidation trends have resulted in improved service standardization, enhanced technological capabilities, and more efficient resource allocation across the industry.

International collaboration has increased as Russian insurance providers seek partnerships with global health insurers and medical service providers to offer international coverage options and medical tourism benefits. These collaborations enhance product offerings for affluent consumers and corporate clients requiring global health coverage solutions.

Strategic focus on digital transformation should be prioritized by insurance providers seeking competitive advantages in the evolving market landscape. MarkWide Research analysis indicates that companies investing in comprehensive digital platforms achieve superior customer retention rates and operational efficiency improvements. Insurers should develop integrated digital ecosystems that combine insurance services with healthcare access and wellness management capabilities.

Market expansion strategies should target underserved regional markets where healthcare infrastructure development creates new opportunities for insurance penetration. Companies should consider innovative service delivery models that leverage technology to overcome geographical barriers and provide cost-effective coverage options to emerging market segments.

Product innovation efforts should focus on developing specialized coverage options for niche market segments including mental health services, alternative medicine, and chronic disease management. These specialized products can command premium pricing while serving underserved customer needs and creating competitive differentiation in the marketplace.

Partnership development with healthcare providers, technology companies, and corporate clients should be prioritized to create integrated value propositions that enhance customer experience and operational efficiency. Strategic partnerships enable resource sharing, risk distribution, and market access expansion while reducing individual company investment requirements.

Market evolution in the Russia health insurance sector points toward continued growth driven by economic development, demographic changes, and technological advancement. MWR projections indicate the private health insurance segment will maintain strong growth momentum with annual expansion rates exceeding 7.2% over the next five years. This growth will be supported by increasing consumer awareness, corporate adoption, and government policies promoting private sector participation in healthcare financing.

Technology integration will accelerate across all market segments, with artificial intelligence, blockchain technology, and Internet of Things applications transforming insurance operations and customer experiences. Digital health platforms will become standard offerings, enabling insurers to provide comprehensive health management services beyond traditional coverage models. The integration of predictive analytics will improve risk assessment accuracy and enable proactive health intervention programs.

Regulatory environment is expected to continue evolving toward greater market liberalization while maintaining consumer protection standards. Future regulatory changes may include expanded coverage requirements, standardized quality metrics, and enhanced data protection measures. These regulatory developments will create both opportunities and challenges for market participants requiring adaptive business strategies.

Market maturation will lead to increased specialization and segmentation as providers focus on specific customer demographics, coverage types, or geographical regions. This specialization trend will drive innovation in product development, service delivery, and customer relationship management, creating opportunities for companies that can effectively serve niche market segments with tailored solutions.

The Russia health insurance market presents a dynamic and evolving landscape characterized by strong fundamentals, growing consumer demand, and significant technological transformation opportunities. The market’s dual structure, combining universal mandatory coverage with expanding voluntary private insurance, creates a stable foundation for sustained growth while offering numerous opportunities for innovation and market differentiation.

Key success factors for market participants include strategic technology investments, customer-centric service development, and adaptive business models that respond to changing consumer preferences and regulatory requirements. The market’s growth trajectory remains positive, supported by demographic trends, economic development, and increasing health consciousness among Russian consumers.

Future market development will be shaped by continued digital transformation, regulatory modernization, and evolving consumer expectations for comprehensive health management solutions. Companies that successfully integrate technology, develop specialized products, and build strategic partnerships will be best positioned to capitalize on emerging opportunities and achieve sustainable competitive advantages in this dynamic market environment.

What is Health Insurance?

Health insurance is a type of insurance coverage that pays for medical and surgical expenses incurred by the insured. In Russia, health insurance can be provided by both public and private entities, covering a range of services from routine check-ups to emergency care.

What are the key players in the Russia Health Insurance Market?

Key players in the Russia Health Insurance Market include SOGAZ, VTB Insurance, and Rosgosstrakh, which offer various health insurance products tailored to individual and corporate needs, among others.

What are the main drivers of the Russia Health Insurance Market?

The main drivers of the Russia Health Insurance Market include the increasing demand for quality healthcare services, a growing awareness of health risks, and the expansion of private health insurance options. Additionally, government initiatives to improve healthcare access contribute to market growth.

What challenges does the Russia Health Insurance Market face?

The Russia Health Insurance Market faces challenges such as regulatory complexities, varying levels of public trust in private insurers, and disparities in healthcare access across different regions. These factors can hinder the growth and effectiveness of health insurance coverage.

What opportunities exist in the Russia Health Insurance Market?

Opportunities in the Russia Health Insurance Market include the potential for digital health solutions, the rise of telemedicine, and the increasing trend of corporate health insurance plans. These developments can enhance service delivery and expand market reach.

What trends are shaping the Russia Health Insurance Market?

Trends shaping the Russia Health Insurance Market include a shift towards personalized health insurance plans, the integration of technology in health services, and a growing emphasis on preventive care. These trends reflect changing consumer preferences and advancements in healthcare delivery.

Russia Health Insurance Market

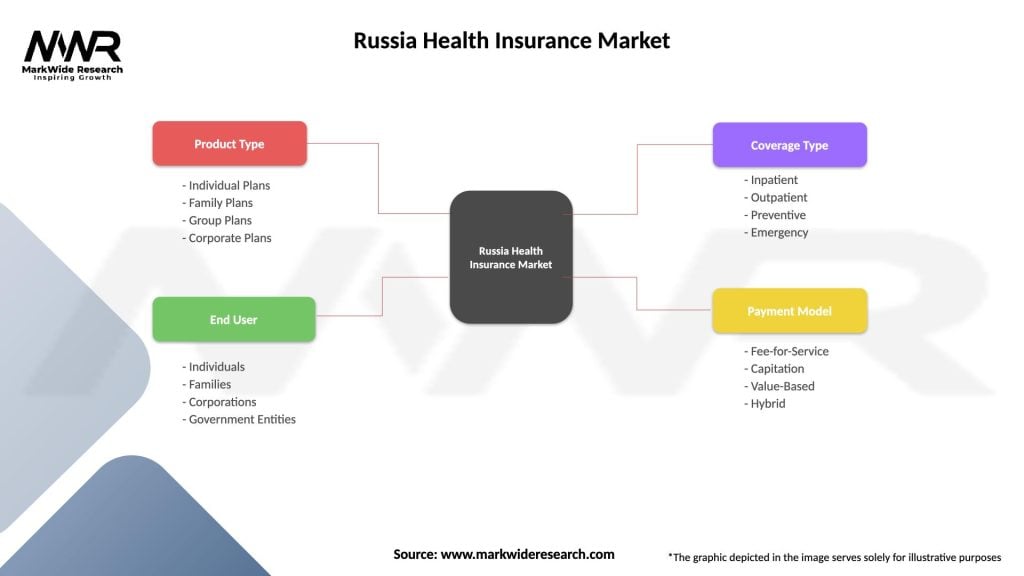

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Family Plans, Group Plans, Corporate Plans |

| End User | Individuals, Families, Corporations, Government Entities |

| Coverage Type | Inpatient, Outpatient, Preventive, Emergency |

| Payment Model | Fee-for-Service, Capitation, Value-Based, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Russia Health Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at