444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Revenue-Based Financing market is witnessing significant growth and is expected to expand rapidly in the coming years. This alternative financing method has gained popularity among startups and small to medium-sized enterprises (SMEs) looking for flexible funding options without diluting their equity. Revenue-Based financing, also known as revenue-based loans or revenue share financing, provides businesses with capital in exchange for a percentage of their future revenue.

Meaning

Revenue-Based Financing is a financing model where investors provide capital to businesses in exchange for a share of their future revenue. Unlike traditional debt financing, which requires fixed monthly repayments regardless of the business’s performance, revenue-based loans offer more flexibility. The repayment is linked to the company’s revenue, meaning that during periods of low revenue, the repayment amount is lower, easing the financial burden on the borrower.

Executive Summary

The Revenue-Based Financing market has experienced substantial growth in recent years, driven by the increasing demand for alternative funding options. Startups and SMEs are attracted to this financing model due to its flexible repayment structure and the ability to avoid equity dilution. The market has witnessed the entry of numerous specialized lenders and platforms, offering a wide range of revenue-based financing solutions. However, certain challenges and opportunities exist within the market that should be carefully considered by both borrowers and lenders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Revenue-Based Financing market is characterized by dynamic factors that shape its growth and development. These dynamics include changing market trends, evolving borrower and investor preferences, regulatory developments, and the overall economic landscape. It is essential for market participants to stay updated with these dynamics to make informed decisions and leverage opportunities.

Regional Analysis

The Revenue-Based Financing market exhibits regional variations influenced by factors such as the maturity of startup ecosystems, regulatory environment, and access to capital. While developed economies like the United States and the United Kingdom have witnessed significant adoption of revenue-based financing, emerging economies in Asia Pacific and Latin America present untapped opportunities for market growth.

Competitive Landscape

Leading Companies in the Revenue-Based Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

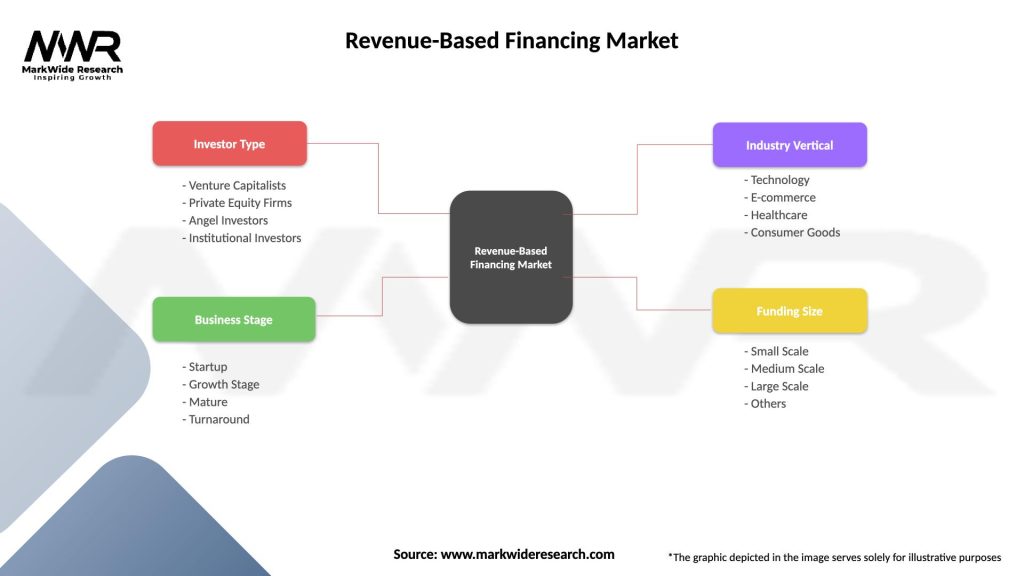

Segmentation

The Revenue-Based Financing market can be segmented based on various factors, including business size, industry vertical, and geographical location. Business size segmentation includes startups, SMEs, and microenterprises. Industry vertical segmentation encompasses technology, healthcare, e-commerce, manufacturing, and others. Geographically, the market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a mixed impact on the Revenue-Based Financing market. While some businesses faced significant challenges due to reduced revenue and uncertainty, others experienced increased demand in sectors like healthcare, e-commerce, and technology. The pandemic highlighted the resilience of revenue-based financing, with its flexible repayment structure helping borrowers navigate through the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

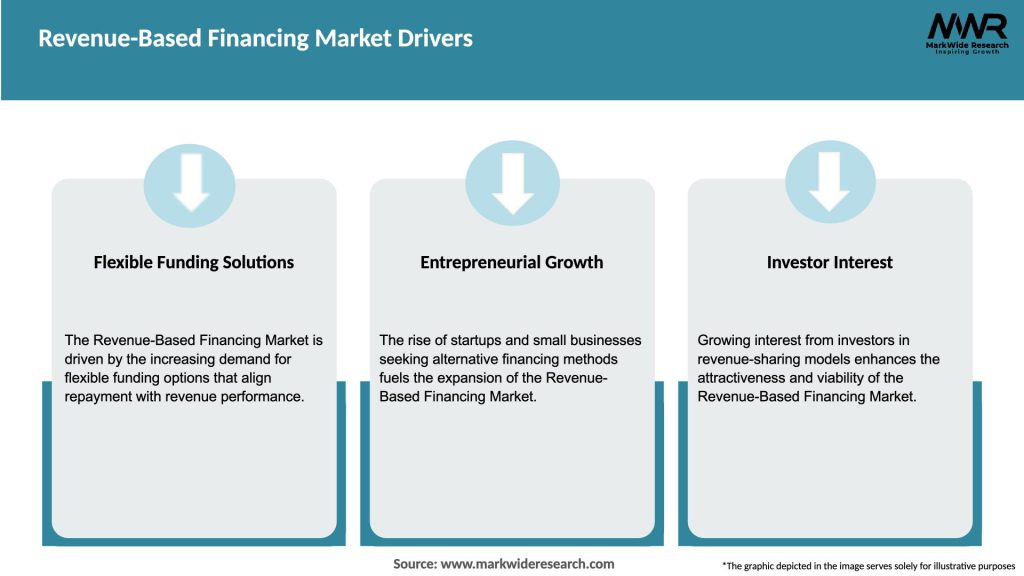

The Revenue-Based Financing market is poised for substantial growth in the coming years. The increasing demand for flexible funding options, the rise of specialized platforms, and the growing investor interest in alternative assets are expected to drive market expansion. However, addressing regulatory challenges, enhancing risk assessment models, and creating awareness among businesses remain crucial for the market’s sustainable growth.

Conclusion

The Revenue-Based Financing market offers a flexible and attractive funding option for startups and SMEs looking to access capital without diluting equity. The market’s growth is driven by factors such as increasing demand for alternative financing, flexibility in repayment, and growing investor interest. However, regulatory challenges, limited awareness, and competition from traditional financing options pose hurdles. By addressing these challenges, leveraging market opportunities, and embracing technological advancements, the Revenue-Based Financing market can unlock its full potential and play a significant role in supporting entrepreneurial ventures and economic growth.

What is Revenue-Based Financing?

Revenue-Based Financing is a funding model where investors provide capital to businesses in exchange for a percentage of the company’s future revenue. This approach allows companies to access funds without giving up equity or taking on traditional debt.

What are the key players in the Revenue-Based Financing Market?

Key players in the Revenue-Based Financing Market include companies like Clearco, Lighter Capital, and Pipe, which specialize in providing revenue-based financing solutions to startups and small businesses, among others.

What are the growth factors driving the Revenue-Based Financing Market?

The Revenue-Based Financing Market is driven by the increasing demand for flexible funding options among startups, the rise of e-commerce businesses, and the growing trend of alternative financing methods that do not require collateral.

What challenges does the Revenue-Based Financing Market face?

Challenges in the Revenue-Based Financing Market include the potential for high repayment costs, the risk of revenue fluctuations impacting repayment ability, and the need for businesses to maintain consistent revenue streams.

What opportunities exist in the Revenue-Based Financing Market?

Opportunities in the Revenue-Based Financing Market include the expansion of financing options for underserved industries, the potential for partnerships with fintech companies, and the increasing acceptance of revenue-based models among traditional investors.

What trends are shaping the Revenue-Based Financing Market?

Trends in the Revenue-Based Financing Market include the growing use of data analytics to assess business performance, the rise of automated funding platforms, and an increasing focus on sustainable business practices among funded companies.

Revenue-Based Financing Market

| Segmentation Details | Description |

|---|---|

| Investor Type | Venture Capitalists, Private Equity Firms, Angel Investors, Institutional Investors |

| Business Stage | Startup, Growth Stage, Mature, Turnaround |

| Industry Vertical | Technology, E-commerce, Healthcare, Consumer Goods |

| Funding Size | Small Scale, Medium Scale, Large Scale, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Revenue-Based Financing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at