444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The refurbished computers and laptops market has emerged as a significant segment within the global technology industry, driven by increasing environmental consciousness, cost-effectiveness considerations, and technological advancement in refurbishment processes. This market encompasses professionally restored desktop computers, laptops, tablets, and related computing devices that have been returned to manufacturers, retailers, or specialized refurbishment companies for various reasons including minor defects, customer returns, or end-of-lease equipment.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 11.2% across key global regions. The increasing adoption of circular economy principles has positioned refurbished computing devices as viable alternatives to new equipment, particularly among cost-conscious consumers, educational institutions, and small to medium enterprises seeking reliable technology solutions at reduced prices.

Consumer behavior patterns have shifted significantly, with 67% of buyers now considering refurbished options as their primary choice for secondary computing needs. This transformation reflects growing awareness of environmental sustainability, coupled with improved quality standards and warranty offerings from reputable refurbishment providers. The market benefits from enhanced testing procedures, comprehensive quality assurance protocols, and professional restoration techniques that ensure refurbished devices meet or exceed original performance specifications.

Regional distribution shows North America and Europe leading market adoption, accounting for approximately 58% of global demand, while Asia-Pacific regions demonstrate the fastest growth trajectory due to increasing digitalization initiatives and expanding middle-class populations seeking affordable computing solutions.

The refurbished computers and laptops market refers to the commercial ecosystem encompassing the acquisition, restoration, certification, and resale of previously owned computing devices that have undergone professional refurbishment processes to restore functionality, appearance, and performance to near-original specifications. This market includes desktop computers, laptops, tablets, workstations, and associated peripherals that have been systematically tested, repaired, upgraded, and certified by qualified technicians.

Refurbishment processes typically involve comprehensive hardware diagnostics, component replacement or repair, software reinstallation, cosmetic restoration, and quality assurance testing to ensure devices meet predetermined performance standards. The market encompasses various sourcing channels including manufacturer returns, corporate lease returns, educational institution upgrades, consumer trade-ins, and excess inventory liquidation.

Key stakeholders in this ecosystem include original equipment manufacturers (OEMs), specialized refurbishment companies, retailers, distributors, corporate buyers, educational institutions, government agencies, and individual consumers. The market operates through multiple distribution channels including online marketplaces, retail stores, direct sales, and business-to-business platforms, each serving distinct customer segments with varying requirements for price, performance, and warranty coverage.

Market fundamentals demonstrate strong growth momentum driven by convergence of environmental sustainability trends, economic considerations, and technological advancement in refurbishment capabilities. The sector has evolved from basic resale operations to sophisticated remanufacturing processes that deliver high-quality computing solutions at competitive price points, typically 30-60% below equivalent new device pricing.

Demand drivers include increasing corporate sustainability initiatives, educational budget constraints, small business cost optimization, and growing consumer acceptance of refurbished technology. According to MarkWide Research analysis, the market benefits from improved refurbishment standards, extended warranty offerings, and enhanced customer confidence in restored device reliability and performance.

Technology trends supporting market expansion include advanced diagnostic tools, automated testing systems, component-level repair capabilities, and comprehensive data sanitization processes. These improvements have elevated refurbished devices from budget alternatives to legitimate primary computing solutions for various user segments.

Competitive landscape features established OEM refurbishment programs, specialized third-party refurbishers, major retailers with certified pre-owned divisions, and emerging online platforms focused exclusively on refurbished technology. Market consolidation trends indicate increasing professionalization and standardization of refurbishment processes across the industry.

Primary market insights reveal fundamental shifts in technology consumption patterns, with refurbished devices gaining mainstream acceptance across diverse customer segments:

Environmental sustainability initiatives represent the primary driver propelling market growth, as organizations and individuals increasingly prioritize circular economy principles and carbon footprint reduction. Corporate sustainability mandates now commonly include refurbished technology procurement as measurable environmental impact reduction strategies, with many organizations setting specific targets for refurbished device adoption percentages.

Cost optimization pressures across educational institutions, small businesses, and budget-conscious consumers create substantial demand for high-quality computing solutions at reduced price points. The significant cost differential between new and refurbished devices, combined with improved quality standards, makes refurbished options increasingly attractive for organizations managing technology budgets while maintaining operational requirements.

Technology advancement in refurbishment processes has elevated device quality and reliability to levels that compete directly with new equipment. Advanced diagnostic tools, component-level repair capabilities, and comprehensive testing protocols ensure refurbished devices meet stringent performance standards, reducing buyer hesitation and expanding market acceptance.

Supply chain optimization by major OEMs has created structured refurbishment programs that capture value from returned, excess, or end-of-lease equipment. These programs provide manufacturers with additional revenue streams while offering customers certified pre-owned alternatives with full warranty support and technical assistance.

Digital transformation acceleration has increased overall computing device demand, creating opportunities for refurbished equipment to serve secondary computing needs, temporary deployments, and backup system requirements where new device investment may not be justified.

Consumer perception challenges continue to limit market penetration, particularly among segments that associate refurbished products with inferior quality or reliability concerns. Despite significant improvements in refurbishment standards, some buyers remain hesitant to purchase pre-owned technology for critical applications, preferring new devices for perceived reliability advantages.

Limited availability of specific models, configurations, or quantities can constrain market growth, particularly for enterprise buyers requiring standardized deployments across large user populations. Refurbished inventory depends on return patterns, lease cycles, and upgrade schedules that may not align with buyer requirements for specific device specifications or delivery timelines.

Technology obsolescence risks affect older refurbished devices that may lack compatibility with current software requirements, security standards, or performance expectations. Rapid technology evolution can reduce the viable refurbishment window for certain device categories, limiting inventory availability and market appeal.

Warranty and support limitations from some refurbishment providers may not match new device coverage, creating buyer uncertainty about long-term device support, repair services, and replacement options. Inconsistent warranty terms across different refurbishment sources can complicate procurement decisions for organizational buyers.

Quality inconsistency among refurbishment providers without standardized processes or certification can result in variable device quality, potentially damaging overall market reputation and buyer confidence in refurbished technology solutions.

Enterprise market expansion presents significant growth opportunities as organizations increasingly recognize refurbished devices as viable solutions for non-critical applications, temporary deployments, and cost-sensitive projects. Large corporations are developing structured refurbished technology procurement policies that could substantially increase market demand and establish predictable revenue streams for refurbishment providers.

Educational sector penetration offers substantial market potential, with schools, colleges, and universities seeking cost-effective computing solutions for student labs, administrative functions, and distance learning initiatives. Educational budget constraints combined with increasing technology requirements create ideal conditions for refurbished device adoption across academic institutions globally.

Emerging market development in regions with growing digital infrastructure needs but limited technology budgets represents significant expansion opportunities. Refurbished devices can accelerate digital inclusion initiatives by providing affordable access to computing technology for businesses, educational institutions, and government agencies in developing economies.

Specialized market segments including healthcare, manufacturing, and retail sectors present opportunities for refurbished devices in specific applications where cost considerations outweigh latest technology requirements. These sectors often require reliable computing solutions for dedicated applications rather than cutting-edge performance specifications.

Subscription and leasing models for refurbished devices could expand market reach by reducing upfront costs and providing flexible upgrade paths for customers seeking predictable technology expenses with lower total cost of ownership compared to new device alternatives.

Supply-demand equilibrium in the refurbished computers and laptops market reflects complex interactions between device return patterns, refurbishment capacity, and buyer demand across multiple market segments. The market experiences cyclical fluctuations based on corporate upgrade cycles, educational procurement schedules, and consumer replacement patterns that influence both supply availability and demand intensity.

Price elasticity demonstrates significant sensitivity to new device pricing, with refurbished device demand increasing substantially when new device prices rise or when economic conditions pressure buyers toward cost-effective alternatives. Market research indicates elasticity coefficients of 1.8-2.2 for price-sensitive segments, suggesting strong responsiveness to relative pricing changes.

Quality perception evolution continues to shape market dynamics as improved refurbishment standards and warranty offerings gradually overcome traditional buyer hesitation. Customer satisfaction metrics show improvement rates of 15-20% annually as refurbishment processes become more sophisticated and standardized across the industry.

Competitive intensity has increased as traditional retailers, OEMs, and specialized refurbishers compete for market share through enhanced service offerings, expanded warranty coverage, and improved customer experience. This competition drives continuous improvement in refurbishment quality and customer service standards.

Technology lifecycle management influences market dynamics through optimal timing for device acquisition, refurbishment, and resale activities. Successful market participants have developed sophisticated forecasting models to predict device availability, refurbishment costs, and market demand patterns.

Comprehensive market analysis employs multi-source data collection methodologies including primary research through industry surveys, expert interviews, and customer feedback analysis, combined with secondary research utilizing industry reports, financial statements, and regulatory filings from key market participants.

Primary research activities encompass structured interviews with refurbishment industry executives, technology procurement managers, and end-user customers across various market segments. Survey methodologies capture quantitative data on purchasing patterns, satisfaction levels, and future procurement intentions to establish market trends and growth projections.

Secondary data analysis incorporates comprehensive review of industry publications, trade association reports, government statistics, and academic research to validate primary findings and establish broader market context. Financial analysis of public companies provides insights into market size, growth rates, and competitive positioning.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Econometric models incorporate macroeconomic factors, technology adoption rates, and industry-specific variables to enhance forecast accuracy and reliability.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical significance testing. Quality assurance protocols verify data consistency and eliminate potential biases in research findings and market projections.

North American markets demonstrate mature adoption patterns with established refurbishment infrastructure and strong consumer acceptance of certified pre-owned computing devices. The region accounts for approximately 34% of global market share, driven by corporate sustainability initiatives, educational budget optimization, and sophisticated refurbishment operations that maintain high quality standards and comprehensive warranty coverage.

European markets exhibit strong growth momentum supported by stringent environmental regulations, circular economy policies, and increasing corporate responsibility mandates that favor refurbished technology adoption. The region shows particular strength in business-to-business segments, with 42% of enterprise buyers actively considering refurbished alternatives for non-critical applications.

Asia-Pacific regions represent the fastest-growing market segment, with emerging economies driving demand for affordable computing solutions across educational, small business, and consumer segments. The region demonstrates annual growth rates exceeding 18% as digital transformation initiatives create substantial demand for cost-effective technology solutions.

Latin American markets show increasing adoption of refurbished devices driven by economic considerations and growing awareness of environmental benefits. Government initiatives promoting digital inclusion and educational technology access create favorable conditions for refurbished device market expansion.

Middle East and African markets present emerging opportunities as infrastructure development and educational initiatives increase demand for computing technology while budget constraints favor cost-effective refurbished alternatives over new device purchases.

Market leadership is distributed among several categories of participants, each serving distinct market segments with specialized capabilities and service offerings:

Competitive differentiation occurs through quality standards, warranty offerings, customer service capabilities, and specialized market focus. Leading participants invest heavily in refurbishment infrastructure, testing equipment, and technician training to maintain quality advantages and customer satisfaction levels.

Product category segmentation reveals distinct market dynamics across different device types:

End-user segmentation identifies key customer categories with distinct requirements and purchasing patterns:

Desktop computer refurbishment represents a stable market segment with consistent demand from office environments, educational computer labs, and home users requiring stationary computing solutions. This category benefits from standardized form factors, easier refurbishment processes, and longer useful life cycles that support multiple refurbishment iterations.

Laptop refurbishment constitutes the largest market segment due to high original device volumes, frequent corporate refresh cycles, and strong consumer demand for portable computing solutions. Laptop refurbishment requires specialized expertise in battery replacement, keyboard repair, and display restoration, creating barriers to entry for less sophisticated refurbishment operations.

Tablet and 2-in-1 device refurbishment presents growth opportunities as these devices become more prevalent in educational and business environments. However, this segment faces challenges from rapid technology evolution and integrated component designs that limit repair options and refurbishment viability.

Workstation refurbishment serves specialized markets requiring high-performance computing capabilities at reduced costs. This segment typically involves higher-value devices with longer useful life cycles, supporting premium pricing and comprehensive refurbishment services.

By application focus, business productivity applications dominate refurbished device usage, followed by educational technology deployment and personal computing needs. Each application category has distinct performance requirements, warranty expectations, and price sensitivity levels that influence refurbishment strategies and market positioning.

Environmental sustainability benefits provide significant value for organizations pursuing corporate social responsibility objectives and environmental impact reduction goals. Refurbished device adoption contributes measurably to circular economy principles, electronic waste reduction, and carbon footprint minimization compared to new device manufacturing and disposal cycles.

Cost optimization advantages enable organizations to maintain technology capabilities while reducing capital expenditures and total cost of ownership. Educational institutions particularly benefit from budget stretching capabilities that allow expanded technology access within constrained funding environments.

Risk mitigation benefits include reduced exposure to technology obsolescence, lower financial commitment for temporary or secondary computing needs, and flexibility to upgrade or replace devices without significant capital loss. These advantages particularly benefit organizations with uncertain technology requirements or budget volatility.

Quality assurance improvements from professional refurbishment processes often result in devices that perform more reliably than original equipment due to comprehensive testing, component replacement, and quality control procedures that exceed original manufacturing standards.

Warranty and support benefits from reputable refurbishment providers now commonly match or exceed new device coverage, providing buyers with confidence and protection comparable to new equipment purchases while maintaining significant cost advantages.

Supply chain flexibility allows organizations to access specific device models, configurations, or quantities that may no longer be available through new device channels, supporting standardization efforts and replacement part availability for existing technology deployments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability-driven procurement has emerged as a dominant trend, with organizations increasingly incorporating environmental impact considerations into technology purchasing decisions. Corporate sustainability mandates now commonly include specific targets for refurbished device adoption, creating predictable demand streams for refurbishment providers and driving market professionalization.

Quality standardization initiatives across the industry are establishing consistent refurbishment processes, testing protocols, and certification standards that improve buyer confidence and market credibility. Industry associations and major participants are developing standardized quality metrics and certification programs that differentiate professional refurbishment operations from basic resale activities.

Warranty enhancement trends show refurbishment providers offering increasingly comprehensive coverage that matches or exceeds new device warranties. This trend includes extended warranty periods, comprehensive repair coverage, and replacement guarantees that address traditional buyer concerns about refurbished device reliability and support.

Technology integration advances in refurbishment processes include automated testing systems, advanced diagnostic tools, and component-level repair capabilities that improve device quality and reduce refurbishment costs. These technological improvements enable more sophisticated refurbishment operations and expand the range of devices suitable for professional restoration.

Channel diversification trends show expansion beyond traditional online marketplaces to include retail partnerships, direct corporate sales, and specialized distribution channels serving specific market segments. This diversification improves market reach and enables targeted service offerings for different customer categories.

Subscription model emergence represents an innovative trend where refurbished devices are offered through leasing or subscription arrangements that reduce upfront costs and provide upgrade flexibility. These models appeal to organizations seeking predictable technology expenses and reduced capital commitments.

Major OEM program expansion has seen leading manufacturers significantly invest in certified refurbishment operations, creating structured programs that capture value from returned, excess, and end-of-lease equipment. These programs provide manufacturers with additional revenue streams while offering customers certified pre-owned alternatives with full warranty support.

Retail partnership development includes major retailers establishing dedicated refurbished technology sections and partnerships with certified refurbishment providers. These partnerships improve market accessibility and provide consumers with trusted purchasing channels for refurbished devices.

Quality certification initiatives have emerged from industry associations and standards organizations to establish consistent refurbishment quality metrics and certification processes. These initiatives aim to improve buyer confidence and differentiate professional refurbishment operations from basic resale activities.

Technology advancement integration includes deployment of advanced diagnostic equipment, automated testing systems, and sophisticated inventory management platforms that improve refurbishment efficiency and quality consistency across industry participants.

Market consolidation activities show increasing merger and acquisition activity as larger participants seek to expand geographic coverage, increase refurbishment capacity, and enhance service capabilities through strategic combinations with specialized refurbishment providers.

Regulatory development includes emerging standards for data sanitization, environmental compliance, and consumer protection that are shaping industry practices and establishing minimum quality standards for refurbished device sales.

Quality standardization focus represents the most critical success factor for market participants, with MWR analysis indicating that consistent quality delivery and comprehensive warranty coverage are essential for building customer confidence and achieving sustainable growth in competitive market conditions.

Market segment specialization offers opportunities for differentiation and competitive advantage, particularly for participants focusing on specific customer categories such as educational institutions, small businesses, or specialized applications that require tailored service offerings and expertise.

Technology investment priorities should emphasize advanced diagnostic capabilities, automated testing systems, and comprehensive inventory management platforms that improve refurbishment efficiency, quality consistency, and operational scalability to support market growth objectives.

Partnership development strategies with OEMs, retailers, and distribution channels can significantly expand market reach and provide access to structured device supply sources that support predictable inventory availability and business planning.

Warranty enhancement initiatives should focus on comprehensive coverage that matches or exceeds new device warranties, addressing traditional buyer concerns and positioning refurbished devices as legitimate alternatives to new equipment purchases.

Sustainability messaging should emphasize measurable environmental benefits and circular economy contributions to align with increasing corporate and consumer focus on environmental responsibility and sustainable technology consumption patterns.

Market growth projections indicate continued expansion driven by increasing environmental consciousness, cost optimization pressures, and improving refurbishment quality standards. The market is expected to maintain double-digit growth rates across key regions as buyer acceptance increases and supply chain infrastructure matures.

Technology evolution will continue to influence market dynamics through improved refurbishment capabilities, enhanced diagnostic tools, and automated quality assurance processes that reduce costs and improve device quality. These technological advances will expand the range of devices suitable for refurbishment and extend viable refurbishment windows.

Market maturation trends suggest increasing professionalization of refurbishment operations, standardization of quality processes, and consolidation among market participants as the industry evolves toward more sophisticated service offerings and comprehensive customer support capabilities.

Regulatory development is expected to establish clearer standards for refurbishment processes, warranty requirements, and environmental compliance that will benefit professional operators while potentially creating barriers for less sophisticated market participants.

Demand evolution will likely show continued growth in enterprise and educational segments as organizations develop structured refurbished technology procurement policies and recognize the strategic value of cost-effective computing solutions that support sustainability objectives.

Geographic expansion opportunities remain significant in emerging markets where digital infrastructure development creates demand for affordable computing solutions, while established markets will likely focus on premium refurbishment services and specialized applications.

The refurbished computers and laptops market represents a dynamic and rapidly evolving sector that has successfully transitioned from basic resale operations to sophisticated remanufacturing processes delivering high-quality computing solutions at competitive price points. The convergence of environmental sustainability trends, cost optimization pressures, and technological advancement in refurbishment capabilities has created favorable market conditions for sustained growth and expansion.

Market fundamentals demonstrate strong demand across diverse customer segments, from cost-conscious consumers to large enterprises pursuing sustainability objectives. The industry has successfully addressed traditional quality concerns through improved refurbishment standards, comprehensive warranty offerings, and professional service capabilities that position refurbished devices as legitimate alternatives to new equipment purchases.

Future prospects remain positive as increasing environmental consciousness, corporate sustainability mandates, and budget optimization pressures continue to drive demand for refurbished computing solutions. The market benefits from established infrastructure, professional refurbishment capabilities, and growing buyer acceptance that support continued expansion and market development opportunities across global regions and customer segments.

What is Refurbished Computers And Laptops?

Refurbished computers and laptops are pre-owned devices that have been restored to a like-new condition. This process often includes repairs, upgrades, and thorough testing to ensure functionality and reliability.

What are the key players in the Refurbished Computers And Laptops Market?

Key players in the refurbished computers and laptops market include companies like Dell, HP, and Apple, which offer certified refurbished products. Other notable companies include Lenovo and Acer, among others.

What are the growth factors driving the Refurbished Computers And Laptops Market?

The growth of the refurbished computers and laptops market is driven by increasing demand for cost-effective technology solutions, rising environmental awareness, and the need for sustainable computing options. Additionally, advancements in refurbishment processes enhance product quality.

What challenges does the Refurbished Computers And Laptops Market face?

Challenges in the refurbished computers and laptops market include consumer skepticism regarding product quality and warranty issues. Additionally, competition from new devices and the perception of refurbished products as inferior can hinder market growth.

What opportunities exist in the Refurbished Computers And Laptops Market?

Opportunities in the refurbished computers and laptops market include expanding e-commerce platforms and increasing acceptance of refurbished products among consumers. The growing trend of remote work also boosts demand for affordable computing solutions.

What trends are shaping the Refurbished Computers And Laptops Market?

Trends in the refurbished computers and laptops market include a rise in online sales channels, enhanced refurbishment technologies, and a focus on sustainability. Additionally, the increasing popularity of circular economy practices is influencing consumer purchasing decisions.

Refurbished Computers And Laptops Market

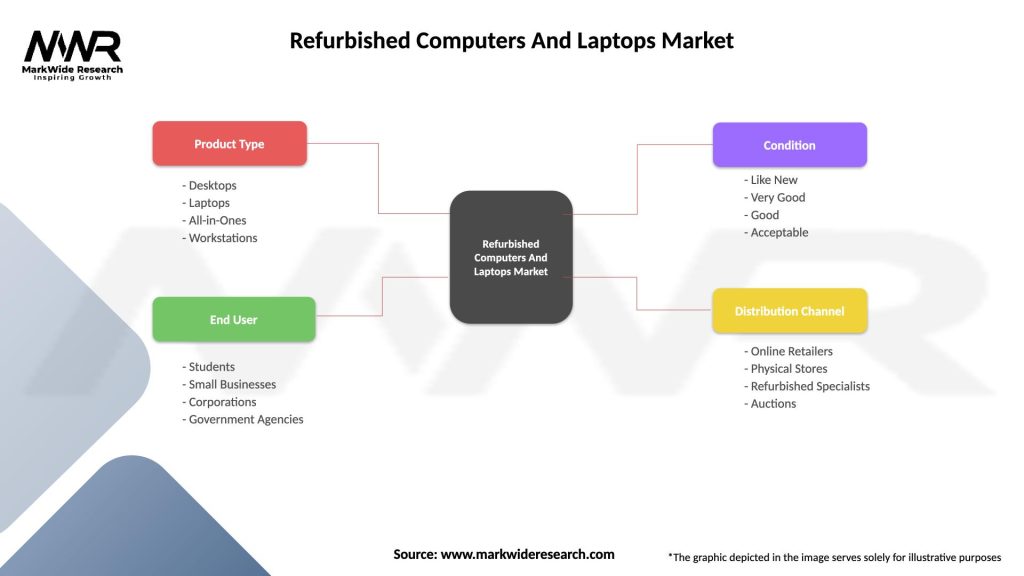

| Segmentation Details | Description |

|---|---|

| Product Type | Desktops, Laptops, All-in-Ones, Workstations |

| End User | Students, Small Businesses, Corporations, Government Agencies |

| Condition | Like New, Very Good, Good, Acceptable |

| Distribution Channel | Online Retailers, Physical Stores, Refurbished Specialists, Auctions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Refurbished Computers And Laptops Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at