444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The renewable energy in France market represents a transformative sector driving the nation’s transition toward sustainable energy independence and carbon neutrality. France’s renewable energy landscape encompasses diverse technologies including wind power, solar photovoltaic systems, hydroelectric generation, biomass energy, and geothermal solutions. The market has experienced substantial growth momentum as the country accelerates its commitment to achieving carbon neutrality by 2050 and reducing greenhouse gas emissions by 55% by 2030.

Government initiatives and regulatory frameworks have positioned France as a leading European market for renewable energy deployment. The country’s Multiannual Energy Programming (PPE) establishes ambitious targets for renewable energy capacity expansion, creating significant opportunities for technology providers, project developers, and energy companies. Wind energy continues to dominate the renewable landscape, while solar power adoption is accelerating rapidly across residential, commercial, and utility-scale applications.

Market dynamics indicate strong growth potential driven by declining technology costs, improved energy storage solutions, and increasing corporate renewable energy procurement. The sector benefits from favorable feed-in tariffs, competitive bidding processes, and supportive financing mechanisms that encourage private sector investment in clean energy infrastructure.

The renewable energy in France market refers to the comprehensive ecosystem of sustainable energy generation technologies, infrastructure development, and related services that harness natural resources to produce clean electricity and thermal energy. This market encompasses the entire value chain from technology manufacturing and project development to energy generation, distribution, and storage solutions.

Renewable energy sources in France include wind power (onshore and offshore), solar photovoltaic and thermal systems, hydroelectric power, biomass and biogas energy, geothermal systems, and emerging technologies such as marine energy. The market involves multiple stakeholders including energy developers, technology manufacturers, utility companies, government agencies, financial institutions, and end-users across residential, commercial, and industrial sectors.

Market participants engage in activities ranging from research and development of advanced renewable technologies to large-scale project financing, construction, operation, and maintenance of renewable energy facilities. The sector also includes energy trading, grid integration services, and innovative business models such as power purchase agreements and community energy projects.

France’s renewable energy market is experiencing unprecedented growth as the country implements ambitious climate policies and energy transition strategies. The market demonstrates robust expansion across all renewable energy segments, with wind and solar technologies leading capacity additions. Government support mechanisms including competitive tenders, simplified permitting processes, and long-term energy planning provide a stable foundation for sustained market development.

Key market drivers include the phase-out of nuclear capacity, increasing electricity demand, corporate sustainability commitments, and technological advancements that have significantly reduced renewable energy costs. The sector benefits from strong public acceptance of renewable energy projects and growing awareness of climate change impacts among French consumers and businesses.

Investment flows into the renewable energy sector have intensified, with both domestic and international capital supporting large-scale infrastructure projects. The market is characterized by increasing consolidation among project developers, strategic partnerships between technology providers and utilities, and the emergence of innovative financing structures that accelerate project deployment.

Future prospects remain highly positive, with the renewable energy sector expected to play a central role in France’s economic recovery and green transition. The market is positioned to benefit from European Union climate policies, technological innovations, and increasing competitiveness of renewable energy solutions compared to conventional power generation.

Strategic analysis reveals several critical insights shaping the renewable energy landscape in France:

Government policy support serves as the primary driver for renewable energy market expansion in France. The country’s National Low-Carbon Strategy establishes clear targets for renewable energy deployment and provides regulatory certainty for long-term investments. Feed-in tariffs and competitive bidding mechanisms ensure stable revenue streams for renewable energy projects while promoting cost competitiveness.

Climate change commitments under the Paris Agreement and European Union climate legislation create mandatory requirements for renewable energy adoption. France’s commitment to achieving carbon neutrality by 2050 necessitates massive renewable energy deployment across all economic sectors. Environmental regulations increasingly favor clean energy solutions over fossil fuel alternatives.

Technological advancements have dramatically improved the cost-effectiveness and reliability of renewable energy systems. Wind turbine efficiency continues to increase while costs decline, making wind power highly competitive with conventional generation. Solar panel efficiency improvements and manufacturing scale economies have reduced solar electricity costs significantly.

Energy security considerations drive diversification away from imported fossil fuels toward domestic renewable energy resources. Geopolitical uncertainties and volatile fossil fuel prices strengthen the economic case for renewable energy investments. Energy independence through renewable energy deployment reduces France’s exposure to international energy market fluctuations.

Corporate sustainability initiatives create substantial demand for renewable energy solutions. Multinational corporations operating in France increasingly require renewable energy to meet global sustainability targets and stakeholder expectations. Supply chain requirements for renewable energy are becoming standard practice across major industries.

Grid integration challenges pose significant constraints on renewable energy market growth in France. The intermittent nature of wind and solar power requires substantial investments in grid flexibility, energy storage, and demand response systems. Transmission infrastructure limitations in some regions restrict the ability to transport renewable energy from generation sites to consumption centers.

Permitting and regulatory complexities can delay renewable energy project development and increase costs. Environmental impact assessments for large-scale renewable projects require extensive documentation and stakeholder consultation processes. Local opposition to certain renewable energy installations, particularly wind farms, can create development challenges in some communities.

Financial barriers continue to affect smaller renewable energy developers and projects. High upfront capital requirements for renewable energy infrastructure can limit market participation, particularly for innovative technologies and smaller-scale projects. Access to financing remains challenging for some market segments despite overall positive investment sentiment.

Technical limitations of existing renewable energy technologies constrain deployment in certain applications and locations. Energy storage costs remain relatively high, limiting the economic viability of renewable energy systems in some use cases. Technology reliability concerns persist for newer renewable energy technologies with limited operational track records.

Market competition from established energy sources and between renewable energy technologies creates pricing pressures. Nuclear power continues to provide significant baseload capacity in France, potentially limiting market opportunities for some renewable energy applications. Natural gas remains competitive for certain applications, particularly in industrial processes and heating.

Offshore wind development presents enormous opportunities for market expansion along France’s extensive coastline. Floating wind technology enables access to deeper water areas with superior wind resources, potentially unlocking significant additional capacity. Government support for offshore wind through dedicated tenders and streamlined permitting creates favorable conditions for large-scale project development.

Energy storage integration offers substantial growth potential as renewable energy penetration increases. Battery storage systems are becoming increasingly cost-effective for grid-scale applications and distributed energy systems. Pumped hydro storage expansion and innovative storage technologies create opportunities for enhanced renewable energy utilization.

Sector coupling initiatives that integrate renewable electricity with heating, transportation, and industrial processes represent significant market opportunities. Power-to-X technologies including hydrogen production, synthetic fuels, and electrification of industrial processes create new demand for renewable electricity. Heat pump deployment and electric vehicle adoption increase electricity demand that can be met through renewable energy.

Distributed energy systems and community energy projects offer opportunities for local renewable energy development. Rooftop solar installations on residential and commercial buildings continue to expand with improving economics and supportive policies. Agrivoltaics and dual-use renewable energy systems create additional deployment opportunities without competing for land use.

Export opportunities for French renewable energy expertise and technology are expanding internationally. French companies are well-positioned to participate in global renewable energy markets, particularly in francophone countries and emerging markets. Technology transfer and project development services represent growing export opportunities.

Supply chain evolution is reshaping the renewable energy market structure in France. Local manufacturing of renewable energy components is increasing to reduce import dependence and support domestic economic development. Supply chain resilience has become a priority following global disruptions, leading to diversification of supplier relationships and strategic inventory management.

Competitive dynamics are intensifying as the market matures and consolidates. Large utility companies are acquiring renewable energy developers and expanding their clean energy portfolios. Technology providers are forming strategic partnerships with project developers to secure market access and improve project economics.

Innovation cycles continue to drive market evolution through improved technologies and business models. Digitalization of renewable energy systems enables better performance monitoring, predictive maintenance, and grid integration. Artificial intelligence and machine learning applications are optimizing renewable energy operations and market participation.

Financial market development is creating new funding mechanisms for renewable energy projects. Green bonds and sustainable finance instruments are channeling capital toward renewable energy investments. Institutional investors including pension funds and insurance companies are increasing allocations to renewable energy infrastructure.

Regulatory evolution continues to shape market conditions and opportunities. European Union policies including the Green Deal and REPowerEU initiative are accelerating renewable energy deployment targets. Carbon pricing mechanisms are improving the economic competitiveness of renewable energy compared to fossil fuel alternatives.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into France’s renewable energy market. Primary research includes extensive interviews with industry executives, government officials, technology providers, project developers, and financial institutions active in the French renewable energy sector.

Secondary research incorporates analysis of government publications, industry reports, academic studies, and regulatory documents related to renewable energy policy and market development in France. Data triangulation methods validate findings across multiple sources to ensure accuracy and completeness of market intelligence.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market trends and growth patterns. Market sizing methodologies combine bottom-up capacity assessments with top-down policy target analysis to develop comprehensive market projections. Scenario modeling evaluates different policy and technology development pathways.

Stakeholder engagement through industry conferences, expert panels, and advisory group discussions provides qualitative insights into market dynamics and future trends. Technology assessment includes evaluation of emerging renewable energy technologies and their potential market impact in the French context.

Regional analysis examines renewable energy development patterns across different French regions, considering local resource availability, policy frameworks, and economic conditions. Competitive intelligence tracks market participant strategies, investment patterns, and technological developments affecting market structure.

Nouvelle-Aquitaine region leads France in renewable energy capacity, particularly wind power development. The region benefits from excellent wind resources along the Atlantic coast and supportive regional policies for renewable energy deployment. Solar installations are also expanding rapidly across the region’s agricultural areas and urban centers.

Occitanie region demonstrates strong growth in both wind and solar energy sectors, leveraging favorable climatic conditions and available land resources. The region has achieved significant renewable energy penetration and serves as a model for other French regions. Biomass energy development is particularly strong due to abundant agricultural and forestry resources.

Grand Est region focuses on wind energy development and biomass utilization, with substantial capacity additions in recent years. The region’s industrial heritage provides opportunities for renewable energy integration in manufacturing processes. Cross-border cooperation with Germany enhances renewable energy trading and grid integration opportunities.

Hauts-de-France region is emerging as a major offshore wind development hub, with several large-scale projects in various development stages. The region’s coastal location and existing port infrastructure provide competitive advantages for offshore wind deployment. Onshore wind continues to expand across the region’s rural areas.

Brittany region combines strong wind resources with innovative marine energy projects, positioning itself as a leader in ocean energy technologies. Tidal energy and wave energy pilot projects demonstrate the region’s commitment to diversified renewable energy development. Energy storage initiatives support grid stability and renewable energy integration.

Provence-Alpes-Côte d’Azur region leverages exceptional solar resources to lead in photovoltaic deployment across residential, commercial, and utility-scale applications. The region’s Mediterranean climate provides optimal conditions for solar energy generation. Hydroelectric power from Alpine resources complements solar generation patterns.

Market leadership in France’s renewable energy sector is distributed among several key categories of companies, each bringing distinct capabilities and market approaches:

Competitive strategies focus on technology innovation, project development capabilities, financial strength, and strategic partnerships. Market consolidation continues as larger companies acquire smaller developers to expand their project pipelines and market presence. International expansion by French renewable energy companies creates opportunities for technology transfer and expertise sharing.

By Technology:

By Application:

By End-User:

Wind Energy Segment: Wind power continues to dominate France’s renewable energy landscape with consistent capacity additions and improving technology performance. Onshore wind benefits from established supply chains and proven economics, while offshore wind represents the next major growth frontier. Turbine technology advances are increasing capacity factors and reducing levelized costs of electricity.

Solar Energy Segment: Solar photovoltaic deployment is accelerating across all market segments, driven by declining module costs and improved system efficiency. Utility-scale solar projects are becoming increasingly competitive in electricity tenders. Distributed solar adoption is growing among residential and commercial consumers seeking energy independence and cost savings.

Hydroelectric Segment: France’s mature hydroelectric sector focuses on modernization and efficiency improvements rather than large-scale capacity expansion. Small-scale hydroelectric projects continue to develop in suitable locations. Pumped storage hydroelectric facilities are gaining importance for grid balancing and renewable energy integration.

Biomass Energy Segment: Biomass energy development emphasizes sustainable feedstock sourcing and advanced conversion technologies. Agricultural waste utilization creates opportunities for rural economic development. Biogas production from organic waste streams is expanding through supportive policies and improved technology.

Geothermal Segment: Geothermal energy applications focus primarily on heating and cooling systems rather than electricity generation. Ground-source heat pumps are experiencing strong growth in residential and commercial applications. Deep geothermal projects are being explored for district heating and industrial applications.

Energy Developers benefit from stable regulatory frameworks, competitive electricity markets, and access to financing for renewable energy projects. Long-term power purchase agreements provide revenue certainty while competitive bidding processes ensure market-based pricing. Grid connection procedures are becoming more streamlined, reducing development timelines and costs.

Technology Providers gain access to a sophisticated market with demanding performance requirements that drive innovation and quality improvements. Local content requirements in some tenders create opportunities for domestic manufacturing and supply chain development. Research and development partnerships with French institutions accelerate technology advancement.

Utility Companies can diversify their generation portfolios, reduce carbon emissions, and meet regulatory requirements through renewable energy investments. Grid integration expertise becomes increasingly valuable as renewable energy penetration grows. Energy services opportunities expand through renewable energy and storage system integration.

Financial Institutions access attractive investment opportunities with stable returns and positive environmental impact. Green finance products and sustainability-linked financing create new revenue streams. Risk management capabilities for renewable energy projects become competitive advantages.

End-Users benefit from reduced electricity costs, energy security, and environmental sustainability through renewable energy adoption. Corporate sustainability goals are achieved through renewable energy procurement strategies. Energy independence reduces exposure to volatile fossil fuel prices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and Smart Grid Integration are transforming renewable energy operations through advanced monitoring, control, and optimization systems. Internet of Things devices and artificial intelligence applications enable predictive maintenance, performance optimization, and improved grid integration. Blockchain technology is being explored for peer-to-peer energy trading and renewable energy certificate tracking.

Energy Storage Deployment is accelerating to address renewable energy intermittency and provide grid services. Battery storage systems are becoming cost-competitive for various applications including frequency regulation, peak shaving, and renewable energy firming. Hybrid renewable energy systems combining generation and storage are increasingly common.

Corporate Renewable Energy Procurement is driving market demand through long-term power purchase agreements and on-site renewable energy installations. Multinational corporations are implementing global renewable energy strategies that include significant French operations. Supply chain sustainability requirements are extending renewable energy adoption throughout industrial ecosystems.

Circular Economy Integration emphasizes sustainable lifecycle management of renewable energy systems including recycling of solar panels, wind turbine components, and battery materials. Sustainable manufacturing practices are becoming standard requirements for renewable energy supply chains. End-of-life planning is integrated into renewable energy project development.

Community Energy Development enables local participation in renewable energy projects through cooperative ownership models and community investment schemes. Energy democracy initiatives promote local control over energy resources and revenues. Rural development benefits from renewable energy projects through land lease payments and local employment opportunities.

Offshore Wind Acceleration: France has launched ambitious offshore wind tenders with multi-gigawatt capacity allocations, attracting major international developers and technology providers. Floating wind technology pilots are advancing toward commercial deployment in deeper water areas. Port infrastructure investments are supporting offshore wind supply chain development.

Solar Manufacturing Renaissance: Several initiatives aim to rebuild European solar manufacturing capacity including potential facilities in France. Technology partnerships between French research institutions and international manufacturers are advancing next-generation solar technologies. Agrivoltaics projects are demonstrating dual-use applications for agricultural land.

Green Hydrogen Development: Major industrial companies are announcing green hydrogen projects using renewable electricity for hydrogen production. Industrial decarbonization strategies increasingly rely on renewable energy and green hydrogen. Export opportunities for green hydrogen are being explored with neighboring countries.

Energy Storage Innovation: MarkWide Research analysis indicates significant investments in battery manufacturing and energy storage system deployment across France. Grid-scale storage projects are being developed to support renewable energy integration. Vehicle-to-grid technologies are being piloted with electric vehicle fleets.

Policy Framework Evolution: New regulations are streamlining renewable energy permitting processes and establishing clearer development guidelines. Carbon pricing mechanisms are being strengthened to improve renewable energy competitiveness. Energy transition financing programs are expanding to support broader renewable energy deployment.

Strategic Focus Areas: Industry participants should prioritize offshore wind development capabilities as this segment offers the greatest growth potential in the French market. Energy storage integration expertise will become increasingly valuable as renewable energy penetration grows. Digital technology adoption can provide competitive advantages through improved operational efficiency and grid services capabilities.

Partnership Strategies: Collaboration between technology providers and project developers can accelerate market penetration and reduce project risks. International partnerships bring advanced technologies and financing capabilities to the French market. Supply chain localization initiatives can reduce costs and improve project economics while supporting domestic economic development.

Investment Priorities: Research and development investments in emerging renewable energy technologies can position companies for future market opportunities. Grid integration capabilities including energy storage and smart grid technologies represent high-growth areas. Sustainability and circular economy practices are becoming competitive requirements rather than optional considerations.

Risk Management: Diversification across multiple renewable energy technologies and market segments can reduce exposure to technology-specific or regulatory risks. Supply chain resilience strategies should address potential disruptions and cost volatility. Stakeholder engagement programs can improve project acceptance and reduce development risks.

Market Positioning: Companies should develop comprehensive renewable energy solutions that address customer needs across the entire energy value chain. Service capabilities including operations and maintenance, energy management, and financing can differentiate market participants. Sustainability credentials and environmental performance are becoming key competitive factors.

Long-term growth prospects for France’s renewable energy market remain exceptionally positive, driven by ambitious climate targets and supportive policy frameworks. Renewable energy capacity is projected to expand significantly across all technology segments, with wind and solar leading deployment. Market maturation will bring improved cost competitiveness and technological performance.

Technology evolution will continue to drive market transformation through improved efficiency, reduced costs, and enhanced grid integration capabilities. Next-generation renewable technologies including floating solar, advanced wind systems, and hybrid renewable installations will create new market opportunities. Energy storage integration will become standard practice for renewable energy projects.

Market structure changes are expected as the sector consolidates and matures. Vertical integration strategies may become more common as companies seek to control entire value chains. New business models including energy-as-a-service and community energy platforms will expand market participation opportunities.

International competitiveness of French renewable energy companies will strengthen through domestic market experience and technological advancement. Export opportunities will expand as global renewable energy markets grow. Technology transfer and project development services represent significant growth potential.

Sectoral integration will accelerate as renewable energy becomes central to decarbonizing transportation, heating, and industrial processes. Electrification trends will increase electricity demand that can be met through renewable energy expansion. Circular economy principles will become standard practice throughout the renewable energy sector, according to MWR projections indicating sustainable growth patterns continuing through the next decade.

France’s renewable energy market represents one of Europe’s most dynamic and promising clean energy sectors, characterized by strong government support, diverse natural resources, and sophisticated market infrastructure. The market has demonstrated remarkable resilience and growth despite global challenges, positioning France as a leader in the European energy transition.

Key success factors include comprehensive policy frameworks, technological innovation, financial market development, and increasing corporate and consumer adoption of renewable energy solutions. The sector benefits from strong fundamentals including excellent wind and solar resources, advanced grid infrastructure, and world-class engineering capabilities that support continued expansion.

Future opportunities are substantial, particularly in offshore wind development, energy storage integration, and sector coupling applications that extend renewable energy benefits across the broader economy. Market participants who invest in technological capabilities, strategic partnerships, and sustainable business practices are well-positioned to capitalize on continued market growth and evolution in France’s transformative renewable energy landscape.

What is Renewable Energy in France?

Renewable Energy in France refers to energy generated from natural resources that are replenished over time, such as solar, wind, hydroelectric, and biomass. This sector is crucial for reducing carbon emissions and promoting sustainable development in the country.

What are the key companies in the Renewable Energy in France Market?

Key companies in the Renewable Energy in France Market include EDF Renewables, Engie, TotalEnergies, and Akuo Energy, among others. These companies are involved in various segments such as solar power, wind energy, and hydroelectric projects.

What are the growth factors driving the Renewable Energy in France Market?

The growth of the Renewable Energy in France Market is driven by government policies promoting clean energy, increasing investments in renewable technologies, and a growing public awareness of climate change. Additionally, advancements in energy storage solutions are enhancing the viability of renewable sources.

What challenges does the Renewable Energy in France Market face?

The Renewable Energy in France Market faces challenges such as regulatory hurdles, the intermittency of renewable energy sources, and competition from traditional fossil fuels. These factors can hinder the pace of transition to a more sustainable energy system.

What opportunities exist in the Renewable Energy in France Market?

Opportunities in the Renewable Energy in France Market include the expansion of offshore wind farms, increased investment in solar energy projects, and the development of smart grid technologies. These areas present significant potential for innovation and growth.

What trends are shaping the Renewable Energy in France Market?

Trends shaping the Renewable Energy in France Market include the rise of decentralized energy systems, increased adoption of electric vehicles, and a focus on energy efficiency. These trends are influencing how energy is produced, consumed, and managed across the country.

Renewable Energy in France Market

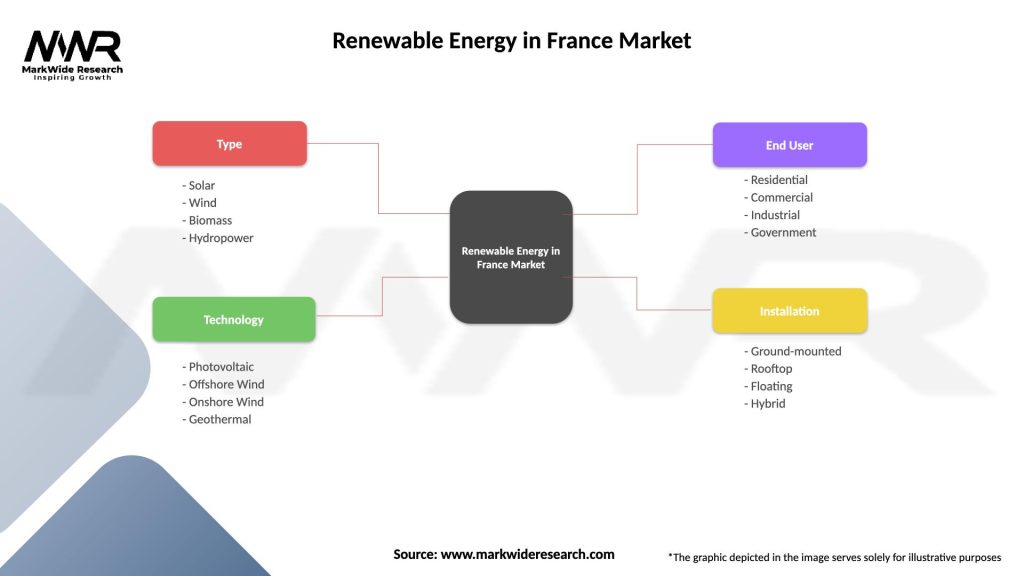

| Segmentation Details | Description |

|---|---|

| Type | Solar, Wind, Biomass, Hydropower |

| Technology | Photovoltaic, Offshore Wind, Onshore Wind, Geothermal |

| End User | Residential, Commercial, Industrial, Government |

| Installation | Ground-mounted, Rooftop, Floating, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Renewable Energy in France Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at