444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The robot rental service market provides businesses with access to robotic solutions without the need for large upfront investments. It offers a flexible and cost-effective alternative to purchasing robots outright, allowing companies to leverage advanced automation technologies for various applications, including manufacturing, logistics, healthcare, agriculture, and entertainment.

Meaning

Robot rental services enable businesses to rent robots for temporary or long-term use, providing access to cutting-edge robotic technologies without the capital expenditure associated with purchasing and maintaining robotic equipment. This model allows companies to scale their robotic deployments according to demand, experiment with different applications, and adapt to changing business needs more efficiently.

Executive Summary

The robot rental service market is experiencing rapid growth due to increasing adoption of automation across industries, rising demand for flexible robotics solutions, and the emergence of new business models that prioritize access over ownership. Key market players offer a wide range of robotic solutions, including industrial robots, collaborative robots (cobots), autonomous mobile robots (AMRs), and service robots, catering to diverse customer requirements and applications.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The robot rental service market is characterized by dynamic trends and evolving customer preferences influenced by factors such as technological innovation, regulatory changes, competitive dynamics, and macroeconomic conditions. Key market players must anticipate and adapt to these dynamics by continuously innovating, collaborating, and delivering value-added solutions that address customer needs and market demands effectively.

Regional Analysis

The robot rental service market exhibits varying trends and growth opportunities across different geographic regions:

Competitive Landscape

Leading Companies in the Robot Rental Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

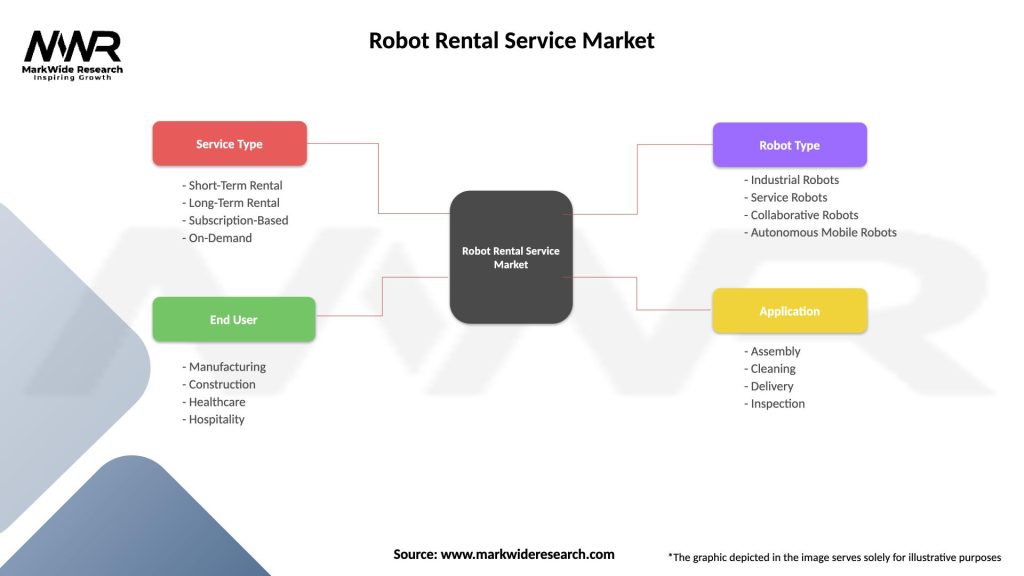

Segmentation

The robot rental service market can be segmented based on various factors, including:

Category-wise Insights

Each category of robot rental services offers unique features, benefits, and applications tailored to different industries and use cases:

Key Benefits for Industry Participants and Stakeholders

The robot rental service market offers several benefits for manufacturers, retailers, and consumers:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the robot rental service market:

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the robot rental service market:

Key Industry Developments

Analyst Suggestions

Based on market trends and developments, analysts suggest the following strategies for robot rental service providers:

Future Outlook

The future outlook for the robot rental service market is optimistic, with continued growth and expansion expected in the coming years. As businesses across industries increasingly adopt automation to improve efficiency, productivity, and competitiveness, the demand for robot rental services is expected to rise, driven by factors such as technological advancements, changing workforce dynamics, and evolving customer preferences. Robot rental service providers that prioritize innovation, collaboration, and customer-centricity are well-positioned to capitalize on this growing market opportunity and drive the next wave of automation and digital transformation.

Conclusion

In conclusion, the robot rental service market is poised for significant growth, driven by advancements in automation technology, increasing labor costs, and a growing demand for flexible solutions across various industries. The emergence of collaborative robots and AI-enhanced automation presents exciting opportunities for stakeholders to enhance operational efficiency while minimizing upfront capital investments. As businesses increasingly seek to integrate robotics into their workflows, the market is witnessing a shift towards subscription-based models, which offer greater accessibility and scalability. However, challenges such as regulatory hurdles, workforce adaptation, and concerns regarding cybersecurity must be addressed to fully harness the potential of this evolving landscape. For investors, the focus should be on companies that are innovating and adapting to these trends, particularly those that emphasize sustainability and user-friendly interfaces. End-users can expect to benefit from enhanced productivity and reduced operational risks as the rental model becomes more prevalent. Looking ahead, the market is likely to see a convergence of robotics with IoT and machine learning technologies, creating a more interconnected ecosystem that will redefine operational paradigms. As the demand for automation continues to rise, the robot rental service market will play a crucial role in shaping the future of work, offering strategic solutions that align with the evolving needs of industries worldwide.

What is Robot Rental Service?

Robot rental service refers to the practice of leasing robotic systems for various applications, such as manufacturing, logistics, and healthcare. This service allows businesses to access advanced technology without the high upfront costs of purchasing robots.

What are the key companies in the Robot Rental Service Market?

Key companies in the Robot Rental Service Market include Fetch Robotics, Robotnik, and SoftBank Robotics, among others. These companies provide a range of robotic solutions tailored for different industries, enhancing operational efficiency.

What are the growth factors driving the Robot Rental Service Market?

The Robot Rental Service Market is driven by factors such as the increasing demand for automation in various sectors, the need for cost-effective solutions, and advancements in robotic technology. Additionally, the growing trend of Industry Four Point Zero is contributing to market expansion.

What challenges does the Robot Rental Service Market face?

Challenges in the Robot Rental Service Market include high maintenance costs, the need for skilled operators, and concerns regarding data security. These factors can hinder the adoption of robotic solutions in certain industries.

What opportunities exist in the Robot Rental Service Market?

The Robot Rental Service Market presents opportunities such as the expansion into emerging markets, the development of specialized robots for niche applications, and the integration of AI and machine learning technologies. These advancements can enhance service offerings and attract new customers.

What trends are shaping the Robot Rental Service Market?

Trends in the Robot Rental Service Market include the increasing use of collaborative robots, the rise of on-demand rental services, and the growing focus on sustainability in robotic solutions. These trends are influencing how businesses approach automation and technology adoption.

Robot Rental Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Short-Term Rental, Long-Term Rental, Subscription-Based, On-Demand |

| End User | Manufacturing, Construction, Healthcare, Hospitality |

| Robot Type | Industrial Robots, Service Robots, Collaborative Robots, Autonomous Mobile Robots |

| Application | Assembly, Cleaning, Delivery, Inspection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Robot Rental Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at