444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Romania oil and gas downstream market represents a critical component of the country’s energy infrastructure, encompassing refining, petrochemicals, distribution, and retail operations. Romania’s downstream sector has undergone significant transformation over the past decade, driven by modernization efforts, regulatory changes, and increasing integration with European Union energy policies. The market demonstrates robust growth potential with expanding refining capacity and enhanced distribution networks across the country.

Market dynamics indicate that Romania’s downstream operations are experiencing a period of strategic realignment, with major investments in refinery upgrades and environmental compliance measures. The sector benefits from Romania’s strategic geographic position, serving as a crucial energy hub connecting Western Europe with the Black Sea region. Refining capacity utilization has improved significantly, reaching approximately 78% efficiency rates across major facilities, while distribution infrastructure continues expanding to meet growing domestic and regional demand.

Industry consolidation has characterized recent market developments, with international energy companies strengthening their presence through strategic acquisitions and partnerships. The downstream market encompasses various segments including petroleum refining, petrochemical production, fuel distribution, and retail marketing operations. Environmental regulations and sustainability initiatives are increasingly shaping investment decisions and operational strategies throughout the Romanian downstream sector.

The Romania oil and gas downstream market refers to the comprehensive network of industrial processes, infrastructure, and commercial activities involved in refining crude oil and natural gas into finished petroleum products, their subsequent distribution, and retail sale to end consumers. This market encompasses all stages from initial refining operations through final product delivery to automotive, industrial, and residential customers throughout Romania and neighboring regions.

Downstream operations include petroleum refining facilities that convert crude oil into gasoline, diesel, heating oil, and other refined products, along with petrochemical plants producing plastics, fertilizers, and specialty chemicals. The market also covers extensive distribution networks including pipelines, storage terminals, truck transport systems, and retail fuel stations. Value chain integration connects upstream production with end-user consumption, creating a complex ecosystem of interconnected facilities and services.

Market participants range from large integrated oil companies operating major refineries to independent distributors and retail fuel station operators. The downstream sector plays a vital role in Romania’s energy security, economic development, and regional energy trade relationships within the broader European energy market framework.

Romania’s downstream market demonstrates strong fundamentals supported by strategic geographic advantages, modernized infrastructure, and growing regional energy demand. The market has experienced substantial improvements in operational efficiency and environmental compliance, positioning Romanian facilities as competitive players in the European energy landscape. Refinery modernization programs have enhanced processing capabilities while reducing environmental impact through advanced technologies and cleaner production methods.

Investment trends show continued commitment to infrastructure development, with major projects focused on expanding storage capacity, upgrading distribution networks, and enhancing retail operations. The market benefits from Romania’s EU membership, providing access to integrated European energy markets and regulatory frameworks that support long-term stability and growth. Demand patterns reflect both domestic consumption growth and increasing export opportunities to neighboring countries.

Competitive dynamics feature a mix of international energy majors and domestic companies, creating a balanced market structure that promotes innovation and efficiency improvements. According to MarkWide Research analysis, the sector demonstrates resilience against market volatility while maintaining steady growth trajectories across key operational segments. Future prospects remain positive, supported by ongoing infrastructure investments and favorable regulatory environment.

Strategic positioning within European energy networks provides Romania’s downstream sector with significant competitive advantages and growth opportunities. The following key insights characterize current market conditions:

Economic growth across Romania and neighboring regions drives increased demand for refined petroleum products, supporting downstream market expansion. Rising industrial activity, transportation sector growth, and improving living standards contribute to steady consumption increases across multiple product categories. Infrastructure development projects throughout the region create additional demand for construction-related petroleum products and industrial chemicals.

European Union integration provides access to larger markets while establishing regulatory frameworks that support long-term investment and operational planning. EU energy policies promote market liberalization and competition, creating opportunities for efficient operators to expand market share. Environmental regulations drive investments in cleaner technologies and processes, positioning compliant facilities for sustained competitive advantages.

Geographic advantages position Romania as a strategic energy hub connecting European markets with Black Sea and Eastern European regions. The country’s location enables cost-effective transportation and distribution to multiple markets, supporting both domestic operations and export activities. Government support for energy sector development through favorable policies and investment incentives encourages continued market growth and modernization efforts.

Technology advancement enables improved operational efficiency, reduced environmental impact, and enhanced product quality throughout downstream operations. Digital transformation initiatives optimize supply chain management, inventory control, and customer service delivery systems. Strategic partnerships between international companies and domestic operators facilitate knowledge transfer and capital investment in market development.

Regulatory complexity associated with EU environmental standards and safety requirements creates compliance costs and operational challenges for downstream operators. Stringent emissions standards and waste management regulations require significant investments in pollution control equipment and monitoring systems. Permitting processes for new facilities and major modifications can be lengthy and complex, potentially delaying project implementation and market entry.

Capital intensity of downstream operations requires substantial financial resources for facility construction, equipment upgrades, and ongoing maintenance activities. High investment requirements can limit market entry opportunities for smaller companies and constrain expansion plans during periods of economic uncertainty. Price volatility in crude oil and natural gas markets creates margin pressure and planning challenges for downstream operators.

Infrastructure constraints in certain regions limit distribution efficiency and market access, particularly for rural and remote areas. Aging pipeline networks and storage facilities require ongoing maintenance and eventual replacement, creating additional capital expenditure requirements. Competition from alternative energy sources, including renewable fuels and electric vehicles, may impact long-term demand growth for traditional petroleum products.

Environmental concerns and public opposition to fossil fuel infrastructure can complicate project approval processes and increase operational costs. Climate change policies and carbon pricing mechanisms may affect the economic viability of certain downstream operations. Skilled workforce shortages in technical and engineering positions can constrain operational efficiency and expansion capabilities.

Petrochemical expansion presents significant growth opportunities as demand for plastics, chemicals, and specialty products continues increasing across European markets. Integration of petrochemical production with existing refining operations can improve overall facility economics and product diversification. Export market development to neighboring countries and regions offers potential for increased throughput and revenue generation.

Renewable fuel integration creates opportunities to blend biofuels and other sustainable products with traditional petroleum products, meeting environmental requirements while maintaining market relevance. Investment in renewable fuel production capabilities positions downstream operators for future market transitions. Digital transformation initiatives can optimize operations, reduce costs, and improve customer service delivery across all market segments.

Strategic acquisitions and partnerships enable market consolidation and operational synergies that enhance competitive positioning. Smaller operators may benefit from integration with larger companies that provide capital resources and technical expertise. Infrastructure modernization projects supported by EU funding programs create opportunities for facility upgrades and capacity expansion.

Regional energy hub development leverages Romania’s geographic advantages to serve broader European and international markets. Enhanced storage and transportation infrastructure can support increased transit operations and trading activities. Specialty product development in high-value segments such as lubricants, aviation fuels, and industrial chemicals offers improved profit margins and market differentiation opportunities.

Supply chain integration throughout Romania’s downstream sector creates complex interdependencies between refining, distribution, and retail operations. Market participants must balance operational efficiency with supply security while managing inventory levels and transportation logistics. Demand seasonality affects different product segments, with heating fuels showing winter peaks and gasoline demand typically higher during summer months.

Competitive pressures drive continuous improvement in operational efficiency, customer service, and cost management across all market segments. Companies invest in technology upgrades, process optimization, and workforce development to maintain competitive advantages. Price dynamics reflect both international commodity markets and local supply-demand conditions, creating opportunities for efficient operators while challenging less competitive facilities.

Regulatory evolution continues shaping market structure and operational requirements, with increasing emphasis on environmental protection and safety standards. Companies must adapt to changing regulations while maintaining profitability and market position. Investment cycles in downstream infrastructure typically span multiple years, requiring long-term planning and financial commitment from market participants.

Market consolidation trends create opportunities for operational synergies and improved economies of scale, while potentially reducing overall competition in certain segments. MWR data indicates that successful companies focus on operational excellence, strategic positioning, and customer relationship management to achieve sustainable competitive advantages in the evolving market environment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Romania’s oil and gas downstream market. Primary research includes direct interviews with industry executives, operational managers, and key stakeholders across refining, distribution, and retail segments. Secondary research incorporates analysis of government statistics, industry reports, regulatory filings, and company financial statements.

Data collection processes utilize both quantitative and qualitative research approaches to capture market trends, competitive dynamics, and operational performance metrics. Industry surveys and expert consultations provide insights into market challenges, opportunities, and future development prospects. Market modeling techniques analyze historical trends and project future scenarios based on various economic and regulatory assumptions.

Validation procedures ensure data accuracy through cross-referencing multiple sources and expert review processes. Market estimates and projections undergo rigorous verification to maintain research credibility and reliability. Analytical frameworks incorporate industry best practices and established research methodologies to provide comprehensive market understanding.

Continuous monitoring of market developments, regulatory changes, and industry announcements ensures research findings remain current and relevant. Regular updates and revisions maintain the accuracy of market assessments and forecasts throughout changing market conditions.

Bucharest region serves as the primary hub for downstream operations, hosting major refining facilities, corporate headquarters, and distribution centers. The capital region accounts for approximately 35% of national downstream activity, benefiting from excellent transportation infrastructure and proximity to major consumption centers. Industrial concentration in the Bucharest area creates synergies between different downstream operations and supporting services.

Constanta region plays a crucial role as Romania’s primary port and gateway for crude oil imports and refined product exports. The Black Sea location provides strategic advantages for international trade and regional distribution operations. Refining capacity in the Constanta area represents approximately 28% of national total, with modern facilities serving both domestic and export markets.

Ploiesti region maintains its historical significance as Romania’s traditional oil industry center, hosting refining facilities and petrochemical operations. The area benefits from established infrastructure and skilled workforce availability, supporting continued downstream operations. Regional specialization in certain product categories creates competitive advantages and market positioning opportunities.

Western regions including Timisoara and Arad areas serve important distribution and retail functions, connecting Romanian downstream operations with Central European markets. Cross-border trade opportunities and EU integration benefits support regional market development. Distribution networks in western regions account for approximately 22% of national retail coverage, with continued expansion planned to serve growing demand.

Market leadership in Romania’s downstream sector features a combination of international energy companies and domestic operators, creating a competitive environment that promotes efficiency and innovation. The competitive landscape demonstrates balanced market structure with multiple significant players across different segments.

Competitive strategies focus on operational efficiency, customer service excellence, and strategic market positioning. Companies invest in technology upgrades, facility modernization, and brand development to maintain competitive advantages. Market differentiation occurs through product quality, service reliability, and customer relationship management across various market segments.

By Product Type:

By End-User Application:

Refining operations demonstrate improved efficiency through modernization programs and technology upgrades, achieving higher conversion rates and better product yields. Romanian refineries have invested significantly in environmental compliance equipment and process optimization systems. Capacity utilization has improved to approximately 82% average levels across major facilities, reflecting better demand-supply balance and operational management.

Distribution networks continue expanding to serve growing market demand and improve geographic coverage throughout Romania. Investment in pipeline infrastructure, storage terminals, and transportation equipment enhances supply chain efficiency and reliability. Retail operations show steady growth with approximately 15% network expansion over recent years, particularly in underserved rural and suburban areas.

Petrochemical integration provides opportunities for value-added production and improved facility economics through feedstock optimization and product diversification. Romanian facilities increasingly focus on higher-value products that command premium pricing and stable demand. Export capabilities have strengthened through infrastructure improvements and market development initiatives targeting regional customers.

Environmental compliance achievements position Romanian downstream operations favorably within EU regulatory frameworks while supporting sustainable development objectives. Investment in cleaner technologies and emission reduction systems demonstrates industry commitment to environmental stewardship and regulatory compliance.

Operational efficiency gains through modern technology adoption and process optimization create cost advantages and improved profitability for downstream operators. Advanced control systems, predictive maintenance programs, and digital integration reduce operational costs while enhancing reliability and safety performance. Market access benefits from Romania’s strategic location and EU membership provide expanded opportunities for trade and investment.

Regulatory stability within EU frameworks offers predictable operating environment and long-term planning capabilities for industry participants. Harmonized standards and regulations facilitate cross-border operations and investment decisions. Infrastructure development supported by EU funding programs creates opportunities for facility upgrades and capacity expansion at favorable financing terms.

Stakeholder value creation occurs through job creation, tax revenue generation, and economic development contributions to local communities. Downstream operations support extensive supply chains and service providers throughout Romanian economy. Energy security benefits for Romania include reduced import dependence and strategic petroleum reserve capabilities that enhance national energy resilience.

Environmental improvements through cleaner technologies and sustainable practices contribute to air quality enhancement and climate change mitigation efforts. Industry investments in environmental protection create positive community relations and regulatory compliance advantages. Innovation opportunities in renewable fuel integration and advanced technologies position the sector for future market transitions and growth opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives are revolutionizing downstream operations through advanced analytics, artificial intelligence, and Internet of Things technologies. Companies implement smart systems for predictive maintenance, inventory optimization, and customer relationship management. Automation adoption increases operational efficiency while reducing labor costs and safety risks across refining and distribution operations.

Sustainability focus drives investment in cleaner technologies, renewable fuel integration, and carbon emission reduction programs. Romanian downstream operators increasingly adopt environmental management systems and sustainability reporting practices. Circular economy principles influence waste reduction, recycling programs, and resource efficiency improvements throughout operations.

Customer experience enhancement through digital platforms, mobile applications, and loyalty programs improves retail operations and commercial customer service. Companies invest in modern fuel station designs, payment systems, and convenience offerings to attract and retain customers. Market consolidation continues as companies seek operational synergies and improved economies of scale through strategic acquisitions and partnerships.

Supply chain optimization utilizes advanced logistics management, real-time tracking systems, and demand forecasting to improve efficiency and reduce costs. Integration of supply chain operations creates competitive advantages through improved reliability and customer service. Product innovation focuses on high-performance fuels, specialty chemicals, and environmentally friendly products that meet evolving market requirements.

Infrastructure modernization projects across major Romanian refineries have enhanced processing capabilities and environmental compliance. Recent investments include advanced distillation units, hydrocracking facilities, and emission control systems that improve operational efficiency. Storage capacity expansion at key terminals increases supply chain flexibility and supports growing throughput requirements.

Strategic partnerships between international energy companies and Romanian operators facilitate technology transfer, capital investment, and market development initiatives. Joint ventures and acquisition activities reshape competitive landscape while creating operational synergies. Regulatory developments including updated environmental standards and safety requirements drive industry adaptation and compliance investments.

Technology implementations encompass advanced process control systems, digital monitoring platforms, and predictive maintenance programs that optimize operations and reduce costs. Cybersecurity investments protect critical infrastructure and operational systems from emerging threats. Market expansion initiatives target regional export opportunities and new customer segments through enhanced distribution networks.

Sustainability programs include renewable fuel development, carbon footprint reduction, and waste minimization initiatives that align with EU environmental objectives. Industry collaboration on research and development projects advances cleaner technologies and sustainable practices. Workforce development programs ensure adequate skilled labor availability for ongoing operations and future expansion plans.

Strategic positioning recommendations emphasize leveraging Romania’s geographic advantages to develop regional energy hub capabilities. Companies should focus on operational excellence, customer service differentiation, and strategic market positioning to maintain competitive advantages. Investment priorities should balance facility modernization with market expansion opportunities while maintaining financial flexibility for future developments.

Technology adoption strategies should prioritize digital transformation initiatives that provide measurable operational improvements and customer value enhancement. Companies should evaluate emerging technologies for potential competitive advantages while managing implementation risks and costs. MarkWide Research analysis suggests that successful operators will integrate sustainability considerations into all strategic planning and operational decisions.

Market development efforts should focus on high-growth segments including petrochemicals, specialty products, and export markets that offer improved profitability and growth potential. Companies should strengthen customer relationships through enhanced service offerings and value-added solutions. Risk management strategies should address price volatility, regulatory changes, and competitive pressures through diversification and operational flexibility.

Partnership opportunities with technology providers, research institutions, and international energy companies can accelerate innovation and market development while sharing investment risks. Collaborative approaches to sustainability challenges and regulatory compliance may provide cost-effective solutions and competitive advantages.

Market prospects for Romania’s oil and gas downstream sector remain positive, supported by continued economic growth, infrastructure development, and regional integration opportunities. The sector is expected to maintain steady growth with projected expansion rates of approximately 4.2% annually over the medium term, driven by domestic demand growth and export market development.

Investment trends will likely focus on sustainability initiatives, technology upgrades, and market expansion projects that enhance competitive positioning. Environmental compliance requirements will drive continued investment in cleaner technologies and emission reduction systems. Market evolution toward renewable fuel integration and sustainable practices will create new opportunities while maintaining traditional product demand.

Competitive dynamics are expected to intensify as companies seek market share growth through operational excellence and customer service differentiation. Consolidation activities may continue as operators pursue synergies and economies of scale. Regulatory environment will likely become more stringent regarding environmental protection and safety standards, requiring ongoing compliance investments.

Technology advancement will continue transforming operations through digitalization, automation, and advanced analytics that improve efficiency and reduce costs. Innovation in sustainable technologies and renewable fuel integration will become increasingly important for long-term competitiveness. Regional integration with European energy markets will provide expanded opportunities while requiring adaptation to evolving market conditions and regulatory requirements.

Romania’s oil and gas downstream market demonstrates strong fundamentals and positive growth prospects supported by strategic geographic advantages, modern infrastructure, and favorable regulatory environment. The sector has successfully adapted to EU integration requirements while maintaining operational efficiency and competitive positioning in regional markets. Investment in modernization and environmental compliance has positioned Romanian downstream operations for sustained growth and market leadership opportunities.

Future success will depend on continued focus on operational excellence, customer service enhancement, and strategic market positioning while adapting to evolving regulatory requirements and market conditions. Companies that effectively balance traditional operations with sustainability initiatives and technology adoption will achieve the strongest competitive advantages. Market opportunities in petrochemicals, export markets, and renewable fuel integration provide pathways for growth and diversification beyond traditional petroleum products.

The Romania oil and gas downstream market is well-positioned to capitalize on regional energy demand growth, EU market integration benefits, and strategic infrastructure advantages that support both domestic operations and international trade activities. Continued investment in technology, sustainability, and market development will ensure the sector’s long-term viability and contribution to Romania’s economic development and energy security objectives.

What is Oil & Gas Downstream?

Oil & Gas Downstream refers to the processes involved in refining crude oil and distributing petroleum products. This includes the production of fuels, lubricants, and other petrochemicals, as well as their transportation and marketing to end-users.

What are the key players in the Romania Oil & Gas Downstream Market?

Key players in the Romania Oil & Gas Downstream Market include OMV Petrom, Rompetrol, and Lukoil Romania. These companies are involved in refining, distribution, and retailing of oil and gas products, among others.

What are the growth factors driving the Romania Oil & Gas Downstream Market?

The growth of the Romania Oil & Gas Downstream Market is driven by increasing energy demand, investments in refining capacity, and the expansion of distribution networks. Additionally, the rise in automotive fuel consumption and industrial applications contributes to market growth.

What challenges does the Romania Oil & Gas Downstream Market face?

The Romania Oil & Gas Downstream Market faces challenges such as regulatory compliance, fluctuating crude oil prices, and environmental concerns. These factors can impact profitability and operational efficiency in the sector.

What opportunities exist in the Romania Oil & Gas Downstream Market?

Opportunities in the Romania Oil & Gas Downstream Market include the adoption of advanced refining technologies, the development of biofuels, and the expansion of electric vehicle charging infrastructure. These trends can enhance sustainability and meet changing consumer preferences.

What trends are shaping the Romania Oil & Gas Downstream Market?

Trends in the Romania Oil & Gas Downstream Market include a shift towards cleaner fuels, increased automation in refining processes, and the integration of digital technologies. These innovations aim to improve efficiency and reduce environmental impact.

Romania Oil & Gas Downstream Market

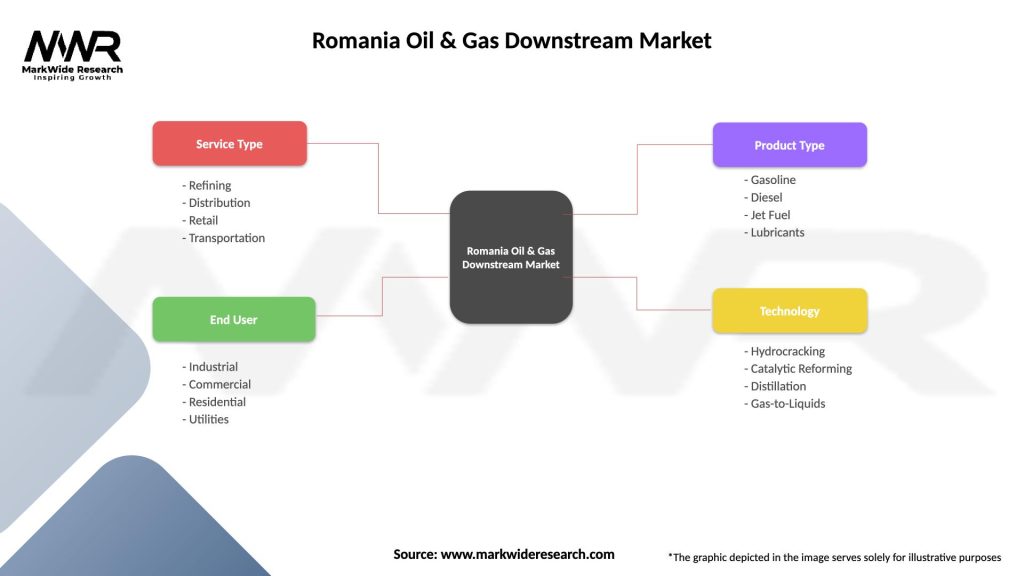

| Segmentation Details | Description |

|---|---|

| Service Type | Refining, Distribution, Retail, Transportation |

| End User | Industrial, Commercial, Residential, Utilities |

| Product Type | Gasoline, Diesel, Jet Fuel, Lubricants |

| Technology | Hydrocracking, Catalytic Reforming, Distillation, Gas-to-Liquids |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Romania Oil & Gas Downstream Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at