444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The market for Robotic Process Automation (RPA) in Financial Services has been experiencing significant growth in recent years. RPA refers to the use of software robots or artificial intelligence (AI) to automate repetitive and rule-based tasks in financial processes. It helps financial institutions streamline operations, improve efficiency, reduce costs, and enhance customer service. This comprehensive report provides insights into the RPA market in the financial services sector, including its meaning, executive summary, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a concluding summary.

Meaning

Robotic Process Automation (RPA) in Financial Services refers to the use of software robots or AI to automate repetitive and rule-based tasks in financial processes. These tasks may include data entry, document processing, account reconciliation, compliance reporting, and many others. RPA enables financial institutions to improve operational efficiency, reduce human errors, and accelerate process turnaround times. It allows employees to focus on more strategic and value-added tasks, while the software robots handle the mundane and repetitive activities.

Executive Summary

The executive summary provides a concise overview of the RPA market in the financial services sector. It highlights the market size, growth rate, key players, and significant market trends. The summary serves as a snapshot of the market’s current state and provides readers with key insights into the market’s potential and future prospects.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The RPA in Financial Services Market is influenced by several key factors:

Digital Transformation: Financial institutions are increasingly adopting RPA as part of their broader digital transformation strategies, which include adopting AI, big data, and cloud technologies to enhance operational efficiency.

Cost Efficiency: RPA allows financial services firms to significantly reduce operational costs by automating routine tasks and optimizing workflows.

Regulatory Compliance: RPA helps automate compliance-related tasks, reducing the risk of human error and ensuring adherence to complex regulatory requirements in financial services.

Customer Experience: By automating routine tasks, financial services firms can provide faster and more efficient customer service, leading to improved customer satisfaction.

Integration with AI and ML: The combination of RPA with AI and ML is enhancing automation capabilities, making it more adaptable and intelligent, capable of handling complex tasks beyond simple automation.

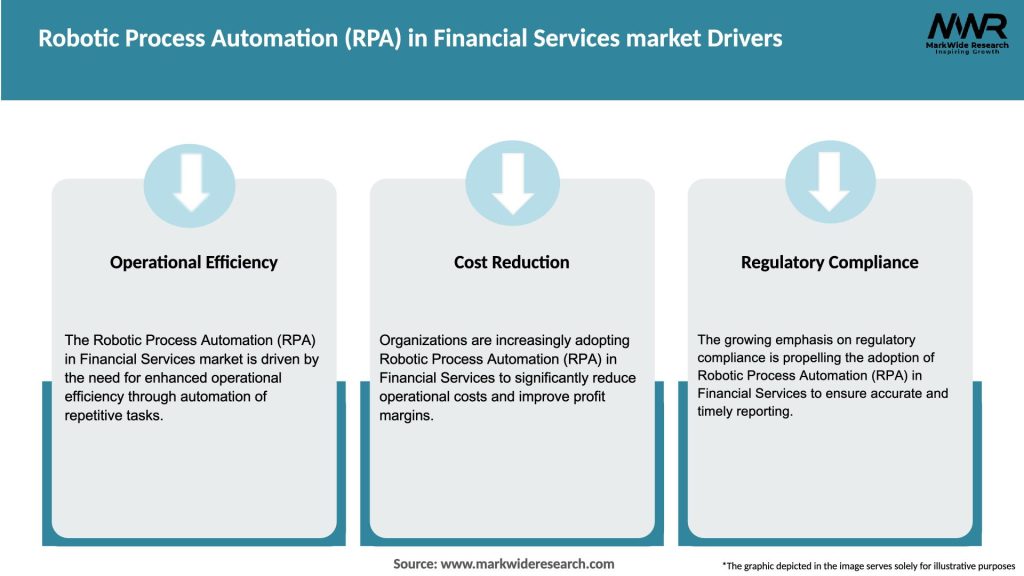

Market Drivers

Several factors are driving the growth of the RPA in Financial Services Market:

Need for Cost Reduction: Financial institutions are under pressure to reduce operational costs, and RPA is an effective solution to automate repetitive tasks, saving both time and money.

Increased Regulatory Pressure: With increasing regulations in the financial services industry, RPA helps firms streamline compliance processes, ensuring consistent and accurate reporting and data management.

Focus on Operational Efficiency: Financial services firms are focused on improving operational efficiency by automating tasks like data entry, transaction processing, and account reconciliation.

Customer Service Improvement: RPA enhances the speed and accuracy of customer service operations, reducing response times and increasing customer satisfaction.

Technological Advancements: Advances in RPA technology, including the integration with AI and ML, are enabling financial institutions to automate more complex tasks and improve decision-making processes.

Market Restraints

Despite the strong growth prospects, the RPA in Financial Services Market faces several challenges:

Integration with Legacy Systems: Many financial institutions rely on outdated legacy systems, which can make the integration of RPA tools difficult and costly.

Data Security and Privacy Concerns: As RPA tools handle sensitive financial data, there are concerns regarding the security and privacy of data, particularly in compliance with regulations like GDPR.

Skilled Workforce Shortage: There is a shortage of skilled professionals capable of managing and implementing RPA technologies, which may hinder the widespread adoption of RPA in the financial services sector.

High Initial Investment: The implementation of RPA can require a significant upfront investment, which may be a barrier for smaller financial institutions with limited resources.

Market Opportunities

The RPA in Financial Services Market presents numerous opportunities for growth and innovation:

Integration with AI and Machine Learning: The integration of RPA with AI and machine learning offers more advanced automation capabilities, enabling financial institutions to automate more complex and decision-based tasks.

Expansion in Emerging Markets: As financial institutions in emerging markets increasingly adopt digital technologies, there is significant potential for RPA growth in these regions.

Expansion of Use Cases: Beyond traditional use cases like data entry and account reconciliation, RPA is expanding into areas such as fraud detection, risk management, and financial analysis, offering new opportunities for financial institutions.

Adoption by Small and Medium Enterprises (SMEs): As RPA solutions become more affordable and scalable, SMEs in the financial sector are beginning to adopt automation, creating additional growth opportunities.

Market Dynamics

The dynamics of the RPA in Financial Services Market are shaped by several factors:

Supply-Side Factors:

Demand-Side Factors:

Economic Factors:

Regional Analysis

The RPA in Financial Services Market shows varied trends across different regions:

North America:

Europe:

Asia-Pacific:

Latin America:

Competitive Landscape

Leading Companies in the Robotic Process Automation (RPA) in Financial Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The RPA in Financial Services Market can be segmented based on various criteria:

By Deployment:

By Application:

By End-User:

Category-wise Insights

Each category within the RPA in Financial Services Market offers unique opportunities:

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 impact section examines the influence of the pandemic on the RPA market in the financial services sector. It discusses the disruptions caused by the global health crisis, such as remote working and the increased reliance on digital processes. The section explores how RPA has helped financial institutions cope with the challenges posed by the pandemic, including the automation of remote operations, the handling of increased transaction volumes, and the reduction of manual errors. It also discusses the potential long-term impact of the pandemic on RPA adoption and the acceleration of digital transformation in the financial services industry.

Key Industry Developments

The key industry developments section highlights significant advancements, collaborations, and innovations within the RPA market in the financial services sector. It discusses partnerships between RPA vendors and financial institutions, collaborations between technology providers and consulting firms, and the launch of new RPA solutions tailored to the specific needs of financial services. The section provides insights into the industry’s efforts to address regulatory compliance challenges, enhance security measures, and integrate RPA with advanced analytics and intelligent automation.

Analyst Suggestions

The analyst suggestions section offers expert recommendations and insights for industry participants and stakeholders in the RPA market in the financial services sector. It provides guidance on RPA implementation strategies, including the identification of suitable processes for automation, the assessment of ROI, and the change management aspects. The section emphasizes the importance of strong governance and risk management frameworks, continuous monitoring and evaluation, and ongoing training and upskilling of employees. It also highlights the significance of collaboration between IT and business teams for successful RPA implementation.

Future Outlook

The future outlook section provides a forward-looking perspective on the RPA market in the financial services sector. It discusses anticipated market trends, technological advancements, and evolving customer needs. The section explores potential growth opportunities, such as the expansion of RPA into new financial services segments and the integration of RPA with emerging technologies like blockchain and robotic analytics. It also considers potential challenges, including regulatory compliance complexities and the need for ongoing innovation and upgradation. Furthermore, the section provides insights into the market’s future prospects and growth potential.

Conclusion

In conclusion, the Robotic Process Automation (RPA) market in the financial services sector is witnessing significant growth as financial institutions recognize the potential of automation to streamline operations, reduce costs, and enhance customer service. RPA offers numerous benefits, including improved operational efficiency, enhanced accuracy, and compliance, and accelerated process turnaround times. The market is driven by factors such as the need for cost optimization, regulatory compliance, and technological advancements in AI and machine learning. However, challenges such as data security concerns and integration complexities may pose restraints to market growth. With ongoing advancements, strategic collaborations, and a focus on digital transformation, the future of the RPA market in the financial services sector looks promising, offering exciting opportunities for industry participants and stakeholders.

What is Robotic Process Automation (RPA)?

Robotic Process Automation (RPA) refers to the use of software robots or ‘bots’ to automate repetitive tasks in business processes. In financial services, RPA can streamline operations such as data entry, transaction processing, and compliance reporting.

What are the key players in the Robotic Process Automation (RPA) in Financial Services market?

Key players in the Robotic Process Automation (RPA) in Financial Services market include UiPath, Automation Anywhere, Blue Prism, and Pega Systems, among others. These companies provide various RPA solutions tailored to enhance efficiency and reduce operational costs in financial institutions.

What are the main drivers of growth in the Robotic Process Automation (RPA) in Financial Services market?

The main drivers of growth in the Robotic Process Automation (RPA) in Financial Services market include the increasing need for operational efficiency, the demand for improved customer service, and the rising regulatory compliance requirements. These factors encourage financial institutions to adopt RPA solutions to enhance productivity.

What challenges does the Robotic Process Automation (RPA) in Financial Services market face?

Challenges in the Robotic Process Automation (RPA) in Financial Services market include concerns over data security, the complexity of integrating RPA with existing systems, and the potential for job displacement. These issues can hinder the widespread adoption of RPA technologies.

What opportunities exist in the Robotic Process Automation (RPA) in Financial Services market?

Opportunities in the Robotic Process Automation (RPA) in Financial Services market include the potential for expanding RPA applications in areas like fraud detection, customer onboarding, and regulatory compliance. As technology advances, there is also room for innovation in AI-driven RPA solutions.

What trends are shaping the Robotic Process Automation (RPA) in Financial Services market?

Trends shaping the Robotic Process Automation (RPA) in Financial Services market include the integration of artificial intelligence and machine learning with RPA, the rise of cloud-based RPA solutions, and an increasing focus on enhancing user experience. These trends are driving the evolution of RPA technologies in the sector.

Robotic Process Automation (RPA) in Financial Services market

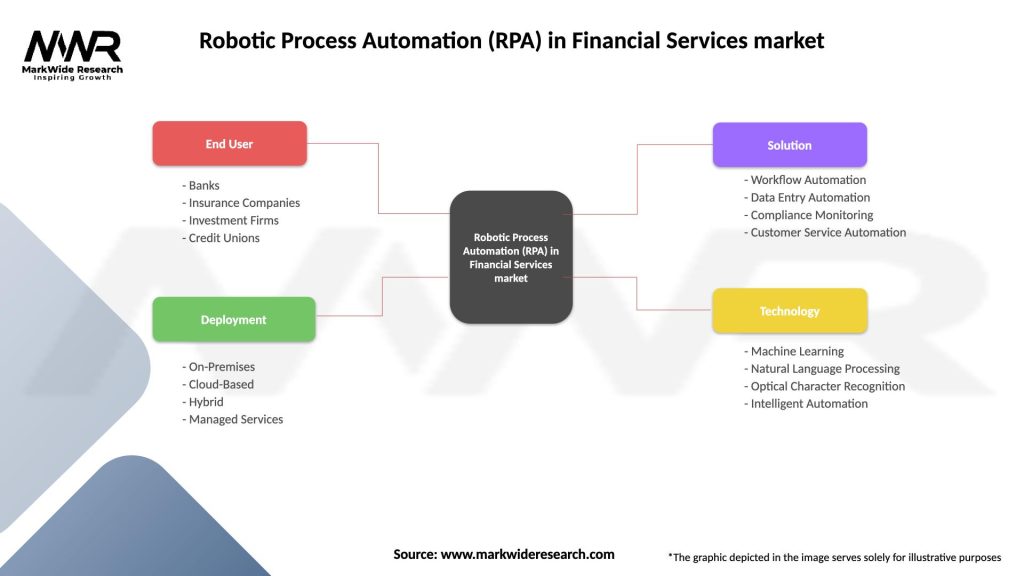

| Segmentation Details | Description |

|---|---|

| End User | Banks, Insurance Companies, Investment Firms, Credit Unions |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Solution | Workflow Automation, Data Entry Automation, Compliance Monitoring, Customer Service Automation |

| Technology | Machine Learning, Natural Language Processing, Optical Character Recognition, Intelligent Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at