444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Romania freight and logistics market represents a dynamic and rapidly evolving sector that serves as a crucial gateway between Western Europe and Eastern markets. Strategic positioning within the European Union has transformed Romania into a significant logistics hub, facilitating trade flows across multiple corridors. The market encompasses comprehensive transportation services, warehousing solutions, distribution networks, and integrated supply chain management systems that support both domestic commerce and international trade operations.

Market dynamics indicate robust growth driven by increasing e-commerce penetration, manufacturing expansion, and enhanced infrastructure development. The sector demonstrates remarkable resilience with annual growth rates exceeding 8.5%, positioning Romania as one of Europe’s fastest-growing logistics markets. Digital transformation initiatives and technological adoption have accelerated operational efficiency improvements, while strategic investments in transportation infrastructure continue to strengthen the country’s competitive positioning.

Geographic advantages include proximity to major European markets, access to the Black Sea, and connectivity through the Danube River system. These natural advantages, combined with competitive labor costs and improving regulatory frameworks, have attracted significant foreign investment in logistics infrastructure. The market serves diverse industries including automotive, retail, manufacturing, agriculture, and technology sectors, each contributing to the overall market expansion and diversification.

The Romania freight and logistics market refers to the comprehensive ecosystem of transportation, warehousing, distribution, and supply chain management services operating within Romania’s borders and facilitating international trade connections. This market encompasses road freight, rail transport, air cargo, maritime shipping, contract logistics, warehousing solutions, and integrated supply chain services that support commercial activities across multiple industry sectors.

Core components include freight forwarding services, third-party logistics providers, transportation companies, warehouse operators, distribution centers, and technology platforms that enable efficient movement of goods. The market serves both business-to-business and business-to-consumer segments, providing essential infrastructure for domestic commerce and international trade operations. Value-added services such as customs clearance, inventory management, order fulfillment, and reverse logistics have become integral components of modern logistics offerings.

Market participants range from large multinational logistics corporations to specialized regional providers, each contributing unique capabilities and service offerings. The sector’s evolution reflects broader economic trends, technological advancement, and changing consumer expectations that demand faster, more reliable, and cost-effective logistics solutions.

Romania’s freight and logistics sector has emerged as a cornerstone of the country’s economic development, demonstrating exceptional growth momentum and strategic importance within the European logistics landscape. The market benefits from substantial infrastructure investments, technological modernization, and favorable geographic positioning that facilitates efficient trade flows between European Union markets and emerging economies in Eastern Europe and Asia.

Key growth drivers include expanding e-commerce activities, increasing foreign direct investment in manufacturing, and government initiatives to modernize transportation infrastructure. The sector has witnessed significant adoption rates of 72% for digital logistics platforms among major operators, indicating strong technological transformation momentum. Road transport dominates the market with approximately 85% market share, while rail and multimodal solutions are gaining traction for long-distance and sustainable transportation requirements.

Competitive landscape features a mix of international logistics giants and domestic specialists, creating a dynamic environment that promotes innovation and service excellence. The market’s resilience during recent global challenges has demonstrated its strategic importance and operational flexibility. Future prospects remain highly positive, supported by continued infrastructure development, digital transformation initiatives, and Romania’s expanding role as a regional logistics hub.

Strategic positioning analysis reveals Romania’s unique advantages in serving as a logistics bridge between established Western European markets and rapidly growing Eastern European economies. The country’s membership in the European Union provides regulatory stability and market access, while competitive operational costs maintain attractiveness for logistics investments.

Economic expansion serves as the primary catalyst for Romania’s freight and logistics market growth, with increasing industrial production, consumer spending, and international trade volumes driving demand for comprehensive logistics services. The country’s integration into global supply chains has created substantial opportunities for logistics providers to develop sophisticated service offerings that meet international standards and requirements.

E-commerce proliferation represents a transformative force reshaping logistics demand patterns and service expectations. Online retail growth has accelerated the need for efficient last-mile delivery networks, urban distribution centers, and flexible fulfillment solutions. Consumer expectations for faster delivery times and enhanced service quality have prompted logistics providers to invest in advanced technologies and expanded service capabilities.

Infrastructure modernization initiatives, supported by European Union funding and government investments, are dramatically improving Romania’s logistics infrastructure. Highway construction projects, rail network upgrades, and port facility enhancements are reducing transportation costs and transit times while increasing capacity and reliability. Digital infrastructure improvements, including broadband connectivity and 5G network deployment, are enabling advanced logistics technologies and real-time supply chain visibility.

Foreign investment in manufacturing and distribution facilities continues to drive logistics demand, particularly in automotive, technology, and consumer goods sectors. International companies establishing operations in Romania require sophisticated logistics support, creating opportunities for both domestic and international logistics providers to develop specialized service offerings.

Infrastructure limitations in certain regions continue to pose challenges for logistics operations, particularly in rural areas where road quality and connectivity may be insufficient for efficient freight movement. While major transportation corridors have received significant investment, secondary routes and regional connections sometimes lack the capacity and quality needed for optimal logistics performance.

Regulatory complexity can create operational challenges, especially for international logistics operations that must navigate varying compliance requirements across different jurisdictions. Administrative procedures for customs clearance, documentation, and cross-border transportation sometimes involve lengthy processes that can impact delivery schedules and operational efficiency.

Labor market dynamics present both opportunities and challenges, with skilled logistics professionals in high demand and potential shortages in specialized areas such as technology integration and supply chain optimization. Wage inflation in the logistics sector, while reflecting economic growth, can impact operational costs and competitiveness compared to other regional markets.

Environmental regulations and sustainability requirements are becoming increasingly stringent, requiring logistics companies to invest in cleaner technologies, alternative fuel vehicles, and carbon reduction initiatives. While these developments support long-term sustainability goals, they can involve significant upfront investments and operational adjustments.

Digital transformation presents enormous opportunities for logistics companies to enhance operational efficiency, improve customer service, and develop new revenue streams through technology-enabled solutions. Artificial intelligence, machine learning, and Internet of Things technologies offer potential for optimizing route planning, predictive maintenance, inventory management, and supply chain visibility.

Sustainable logistics initiatives create opportunities for companies that can develop and implement environmentally friendly transportation solutions, including electric vehicles, alternative fuels, and carbon-neutral logistics services. Green logistics capabilities are increasingly important for attracting environmentally conscious customers and meeting corporate sustainability requirements.

Regional expansion opportunities exist for Romanian logistics companies to extend their services into neighboring markets, leveraging their geographic positioning and operational expertise. Cross-border trade facilitation services, particularly with non-EU countries, represent significant growth potential as regional economic integration continues to develop.

Value-added services development offers opportunities to increase revenue per customer and strengthen competitive positioning through specialized offerings such as supply chain consulting, inventory optimization, quality control, and customized packaging solutions. Industry-specific logistics solutions for sectors like healthcare, automotive, and technology can command premium pricing and create long-term customer relationships.

Competitive intensity within Romania’s freight and logistics market has increased significantly as both domestic and international players compete for market share in this rapidly growing sector. Market consolidation trends are evident as larger logistics companies acquire smaller regional operators to expand their geographic coverage and service capabilities, while specialized providers focus on niche markets and value-added services.

Technology disruption is reshaping traditional logistics business models, with companies investing heavily in digital platforms, automation technologies, and data analytics capabilities. Customer expectations continue to evolve, demanding greater transparency, faster delivery times, and more flexible service options, driving logistics providers to innovate and enhance their operational capabilities.

Supply chain resilience has become a critical focus area following recent global disruptions, with companies seeking to diversify their logistics networks and develop more flexible operational models. Risk management considerations now play a larger role in logistics decision-making, influencing everything from supplier selection to transportation route planning and inventory positioning strategies.

Regulatory evolution continues to shape market dynamics, with new environmental standards, safety requirements, and digital documentation procedures influencing operational practices and investment priorities. Market participants must continuously adapt to changing regulatory landscapes while maintaining operational efficiency and cost competitiveness.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Romania’s freight and logistics market dynamics. Primary research activities included extensive interviews with industry executives, logistics professionals, government officials, and key stakeholders across the supply chain ecosystem to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, government statistics, trade publications, company financial statements, and regulatory documents to establish market context and validate primary research findings. Data triangulation techniques were employed to cross-verify information from multiple sources and ensure research accuracy and reliability.

Market sizing methodologies incorporated bottom-up and top-down approaches, analyzing transportation volumes, logistics spending patterns, infrastructure capacity utilization, and economic indicators to develop comprehensive market assessments. Quantitative analysis focused on growth rates, market share distributions, operational efficiency metrics, and performance benchmarks across different market segments.

Qualitative insights were gathered through structured interviews, focus groups, and expert consultations to understand market dynamics, competitive positioning, customer requirements, and future development trends. MarkWide Research analytical frameworks were applied to synthesize research findings and develop actionable market intelligence for stakeholders.

Bucharest metropolitan area dominates Romania’s logistics market, accounting for approximately 35% of total logistics activity due to its role as the economic and administrative center. The capital region benefits from the highest concentration of distribution centers, logistics facilities, and transportation infrastructure, serving as the primary hub for both domestic distribution and international trade operations.

Western regions, particularly around Cluj-Napoca and Timișoara, represent rapidly growing logistics markets driven by manufacturing expansion and proximity to Western European markets. These areas have attracted significant foreign investment in automotive and technology sectors, creating substantial demand for specialized logistics services and modern warehouse facilities.

Southern regions along the Danube River corridor offer strategic advantages for multimodal transportation and serve as important gateways for trade with Balkan countries. Port cities like Constanța provide crucial maritime connections and have experienced substantial infrastructure investments to enhance their logistics capabilities and capacity.

Northern and eastern regions present emerging opportunities as infrastructure development progresses and cross-border trade with neighboring countries expands. These areas benefit from lower operational costs and strategic positioning for serving regional markets, though infrastructure limitations may constrain short-term growth potential.

Market leadership is distributed among several categories of logistics providers, each bringing distinct capabilities and competitive advantages to Romania’s freight and logistics market. The competitive environment features intense rivalry across different service segments and geographic markets.

Competitive strategies focus on technology adoption, service diversification, geographic expansion, and customer relationship development. Market differentiation is achieved through specialized industry expertise, advanced technology platforms, sustainable logistics solutions, and comprehensive service portfolios that address evolving customer requirements.

Transportation mode segmentation reveals the diverse logistics solutions available in Romania’s market, with each mode serving specific customer requirements and cargo characteristics. Road transport maintains the largest market share due to flexibility, door-to-door service capabilities, and comprehensive geographic coverage throughout Romania and neighboring countries.

By Transportation Mode:

By Service Type:

Road freight operations demonstrate the highest growth rates and market penetration, benefiting from infrastructure improvements and increasing demand for flexible transportation solutions. Technology integration in road transport includes GPS tracking, route optimization, and fleet management systems that enhance operational efficiency and customer service quality.

Contract logistics services are experiencing rapid expansion as companies seek to outsource non-core logistics functions and focus on their primary business activities. Value-added services within contract logistics include inventory optimization, quality control, packaging, and reverse logistics capabilities that create additional revenue opportunities and strengthen customer relationships.

E-commerce logistics represents the fastest-growing category, driven by online retail expansion and changing consumer expectations for delivery speed and convenience. Last-mile delivery innovations include urban distribution centers, alternative delivery methods, and technology-enabled solutions that improve delivery efficiency and customer satisfaction.

Industrial logistics serves manufacturing sectors with specialized transportation and warehousing solutions tailored to specific industry requirements. Automotive logistics particularly benefits from Romania’s growing automotive manufacturing sector, requiring sophisticated supply chain coordination and just-in-time delivery capabilities.

Logistics service providers benefit from Romania’s strategic geographic position, competitive operational costs, and growing market demand that create opportunities for business expansion and revenue growth. Market diversification opportunities allow providers to serve multiple industry sectors and develop specialized expertise that commands premium pricing.

Manufacturing companies gain access to efficient logistics networks that support their production and distribution requirements while reducing operational costs and improving supply chain reliability. Supply chain optimization through professional logistics services enables manufacturers to focus on core competencies while ensuring efficient product distribution.

Retail and e-commerce businesses benefit from sophisticated fulfillment and delivery networks that enable them to meet customer expectations for fast, reliable service. Scalable logistics solutions allow retailers to expand their market reach and handle seasonal demand fluctuations without significant infrastructure investments.

Government and economic development stakeholders benefit from job creation, tax revenue generation, and enhanced trade facilitation that supports overall economic growth. Infrastructure utilization improvements through efficient logistics operations maximize the return on public infrastructure investments and enhance Romania’s competitiveness as a business destination.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration is transforming Romania’s logistics landscape, with companies implementing advanced technologies to enhance operational efficiency and customer service. Artificial intelligence and machine learning applications are being deployed for route optimization, demand forecasting, and predictive maintenance, while Internet of Things sensors provide real-time visibility into shipment status and asset utilization.

Sustainability initiatives are gaining momentum as logistics companies respond to environmental regulations and customer demands for greener transportation solutions. Electric vehicle adoption is increasing for urban delivery operations, while alternative fuel technologies and carbon offset programs are being implemented for long-distance transportation.

Omnichannel logistics solutions are becoming essential as retailers seek to provide seamless customer experiences across online and offline channels. Flexible fulfillment options including buy-online-pick-up-in-store, same-day delivery, and flexible return processes require sophisticated logistics coordination and technology integration.

Supply chain resilience has become a strategic priority, with companies diversifying their logistics networks and developing contingency plans to handle disruptions. Near-shoring trends are creating opportunities for Romanian logistics providers as companies seek to reduce supply chain risks and improve responsiveness to European markets.

Infrastructure modernization projects continue to transform Romania’s logistics capabilities, with major highway construction, rail network upgrades, and port facility expansions enhancing connectivity and capacity. European Union funding supports many of these initiatives, ensuring continued improvement in transportation infrastructure quality and efficiency.

Technology partnerships between logistics companies and technology providers are accelerating digital transformation initiatives. Cloud-based platforms, mobile applications, and integrated software solutions are being implemented to improve operational visibility, customer communication, and supply chain coordination.

Foreign investment in logistics infrastructure continues to grow, with international companies establishing distribution centers and logistics facilities to serve regional markets. MarkWide Research analysis indicates that these investments are particularly concentrated in areas with strong transportation connectivity and proximity to major consumer markets.

Regulatory developments include new environmental standards, digital documentation requirements, and safety regulations that are shaping industry practices and investment priorities. Compliance initiatives are driving technology adoption and operational improvements across the logistics sector.

Strategic positioning recommendations emphasize the importance of technology investment and service differentiation for logistics companies operating in Romania’s competitive market. Digital capabilities should be prioritized to meet evolving customer expectations and improve operational efficiency, while specialized industry expertise can create competitive advantages and premium pricing opportunities.

Geographic expansion strategies should focus on underserved regional markets and cross-border opportunities that leverage Romania’s strategic location. Partnership development with local operators can facilitate market entry and provide access to established customer relationships and operational expertise.

Sustainability investments are recommended to meet regulatory requirements and customer expectations while potentially reducing operational costs through improved fuel efficiency and optimized routing. Green logistics capabilities can become important differentiators in competitive bidding processes and customer selection criteria.

Workforce development initiatives should address skills gaps in technology integration, supply chain optimization, and customer service to support business growth and operational excellence. Training programs and professional development opportunities can improve employee retention and service quality while building organizational capabilities for future growth.

Growth prospects for Romania’s freight and logistics market remain highly positive, supported by continued economic expansion, infrastructure development, and increasing integration into European and global supply chains. Market evolution is expected to accelerate with projected growth rates of 9.2% annually over the next five years, driven by e-commerce expansion, manufacturing growth, and technology adoption.

Technology transformation will continue to reshape the logistics landscape, with automation, artificial intelligence, and digital platforms becoming standard components of competitive logistics operations. Customer expectations for transparency, speed, and reliability will drive continued innovation and service enhancement across the industry.

Infrastructure completion of major transportation projects will significantly enhance Romania’s logistics capabilities and competitive positioning within European markets. Connectivity improvements will reduce transportation costs and transit times while increasing capacity for handling growing trade volumes.

Market consolidation trends are expected to continue as larger logistics companies acquire smaller operators to expand their geographic coverage and service capabilities. MWR projections indicate that market concentration among top providers could reach 45% within the next decade, while specialized service providers will continue to find opportunities in niche markets and value-added services.

Romania’s freight and logistics market represents a dynamic and rapidly expanding sector that plays a crucial role in the country’s economic development and European integration. The market’s strategic advantages, including geographic positioning, competitive costs, and improving infrastructure, create substantial opportunities for both domestic and international logistics providers to develop successful operations and capture market share.

Technology adoption and digital transformation initiatives are reshaping traditional logistics business models, enabling enhanced operational efficiency, improved customer service, and new revenue opportunities. Companies that successfully integrate advanced technologies while maintaining focus on customer requirements and operational excellence are best positioned to thrive in this competitive environment.

Future success in Romania’s logistics market will depend on companies’ ability to adapt to evolving customer expectations, regulatory requirements, and technological developments while leveraging the country’s strategic advantages and growing economic opportunities. The market’s continued expansion and modernization ensure that Romania will remain an important logistics hub within the broader European transportation and supply chain network.

What is Freight and Logistics?

Freight and logistics refer to the processes involved in the transportation, warehousing, and distribution of goods. This includes various modes of transport such as road, rail, air, and sea, as well as the management of supply chains and inventory.

What are the key players in the Romania Freight and Logistics Market?

Key players in the Romania Freight and Logistics Market include companies like DSV Panalpina, Kuehne + Nagel, and DB Schenker, which provide comprehensive logistics solutions. These companies are involved in various sectors such as e-commerce, automotive, and manufacturing, among others.

What are the main drivers of growth in the Romania Freight and Logistics Market?

The growth of the Romania Freight and Logistics Market is driven by factors such as the expansion of e-commerce, increasing demand for efficient supply chain solutions, and improvements in infrastructure. Additionally, the rise in international trade and investment in logistics technology are significant contributors.

What challenges does the Romania Freight and Logistics Market face?

Challenges in the Romania Freight and Logistics Market include regulatory hurdles, fluctuating fuel prices, and the need for skilled labor. Additionally, the market faces competition from other regions and the impact of economic fluctuations.

What opportunities exist in the Romania Freight and Logistics Market?

Opportunities in the Romania Freight and Logistics Market include the potential for digital transformation through technology adoption, growth in the pharmaceutical and automotive sectors, and the development of green logistics solutions. These factors can enhance operational efficiency and sustainability.

What trends are shaping the Romania Freight and Logistics Market?

Trends in the Romania Freight and Logistics Market include the increasing use of automation and AI in logistics operations, the rise of last-mile delivery solutions, and a focus on sustainability practices. These trends are reshaping how logistics companies operate and meet customer demands.

Romania Freight and Logistics Market

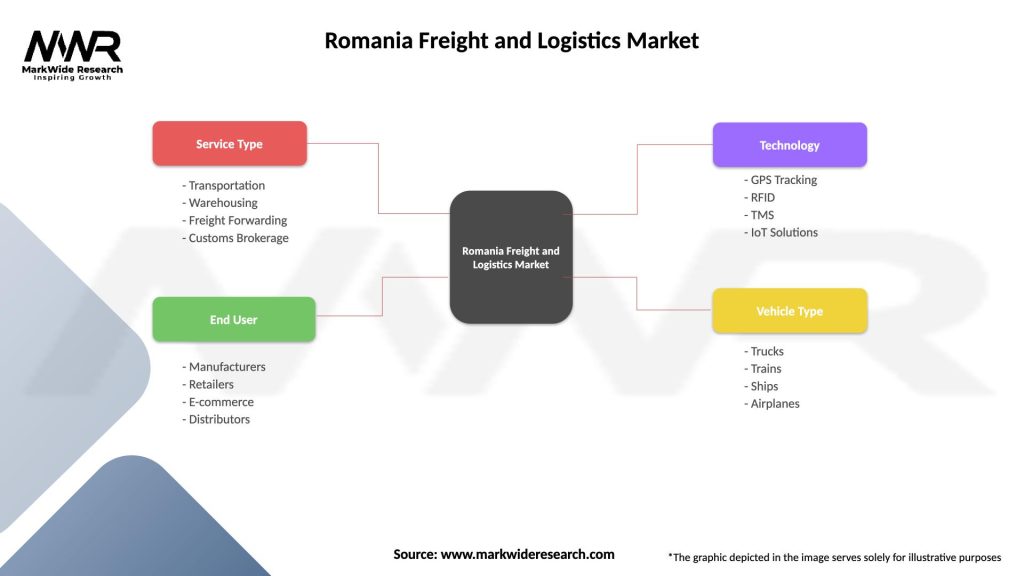

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Freight Forwarding, Customs Brokerage |

| End User | Manufacturers, Retailers, E-commerce, Distributors |

| Technology | GPS Tracking, RFID, TMS, IoT Solutions |

| Vehicle Type | Trucks, Trains, Ships, Airplanes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Romania Freight and Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at