444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Russia container glass market represents a significant segment within the country’s packaging industry, driven by robust demand from food and beverage manufacturers, pharmaceutical companies, and cosmetic producers. Container glass manufacturing in Russia has experienced steady growth, supported by increasing domestic consumption and the government’s focus on import substitution policies. The market encompasses various glass packaging solutions including bottles, jars, and specialty containers designed for different industrial applications.

Market dynamics indicate that the Russian container glass sector is experiencing a transformation period, with manufacturers investing in advanced production technologies and sustainable manufacturing processes. The industry benefits from abundant raw material availability, including silica sand and other essential components required for glass production. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 4.2% over the forecast period, driven by increasing demand from the alcoholic beverages sector and growing consumer preference for glass packaging.

Regional distribution shows that approximately 35% of production capacity is concentrated in the Central Federal District, while the Volga Federal District accounts for 28% of manufacturing output. The market’s resilience stems from its ability to serve both domestic consumption needs and export opportunities to neighboring countries, particularly in the Commonwealth of Independent States (CIS) region.

The Russia container glass market refers to the comprehensive ecosystem of manufacturing, distributing, and utilizing glass packaging solutions across various industries within the Russian Federation. This market encompasses the production of glass containers designed for packaging food products, beverages, pharmaceuticals, cosmetics, and industrial chemicals. Container glass specifically includes bottles, jars, vials, and other hollow glass products manufactured through automated production processes.

Market participants include glass manufacturers, raw material suppliers, packaging converters, and end-user industries that rely on glass containers for product packaging and preservation. The market operates within a complex supply chain that begins with raw material extraction and processing, continues through glass melting and forming operations, and concludes with finished container distribution to various industrial sectors.

Russia’s container glass market demonstrates remarkable stability and growth potential despite challenging economic conditions and international sanctions. The market benefits from strong domestic demand, particularly from the food and beverage industry, which accounts for approximately 72% of total glass container consumption. Manufacturing capabilities have been strengthened through strategic investments in modern production equipment and energy-efficient technologies.

Key market drivers include the growing preference for sustainable packaging solutions, increasing alcohol consumption, and the expansion of the pharmaceutical industry. The market has shown resilience through import substitution initiatives, with domestic production meeting approximately 85% of local demand. Export activities contribute significantly to market growth, with Russian glass containers gaining acceptance in international markets due to competitive pricing and quality improvements.

Technological advancement remains a critical factor, with manufacturers adopting automated production lines and implementing quality control systems that meet international standards. The market outlook remains positive, supported by government policies promoting domestic manufacturing and increasing consumer awareness about environmental sustainability.

Strategic analysis reveals several critical insights that define the Russia container glass market landscape:

Consumer preference shifts toward sustainable packaging solutions represent the primary driver for Russia’s container glass market growth. Environmental consciousness among Russian consumers has increased significantly, with glass containers perceived as premium, recyclable packaging that preserves product quality and safety. Food safety regulations have become more stringent, favoring glass containers due to their non-reactive properties and ability to maintain product integrity over extended periods.

Alcoholic beverage consumption continues to drive substantial demand for glass bottles, particularly in the vodka, beer, and wine segments. The premiumization trend in alcoholic beverages has led to increased demand for specialty glass containers with unique designs and enhanced aesthetic appeal. Pharmaceutical industry expansion creates additional demand for specialized glass vials and containers that meet strict regulatory requirements for drug packaging and storage.

Import substitution policies implemented by the Russian government have created favorable conditions for domestic glass manufacturers. These policies encourage local production and reduce dependence on imported packaging materials, providing market protection and growth opportunities for Russian container glass producers. Export market development has opened new revenue streams, with Russian glass containers gaining acceptance in neighboring countries due to competitive pricing and improving quality standards.

Energy cost volatility represents a significant challenge for Russia’s container glass industry, as glass manufacturing is highly energy-intensive. Fluctuating natural gas and electricity prices directly impact production costs and profit margins, forcing manufacturers to implement energy efficiency measures and explore alternative energy sources. Raw material price fluctuations also create operational challenges, particularly for specialized glass types requiring imported additives and colorants.

International sanctions have limited access to advanced glass manufacturing equipment and technology from Western suppliers, slowing modernization efforts and technological advancement. This constraint has forced manufacturers to seek alternative suppliers or develop domestic capabilities, which often requires significant time and investment. Competition from alternative packaging materials, particularly plastic containers and flexible packaging, poses ongoing challenges in certain market segments where cost considerations outweigh environmental benefits.

Transportation costs and logistics challenges affect market competitiveness, especially for export operations. The vast geographical expanse of Russia creates distribution challenges and increases delivery costs to remote regions. Skilled labor shortages in specialized glass manufacturing processes limit production capacity expansion and quality improvement initiatives across the industry.

Circular economy initiatives present substantial opportunities for Russian container glass manufacturers to develop closed-loop recycling systems and sustainable production practices. Government support for environmental protection creates favorable conditions for investments in recycling infrastructure and eco-friendly manufacturing processes. Premium packaging demand in luxury goods and craft beverage segments offers opportunities for specialized glass container production with higher profit margins.

Export market expansion to Asia-Pacific countries represents significant growth potential, particularly in markets where Russian glass containers can compete effectively on price and quality. Strategic partnerships with international distributors and packaging companies could facilitate market entry and establish long-term business relationships. Technology partnerships with domestic research institutions and universities could accelerate innovation in glass formulations and manufacturing processes.

E-commerce growth creates new packaging requirements for safe product delivery, opening opportunities for specialized glass containers designed for online retail applications. Pharmaceutical market expansion driven by healthcare sector development offers opportunities for high-value specialty glass products including vaccine vials and precision dosing containers.

Supply chain integration has become increasingly important in Russia’s container glass market, with manufacturers establishing closer relationships with raw material suppliers and end-user industries. This integration helps stabilize costs, ensure consistent quality, and improve delivery reliability. Technological innovation drives competitive differentiation, with companies investing in advanced furnace designs, automated production systems, and quality control technologies.

Market consolidation continues as larger manufacturers acquire smaller regional players to achieve economies of scale and expand geographical coverage. This consolidation trend strengthens the competitive position of major players while creating challenges for independent manufacturers. Customer relationship management has evolved to focus on long-term partnerships rather than transactional relationships, with manufacturers providing technical support and customized solutions.

Regulatory compliance requirements continue to evolve, particularly in food safety and environmental protection areas. Manufacturers must invest in compliance systems and documentation to meet changing regulatory standards while maintaining operational efficiency. Market intelligence and data analytics have become critical capabilities for understanding customer needs, optimizing production schedules, and identifying new market opportunities.

Comprehensive market analysis for the Russia container glass market employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included structured interviews with industry executives, manufacturing managers, and key stakeholders across the glass packaging value chain. Survey data was collected from over 150 market participants including manufacturers, distributors, and end-user companies.

Secondary research encompassed analysis of industry reports, government statistics, trade association data, and company financial statements. Historical market data spanning five years was analyzed to identify trends, growth patterns, and cyclical variations. Market modeling techniques were applied to project future market scenarios and validate growth assumptions through multiple analytical approaches.

Data triangulation methods ensured consistency between different information sources and research approaches. Expert validation sessions with industry professionals confirmed key findings and provided additional insights into market dynamics. Quantitative analysis focused on production statistics, trade data, and financial performance metrics, while qualitative research explored market trends, competitive strategies, and future opportunities.

Central Federal District dominates Russia’s container glass market with the highest concentration of manufacturing facilities and consumption centers. This region benefits from proximity to major metropolitan areas, well-developed transportation infrastructure, and access to skilled labor. Moscow and surrounding areas account for approximately 22% of total market demand, driven by high population density and concentrated industrial activity.

Volga Federal District represents the second-largest regional market, characterized by strong industrial base and strategic location for serving both domestic and export markets. The region’s glass manufacturers benefit from competitive energy costs and access to raw materials. Nizhny Novgorod region has emerged as a significant production hub with modern manufacturing facilities and export capabilities.

Northwestern Federal District shows strong growth potential, particularly in the St. Petersburg area, where proximity to Baltic ports facilitates export operations. The region’s manufacturers focus on high-quality products for premium market segments. Siberian Federal District represents an emerging market with growing demand from local food and beverage industries, though transportation costs remain a challenge for market development.

Southern Federal District benefits from agricultural processing industries that require glass packaging for food products. The region’s strategic location provides access to export markets in the Middle East and Central Asia, creating additional growth opportunities for local manufacturers.

Market leadership in Russia’s container glass industry is characterized by a mix of large integrated manufacturers and specialized regional producers. The competitive environment has intensified as companies invest in modernization and capacity expansion to capture growing market opportunities.

Competitive strategies focus on technological advancement, cost optimization, and customer service excellence. Companies are investing in automated production systems, energy-efficient furnaces, and quality control technologies to maintain competitive advantages. Strategic partnerships with raw material suppliers and end-user industries have become increasingly important for securing long-term business relationships and market stability.

By Product Type:

By End-Use Industry:

By Glass Type:

Food and Beverage Containers represent the largest category within Russia’s container glass market, driven by consumer preference for glass packaging in premium food products. This segment benefits from growing demand for organic and natural food products that require non-reactive packaging materials. Innovation trends include lightweight bottle designs, enhanced barrier properties, and improved aesthetic appeal to support brand differentiation strategies.

Alcoholic Beverage Packaging continues to show strong performance, particularly in the premium spirits and craft beer segments. Russian vodka manufacturers increasingly prefer high-quality glass bottles that enhance product presentation and brand image. Export opportunities in this category have expanded as Russian alcoholic beverages gain international recognition and market acceptance.

Pharmaceutical Glass Containers represent a high-growth, high-value category with stringent quality requirements and regulatory compliance needs. The segment benefits from healthcare sector expansion and increasing demand for specialized drug delivery systems. Technical specifications for pharmaceutical glass require advanced manufacturing capabilities and quality control systems that create barriers to entry for smaller manufacturers.

Cosmetics and Personal Care packaging shows strong growth potential as Russian consumers increasingly prefer premium beauty products. This category emphasizes aesthetic appeal, unique designs, and brand differentiation through packaging innovation. Market trends include sustainable packaging solutions and refillable container systems that align with environmental consciousness.

Manufacturers benefit from strong domestic demand, government support for import substitution, and growing export opportunities. Access to abundant raw materials and competitive energy costs provide operational advantages compared to international competitors. Investment opportunities in modernization and capacity expansion offer potential for significant returns as market demand continues to grow.

Raw Material Suppliers enjoy stable demand from glass manufacturers and opportunities to develop specialized materials for high-value applications. Long-term supply contracts provide revenue predictability and support business planning initiatives. Technology providers find opportunities to supply advanced manufacturing equipment and automation systems as manufacturers modernize their operations.

End-User Industries benefit from reliable supply of high-quality glass containers, competitive pricing, and improved customer service from domestic suppliers. Reduced dependence on imports provides supply chain stability and cost predictability. Logistics and Transportation companies benefit from increased domestic production and growing export activities that generate additional freight volumes.

Government and Regulatory Bodies achieve policy objectives including import substitution, industrial development, and environmental protection through a strong domestic container glass industry. Tax revenues and employment creation contribute to regional economic development goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has become a dominant trend in Russia’s container glass market, with manufacturers implementing circular economy principles and increasing recycled content in new products. Companies are investing in energy-efficient production technologies and waste reduction initiatives to meet environmental objectives and reduce operational costs. Consumer awareness about environmental issues drives demand for sustainable packaging solutions across all market segments.

Digital Transformation is reshaping manufacturing operations through implementation of Industry 4.0 technologies, automated quality control systems, and predictive maintenance programs. These technologies improve production efficiency, reduce defect rates, and enable real-time monitoring of manufacturing processes. Data analytics applications help optimize production schedules, inventory management, and customer service delivery.

Customization and Personalization trends are driving demand for unique glass container designs that support brand differentiation strategies. Manufacturers are developing flexible production capabilities to accommodate smaller batch sizes and specialized requirements. Design innovation focuses on lightweight containers, enhanced functionality, and aesthetic appeal that meets evolving consumer preferences.

Supply Chain Localization continues as companies seek to reduce dependence on imported materials and components. This trend creates opportunities for domestic suppliers and supports the development of integrated supply chains within Russia. Strategic partnerships between manufacturers and suppliers are becoming more common to ensure supply security and cost competitiveness.

Capacity Expansion Projects have been announced by several major manufacturers, with investments focused on modern production facilities and advanced manufacturing technologies. These projects aim to meet growing domestic demand and expand export capabilities. Modernization initiatives include furnace upgrades, automation systems, and quality control improvements that enhance competitiveness.

Strategic Acquisitions and partnerships have reshaped the competitive landscape, with larger companies acquiring regional manufacturers to expand geographical coverage and market share. These consolidation activities create synergies and improve operational efficiency across the industry. Technology licensing agreements with domestic research institutions support innovation and technology development initiatives.

Export Market Development has accelerated with Russian manufacturers establishing distribution networks in neighboring countries and emerging markets. Trade agreements and diplomatic relationships facilitate market access and business development activities. Quality certifications and international standard compliance have improved market acceptance and competitive positioning.

Sustainability Initiatives include investments in recycling infrastructure, energy-efficient production technologies, and environmental management systems. Companies are setting ambitious targets for carbon footprint reduction and waste minimization. Circular economy projects focus on closed-loop recycling systems and sustainable raw material sourcing.

MarkWide Research analysis indicates that Russian container glass manufacturers should prioritize technology modernization and quality improvement initiatives to enhance competitiveness in both domestic and international markets. Investment in automated production systems and quality control technologies will be essential for meeting evolving customer requirements and regulatory standards.

Market diversification strategies should focus on developing high-value specialty segments including pharmaceutical packaging and premium consumer goods containers. These segments offer better profit margins and growth potential compared to commodity glass containers. Export market development requires sustained investment in quality systems, customer service capabilities, and international marketing initiatives.

Sustainability integration should be accelerated through investments in recycling infrastructure, energy-efficient technologies, and environmental management systems. Companies that lead in sustainability will gain competitive advantages and access to environmentally conscious customer segments. Supply chain optimization through vertical integration and strategic partnerships will improve cost competitiveness and supply security.

Innovation capabilities should be strengthened through partnerships with research institutions, technology licensing agreements, and internal R&D investments. Focus areas should include lightweight container designs, enhanced barrier properties, and smart packaging technologies that add value for end users.

Market growth prospects for Russia’s container glass industry remain positive, supported by strong domestic demand, government policy support, and expanding export opportunities. MWR projections indicate sustained growth across key market segments, with particular strength in premium packaging applications and pharmaceutical containers. The industry is expected to benefit from continued import substitution initiatives and increasing consumer preference for sustainable packaging solutions.

Technology advancement will drive industry transformation over the forecast period, with manufacturers adopting advanced production systems, automation technologies, and digital management platforms. These investments will improve operational efficiency, product quality, and customer service capabilities. Innovation focus will shift toward specialized glass formulations, lightweight designs, and smart packaging features that enhance product functionality.

Export market expansion represents a significant growth opportunity, with Russian glass containers expected to gain market share in neighboring countries and emerging markets. Quality improvements and competitive pricing will support international market penetration. Regional market development within Russia will continue as transportation infrastructure improves and regional economies expand.

Sustainability trends will reshape industry practices, with circular economy principles becoming standard operating procedures. Companies that successfully integrate environmental considerations into their business strategies will achieve competitive advantages and access to premium market segments. Regulatory evolution will continue to emphasize environmental protection and product safety, requiring ongoing compliance investments and operational adjustments.

Russia’s container glass market demonstrates strong fundamentals and promising growth prospects despite challenging external conditions. The industry benefits from abundant raw materials, competitive energy costs, and supportive government policies that favor domestic production. Market dynamics indicate sustained demand growth across key segments, with particular strength in food and beverage packaging, pharmaceutical containers, and premium consumer goods applications.

Competitive positioning continues to improve as manufacturers invest in modernization, quality enhancement, and customer service capabilities. The industry’s focus on sustainability, innovation, and export market development creates multiple pathways for future growth and profitability. Strategic opportunities exist for companies that can successfully navigate technological transformation while maintaining cost competitiveness and operational excellence.

The long-term outlook for Russia’s container glass market remains positive, supported by demographic trends, economic development, and evolving consumer preferences that favor glass packaging solutions. Success in this market will require continued investment in technology, quality systems, and market development initiatives that position Russian manufacturers as reliable suppliers of high-quality glass containers for both domestic and international customers.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Russia Container Glass Market?

Key players in the Russia Container Glass Market include companies like Rusnano, Saint-Gobain, and OOO Glass, which are involved in the production and distribution of container glass products, among others.

What are the growth factors driving the Russia Container Glass Market?

The growth of the Russia Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and the growing trend of eco-friendly consumer behavior.

What challenges does the Russia Container Glass Market face?

The Russia Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and regulatory pressures regarding environmental sustainability.

What opportunities exist in the Russia Container Glass Market?

Opportunities in the Russia Container Glass Market include the expansion of the e-commerce sector, innovations in glass recycling technologies, and the increasing popularity of premium glass packaging among consumers.

What trends are shaping the Russia Container Glass Market?

Trends in the Russia Container Glass Market include a shift towards lightweight glass containers, the adoption of smart packaging technologies, and a growing emphasis on reducing carbon footprints in production processes.

Russia Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Tumblers |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Grade | Recycled, Soda-Lime, Borosilicate, Lead Glass |

| Application | Packaging, Storage, Transportation, Display |

Please note: The segmentation can be entirely customized to align with our client’s needs.

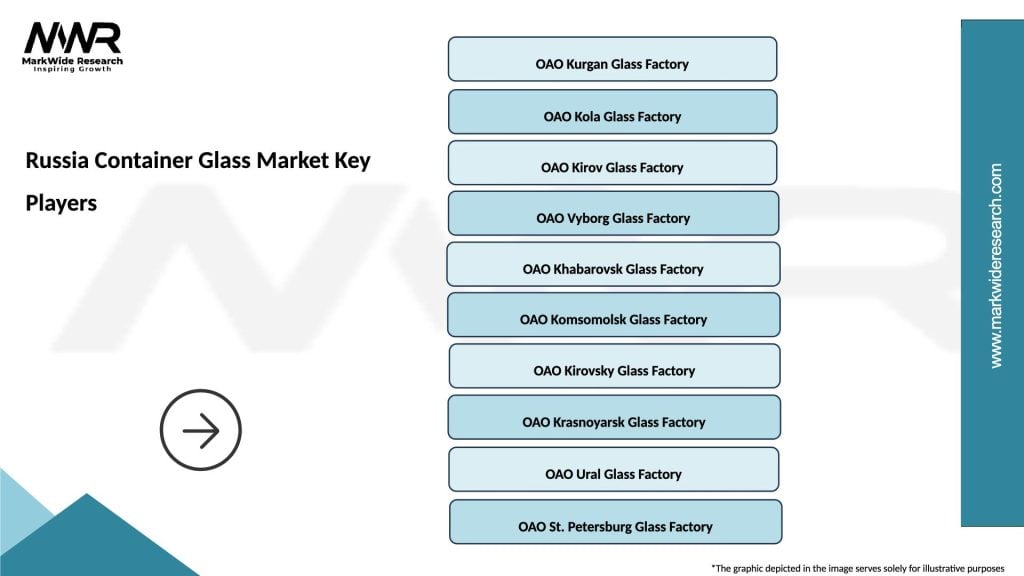

Leading companies in the Russia Container Glass Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at