444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Russia gas generator market refers to the industry involved in the production, distribution, and utilization of gas generators in the country. Gas generators are devices that convert natural gas or liquefied petroleum gas (LPG) into electrical energy. These generators are widely used in various sectors, including residential, commercial, and industrial, to meet the increasing demand for reliable and continuous power supply.

Meaning

A gas generator is a type of power generation equipment that operates by burning gas fuel, such as natural gas or LPG, to produce electricity. The combustion of gas in the generator’s engine drives an alternator, which generates electrical power. Gas generators are known for their efficiency, reliability, and lower emissions compared to other types of power generation equipment. They are widely used in areas where a constant and uninterrupted power supply is crucial.

Executive Summary

The Russia gas generator market has witnessed significant growth in recent years. The increasing need for reliable and uninterrupted power supply, particularly in remote and off-grid locations, has been a key driver for market growth. Gas generators offer numerous advantages, including lower operational costs, reduced emissions, and easy availability of fuel sources. These factors have contributed to the rising adoption of gas generators across various industries in Russia.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Russia gas generator market is driven by a combination of factors, including the need for reliable power supply, government initiatives, industrial applications, and advancements in technology. While the market offers significant growth opportunities, challenges such as high initial costs, infrastructure limitations, and fluctuating gas prices need to be addressed. However, the increasing focus on clean energy and the emergence of new market segments provide a favorable environment for the growth of the gas generator market in Russia.

Regional Analysis

The Russia gas generator market can be segmented into various regions, including Moscow, Saint Petersburg, Novosibirsk, Yekaterinburg, and others. Moscow and Saint Petersburg account for a significant share of the market due to their large industrial and commercial sectors. These regions have a high demand for gas generators to ensure uninterrupted power supply for various applications. Novosibirsk and Yekaterinburg also contribute to the market growth, driven by the growing industrial activities in these regions.

Competitive Landscape

Leading Companies in Russia Gas Generator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

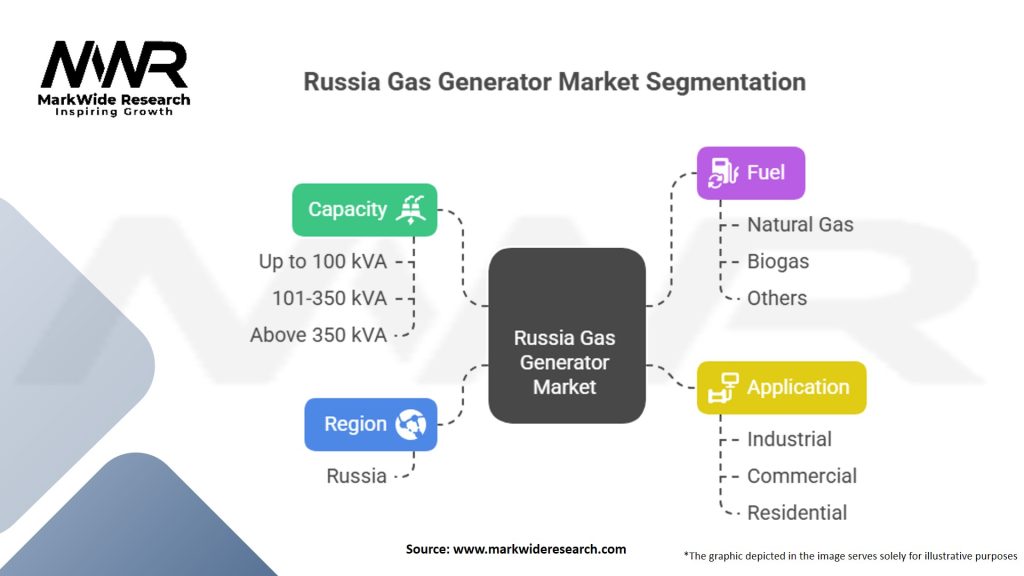

Segmentation

The Russia gas generator market can be segmented based on generator capacity, end-use industry, and fuel type.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had both positive and negative impacts on the Russia gas generator market. On one hand, the increased demand for power in the healthcare sector and essential industries led to a surge in the adoption of gas generators. On the other hand, the economic slowdown, supply chain disruptions, and reduced industrial activities during the lockdowns affected the overall market growth. However, the market has shown resilience, and the recovery is expected to be driven by the gradual easing of restrictions and the resumption of industrial and commercial activities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Russia gas generator market is expected to witness steady growth in the coming years. The increasing demand for reliable power supply, government initiatives promoting clean energy, and the growing industrial and construction sectors are driving market expansion. Technological advancements and the integration of smart technologies will further enhance the efficiency and performance of gas generators. However, manufacturers need to address challenges related to high initial costs and infrastructure limitations. The market’s future outlook remains positive, with opportunities emerging from rural electrification projects, data centers, and the adoption of distributed generation solutions.

Conclusion

The Russia gas generator market is experiencing significant growth, driven by the need for reliable power supply, government support, and advancements in technology. Gas generators offer several benefits, including reliability, cost savings, and environmental sustainability. However, challenges such as high initial costs and infrastructure limitations need to be overcome. The market presents opportunities in rural electrification, construction, and data center applications. Continuous research and development, diversification of fuel options, and strong distribution networks will be key factors for success in the competitive market. Overall, the future of the Russia gas generator market looks promising, with steady growth expected in the coming years.

What is Gas Generator?

A gas generator is a device that converts gas fuel into electrical energy, commonly used for power generation in various applications such as residential, commercial, and industrial settings.

What are the key players in the Russia Gas Generator Market?

Key players in the Russia Gas Generator Market include companies like Gazprom, Caterpillar, and Cummins, which are known for their innovative gas generator solutions and extensive market presence, among others.

What are the main drivers of the Russia Gas Generator Market?

The main drivers of the Russia Gas Generator Market include the increasing demand for reliable power supply, the growth of the oil and gas industry, and the push for cleaner energy solutions.

What challenges does the Russia Gas Generator Market face?

Challenges in the Russia Gas Generator Market include regulatory hurdles, fluctuating fuel prices, and competition from alternative energy sources.

What opportunities exist in the Russia Gas Generator Market?

Opportunities in the Russia Gas Generator Market include advancements in technology, the potential for export to neighboring countries, and the growing trend towards energy efficiency and sustainability.

What trends are shaping the Russia Gas Generator Market?

Trends shaping the Russia Gas Generator Market include the integration of smart technologies, increased focus on emissions reduction, and the development of hybrid systems that combine gas generators with renewable energy sources.

Russia Gas Generator Market

| Segmentation Details | Description |

|---|---|

| Capacity | Up to 100 kVA, 101-350 kVA, Above 350 kVA |

| Fuel | Natural Gas, Biogas, Others |

| Application | Industrial, Commercial, Residential |

| Region | Russia |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Russia Gas Generator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at