444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The roll to roll printed electronics market represents a revolutionary manufacturing paradigm that transforms how electronic devices and components are produced. This innovative technology enables the continuous production of electronic circuits and devices on flexible substrates using high-speed printing processes. Market dynamics indicate substantial growth potential driven by increasing demand for flexible electronics, cost-effective manufacturing solutions, and emerging applications across diverse industries.

Manufacturing efficiency stands as a primary driver, with roll to roll processes achieving production speeds that are significantly faster than traditional semiconductor fabrication methods. The technology enables manufacturers to produce electronic components at reduced costs while maintaining quality standards suitable for various commercial applications. Substrate flexibility opens new possibilities for electronic device integration in previously impossible form factors.

Industry adoption continues expanding across sectors including consumer electronics, automotive, healthcare, and packaging industries. The technology’s ability to produce large-area electronics on flexible materials creates opportunities for innovative product designs and applications. MarkWide Research analysis indicates growing interest from manufacturers seeking cost-effective alternatives to conventional electronic manufacturing processes.

Technological advancement in printing materials, substrate development, and process optimization drives market evolution. The integration of advanced conductive inks, improved printing resolution, and enhanced substrate properties enables production of increasingly sophisticated electronic devices through roll to roll processes.

The roll to roll printed electronics market refers to the commercial ecosystem encompassing manufacturing processes, materials, equipment, and applications that utilize continuous printing techniques to produce electronic circuits and devices on flexible substrates. This technology represents a fundamental shift from traditional batch-based semiconductor manufacturing to continuous, high-volume production methods.

Core technology involves feeding flexible substrate materials through printing systems that deposit conductive, semiconductive, and insulating materials in precise patterns to create functional electronic circuits. The process enables production of various electronic components including sensors, displays, batteries, photovoltaic cells, and radio frequency identification devices.

Manufacturing advantages include reduced material waste, lower energy consumption, faster production speeds, and the ability to create large-area electronics on flexible substrates. The technology supports production of electronic devices that can be bent, folded, or stretched while maintaining functionality, opening new application possibilities.

Market transformation in the roll to roll printed electronics sector reflects the convergence of advanced materials science, precision printing technology, and growing demand for flexible electronic solutions. The industry demonstrates robust growth potential driven by technological innovations and expanding application areas across multiple sectors.

Key growth drivers include increasing adoption of flexible displays, rising demand for smart packaging solutions, and growing interest in wearable electronics. The technology’s cost advantages over traditional manufacturing methods attract manufacturers seeking to reduce production costs while enabling new product categories. Application diversity spans from simple printed circuits to complex electronic systems.

Competitive landscape features established printing equipment manufacturers, specialty materials suppliers, and innovative technology developers working to advance roll to roll printing capabilities. Market participants focus on improving printing resolution, developing new functional materials, and expanding substrate compatibility to address evolving customer requirements.

Future prospects indicate continued market expansion supported by ongoing technological developments and increasing commercial adoption. The technology’s potential to enable mass production of flexible electronics at competitive costs positions it as a transformative force in electronics manufacturing.

Technology maturation drives increasing commercial viability of roll to roll printed electronics across diverse applications. The following insights highlight critical market developments:

Technological advancement serves as the primary catalyst driving roll to roll printed electronics market expansion. Continuous improvements in printing resolution, material properties, and process reliability enable production of increasingly sophisticated electronic devices through roll to roll manufacturing methods.

Cost efficiency represents a fundamental driver as manufacturers seek alternatives to expensive traditional semiconductor fabrication processes. Roll to roll printing offers significant cost advantages through reduced material waste, lower energy consumption, and higher production throughput. Manufacturing economics become particularly attractive for large-area electronics and high-volume applications.

Flexible electronics demand continues growing across consumer electronics, automotive, and healthcare sectors. The technology’s ability to produce electronic devices on flexible substrates enables new product categories including bendable displays, wearable sensors, and conformable electronic systems. Design flexibility opens possibilities for innovative product architectures.

Smart packaging applications drive significant market growth as brands seek to integrate electronic functionality into packaging materials. Roll to roll printing enables cost-effective production of smart labels, temperature sensors, and interactive packaging elements. Consumer engagement through smart packaging creates new marketing opportunities.

Internet of Things expansion requires cost-effective production of numerous sensors and communication devices. Roll to roll printing provides an economical manufacturing approach for producing large quantities of simple electronic devices needed for IoT applications. Sensor proliferation across smart cities and industrial applications drives demand.

Technical limitations currently constrain the complexity of electronic devices producible through roll to roll printing processes. While suitable for many applications, the technology cannot yet match the performance characteristics and miniaturization levels achievable through traditional semiconductor manufacturing for high-performance electronic devices.

Material challenges persist in developing conductive inks and functional materials that combine excellent electrical properties with printing compatibility and long-term stability. Performance trade-offs between printability and electrical characteristics limit application scope for demanding electronic applications.

Quality control presents ongoing challenges in maintaining consistent electrical properties across large-area printed electronics. Variations in printing conditions, substrate properties, and environmental factors can affect device performance and reliability. Manufacturing consistency requires sophisticated process control systems.

Market education remains necessary as many potential customers lack familiarity with roll to roll printed electronics capabilities and limitations. Technology awareness and understanding of appropriate applications require continued industry education efforts to accelerate adoption.

Infrastructure investment requirements for roll to roll printing equipment and facility modifications can present barriers for companies considering technology adoption. Capital requirements may limit access for smaller manufacturers despite long-term cost advantages.

Emerging applications in healthcare present substantial opportunities for roll to roll printed electronics. The technology enables production of disposable medical sensors, smart bandages, and flexible monitoring devices at costs suitable for single-use applications. Healthcare digitization trends create growing demand for cost-effective electronic medical devices.

Automotive integration opportunities expand as vehicles incorporate increasing numbers of sensors and electronic systems. Roll to roll printing can produce flexible sensors for interior monitoring, exterior sensing applications, and decorative electronic elements. Vehicle electrification and autonomous driving technologies require numerous cost-effective sensors.

Smart textiles represent an emerging market where roll to roll printing enables integration of electronic functionality directly into fabric materials. Applications include heated clothing, biometric monitoring garments, and interactive textile displays. Wearable technology convergence with textiles creates new product categories.

Energy harvesting applications benefit from roll to roll printing’s ability to produce large-area photovoltaic cells and flexible batteries at reduced costs. The technology enables integration of energy generation and storage capabilities into various products and structures. Renewable energy adoption drives demand for cost-effective energy harvesting solutions.

Building integration opportunities emerge as smart building technologies require numerous sensors and communication devices. Roll to roll printing can produce flexible electronics suitable for integration into building materials and surfaces. Smart infrastructure development creates demand for distributed electronic systems.

Supply chain evolution reflects the growing maturity of roll to roll printed electronics as specialized suppliers develop materials, equipment, and services specifically for this manufacturing approach. Ecosystem development includes conductive ink manufacturers, substrate suppliers, printing equipment providers, and contract manufacturing services.

Technology convergence occurs as traditional printing companies expand into electronics manufacturing while electronics companies adopt printing technologies. This convergence accelerates innovation and market development through combined expertise in printing processes and electronic device design. Cross-industry collaboration drives technological advancement.

Performance improvements continue through ongoing research and development efforts focused on enhancing printing resolution, developing new functional materials, and optimizing manufacturing processes. Innovation cycles demonstrate consistent progress in addressing technical limitations and expanding application possibilities.

Market segmentation becomes increasingly defined as different application areas develop specific requirements and performance standards. Application-specific solutions emerge to address unique needs in sectors such as healthcare, automotive, and consumer electronics.

Regulatory considerations evolve as printed electronics enter regulated industries such as healthcare and automotive. Standards development provides frameworks for quality assurance and performance validation in critical applications.

Comprehensive analysis of the roll to roll printed electronics market employs multiple research methodologies to ensure accurate and complete market understanding. Primary research includes interviews with industry participants, technology developers, and end-users to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry publications, patent filings, academic research, and company financial reports to understand technological developments and market dynamics. Data triangulation validates findings through multiple independent sources and analytical approaches.

Market modeling utilizes quantitative analysis techniques to project market trends and identify growth opportunities. Statistical analysis of historical data and current market indicators provides foundation for future market projections and trend identification.

Expert consultation with technology specialists, industry analysts, and market participants provides qualitative insights into market dynamics and future developments. Industry expertise enhances understanding of technical capabilities and commercial viability factors.

Continuous monitoring of market developments ensures research findings remain current and relevant. Dynamic analysis adapts to evolving market conditions and emerging trends in the rapidly developing roll to roll printed electronics sector.

North America maintains a leading position in roll to roll printed electronics development and adoption, driven by strong research and development capabilities and early technology adoption across industries. The region benefits from established printing industries and significant investment in flexible electronics research. Innovation leadership positions North America at the forefront of technology development.

Europe demonstrates significant market presence through advanced manufacturing capabilities and strong focus on sustainable production technologies. European companies lead in development of environmentally friendly printing materials and processes. Regulatory frameworks support adoption of printed electronics in healthcare and automotive applications.

Asia Pacific represents the fastest-growing regional market, with growth rates exceeding 12% annually driven by large-scale manufacturing capabilities and growing electronics production. The region’s established printing and electronics industries provide strong foundation for roll to roll printed electronics adoption. Manufacturing scale enables cost-effective production for global markets.

China emerges as a major market participant through significant investments in printing technology and electronics manufacturing infrastructure. Government support for advanced manufacturing technologies accelerates market development and technology adoption.

Japan contributes advanced materials and precision printing technologies that enhance roll to roll printed electronics capabilities. Technical expertise in materials science and manufacturing processes drives innovation in the sector.

Market leadership in roll to roll printed electronics involves companies from diverse backgrounds including traditional printing equipment manufacturers, electronics companies, and specialized technology developers. The competitive landscape reflects the interdisciplinary nature of the technology.

Strategic partnerships between printing companies and electronics manufacturers accelerate technology development and market adoption. Collaboration models combine printing expertise with electronics knowledge to address technical challenges and expand application possibilities.

Technology segmentation reflects diverse printing approaches used in roll to roll electronics manufacturing:

By Printing Technology:

By Application:

By Substrate Material:

Display applications represent the largest segment of roll to roll printed electronics, driven by demand for flexible displays in consumer electronics and signage applications. Market share for display applications reaches approximately 35% of total market volume, reflecting the technology’s suitability for large-area electronic production.

Sensor applications demonstrate rapid growth as Internet of Things deployment creates demand for cost-effective sensing devices. Roll to roll printing enables production of simple sensors at costs suitable for widespread deployment. Growth rates in sensor applications exceed 15% annually driven by smart city and industrial monitoring applications.

Smart packaging emerges as a high-growth category with adoption rates increasing by over 20% annually as brands seek to integrate electronic functionality into packaging materials. The technology enables production of interactive labels, freshness sensors, and authentication devices at costs compatible with packaging economics.

Energy applications including batteries and photovoltaics benefit from roll to roll printing’s ability to produce large-area devices at reduced costs. Manufacturing efficiency improvements of up to 60% compared to traditional methods make printed energy devices increasingly competitive.

RFID applications leverage roll to roll printing’s high-volume production capabilities to reduce tag costs and enable widespread deployment. Cost reductions of up to 40% compared to traditional RFID manufacturing make printed tags attractive for various tracking applications.

Manufacturers benefit from significant cost reductions and improved production efficiency through roll to roll printed electronics adoption. Production speed increases enable higher throughput while reduced material waste improves manufacturing economics. The technology’s scalability supports both prototype development and high-volume production requirements.

Product developers gain access to new design possibilities through flexible substrate compatibility and large-area electronics capabilities. Design freedom enables creation of products with form factors impossible using traditional rigid electronics. Integration possibilities expand product functionality while maintaining cost effectiveness.

End users receive access to electronic functionality at reduced costs and in new form factors. Product innovation enabled by printed electronics creates enhanced user experiences and new application possibilities. Flexible and conformable electronics integrate seamlessly into various products and environments.

Supply chain partners benefit from new business opportunities in materials, equipment, and services supporting roll to roll printed electronics. Market expansion creates demand for specialized inks, substrates, and manufacturing equipment. Service opportunities include contract manufacturing and application development.

Investors gain exposure to a rapidly growing technology sector with applications across multiple industries. Market growth potential and technology advancement create investment opportunities in equipment manufacturers, materials suppliers, and application developers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Material innovation drives continuous improvement in conductive inks and functional materials for printed electronics. Advanced formulations enhance electrical properties while maintaining printing compatibility and environmental stability. MWR analysis indicates accelerating development of specialized materials for specific applications.

Resolution enhancement represents a critical trend as printing technologies achieve finer feature sizes suitable for more complex electronic circuits. Precision improvements expand the range of electronic devices producible through roll to roll processes while maintaining cost advantages.

Application diversification continues as new uses for printed electronics emerge across industries. Market expansion into healthcare, automotive, and building integration creates new growth opportunities and drives technology development to meet specific application requirements.

Sustainability focus influences material selection and process development as manufacturers seek environmentally friendly alternatives. Green chemistry approaches in ink formulation and substrate development align with corporate sustainability objectives.

Hybrid integration combines printed electronics with traditional electronic components to create systems that leverage the advantages of both technologies. System optimization enables cost-effective solutions that meet performance requirements while utilizing printed electronics where appropriate.

Technology partnerships between printing equipment manufacturers and electronics companies accelerate development of specialized roll to roll printing systems. Collaborative development combines printing expertise with electronics knowledge to address technical challenges and expand capabilities.

Material breakthroughs in conductive inks and functional materials enable new applications and improved performance in printed electronics. Innovation cycles demonstrate consistent progress in addressing material limitations and expanding application possibilities.

Manufacturing scale-up initiatives establish high-volume production capabilities for printed electronics across multiple regions. Capacity expansion supports growing demand while reducing production costs through economies of scale.

Standards development provides frameworks for quality assurance and performance validation in printed electronics applications. Industry standards facilitate market adoption by establishing reliability and performance benchmarks.

Application demonstrations showcase printed electronics capabilities in real-world applications, building market confidence and driving adoption. Proof of concept projects validate technology performance and commercial viability across diverse applications.

Technology investment should focus on addressing current limitations in printing resolution and material performance to expand application opportunities. Research priorities include development of higher-performance conductive inks and improved printing processes for complex circuits.

Market development requires continued education of potential customers about printed electronics capabilities and appropriate applications. Application engineering support helps customers identify suitable uses and optimize designs for printed electronics manufacturing.

Partnership strategies should leverage complementary expertise between printing companies and electronics manufacturers. Collaborative approaches accelerate technology development and market adoption through combined knowledge and resources.

Quality systems development becomes critical as printed electronics enter demanding applications requiring consistent performance and reliability. Process control investments ensure manufacturing consistency and product quality.

Sustainability initiatives should address environmental concerns through development of eco-friendly materials and processes. Green technology approaches align with market trends and regulatory requirements while supporting long-term market growth.

Market expansion continues as roll to roll printed electronics technology matures and addresses current limitations. Growth projections indicate sustained market development driven by expanding applications and improving technology capabilities. Adoption rates are expected to accelerate as performance improvements and cost reductions make the technology attractive for additional applications.

Technology evolution focuses on enhancing printing resolution, developing advanced materials, and improving manufacturing consistency. Innovation trends suggest continued progress in addressing technical challenges while expanding the range of electronic devices producible through printing processes.

Application growth spans multiple sectors with particularly strong development expected in healthcare, automotive, and smart packaging applications. Market diversification reduces dependence on any single application area while creating multiple growth drivers for the technology.

Geographic expansion extends market development beyond current leading regions as manufacturing capabilities and market awareness grow globally. Regional development creates new opportunities while supporting local electronics manufacturing ecosystems.

Integration trends combine printed electronics with other technologies to create hybrid systems that optimize performance and cost. System solutions approach enables broader adoption by addressing complete application requirements rather than individual component needs.

Roll to roll printed electronics represents a transformative manufacturing technology that enables cost-effective production of flexible electronic devices across diverse applications. The market demonstrates strong growth potential driven by technological advancement, expanding applications, and significant cost advantages over traditional electronics manufacturing methods.

Market dynamics reflect the technology’s maturation from research and development to commercial viability across multiple sectors. Continuous improvements in printing capabilities, material properties, and manufacturing processes expand the range of electronic devices producible through roll to roll methods while maintaining economic advantages.

Future success depends on continued technology development to address current limitations while expanding into new application areas. The convergence of printing expertise with electronics knowledge creates opportunities for innovative solutions that leverage the unique advantages of printed electronics manufacturing.

Industry participants benefit from significant opportunities in this rapidly evolving market through strategic investments in technology development, market education, and application engineering. The roll to roll printed electronics market positions itself as a key enabler of future electronic device innovation and cost-effective manufacturing solutions.

What is Roll to Roll Printed Electronics?

Roll to Roll Printed Electronics refers to a manufacturing process that enables the production of electronic devices on flexible substrates using a continuous roll of material. This technology is widely used in applications such as flexible displays, sensors, and photovoltaic cells.

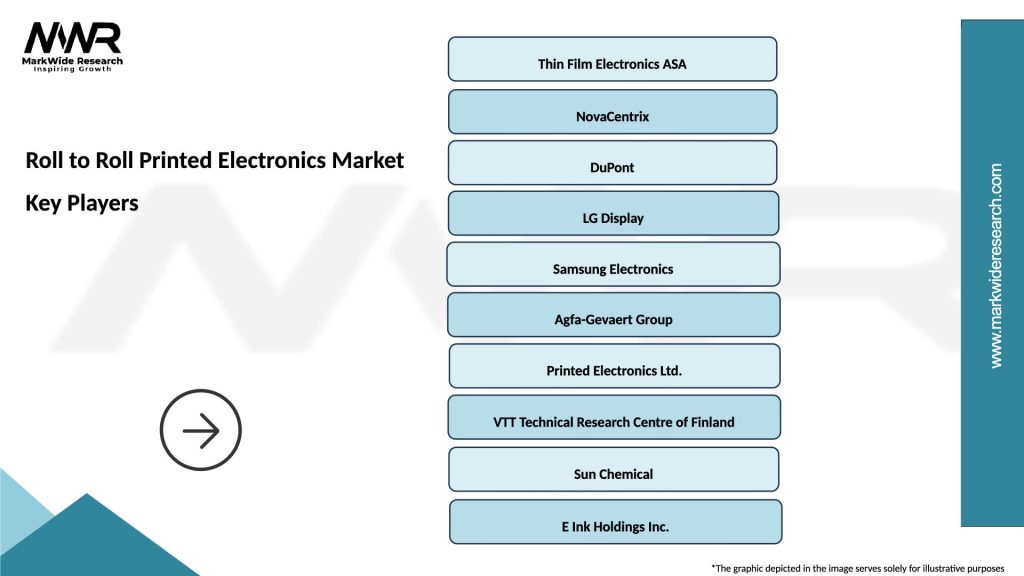

What are the key players in the Roll to Roll Printed Electronics Market?

Key players in the Roll to Roll Printed Electronics Market include companies like Thinfilm Electronics, NovaCentrix, and DuPont, which are known for their innovations in printed electronics and flexible manufacturing processes, among others.

What are the growth factors driving the Roll to Roll Printed Electronics Market?

The Roll to Roll Printed Electronics Market is driven by the increasing demand for lightweight and flexible electronic devices, advancements in printing technologies, and the growing adoption of smart packaging solutions across various industries.

What challenges does the Roll to Roll Printed Electronics Market face?

Challenges in the Roll to Roll Printed Electronics Market include issues related to the scalability of production processes, the need for high-quality materials, and competition from traditional electronics manufacturing methods.

What opportunities exist in the Roll to Roll Printed Electronics Market?

Opportunities in the Roll to Roll Printed Electronics Market include the development of new applications in wearable technology, the integration of printed electronics in automotive displays, and the potential for sustainable manufacturing practices.

What trends are shaping the Roll to Roll Printed Electronics Market?

Trends in the Roll to Roll Printed Electronics Market include the increasing use of organic materials for printing, advancements in ink formulations, and the rise of Internet of Things (IoT) applications that require flexible and lightweight electronic components.

Roll to Roll Printed Electronics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Displays, Sensors, Photovoltaics, Batteries |

| Technology | Inkjet Printing, Gravure Printing, Screen Printing, Laser Printing |

| End User | Consumer Electronics, Automotive OEMs, Healthcare Devices, Industrial Equipment |

| Application | Wearable Technology, Smart Packaging, Home Automation, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Roll to Roll Printed Electronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at