444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Romania Intensive Care Unit (ICU) beds and surfaces market represents a critical segment of the country’s healthcare infrastructure, experiencing substantial growth driven by modernization initiatives and increasing healthcare demands. Romania’s healthcare system has undergone significant transformation in recent years, with particular emphasis on upgrading critical care facilities and equipment to meet European Union standards and improve patient outcomes.

Market dynamics indicate that Romania’s ICU beds and surfaces sector is expanding at a robust 8.2% CAGR, reflecting the government’s commitment to healthcare infrastructure development and the growing recognition of advanced critical care equipment’s importance. The market encompasses various specialized bed types, including electric ICU beds, manual ICU beds, and advanced surface technologies designed to prevent pressure ulcers and enhance patient comfort during extended critical care stays.

Healthcare modernization programs across Romania have prioritized the upgrade of intensive care units, particularly in major hospitals located in Bucharest, Cluj-Napoca, Timișoara, and other metropolitan areas. This modernization drive has created substantial demand for technologically advanced ICU beds equipped with integrated monitoring systems, adjustable positioning capabilities, and specialized surfaces that support optimal patient care protocols.

Regional distribution shows that approximately 45% of market demand originates from public hospitals, while private healthcare facilities account for 35% of procurement activities. The remaining market share is distributed among specialty clinics and emergency care centers that require high-quality ICU equipment to deliver comprehensive critical care services.

The Romania Intensive Care Unit beds and surfaces market refers to the comprehensive ecosystem of specialized medical equipment designed for critical patient care within Romanian healthcare facilities. This market encompasses advanced hospital beds specifically engineered for intensive care environments, along with specialized mattress surfaces and support systems that enhance patient comfort, prevent complications, and facilitate optimal medical care delivery.

ICU beds in this context represent sophisticated medical devices that go beyond traditional hospital beds, incorporating features such as electronic positioning controls, integrated patient monitoring capabilities, side rail systems, and compatibility with various medical equipment attachments. These beds are designed to support critically ill patients who require continuous monitoring and frequent position adjustments for optimal care outcomes.

Specialized surfaces include pressure-relieving mattresses, alternating pressure systems, low air loss surfaces, and advanced foam technologies that prevent pressure ulcers and support patient recovery. These surfaces are crucial components of comprehensive ICU care, particularly for patients requiring extended bed rest during critical illness recovery periods.

Romania’s ICU beds and surfaces market demonstrates strong growth momentum, driven by healthcare infrastructure modernization, increasing critical care demands, and alignment with European healthcare standards. The market benefits from government healthcare investments, EU funding programs, and growing awareness of advanced critical care equipment’s role in improving patient outcomes and reducing healthcare costs through enhanced efficiency.

Key market drivers include the ongoing digital transformation of Romanian healthcare, increasing prevalence of chronic diseases requiring intensive care, and the need to upgrade aging hospital infrastructure. The COVID-19 pandemic highlighted the critical importance of adequate ICU capacity and advanced equipment, accelerating procurement decisions and modernization timelines across the healthcare system.

Technology adoption shows that 72% of new ICU bed installations incorporate smart monitoring capabilities and electronic positioning systems, reflecting healthcare providers’ preference for advanced features that enhance patient care efficiency. The market also benefits from increasing focus on infection control protocols, driving demand for beds and surfaces with antimicrobial properties and easy-to-clean designs.

Competitive landscape features both international medical equipment manufacturers and emerging local suppliers, creating a dynamic market environment with diverse product offerings and competitive pricing strategies. This competition benefits Romanian healthcare providers through improved product quality, enhanced service support, and more favorable procurement terms.

Market segmentation analysis reveals distinct patterns in ICU bed and surface procurement across Romania’s healthcare system. The following key insights shape market development and strategic planning:

Healthcare infrastructure modernization serves as the primary driver for Romania’s ICU beds and surfaces market growth. The government’s commitment to upgrading medical facilities through EU structural funds and national healthcare programs creates sustained demand for advanced critical care equipment. This modernization effort focuses on replacing outdated equipment with technologically advanced solutions that improve patient outcomes and operational efficiency.

Demographic trends significantly influence market expansion, with Romania’s aging population requiring increased critical care services. The growing prevalence of chronic diseases, cardiovascular conditions, and complex medical cases necessitates expanded ICU capacity and advanced equipment capable of supporting diverse patient needs. Healthcare providers recognize that modern ICU beds and surfaces are essential for delivering comprehensive critical care services.

EU compliance requirements drive continuous equipment upgrades as Romanian healthcare facilities must meet stringent European standards for medical devices and patient safety. These regulatory requirements ensure that ICU equipment incorporates the latest safety features, quality standards, and performance capabilities, creating ongoing demand for compliant products and system upgrades.

Technology advancement in medical equipment creates opportunities for healthcare providers to enhance patient care through smart bed systems, integrated monitoring capabilities, and advanced surface technologies. The integration of Internet of Things (IoT) technology, electronic health records compatibility, and automated positioning systems makes modern ICU beds essential tools for efficient critical care delivery.

Patient safety focus increasingly drives procurement decisions, with healthcare providers prioritizing equipment that reduces complications, prevents pressure ulcers, and supports optimal patient positioning. Advanced surface technologies and bed features that enhance patient safety align with quality improvement initiatives and risk management strategies across Romanian healthcare facilities.

Budget constraints represent a significant challenge for many Romanian healthcare facilities, particularly smaller regional hospitals with limited capital investment budgets. The high initial cost of advanced ICU beds and specialized surfaces can delay procurement decisions and limit the scope of equipment upgrades, creating disparities in critical care capabilities across different healthcare facilities.

Technical complexity associated with modern ICU equipment requires specialized training for healthcare staff and technical support infrastructure. Many facilities face challenges in implementing advanced bed systems due to limited technical expertise, inadequate training programs, and insufficient maintenance capabilities, which can slow adoption rates and increase operational costs.

Infrastructure limitations in older hospital buildings may restrict the installation of advanced ICU beds and associated equipment. Electrical system upgrades, space modifications, and structural improvements required to support modern critical care equipment can significantly increase project costs and implementation timelines, deterring some facilities from pursuing comprehensive upgrades.

Procurement bureaucracy in public healthcare systems can create delays in equipment acquisition and implementation. Complex tender processes, lengthy approval procedures, and administrative requirements may slow market growth and limit healthcare providers’ ability to respond quickly to equipment needs and technology advancement opportunities.

Maintenance and service challenges for sophisticated ICU equipment require specialized technical support and readily available spare parts. Limited local service networks and dependence on international suppliers for maintenance support can increase operational costs and create concerns about equipment reliability and downtime risks.

EU funding programs present substantial opportunities for healthcare infrastructure development and equipment procurement across Romania. European structural and investment funds specifically allocated for healthcare modernization provide financial resources for comprehensive ICU upgrades, creating favorable conditions for market expansion and technology adoption.

Public-private partnerships offer innovative financing and implementation models for ICU equipment procurement and facility upgrades. These partnerships can accelerate modernization timelines, reduce public sector financial burden, and bring private sector expertise to healthcare infrastructure development, creating new market opportunities and business models.

Technology integration opportunities emerge from the convergence of ICU equipment with digital health systems, artificial intelligence, and remote monitoring capabilities. Healthcare providers increasingly seek integrated solutions that connect ICU beds and surfaces with hospital information systems, creating demand for smart, connected medical equipment.

Regional expansion potential exists in smaller cities and rural areas where healthcare infrastructure development lags behind metropolitan centers. Government initiatives to improve healthcare access and quality in underserved regions create new market opportunities for ICU equipment suppliers and service providers.

Specialty care development in areas such as cardiac surgery, neurocritical care, and pediatric intensive care creates demand for specialized ICU beds and surfaces designed for specific patient populations. This market segmentation offers opportunities for suppliers to develop targeted solutions and capture premium market segments.

Supply chain evolution in Romania’s ICU beds and surfaces market reflects the balance between international suppliers and emerging local manufacturing capabilities. International manufacturers maintain strong market presence through established distribution networks and comprehensive product portfolios, while local suppliers increasingly focus on specific market segments and value-added services.

Competitive dynamics show intensifying competition as market growth attracts new entrants and existing players expand their offerings. This competition benefits healthcare providers through improved product quality, competitive pricing, and enhanced service support, while challenging suppliers to differentiate their offerings and demonstrate clear value propositions.

Technology adoption patterns reveal that Romanian healthcare providers increasingly prioritize integrated solutions that combine advanced bed functionality with specialized surface technologies. The trend toward comprehensive ICU solutions rather than individual component purchases reflects healthcare providers’ desire for simplified procurement, improved compatibility, and enhanced operational efficiency.

Regulatory environment continues to evolve with stricter safety standards, quality requirements, and performance specifications for medical equipment. These regulatory changes drive continuous product improvement and innovation while ensuring that ICU beds and surfaces meet the highest safety and quality standards for patient care.

Market maturation indicators suggest that Romania’s ICU equipment market is transitioning from basic modernization to advanced technology adoption, with healthcare providers increasingly focused on features such as smart monitoring, predictive analytics, and integrated care coordination capabilities.

Comprehensive market analysis for Romania’s ICU beds and surfaces market employed multiple research methodologies to ensure accurate and reliable market insights. Primary research included structured interviews with healthcare facility administrators, procurement managers, and clinical staff across major Romanian hospitals to understand equipment needs, purchasing patterns, and technology preferences.

Secondary research encompassed analysis of government healthcare statistics, hospital procurement records, medical equipment import data, and healthcare infrastructure development reports. This research provided quantitative foundation for market sizing, growth projections, and trend analysis across different market segments and geographic regions.

Industry expert consultations with medical equipment manufacturers, distributors, and healthcare technology specialists provided insights into market dynamics, competitive landscape, and technology development trends. These consultations helped validate market findings and identify emerging opportunities and challenges within the Romanian healthcare equipment sector.

Market validation processes included cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and analyzing market trends against broader European healthcare equipment markets. This validation ensured that research findings accurately reflect current market conditions and future growth prospects.

Data analysis techniques incorporated statistical modeling, trend analysis, and comparative market assessment to develop comprehensive market insights and projections. The research methodology emphasized accuracy, reliability, and practical applicability for healthcare providers and industry stakeholders.

Bucharest metropolitan area dominates Romania’s ICU beds and surfaces market, accounting for approximately 35% of total market demand. The capital region benefits from the highest concentration of major hospitals, specialized medical centers, and healthcare infrastructure investment, creating substantial and consistent demand for advanced ICU equipment and surfaces.

Transylvania region, centered around Cluj-Napoca, represents the second-largest market segment with 18% market share. This region’s strong healthcare infrastructure, university medical centers, and growing private healthcare sector drive demand for modern ICU equipment and specialized surfaces. The region’s economic development and EU funding access support continued healthcare infrastructure investment.

Western Romania, including Timișoara and surrounding areas, accounts for 15% of market activity. The region’s proximity to Western European markets, strong industrial base, and healthcare modernization initiatives create favorable conditions for ICU equipment procurement and technology adoption. Cross-border healthcare collaborations also influence equipment standards and procurement decisions.

Southern Romania regions show 12% market participation, with growth driven by regional hospital upgrades and healthcare infrastructure development programs. Government initiatives to improve healthcare access in underserved areas create opportunities for ICU equipment suppliers and service providers in these markets.

Northern and Eastern regions collectively represent 20% of market demand, with growth potential driven by ongoing healthcare infrastructure development and EU funding programs. These regions present opportunities for market expansion as healthcare facilities upgrade equipment and expand critical care capabilities to serve local populations more effectively.

Market leadership in Romania’s ICU beds and surfaces sector features a combination of established international manufacturers and emerging regional suppliers. The competitive environment emphasizes product quality, technological innovation, and comprehensive service support to meet diverse healthcare provider needs.

Competitive strategies focus on technology differentiation, comprehensive service support, and value-based pricing models. Leading suppliers emphasize product innovation, clinical evidence, and total cost of ownership advantages to differentiate their offerings in the competitive Romanian market.

Market positioning varies among competitors, with some focusing on premium technology solutions while others emphasize cost-effective alternatives for budget-conscious healthcare providers. This diversity creates opportunities for healthcare facilities to select equipment that best matches their specific needs and financial capabilities.

Product type segmentation reveals distinct market categories based on bed functionality and technology integration. Electric ICU beds dominate the market with advanced positioning capabilities, integrated controls, and smart monitoring features. Manual ICU beds maintain relevance in specific applications where simplicity and cost-effectiveness are prioritized.

By Technology:

By Surface Type:

By End User:

Electric ICU beds category demonstrates the strongest growth momentum, driven by healthcare providers’ preference for advanced functionality and technology integration. These beds offer superior patient positioning capabilities, integrated monitoring systems, and compatibility with modern hospital information systems. The category benefits from increasing focus on patient safety, staff efficiency, and care quality improvement initiatives.

Pressure relief surfaces represent a rapidly expanding category as healthcare providers prioritize patient safety and complication prevention. Advanced surface technologies that prevent pressure ulcers and support patient comfort during extended ICU stays show strong adoption rates. This category benefits from clinical evidence demonstrating cost savings through reduced complications and improved patient outcomes.

Smart bed technologies emerge as a premium category with significant growth potential. These beds incorporate IoT connectivity, predictive analytics, and automated monitoring capabilities that enhance patient care and operational efficiency. Healthcare providers increasingly recognize the value of integrated solutions that connect ICU beds with hospital information systems and clinical workflows.

Specialty ICU beds for specific medical conditions show growing demand as Romanian healthcare facilities expand their specialized care capabilities. Cardiac surgery beds, neurocritical care beds, and pediatric ICU beds require specialized features and configurations that command premium pricing while delivering enhanced patient care outcomes.

Surface technology integration with bed systems creates comprehensive solutions that address multiple patient care needs simultaneously. Healthcare providers prefer integrated offerings that combine advanced bed functionality with specialized surface technologies, simplifying procurement decisions and ensuring optimal compatibility between system components.

Healthcare providers benefit from advanced ICU beds and surfaces through improved patient outcomes, enhanced staff efficiency, and reduced complication rates. Modern equipment enables better patient positioning, continuous monitoring, and integrated care coordination, leading to shorter ICU stays and improved recovery rates. These benefits translate into cost savings and improved quality metrics for healthcare facilities.

Patients and families experience enhanced comfort, safety, and care quality through advanced ICU equipment. Pressure-relieving surfaces reduce discomfort and prevent complications, while smart bed features enable more responsive care and better communication with healthcare providers. These improvements contribute to better patient experiences and recovery outcomes.

Healthcare staff benefit from ergonomic design features, automated positioning capabilities, and integrated monitoring systems that reduce physical strain and improve workflow efficiency. Advanced ICU beds and surfaces enable healthcare workers to provide better patient care while reducing their own risk of injury and fatigue.

Equipment manufacturers gain access to a growing market with increasing demand for advanced technology and comprehensive solutions. The Romanian market offers opportunities for product innovation, technology integration, and service expansion that can drive revenue growth and market share expansion.

Government healthcare systems achieve improved healthcare outcomes and cost efficiency through strategic investments in advanced ICU equipment. Modern beds and surfaces support quality improvement initiatives, reduce healthcare-associated complications, and enhance the overall effectiveness of critical care services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart technology integration represents the most significant trend shaping Romania’s ICU beds and surfaces market. Healthcare providers increasingly demand beds equipped with IoT sensors, predictive analytics, and automated monitoring capabilities that enhance patient care and operational efficiency. This trend drives product development toward comprehensive digital health solutions.

Infection control emphasis has intensified following the COVID-19 pandemic, with healthcare facilities prioritizing equipment with antimicrobial surfaces, easy-cleaning designs, and contamination prevention features. This trend influences product specifications and procurement decisions across all market segments, creating demand for advanced materials and surface treatments.

Integrated care solutions trend toward comprehensive systems that combine ICU beds, specialized surfaces, and monitoring technologies in unified platforms. Healthcare providers prefer solutions that simplify procurement, ensure compatibility, and provide seamless integration with existing hospital information systems and clinical workflows.

Sustainability focus increasingly influences equipment selection, with healthcare providers considering environmental impact, energy efficiency, and product lifecycle factors in procurement decisions. This trend drives manufacturers to develop more sustainable products and implement circular economy principles in product design and manufacturing.

Customization demand grows as healthcare facilities seek equipment tailored to specific patient populations, clinical specialties, and facility requirements. This trend creates opportunities for manufacturers to develop specialized solutions and provide customization services that meet unique healthcare provider needs.

Technology advancement in ICU bed design includes the integration of artificial intelligence for predictive patient monitoring, automated positioning systems that prevent pressure ulcers, and advanced surface materials that enhance patient comfort and safety. These developments represent significant improvements in critical care equipment capabilities and patient outcomes.

Regulatory updates have strengthened safety standards and performance requirements for ICU equipment, ensuring that beds and surfaces meet the highest quality and safety standards. Recent regulatory changes emphasize cybersecurity for connected devices, biocompatibility of materials, and comprehensive risk management throughout product lifecycles.

Market consolidation activities include strategic acquisitions and partnerships among equipment manufacturers, creating larger, more comprehensive solution providers. These consolidations enable companies to offer integrated product portfolios and enhanced service capabilities while achieving economies of scale in manufacturing and distribution.

Innovation partnerships between equipment manufacturers and healthcare technology companies drive development of next-generation ICU solutions. These collaborations focus on integrating beds and surfaces with hospital information systems, electronic health records, and clinical decision support tools to create comprehensive care platforms.

Service model evolution toward comprehensive support packages that include equipment maintenance, staff training, and technology updates. Manufacturers increasingly offer service-based business models that provide ongoing value to healthcare providers while ensuring optimal equipment performance and longevity.

Strategic procurement planning should emphasize total cost of ownership rather than initial purchase price when evaluating ICU beds and surfaces. MarkWide Research analysis indicates that healthcare providers achieve better long-term value through comprehensive evaluation of equipment lifecycle costs, including maintenance, training, and upgrade requirements.

Technology integration priorities should focus on solutions that enhance both patient care and operational efficiency. Healthcare facilities should prioritize equipment that integrates seamlessly with existing hospital information systems while providing clear clinical benefits and measurable improvements in patient outcomes and staff productivity.

Vendor selection criteria should include comprehensive service support, local technical expertise, and long-term partnership potential. Healthcare providers benefit from suppliers who offer ongoing training, maintenance support, and technology updates that ensure optimal equipment performance throughout its operational lifecycle.

Funding strategy optimization should leverage available EU funding programs and explore innovative financing models such as public-private partnerships. Healthcare facilities can accelerate modernization timelines and reduce financial burden through strategic use of available funding opportunities and alternative financing approaches.

Staff preparation initiatives should accompany equipment procurement to ensure successful implementation and optimal utilization. Comprehensive training programs, change management support, and ongoing education initiatives are essential for maximizing the benefits of advanced ICU equipment investments.

Market growth trajectory for Romania’s ICU beds and surfaces market remains positive, with continued expansion expected through healthcare infrastructure modernization and increasing critical care demands. MarkWide Research projections indicate sustained growth driven by government investment, EU funding utilization, and healthcare providers’ commitment to quality improvement initiatives.

Technology evolution will continue toward more sophisticated, integrated solutions that combine advanced bed functionality with intelligent monitoring, predictive analytics, and automated care coordination capabilities. Future ICU beds will likely incorporate artificial intelligence, machine learning, and advanced sensor technologies that enhance patient care and operational efficiency.

Market maturation will shift focus from basic modernization to advanced technology adoption and specialized solutions. Healthcare providers will increasingly demand equipment that addresses specific patient populations, clinical specialties, and operational requirements, creating opportunities for customized and specialized product offerings.

Regional development will expand market opportunities beyond major metropolitan areas as healthcare infrastructure investment reaches smaller cities and rural regions. This expansion will create new market segments and drive demand for cost-effective solutions that deliver advanced care capabilities in diverse healthcare settings.

Integration trends will accelerate toward comprehensive healthcare technology platforms that connect ICU equipment with broader hospital systems, electronic health records, and clinical decision support tools. This integration will create new value propositions and competitive advantages for equipment suppliers who can deliver comprehensive solutions.

Romania’s ICU beds and surfaces market presents substantial growth opportunities driven by healthcare infrastructure modernization, increasing critical care demands, and commitment to European healthcare standards. The market benefits from strong government support, EU funding availability, and healthcare providers’ recognition of advanced equipment’s role in improving patient outcomes and operational efficiency.

Market dynamics favor continued expansion with technology integration, smart bed adoption, and comprehensive care solutions driving demand across public and private healthcare sectors. The competitive landscape offers diverse options for healthcare providers while encouraging innovation and value improvement among equipment suppliers.

Strategic success in this market requires understanding of local healthcare needs, regulatory requirements, and procurement processes. Healthcare providers and equipment suppliers who focus on total value delivery, comprehensive service support, and long-term partnerships will achieve optimal outcomes in Romania’s evolving ICU equipment market.

Future prospects remain positive as Romania continues healthcare system modernization and alignment with European standards. The market will continue evolving toward more sophisticated, integrated solutions that enhance patient care quality while improving operational efficiency and cost-effectiveness for healthcare providers across the country.

What is Intensive Care Unit (ICU) Beds And Surfaces?

Intensive Care Unit (ICU) Beds And Surfaces refer to specialized medical equipment designed for critically ill patients. These beds provide advanced features such as adjustable positioning, pressure relief surfaces, and integrated monitoring systems to enhance patient care and comfort.

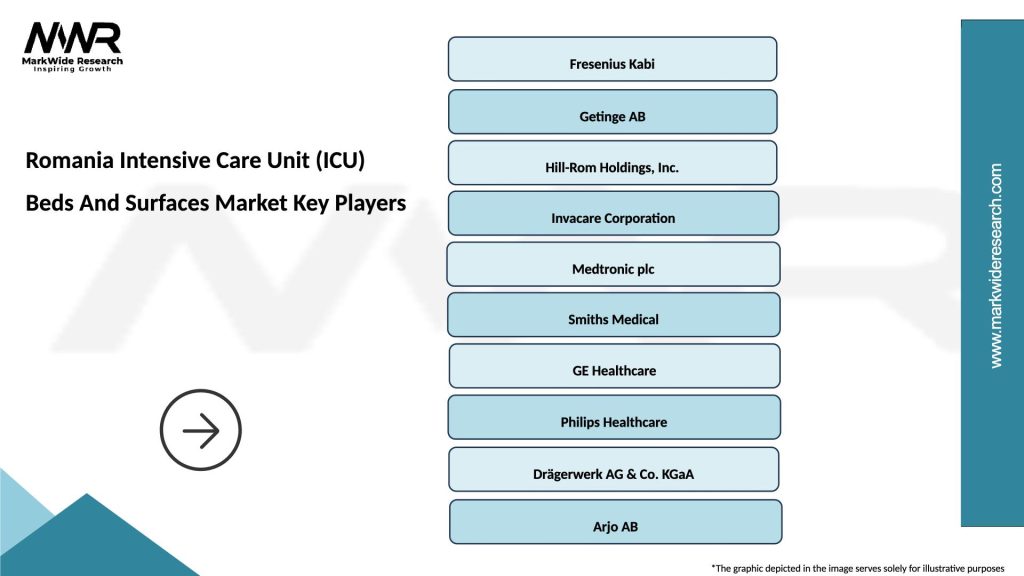

What are the key players in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market?

Key players in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market include companies like Getinge AB, Hill-Rom Holdings, Inc., and Stryker Corporation, among others. These companies are known for their innovative products and solutions tailored for critical care environments.

What are the growth factors driving the Romania Intensive Care Unit (ICU) Beds And Surfaces Market?

The growth of the Romania Intensive Care Unit (ICU) Beds And Surfaces Market is driven by factors such as the increasing prevalence of chronic diseases, the rising number of surgical procedures, and advancements in healthcare technology. Additionally, the demand for improved patient outcomes and comfort is propelling market expansion.

What challenges does the Romania Intensive Care Unit (ICU) Beds And Surfaces Market face?

The Romania Intensive Care Unit (ICU) Beds And Surfaces Market faces challenges such as high costs associated with advanced ICU equipment and the need for regular maintenance and training. Furthermore, regulatory compliance and the availability of skilled healthcare professionals can also impact market growth.

What opportunities exist in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market?

Opportunities in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market include the development of smart beds with integrated technology for remote monitoring and patient management. Additionally, increasing investments in healthcare infrastructure and the expansion of private healthcare facilities present significant growth potential.

What trends are shaping the Romania Intensive Care Unit (ICU) Beds And Surfaces Market?

Trends in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market include the rising adoption of telemedicine and remote patient monitoring solutions. There is also a growing focus on ergonomic designs and customizable features in ICU beds to enhance patient care and staff efficiency.

Romania Intensive Care Unit (ICU) Beds And Surfaces Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Beds, Manual Beds, Stretchers, Overbed Tables |

| Technology | Smart Beds, Pressure Relief Systems, Monitoring Devices, Adjustable Surfaces |

| End User | Public Hospitals, Private Clinics, Rehabilitation Centers, Emergency Services |

| Application | Critical Care, Postoperative Recovery, Trauma Management, Long-term Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Romania Intensive Care Unit (ICU) Beds And Surfaces Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at