444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Renewable Energy Project Operation and Maintenance (O&M) market is experiencing significant growth as the deployment of renewable energy projects continues to expand globally. O&M services play a crucial role in ensuring the efficient and reliable operation of renewable energy assets, including solar, wind, and hydroelectric power plants. This market is primarily driven by the increasing adoption of renewable energy sources, the growing installed capacity of renewable energy projects, and the need to optimize asset performance and maximize returns on investment.

Meaning

Renewable Energy Project Operation and Maintenance (O&M) involves the management, monitoring, and upkeep of renewable energy assets throughout their lifecycle, including installation, commissioning, operation, and decommissioning. O&M services encompass a wide range of activities, such as preventive maintenance, corrective maintenance, performance monitoring, asset management, and spare parts supply, aimed at ensuring the reliable and efficient operation of renewable energy projects. These services are essential for maximizing energy production, minimizing downtime, and extending the lifespan of renewable energy assets.

Executive Summary

The Renewable Energy Project Operation and Maintenance market is witnessing robust growth, driven by the increasing demand for reliable and efficient operation of renewable energy assets. Key players in the market are focusing on innovation, technology adoption, and service differentiation to meet the evolving needs of renewable energy project owners and operators.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Renewable Energy Project Operation and Maintenance market is characterized by increasing complexity, technological advancements, and evolving customer expectations. Key players in the market are leveraging innovation, digitalization, and data analytics to optimize O&M processes, improve asset performance, and deliver value-added services to their clients. Moreover, partnerships, collaborations, and mergers and acquisitions are reshaping the competitive landscape and driving market consolidation as companies seek to expand their service offerings and market reach.

Regional Analysis

Geographically, the Renewable Energy Project Operation and Maintenance market is witnessing significant growth across regions, with Asia-Pacific expected to lead the market expansion due to rapid renewable energy deployment and supportive government policies and incentives. North America and Europe are also significant markets, driven by the growing installed capacity of renewable energy projects and the need to optimize asset performance and reliability.

Competitive Landscape

The Renewable Energy Project Operation and Maintenance market is highly competitive, with a mix of established players and new entrants vying for market share. Key players include EDF Renewables, Vestas, NextEra Energy Resources, and Enel Green Power, among others. These companies offer a wide range of O&M services, including preventive maintenance, corrective maintenance, performance monitoring, and asset management, tailored to the specific needs of renewable energy project owners and operators.

Segmentation

The Renewable Energy Project Operation and Maintenance market can be segmented based on technology, service type, project type, and geography. By technology, the market includes solar PV, onshore wind, offshore wind, hydroelectric, and others. Service types encompass preventive maintenance, corrective maintenance, performance monitoring, asset management, and spare parts supply. Project types range from utility-scale projects to distributed generation and off-grid systems.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has presented challenges and opportunities for the Renewable Energy Project Operation and Maintenance market. While the pandemic has disrupted supply chains, project schedules, and workforce mobility, it has also underscored the importance of resilient and reliable energy systems in supporting essential services and economic activities. As economies recover and renewable energy deployment resumes, the demand for O&M services is expected to rebound, driven by the need to optimize asset performance, minimize operational risks, and maximize returns on investment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Renewable Energy Project Operation and Maintenance market is poised for continued growth and innovation in the coming years, driven by the increasing deployment of renewable energy projects and the growing importance of asset optimization and reliability. Key players in the market are expected to focus on technology advancements, market expansion, and service differentiation to capitalize on emerging opportunities and gain a competitive edge. Moreover, investments in workforce development, regulatory support, and market incentives are likely to accelerate the adoption and deployment of O&M services, supporting the transition towards a more sustainable, resilient, and efficient energy future.

Conclusion

In conclusion, the Renewable Energy Project Operation and Maintenance market presents lucrative opportunities for businesses and stakeholders seeking to support the efficient and reliable operation of renewable energy assets. With the right strategy, innovation, and collaboration, companies can capitalize on emerging trends and market dynamics to drive growth and achieve long-term success in this dynamic and rapidly evolving market. By focusing on technology adoption, market expansion, and service excellence, the Renewable Energy Project Operation and Maintenance market can play a crucial role in supporting the transition towards a more sustainable, resilient, and efficient energy future.

What is Renewable Energy Project Operation and Maintenance?

Renewable Energy Project Operation and Maintenance refers to the processes involved in managing and servicing renewable energy facilities, such as wind farms, solar power plants, and hydroelectric stations, to ensure optimal performance and longevity.

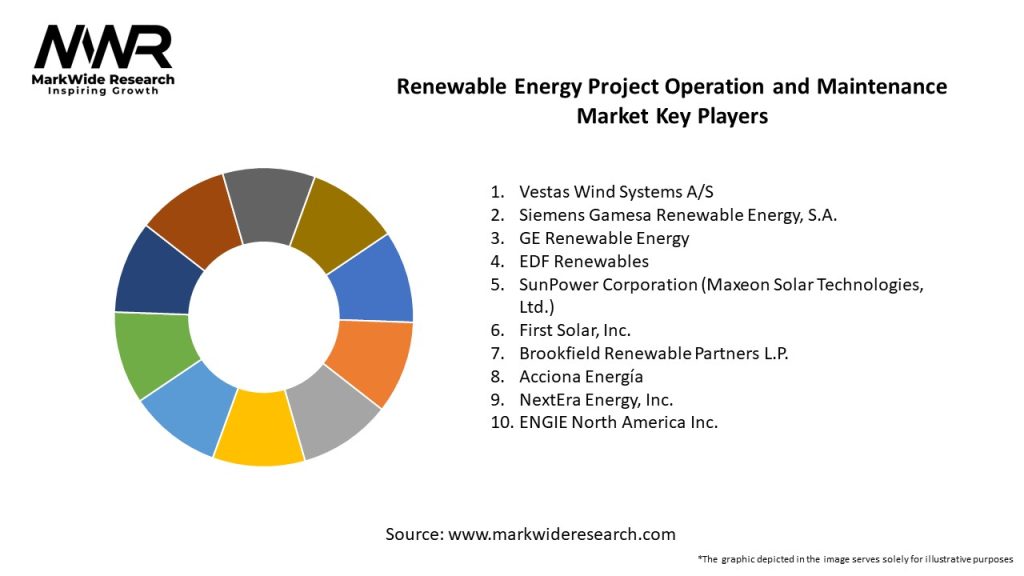

What are the key players in the Renewable Energy Project Operation and Maintenance Market?

Key players in the Renewable Energy Project Operation and Maintenance Market include companies like Siemens Gamesa, Vestas, GE Renewable Energy, and First Solar, among others.

What are the main drivers of the Renewable Energy Project Operation and Maintenance Market?

The main drivers of the Renewable Energy Project Operation and Maintenance Market include the increasing demand for renewable energy sources, government incentives for clean energy, and advancements in technology that enhance operational efficiency.

What challenges does the Renewable Energy Project Operation and Maintenance Market face?

Challenges in the Renewable Energy Project Operation and Maintenance Market include the high initial costs of renewable energy projects, the need for skilled labor, and the variability of renewable energy sources which can complicate maintenance schedules.

What opportunities exist in the Renewable Energy Project Operation and Maintenance Market?

Opportunities in the Renewable Energy Project Operation and Maintenance Market include the expansion of renewable energy infrastructure, the integration of smart technologies for predictive maintenance, and the growing focus on sustainability and carbon reduction initiatives.

What trends are shaping the Renewable Energy Project Operation and Maintenance Market?

Trends shaping the Renewable Energy Project Operation and Maintenance Market include the increasing adoption of digital tools for monitoring and management, the rise of hybrid energy systems, and a greater emphasis on environmental, social, and governance (ESG) criteria in project management.

Renewable Energy Project Operation and Maintenance Market

| Segmentation Details | Description |

|---|---|

| Service Type | Preventive Maintenance, Corrective Maintenance, Predictive Maintenance, Remote Monitoring |

| Technology | Solar, Wind, Biomass, Hydropower |

| End User | Utilities, Independent Power Producers, Government, Commercial |

| Application | Power Generation, Energy Storage, Grid Management, Others |

Leading Companies in the Renewable Energy Project Operation and Maintenance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at