444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) market are experiencing significant growth driven by the increasing focus on sustainable waste management practices and the rising demand for alternative fuels in various industries. RDF and SRF are derived from non-recyclable waste materials through advanced processing techniques, making them viable substitutes for conventional fossil fuels. As governments and industries worldwide seek to reduce carbon emissions, minimize landfill waste, and promote circular economy principles, the market for RDF and SRF is poised for considerable expansion.

Meaning

Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) refer to processed fuels derived from non-recyclable waste materials such as municipal solid waste (MSW), commercial waste, and industrial residues. These fuels undergo advanced treatment processes such as shredding, drying, and pelletization to produce high-quality, homogeneous fuel products suitable for use in industrial boilers, cement kilns, and power plants. By converting waste into energy, RDF and SRF contribute to resource recovery, waste diversion, and greenhouse gas emissions reduction, supporting sustainable waste management and renewable energy objectives.

Executive Summary

The RDF and SRF market are witnessing robust growth as governments, industries, and waste management stakeholders increasingly recognize the economic and environmental benefits of converting non-recyclable waste into valuable fuel resources. Key drivers of market expansion include regulatory mandates promoting waste-to-energy initiatives, advancements in waste processing technologies, and the growing demand for renewable fuels. Despite challenges such as feedstock quality variability and market competition, the market for RDF and SRF is expected to continue growing as stakeholders embrace circular economy principles and seek sustainable waste management solutions.

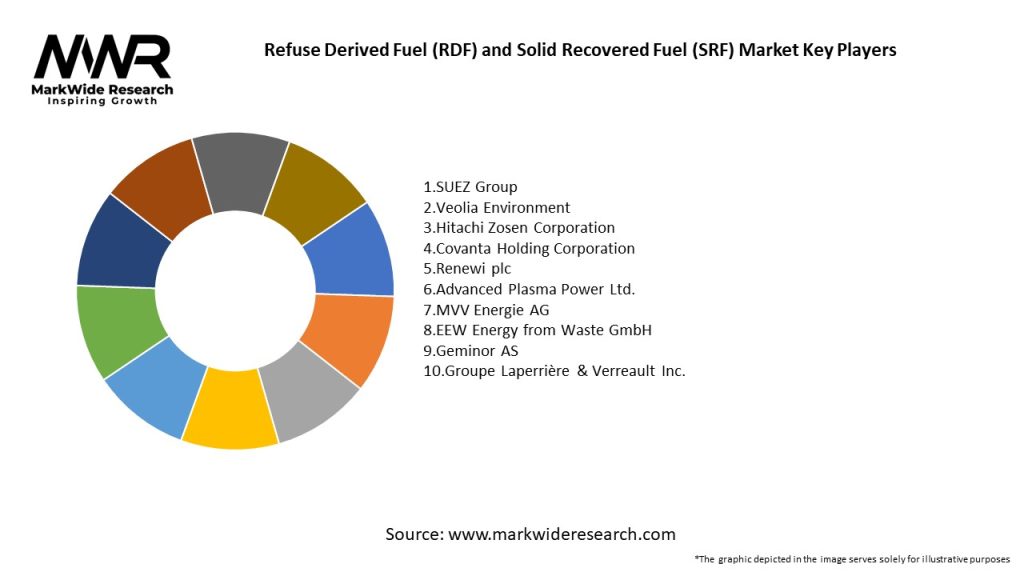

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The RDF and SRF market are characterized by dynamic factors such as waste composition, regulatory frameworks, technological innovation, and market demand. Understanding and navigating these dynamics are critical for stakeholders to capitalize on emerging opportunities, address challenges, and sustain market growth in the evolving waste-to-energy landscape.

Regional Analysis

The RDF and SRF market are geographically diverse, with significant growth opportunities in regions with high waste generation, limited landfill capacity, and supportive regulatory environments. Europe leads the global market, driven by stringent waste management regulations, robust infrastructure, and strong demand for renewable fuels. North America and Asia Pacific are emerging markets, fueled by increasing waste volumes, growing energy demand, and government initiatives promoting sustainable waste management and renewable energy development.

Competitive Landscape

Leading Companies in the RDF and SRF Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The RDF and SRF market can be segmented based on feedstock type, processing technology, end-use application, and geographic region. By feedstock type, it includes municipal solid waste (MSW), commercial and industrial waste, construction and demolition (C&D) debris, and agricultural residues. By processing technology, it encompasses mechanical sorting, biological treatment, thermal conversion, and chemical processing. By end-use application, it spans cement kilns, power plants, industrial boilers, and district heating systems.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has affected the RDF and SRF market by disrupting waste collection, processing, and energy demand patterns, leading to temporary slowdowns in project development, investment decisions, and market expansion. However, the pandemic has also highlighted the importance of resilient waste management systems, renewable energy sources, and sustainable supply chains in mitigating global crises and building a more resilient and sustainable future. As economies recover and industries rebound, the demand for RDF and SRF is expected to rebound, driven by environmental regulations, sustainability goals, and industry initiatives promoting waste-to-energy solutions and circular economy practices.

Key Industry Developments

Analyst Suggestions

Future Outlook

The RDF and SRF market are poised for significant growth in the coming years, driven by the increasing demand for sustainable waste management solutions, renewable energy sources, and circular economy practices. As governments, industries, and communities worldwide prioritize environmental sustainability, resource efficiency, and climate resilience, the demand for RDF and SRF is expected to continue growing, creating new opportunities for stakeholders to innovate, collaborate, and lead the transition towards a more sustainable and circular waste-to-energy ecosystem.

Conclusion

In conclusion, the RDF and SRF market present significant opportunities for stakeholders to address environmental challenges, promote renewable energy production, and advance circular economy objectives through sustainable waste management practices. By converting non-recyclable waste into valuable fuel resources, RDF and SRF contribute to waste diversion, resource recovery, and greenhouse gas emissions reduction, supporting environmental sustainability and economic development. Despite challenges such as feedstock variability and market competition, the outlook for RDF and SRF remains positive, driven by regulatory support, technological advancements, and market demand for renewable fuel alternatives and circular economy solutions. To realize the full potential of RDF and SRF, stakeholders must invest in innovation, collaboration, and sustainable business practices to create a more resilient, efficient, and sustainable waste-to-energy ecosystem for the benefit of present and future generations.

What is Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF)?

Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) are alternative fuels produced from various types of waste materials. RDF is typically made from municipal solid waste, while SRF is derived from industrial waste and is processed to meet specific quality standards for combustion.

What are the key players in the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market?

Key players in the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market include companies like Veolia, SUEZ, and Covanta, which are involved in waste management and energy recovery. These companies focus on converting waste into energy and fuel, contributing to sustainability efforts, among others.

What are the growth factors driving the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market?

The growth of the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market is driven by increasing waste generation and the need for sustainable waste management solutions. Additionally, the rising demand for renewable energy sources and government regulations promoting waste-to-energy initiatives are significant factors.

What challenges does the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market face?

The Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market faces challenges such as fluctuating waste quality and the need for advanced processing technologies. Additionally, regulatory hurdles and public perception regarding waste-derived fuels can hinder market growth.

What opportunities exist in the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market?

Opportunities in the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market include the development of new technologies for better fuel quality and efficiency. Furthermore, expanding applications in industrial sectors and increasing investments in waste-to-energy projects present significant growth potential.

What trends are shaping the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market?

Trends in the Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market include a growing emphasis on circular economy practices and innovations in waste processing technologies. Additionally, there is an increasing focus on reducing carbon emissions and enhancing energy recovery from waste materials.

Refuse Derived Fuel (RDF) and Solid Recovered Fuel (SRF) Market

| Segmentation Details | Description |

|---|---|

| Product Type | RDF, SRF, Biomass Fuel, Waste-to-Energy Fuel |

| Application | Cement Production, Power Generation, Industrial Heating, Waste Management |

| End User | Cement Manufacturers, Power Plants, Industrial Facilities, Waste Processing Companies |

| Technology | Gasification, Incineration, Anaerobic Digestion, Pyrolysis |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the RDF and SRF Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at