444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The reverse mortgage services market has emerged as a vital component of the financial landscape, offering seniors a unique financial tool to unlock the equity in their homes. This market caters primarily to elderly homeowners seeking to supplement their retirement income, manage healthcare expenses, or enhance their overall financial well-being. Reverse mortgage services allow homeowners aged 62 and older to convert a portion of their home equity into cash without the need to sell their homes or take on monthly mortgage payments. As the aging population continues to grow globally, the demand for reverse mortgage services is expected to rise, presenting opportunities and challenges for industry participants and stakeholders alike.

Meaning

Reverse mortgage services enable homeowners to access the equity in their homes by receiving payments from a lender, either in a lump sum, monthly installments, or a line of credit. Unlike traditional mortgages, where homeowners make monthly payments to a lender, reverse mortgages involve the lender making payments to the homeowner, with the loan balance typically due when the homeowner moves out of the home or passes away. This financial product is particularly attractive to seniors who wish to stay in their homes while supplementing their retirement income or covering expenses such as healthcare, home renovations, or debt consolidation.

Executive Summary

The reverse mortgage services market has experienced significant growth in recent years, driven by demographic trends, changing retirement landscapes, and evolving consumer preferences. This market offers a valuable financial solution for seniors seeking to tap into their home equity without selling their homes. However, it also faces regulatory scrutiny, consumer protection concerns, and reputational risks. Understanding the key market dynamics, trends, and regulatory considerations is crucial for industry players to navigate the complexities of the reverse mortgage services market and meet the needs of aging homeowners effectively.

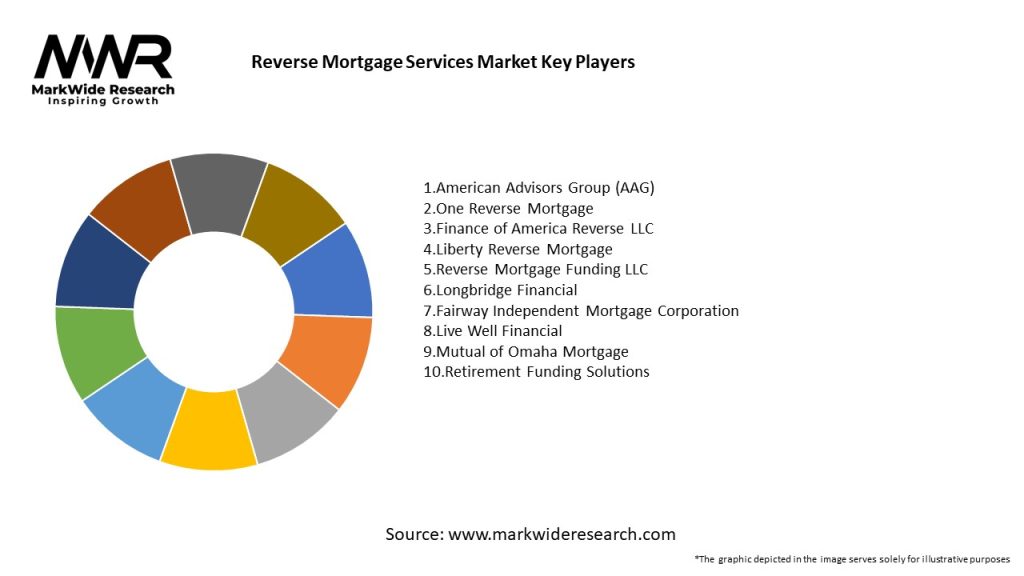

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The reverse mortgage services market operates in a dynamic environment shaped by demographic trends, economic conditions, regulatory changes, and consumer preferences. These dynamics influence market growth, product innovation, industry consolidation, and consumer behavior. Understanding the market dynamics is essential for industry participants to anticipate trends, identify opportunities, mitigate risks, and adapt their strategies to evolving market conditions.

Regional Analysis

The reverse mortgage services market exhibits regional variations influenced by factors such as demographic profiles, housing market trends, regulatory frameworks, and cultural attitudes toward homeownership and aging. Let’s explore some key regions:

Competitive Landscape

Leading companies in the Reverse Mortgage Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The reverse mortgage services market can be segmented based on various factors such as:

Segmentation provides a more nuanced understanding of the reverse mortgage services market, enabling industry players to tailor their products, services, and marketing strategies to specific customer segments and market segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the reverse mortgage services market’s strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Understanding these factors through a SWOT analysis helps reverse mortgage service providers identify market opportunities, address challenges, and develop strategies to enhance their competitiveness and sustainability in the dynamic reverse mortgage services market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the reverse mortgage services market, influencing trends such as:

Key Industry Developments

Analyst Suggestions

Future Outlook

The reverse mortgage services market is poised for continued growth and evolution, driven by demographic trends, regulatory reforms, technological advancements, and changing consumer preferences. As the aging population expands globally, the demand for reverse mortgage solutions is expected to increase, presenting opportunities for industry players to innovate, expand market reach, and address unmet needs in the retirement finance landscape. However, challenges such as regulatory uncertainties, reputational risks, and economic vulnerabilities remain, requiring proactive strategies, adaptive approaches, and collaborative efforts to build a sustainable and resilient reverse mortgage services market that serves the needs of seniors, enhances their financial security, and promotes aging in place principles.

Conclusion

The reverse mortgage services market plays a vital role in the retirement finance ecosystem, offering seniors a valuable financial tool to access their home equity, supplement their retirement income, and enhance their financial well-being. Despite challenges and misconceptions, reverse mortgages provide a means for seniors to age in place, manage retirement expenses, and achieve their financial goals while retaining ownership of their homes. By embracing innovation, compliance, education, and collaboration, industry stakeholders can shape a dynamic and inclusive reverse mortgage services market that meets the diverse needs of seniors, promotes financial empowerment and security, and supports healthy aging principles for future generations.

What is Reverse Mortgage Services?

Reverse mortgage services allow homeowners, typically seniors, to convert part of their home equity into cash while retaining ownership of their home. This financial product is designed to provide additional income for retirees, helping them manage expenses and improve their quality of life.

What are the key players in the Reverse Mortgage Services Market?

Key players in the Reverse Mortgage Services Market include companies like AAG (American Advisors Group), Reverse Mortgage Funding LLC, and One Reverse Mortgage, among others. These companies offer various reverse mortgage products and services tailored to meet the needs of seniors.

What are the growth factors driving the Reverse Mortgage Services Market?

The growth of the Reverse Mortgage Services Market is driven by an aging population seeking financial solutions for retirement, increasing home equity among seniors, and the rising cost of living. Additionally, greater awareness and acceptance of reverse mortgages as a viable financial option contribute to market expansion.

What challenges does the Reverse Mortgage Services Market face?

The Reverse Mortgage Services Market faces challenges such as regulatory scrutiny, misconceptions about reverse mortgages, and potential market volatility. These factors can hinder consumer confidence and affect the overall growth of the market.

What opportunities exist in the Reverse Mortgage Services Market?

Opportunities in the Reverse Mortgage Services Market include the development of innovative products tailored to diverse consumer needs, partnerships with financial advisors, and expanding educational initiatives to inform potential borrowers. These strategies can enhance market penetration and consumer trust.

What trends are shaping the Reverse Mortgage Services Market?

Trends in the Reverse Mortgage Services Market include the increasing use of technology for application processes, personalized financial planning services, and a growing focus on customer service. These trends aim to improve the overall experience for borrowers and streamline the reverse mortgage process.

Reverse Mortgage Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Home Equity Conversion Mortgages, Proprietary Reverse Mortgages, Single-Purpose Reverse Mortgages, Government-Insured Reverse Mortgages |

| Client Type | Senior Homeowners, Financial Advisors, Mortgage Brokers, Real Estate Agents |

| Loan Type | Fixed-Rate Loans, Adjustable-Rate Loans, Line of Credit Loans, Combination Loans |

| Distribution Channel | Direct Lenders, Banks, Credit Unions, Online Platforms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Reverse Mortgage Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at