444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The robotic process automation in legal services market represents a transformative technological revolution reshaping how law firms, corporate legal departments, and judicial institutions operate. This rapidly expanding sector encompasses the deployment of software robots and artificial intelligence to automate repetitive, rule-based legal tasks that traditionally required significant human intervention. Legal professionals are increasingly adopting RPA solutions to streamline document review, contract analysis, compliance monitoring, and case management processes.

Market dynamics indicate unprecedented growth driven by the legal industry’s urgent need for operational efficiency and cost reduction. The sector is experiencing a compound annual growth rate of 32.4%, reflecting the accelerating adoption of automation technologies across various legal practice areas. Law firms ranging from boutique practices to global enterprises are implementing RPA solutions to enhance productivity, reduce human error, and deliver more competitive pricing to clients.

Technology integration within legal services has reached a critical inflection point, with RPA serving as the foundation for broader digital transformation initiatives. The market encompasses diverse applications including contract lifecycle management, regulatory compliance automation, litigation support, and intellectual property management. Corporate legal departments are particularly aggressive adopters, leveraging RPA to manage increasing regulatory complexity while controlling operational costs.

The robotic process automation in legal services market refers to the comprehensive ecosystem of software solutions, platforms, and services designed to automate routine legal processes through the use of artificial intelligence, machine learning, and rule-based automation technologies. This market encompasses the development, deployment, and maintenance of RPA systems specifically tailored for legal workflows, document processing, compliance management, and case administration within law firms, corporate legal departments, and judicial institutions.

RPA technology in legal contexts involves the creation of software robots that can mimic human actions in digital environments, performing tasks such as data extraction from legal documents, populating case management systems, generating standard legal forms, and conducting preliminary legal research. These automated systems operate continuously, processing large volumes of legal work with consistent accuracy while freeing legal professionals to focus on higher-value strategic and advisory activities.

Market transformation in the legal services sector is being driven by the rapid adoption of robotic process automation technologies that promise to revolutionize traditional legal practice models. The sector is witnessing unprecedented investment in automation solutions as legal organizations seek to address mounting pressure for cost efficiency, improved accuracy, and faster service delivery. Legal technology adoption has accelerated significantly, with RPA implementations showing average efficiency improvements of 68% across various legal processes.

Key market drivers include increasing regulatory complexity, growing client demands for cost-effective legal services, and the need for enhanced accuracy in document-intensive legal work. The market is characterized by diverse stakeholder participation, including established legal technology vendors, emerging RPA specialists, and traditional software companies expanding into legal automation. Implementation success rates have reached 78% for organizations with structured change management approaches.

Competitive dynamics are intensifying as technology providers compete to deliver comprehensive RPA solutions tailored specifically for legal workflows. The market is experiencing consolidation through strategic partnerships and acquisitions, while new entrants continue to introduce innovative automation capabilities. Client satisfaction metrics indicate that legal organizations implementing RPA report 85% improvement in process consistency and quality control.

Strategic insights reveal that the robotic process automation market in legal services is fundamentally reshaping how legal work is conceptualized, priced, and delivered. The following key insights highlight the most significant market developments:

Primary market drivers propelling the adoption of robotic process automation in legal services stem from fundamental shifts in client expectations, regulatory requirements, and competitive pressures within the legal industry. The most significant driver is the relentless pressure for cost reduction as clients increasingly demand more value-oriented legal services without compromising quality or compliance standards.

Regulatory complexity continues to escalate across multiple jurisdictions, creating an environment where manual compliance monitoring becomes increasingly impractical and error-prone. Legal organizations are turning to RPA solutions to maintain comprehensive regulatory oversight while managing the associated costs. Compliance automation enables firms to monitor regulatory changes continuously and update their processes accordingly, reducing the risk of non-compliance penalties.

Talent acquisition challenges in the legal sector are driving automation adoption as firms struggle to recruit and retain qualified professionals for routine legal tasks. RPA solutions address this challenge by automating repetitive work, allowing existing legal professionals to focus on higher-value activities that require human judgment and expertise. Workforce optimization through automation has become a strategic imperative for maintaining competitive advantage.

Client service expectations have evolved dramatically, with corporate clients demanding faster response times, greater transparency, and more predictable costs. RPA enables legal service providers to meet these expectations by standardizing processes, reducing turnaround times, and providing real-time visibility into case progress and resource utilization.

Implementation challenges represent the most significant restraints limiting the rapid expansion of robotic process automation in legal services. Many legal organizations face substantial barriers related to legacy system integration, data security concerns, and the inherent complexity of legal workflows that resist standardization. Technology infrastructure limitations in traditional law firms often require significant investment before RPA implementation becomes feasible.

Regulatory uncertainty surrounding the use of automation in legal services creates hesitation among conservative legal practitioners who are concerned about professional liability and ethical compliance. Bar associations and regulatory bodies are still developing comprehensive guidelines for RPA implementation, creating a cautious adoption environment. Professional responsibility concerns require careful navigation to ensure automated processes maintain appropriate oversight and accountability.

Cultural resistance within traditional legal organizations poses significant challenges to RPA adoption. Many legal professionals express concerns about job displacement and the potential devaluation of traditional legal skills. Change management initiatives must address these concerns while demonstrating how automation enhances rather than replaces human legal expertise.

Cost considerations for comprehensive RPA implementation can be substantial, particularly for smaller legal organizations with limited technology budgets. The total cost of ownership includes not only software licensing but also system integration, training, and ongoing maintenance requirements. Return on investment calculations must account for these comprehensive costs while projecting realistic efficiency gains.

Emerging opportunities in the robotic process automation legal services market are creating new avenues for growth and innovation across multiple dimensions of legal practice. The integration of artificial intelligence with RPA platforms is opening possibilities for more sophisticated legal automation that can handle complex decision-making processes previously requiring human intervention.

Small and medium-sized law firms represent a significant untapped market opportunity as RPA technology becomes more accessible and affordable. Cloud-based RPA solutions are reducing implementation barriers and enabling smaller legal practices to compete more effectively with larger firms by leveraging automation for operational efficiency. Market democratization through technology is leveling the competitive playing field.

International expansion opportunities are emerging as multinational corporations seek consistent legal service delivery across different jurisdictions. RPA solutions that can adapt to varying regulatory requirements while maintaining standardized processes are particularly valuable for global legal operations. Cross-border legal services automation represents a substantial growth opportunity for technology providers.

Specialized practice areas such as intellectual property management, regulatory compliance, and contract lifecycle management offer significant opportunities for targeted RPA solutions. These areas involve high volumes of routine work that can benefit substantially from automation while requiring specialized legal knowledge for solution design. Vertical market specialization is driving innovation in RPA applications.

Market dynamics in the robotic process automation legal services sector are characterized by rapid technological evolution, shifting client expectations, and evolving regulatory frameworks. The interplay between these forces is creating a dynamic environment where early adopters gain competitive advantages while late adopters face increasing pressure to modernize their operations.

Technology advancement is accelerating the sophistication of RPA solutions, with machine learning and natural language processing capabilities enabling automation of increasingly complex legal tasks. According to MarkWide Research analysis, organizations implementing advanced RPA solutions report productivity improvements of 45% within the first year of deployment. Innovation cycles are shortening as vendors compete to deliver more comprehensive automation capabilities.

Competitive pressure is intensifying as legal service providers recognize that automation capabilities are becoming essential for maintaining market position. Firms that successfully implement RPA can offer more competitive pricing while maintaining profitability, creating pressure on competitors to adopt similar technologies. Market differentiation is increasingly dependent on technological capabilities rather than traditional factors.

Client sophistication regarding legal technology is growing rapidly, with corporate legal departments becoming more knowledgeable about automation possibilities and more demanding in their service provider selection criteria. This trend is driving legal service providers to invest in RPA capabilities to meet client expectations and maintain competitive relationships.

Comprehensive research methodology employed in analyzing the robotic process automation in legal services market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. The research approach combines primary data collection through industry surveys and interviews with secondary data analysis from authoritative industry sources and regulatory filings.

Primary research activities include structured interviews with legal technology executives, law firm managing partners, corporate legal department leaders, and RPA solution providers. Survey methodologies capture quantitative data on adoption rates, implementation challenges, and performance metrics across different segments of the legal services market. Industry expert panels provide qualitative insights into market trends and future developments.

Secondary research sources encompass industry reports, regulatory filings, patent databases, and academic research publications related to legal technology and process automation. Market sizing and forecasting models incorporate historical data trends, technology adoption curves, and economic indicators affecting the legal services industry. Data validation processes ensure consistency and accuracy across multiple information sources.

Analytical frameworks applied to the research data include competitive landscape analysis, market segmentation modeling, and trend identification algorithms. Statistical analysis techniques validate research findings and support market projections. Quality assurance protocols ensure research methodology adherence and data integrity throughout the analysis process.

North American markets dominate the robotic process automation in legal services sector, accounting for approximately 52% of global adoption due to the region’s advanced legal technology infrastructure and high concentration of large law firms and corporate legal departments. The United States leads in RPA implementation with particularly strong adoption in corporate legal departments and large law firms serving Fortune 500 clients.

European markets represent the second-largest regional segment, with the United Kingdom, Germany, and Netherlands showing the highest adoption rates. European legal organizations are particularly focused on RPA solutions that address regulatory compliance requirements, including GDPR compliance automation and cross-border legal process standardization. Regional market share in Europe accounts for approximately 28% of global implementations.

Asia-Pacific regions are experiencing rapid growth in legal RPA adoption, driven by expanding multinational corporate presence and modernization of legal service delivery models. Australia, Singapore, and Japan lead regional adoption, with particular strength in financial services legal departments and international law firms. Growth rates in Asia-Pacific markets exceed 40% annually as legal organizations invest in technology infrastructure.

Emerging markets in Latin America, Middle East, and Africa are beginning to adopt RPA solutions, primarily driven by multinational corporations establishing regional legal operations. These markets represent significant future growth opportunities as legal technology infrastructure develops and local legal service providers recognize automation benefits. Market penetration in emerging regions currently represents 12% of global adoption but is expanding rapidly.

Market leadership in the robotic process automation legal services sector is distributed among several categories of technology providers, each bringing distinct capabilities and market approaches. The competitive landscape includes established legal technology vendors, specialized RPA providers, and emerging startups focused specifically on legal automation solutions.

Competitive differentiation is increasingly focused on legal industry specialization, with vendors developing purpose-built solutions for specific legal workflows rather than generic automation tools. Strategic partnerships between RPA vendors and established legal technology providers are creating comprehensive automation ecosystems tailored for legal practice management.

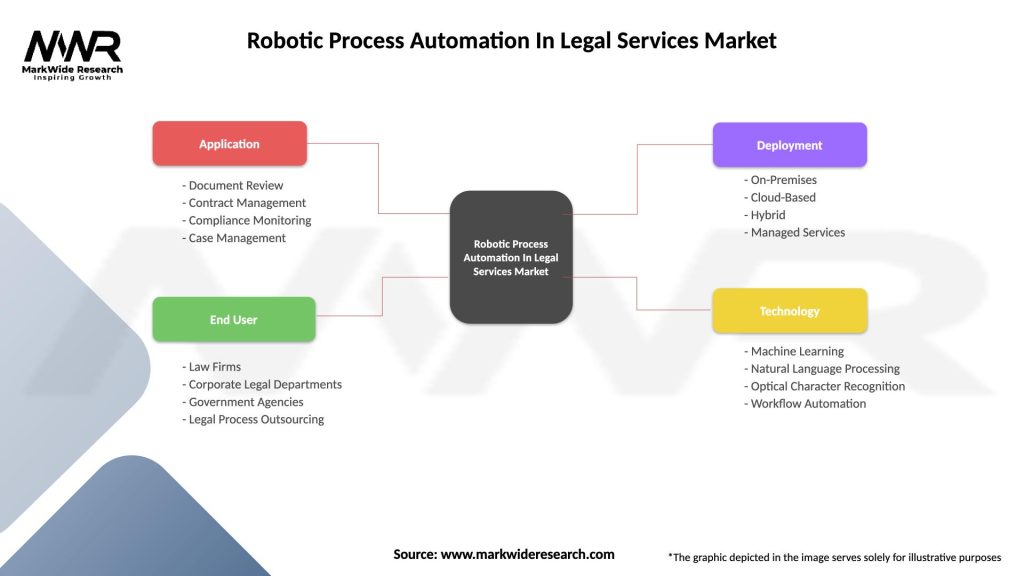

Market segmentation in the robotic process automation legal services sector reflects the diverse applications and deployment models across different types of legal organizations and practice areas. Segmentation analysis reveals distinct patterns of adoption and technology preferences based on organizational size, practice focus, and client requirements.

By Organization Type:

By Application Area:

Document processing automation represents the largest category within the legal RPA market, driven by the document-intensive nature of legal work and the significant efficiency gains achievable through automation. This category includes automated document review, contract analysis, and legal research support systems that can process large volumes of documents with consistent accuracy and speed.

Compliance automation solutions are experiencing rapid growth as regulatory requirements become increasingly complex and penalties for non-compliance escalate. These systems monitor regulatory changes, update compliance procedures, and generate required reports automatically. Regulatory technology integration with RPA platforms is creating comprehensive compliance management ecosystems.

Workflow automation platforms focus on streamlining legal processes from case intake through resolution, integrating with existing practice management systems to create seamless operational efficiency. These solutions typically include task assignment, deadline tracking, and progress monitoring capabilities that reduce administrative overhead while improving client service delivery.

Analytics and reporting automation provides legal organizations with real-time insights into operational performance, resource utilization, and client service metrics. These systems automatically generate dashboards and reports that support strategic decision-making and client relationship management. Business intelligence capabilities are becoming standard features in comprehensive RPA platforms.

Legal service providers realize substantial benefits from RPA implementation, including dramatic improvements in operational efficiency, cost reduction, and service quality consistency. Automation enables law firms to handle larger case volumes without proportional increases in staffing, improving profitability while maintaining competitive pricing. Quality control improvements through standardized processes reduce errors and enhance client satisfaction.

Corporate clients benefit from more predictable legal costs, faster service delivery, and improved transparency in legal process management. RPA implementations enable legal service providers to offer fixed-fee arrangements for routine legal work, providing clients with better cost predictability. Service delivery improvements include faster turnaround times and more consistent work product quality.

Legal professionals experience enhanced job satisfaction as automation eliminates routine, repetitive tasks and enables focus on higher-value strategic and advisory work. RPA implementation creates opportunities for career advancement into legal technology management roles while preserving the essential human elements of legal practice. Professional development opportunities expand as legal professionals acquire technology management skills.

Technology vendors benefit from expanding market opportunities as legal organizations increase their technology investments. The legal services market represents a substantial and growing opportunity for RPA providers, with potential for long-term client relationships and recurring revenue models. Market expansion opportunities continue to grow as automation adoption accelerates across the legal industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration with RPA platforms is transforming the capabilities of legal automation systems, enabling more sophisticated document analysis, contract review, and legal research functions. This trend is creating opportunities for automation of complex legal tasks that previously required human expertise. Cognitive automation is becoming the next frontier in legal technology evolution.

Cloud-based deployment models are gaining traction as legal organizations seek more flexible and cost-effective RPA implementation options. Cloud platforms reduce infrastructure requirements and enable faster deployment while providing scalability for growing legal practices. Software-as-a-Service models are making RPA more accessible to smaller legal organizations.

Industry-specific solutions are emerging as RPA vendors develop deeper expertise in legal workflows and regulatory requirements. These specialized solutions offer pre-configured automation templates and compliance features tailored specifically for legal practice areas. Vertical market focus is driving innovation in legal automation capabilities.

Integration ecosystem development is creating comprehensive legal technology platforms that combine RPA with practice management, document management, and client relationship management systems. These integrated platforms provide seamless workflow automation across all aspects of legal practice. Platform consolidation is simplifying technology management for legal organizations.

Strategic partnerships between RPA vendors and established legal technology providers are creating comprehensive automation ecosystems tailored for legal practice management. These partnerships combine RPA capabilities with specialized legal software to deliver integrated solutions that address end-to-end legal workflows. Technology integration initiatives are accelerating market development.

Regulatory framework development by bar associations and legal regulatory bodies is providing clearer guidance on RPA implementation while maintaining professional responsibility standards. These frameworks are reducing uncertainty and encouraging broader adoption of automation technologies in legal services. Professional standards evolution is supporting market growth.

Investment activity in legal technology startups focusing on RPA applications has increased significantly, with venture capital firms recognizing the substantial market opportunity in legal automation. This investment is driving innovation and accelerating the development of specialized legal RPA solutions. Funding availability is supporting rapid market expansion.

Enterprise adoption by major law firms and corporate legal departments is demonstrating the viability and benefits of large-scale RPA implementation. These high-profile deployments are serving as case studies that encourage broader market adoption. Success stories are building confidence in RPA technology among conservative legal organizations.

Implementation strategy recommendations emphasize the importance of starting with well-defined, high-volume processes that can demonstrate clear return on investment. Legal organizations should focus on processes with standardized workflows and minimal exception handling to ensure successful initial deployments. Phased implementation approaches reduce risk while building organizational confidence in automation technology.

Change management initiatives should address cultural resistance and skill development needs within legal organizations. Successful RPA implementation requires comprehensive training programs and clear communication about how automation enhances rather than replaces human legal expertise. Stakeholder engagement throughout the implementation process is critical for achieving adoption success.

Vendor selection criteria should prioritize legal industry expertise, integration capabilities, and long-term platform viability over lowest initial cost. Organizations should evaluate vendors based on their understanding of legal workflows, compliance requirements, and ability to provide ongoing support. Due diligence processes should include reference checks with similar legal organizations.

Performance measurement frameworks should be established before RPA implementation to track efficiency gains, cost reductions, and quality improvements. Regular assessment of automation performance enables continuous optimization and demonstrates value to organizational stakeholders. Metrics-driven management ensures sustained benefits from RPA investments.

Market evolution in the robotic process automation legal services sector is expected to accelerate significantly over the next five years, driven by continued technology advancement and increasing competitive pressure for operational efficiency. MWR projects that automation adoption rates will reach 75% among large law firms and 60% among corporate legal departments by 2029, representing substantial growth from current levels.

Technology advancement will focus on integration of artificial intelligence capabilities that enable automation of increasingly complex legal tasks requiring judgment and analysis. Natural language processing improvements will enhance contract analysis capabilities, while machine learning algorithms will improve document review accuracy and efficiency. Cognitive automation will become standard in comprehensive legal RPA platforms.

Market consolidation is expected to continue as successful RPA vendors acquire specialized legal technology companies to build comprehensive automation ecosystems. This consolidation will create more powerful platforms while potentially reducing the number of vendor options available to legal organizations. Platform integration will become a key competitive differentiator.

Global expansion opportunities will drive market growth as legal organizations worldwide recognize the competitive advantages of automation technology. International law firms will lead adoption in emerging markets, followed by local legal service providers seeking to compete more effectively. Market democratization through cloud-based solutions will enable broader global adoption across organizations of all sizes.

The robotic process automation in legal services market represents a fundamental transformation in how legal work is conceptualized, delivered, and valued. This dynamic sector has evolved from experimental implementations to mainstream adoption, driven by compelling economic benefits and competitive pressures that make automation essential for sustainable legal practice. Market maturation is evident in the sophistication of available solutions and the success of large-scale implementations across diverse legal organizations.

Strategic implications for legal service providers extend beyond operational efficiency to encompass new business models, service delivery approaches, and competitive positioning strategies. Organizations that successfully implement RPA gain significant advantages in cost structure, service quality, and market responsiveness. Technology adoption has become a strategic imperative rather than an optional enhancement for legal organizations seeking long-term viability.

Future market development will be characterized by continued innovation in automation capabilities, expanding applications across legal practice areas, and growing integration with broader legal technology ecosystems. The convergence of RPA with artificial intelligence, cloud computing, and analytics platforms will create unprecedented opportunities for legal service transformation. Industry evolution toward technology-enabled legal services delivery models appears irreversible, positioning RPA as a foundational element of modern legal practice infrastructure.

What is Robotic Process Automation In Legal Services?

Robotic Process Automation In Legal Services refers to the use of software robots to automate repetitive tasks within legal processes, such as document review, contract management, and compliance checks. This technology enhances efficiency and accuracy in legal operations.

What are the key players in the Robotic Process Automation In Legal Services Market?

Key players in the Robotic Process Automation In Legal Services Market include UiPath, Automation Anywhere, Blue Prism, and Pega Systems. These companies provide various automation solutions tailored for legal applications, among others.

What are the main drivers of growth in the Robotic Process Automation In Legal Services Market?

The main drivers of growth in the Robotic Process Automation In Legal Services Market include the increasing demand for operational efficiency, the need for error reduction in legal documentation, and the rising adoption of digital transformation in law firms.

What challenges does the Robotic Process Automation In Legal Services Market face?

Challenges in the Robotic Process Automation In Legal Services Market include resistance to change from legal professionals, concerns about data security and compliance, and the complexity of integrating automation with existing legal systems.

What opportunities exist in the Robotic Process Automation In Legal Services Market?

Opportunities in the Robotic Process Automation In Legal Services Market include the potential for enhanced client service through faster response times, the ability to handle large volumes of data efficiently, and the expansion of automation into new legal areas such as litigation support.

What trends are shaping the Robotic Process Automation In Legal Services Market?

Trends shaping the Robotic Process Automation In Legal Services Market include the increasing use of artificial intelligence to enhance automation capabilities, the growth of cloud-based automation solutions, and a focus on user-friendly interfaces that require minimal technical expertise.

Robotic Process Automation In Legal Services Market

| Segmentation Details | Description |

|---|---|

| Application | Document Review, Contract Management, Compliance Monitoring, Case Management |

| End User | Law Firms, Corporate Legal Departments, Government Agencies, Legal Process Outsourcing |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Technology | Machine Learning, Natural Language Processing, Optical Character Recognition, Workflow Automation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Robotic Process Automation In Legal Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at