444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The real estate IT market represents a rapidly evolving sector that encompasses comprehensive technology solutions designed to streamline property management, enhance customer experiences, and optimize operational efficiency across residential, commercial, and industrial real estate segments. This dynamic market has witnessed unprecedented growth driven by digital transformation initiatives, increasing demand for automated property management systems, and the growing adoption of cloud-based solutions throughout the real estate industry.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate (CAGR) of 8.7% as organizations increasingly recognize the strategic value of technology integration. The market encompasses diverse technology solutions including property management software, customer relationship management (CRM) systems, virtual reality applications, artificial intelligence-powered analytics, and blockchain-based transaction platforms that collectively transform traditional real estate operations.

Regional distribution shows North America maintaining a dominant position with approximately 42% market share, followed by Europe at 28% and Asia-Pacific demonstrating the fastest growth trajectory. The increasing penetration of mobile technologies, rising consumer expectations for digital experiences, and regulatory compliance requirements continue to drive substantial investments in real estate technology infrastructure across global markets.

The real estate IT market refers to the comprehensive ecosystem of technology solutions, software applications, and digital platforms specifically designed to support, enhance, and automate various aspects of real estate operations including property management, sales processes, customer engagement, financial transactions, and regulatory compliance across residential, commercial, and industrial property sectors.

Core components of this market include property management systems that streamline tenant relations and maintenance operations, customer relationship management platforms that enhance sales and marketing effectiveness, virtual and augmented reality applications that revolutionize property showcasing, and advanced analytics tools that provide actionable insights for investment decisions and market analysis.

Technology integration within real estate operations encompasses cloud-based solutions that enable remote access and scalability, mobile applications that facilitate on-the-go property management, artificial intelligence systems that automate routine tasks and provide predictive analytics, and blockchain platforms that enhance transaction security and transparency throughout the property acquisition and management lifecycle.

Strategic analysis reveals the real estate IT market experiencing transformational growth as industry stakeholders increasingly embrace digital solutions to address evolving customer expectations, operational challenges, and competitive pressures. The market demonstrates strong momentum across multiple technology segments with cloud-based solutions achieving 67% adoption rate among enterprise-level real estate organizations.

Key growth drivers include the accelerating shift toward remote work models that demand flexible property management capabilities, increasing consumer preference for digital property search and transaction processes, and growing regulatory requirements that necessitate comprehensive compliance management systems. The integration of artificial intelligence and machine learning technologies has emerged as a critical differentiator, with 54% of real estate companies implementing AI-powered solutions for enhanced decision-making and operational efficiency.

Market segmentation analysis indicates property management software maintaining the largest share, followed by CRM solutions and emerging technologies such as virtual reality applications and blockchain platforms. The commercial real estate segment demonstrates particularly strong growth potential, driven by increasing demand for sophisticated portfolio management tools and advanced analytics capabilities that support complex investment strategies and risk assessment processes.

Fundamental market insights reveal several critical trends shaping the real estate IT landscape:

Primary market drivers propelling real estate IT market expansion include the fundamental shift toward digital-first business models that require comprehensive technology infrastructure to support modern property management operations. The increasing complexity of real estate portfolios demands sophisticated software solutions capable of managing diverse property types, multiple stakeholder relationships, and complex financial structures across various geographic markets.

Customer experience expectations continue to drive technology adoption as consumers increasingly demand seamless digital interactions throughout the property search, evaluation, and transaction processes. The rise of remote work models has accelerated demand for virtual property tours, digital document management, and online transaction capabilities that enable efficient property operations without traditional in-person requirements.

Operational efficiency requirements motivate real estate organizations to implement automated solutions that reduce manual processes, minimize human error, and optimize resource allocation. The growing emphasis on data-driven decision making necessitates advanced analytics platforms that provide actionable insights for investment strategies, market analysis, and performance optimization across property portfolios.

Regulatory compliance demands increasingly require sophisticated technology solutions to manage complex legal requirements, financial reporting obligations, and industry-specific regulations that vary across different markets and property types. The need for comprehensive audit trails, automated compliance monitoring, and real-time reporting capabilities drives continued investment in specialized real estate technology platforms.

Implementation challenges represent significant market restraints as many real estate organizations face difficulties integrating new technology solutions with existing legacy systems, requiring substantial time and resource investments for successful deployment. The complexity of real estate operations often necessitates extensive customization and training requirements that can delay implementation timelines and increase total cost of ownership.

Cost considerations continue to constrain market growth, particularly among smaller real estate firms that may lack the financial resources necessary for comprehensive technology upgrades. The ongoing subscription costs associated with cloud-based solutions, combined with implementation expenses and staff training requirements, can create significant financial barriers for organizations with limited technology budgets.

Data security concerns pose ongoing challenges as real estate organizations handle sensitive financial information, personal data, and confidential transaction details that require robust cybersecurity measures. The increasing frequency of cyber attacks targeting real estate companies has heightened awareness of security risks, leading some organizations to delay technology adoption until comprehensive security frameworks can be established.

Change management resistance within traditional real estate organizations can impede technology adoption as established workflows and processes may be deeply ingrained in company culture. The need for comprehensive staff training, process reengineering, and cultural adaptation can create internal resistance that slows technology implementation and reduces overall effectiveness of new systems.

Emerging technology integration presents substantial opportunities as artificial intelligence, machine learning, and predictive analytics capabilities become more sophisticated and accessible to real estate organizations of all sizes. The development of specialized AI applications for property valuation, market analysis, and customer behavior prediction offers significant potential for enhanced decision-making and competitive advantage.

Global market expansion opportunities exist in developing regions where real estate markets are experiencing rapid growth and modernization. The increasing urbanization trends and growing middle-class populations in emerging economies create demand for sophisticated property management solutions and digital real estate platforms that can support expanding property markets.

Sustainability integration represents a growing opportunity as environmental consciousness drives demand for green building technologies, energy management systems, and sustainability reporting capabilities within real estate IT solutions. The integration of IoT sensors, smart building technologies, and environmental monitoring systems creates new revenue streams and market differentiation opportunities.

Blockchain applications offer transformative potential for real estate transactions, property records management, and smart contract implementation. The development of blockchain-based solutions for property ownership verification, transaction processing, and rental agreements could revolutionize traditional real estate processes and create new market segments for technology providers.

Competitive dynamics within the real estate IT market reflect intense competition among established software providers, emerging technology startups, and traditional real estate companies developing internal technology capabilities. The market demonstrates increasing consolidation as larger technology companies acquire specialized real estate software providers to expand their market presence and enhance solution portfolios.

Innovation cycles continue to accelerate with new technology releases occurring more frequently and featuring enhanced capabilities for automation, integration, and user experience optimization. According to MarkWide Research analysis, technology refresh cycles have shortened to approximately 3-4 years as organizations seek to maintain competitive advantages through continuous technology upgrades.

Partnership strategies are becoming increasingly important as real estate IT providers collaborate with complementary technology companies, real estate service providers, and industry associations to create comprehensive solution ecosystems. These strategic alliances enable enhanced functionality, broader market reach, and improved customer value propositions through integrated technology platforms.

Customer expectations continue to evolve rapidly, driving demand for more intuitive user interfaces, mobile-optimized applications, and seamless integration capabilities. The growing influence of consumer technology experiences shapes expectations for real estate software, requiring providers to prioritize user experience design and continuous feature enhancement to maintain market competitiveness.

Comprehensive research approach employed for this market analysis incorporates multiple data collection methodologies including primary research through industry expert interviews, secondary research utilizing industry publications and reports, and quantitative analysis of market trends and performance metrics across various real estate IT segments and geographic regions.

Primary research activities included structured interviews with real estate IT vendors, property management companies, real estate investment firms, and technology consultants to gather firsthand insights regarding market trends, challenges, opportunities, and future outlook. Survey methodologies captured quantitative data regarding technology adoption rates, investment priorities, and satisfaction levels across different market segments.

Secondary research sources encompassed industry publications, company annual reports, technology research studies, and regulatory filings to validate primary research findings and provide comprehensive market context. Data triangulation techniques ensured accuracy and reliability of research conclusions through cross-verification of information from multiple independent sources.

Analytical frameworks utilized advanced statistical methods, trend analysis, and market modeling techniques to identify growth patterns, competitive dynamics, and future market projections. The research methodology incorporated both quantitative and qualitative analysis approaches to provide balanced perspectives on market opportunities, challenges, and strategic implications for industry stakeholders.

North American market maintains leadership position with approximately 42% global market share, driven by high technology adoption rates, substantial real estate investment activity, and presence of major technology providers. The United States demonstrates particularly strong growth in commercial real estate IT solutions, while Canada shows increasing adoption of cloud-based property management systems across residential and commercial segments.

European market dynamics reflect diverse regional requirements with the United Kingdom, Germany, and France leading technology adoption initiatives. The region demonstrates 28% market share with strong emphasis on regulatory compliance solutions, sustainability features, and integration capabilities that support complex multi-country real estate operations and varying legal requirements.

Asia-Pacific region exhibits the fastest growth trajectory with projected CAGR of 11.2%, driven by rapid urbanization, expanding middle-class populations, and increasing real estate investment activity. China, India, and Australia lead regional adoption with growing demand for mobile-first solutions, AI-powered analytics, and comprehensive property management platforms supporting large-scale residential and commercial developments.

Latin American markets show emerging opportunities with Brazil and Mexico demonstrating increasing technology adoption rates. The region benefits from growing real estate investment, improving technology infrastructure, and increasing demand for digital solutions that support expanding property markets and modernizing real estate operations.

Middle East and Africa represent developing markets with significant growth potential driven by major infrastructure projects, urban development initiatives, and increasing foreign investment in real estate sectors. The region shows particular interest in integrated solutions that support large-scale development projects and sophisticated property portfolio management requirements.

Market leadership is distributed among several key categories of providers including established enterprise software companies, specialized real estate technology vendors, and emerging innovative startups that focus on specific market segments or technology applications.

Competitive strategies focus on product innovation, strategic acquisitions, partnership development, and geographic expansion to capture market share and enhance solution portfolios. Companies increasingly emphasize integration capabilities, user experience optimization, and specialized industry expertise to differentiate their offerings in competitive markets.

By Solution Type:

By Deployment Model:

By Property Type:

Property Management Software represents the largest market segment with comprehensive solutions addressing tenant management, maintenance coordination, financial reporting, and lease administration requirements. This category demonstrates strong growth driven by increasing demand for automated workflows, mobile accessibility, and integration capabilities that streamline property operations across diverse portfolio types.

Customer Relationship Management solutions show robust expansion as real estate organizations prioritize enhanced customer experiences, sales process optimization, and marketing automation capabilities. The integration of AI-powered lead scoring, automated communication workflows, and comprehensive customer analytics drives adoption across residential and commercial real estate segments.

Asset Management Systems experience growing demand from institutional investors, real estate investment trusts, and property investment firms requiring sophisticated portfolio analysis, performance tracking, and risk management capabilities. These solutions incorporate advanced analytics, market intelligence, and predictive modeling to support strategic investment decisions and optimize portfolio performance.

Transaction Management platforms gain traction as digital transformation initiatives focus on streamlining property acquisition, disposition, and leasing processes. The integration of electronic signature capabilities, document management systems, and automated workflow tools reduces transaction timelines and enhances operational efficiency throughout the deal lifecycle.

Analytics and Reporting solutions demonstrate significant growth potential as data-driven decision making becomes increasingly important for real estate organizations. The incorporation of machine learning algorithms, predictive analytics, and comprehensive market intelligence provides actionable insights for investment strategies, operational optimization, and competitive positioning.

Operational Efficiency Gains represent primary benefits as real estate IT solutions automate routine tasks, streamline workflows, and reduce manual processes that traditionally consume significant time and resources. Organizations report productivity improvements of 35-45% through implementation of comprehensive property management platforms that integrate multiple operational functions.

Enhanced Customer Experiences result from digital transformation initiatives that provide seamless interactions, self-service capabilities, and responsive communication channels. Property managers and real estate professionals benefit from improved tenant satisfaction, reduced service requests, and enhanced customer retention rates through technology-enabled service delivery.

Data-Driven Decision Making capabilities enable real estate organizations to leverage comprehensive analytics, market intelligence, and performance metrics for strategic planning and operational optimization. The availability of real-time data and predictive insights supports more informed investment decisions, risk management strategies, and portfolio optimization initiatives.

Cost Reduction Opportunities emerge through automation of manual processes, optimization of resource allocation, and elimination of redundant systems and workflows. Organizations achieve significant cost savings through reduced administrative overhead, improved operational efficiency, and enhanced productivity across property management operations.

Scalability and Flexibility benefits enable real estate organizations to adapt quickly to changing market conditions, expand operations efficiently, and support growth initiatives without proportional increases in operational complexity. Cloud-based solutions provide particular advantages for organizations managing diverse property portfolios across multiple geographic markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a dominant trend with real estate organizations implementing AI-powered solutions for property valuation, market analysis, customer service automation, and predictive maintenance. The adoption of machine learning algorithms enables more accurate property recommendations, automated lease negotiations, and intelligent portfolio optimization strategies.

Mobile-First Development continues gaining momentum as field operations, remote work requirements, and customer expectations drive demand for comprehensive mobile applications. Property managers increasingly require mobile access to tenant communications, maintenance coordination, and financial reporting capabilities that support efficient operations regardless of location.

Blockchain Implementation shows growing interest for secure transaction processing, property records management, and smart contract automation. Early adopters explore blockchain applications for property ownership verification, rental agreements, and transparent transaction histories that enhance security and reduce fraud risks.

Internet of Things Integration expands rapidly with smart building technologies, environmental monitoring systems, and predictive maintenance capabilities becoming standard features in modern real estate IT solutions. IoT sensors provide real-time data on energy consumption, occupancy patterns, and equipment performance that enable proactive management strategies.

Sustainability Features gain prominence as environmental consciousness drives demand for energy management, carbon footprint tracking, and sustainability reporting capabilities within property management platforms. Organizations prioritize green building certifications, environmental compliance, and energy efficiency optimization through technology-enabled solutions.

Strategic Acquisitions continue reshaping the competitive landscape as established technology companies acquire specialized real estate software providers to expand solution portfolios and market reach. Recent consolidation activities focus on enhancing integration capabilities, expanding geographic presence, and combining complementary technology platforms.

Partnership Expansions accelerate between real estate IT providers and complementary technology companies, creating comprehensive solution ecosystems that address diverse customer requirements. Strategic alliances enable enhanced functionality, broader market access, and improved customer value propositions through integrated platforms.

Product Innovation Initiatives focus on user experience optimization, artificial intelligence integration, and mobile application development that address evolving customer expectations and operational requirements. Technology providers prioritize continuous feature enhancement, performance optimization, and security improvements to maintain competitive advantages.

Market Expansion Strategies target emerging geographic regions and underserved market segments through localized solutions, strategic partnerships, and targeted marketing initiatives. Companies increasingly focus on developing region-specific features, compliance capabilities, and language support to capture growth opportunities in international markets.

Regulatory Compliance Enhancements address evolving legal requirements, data protection regulations, and industry-specific compliance standards through comprehensive security frameworks, audit capabilities, and automated reporting features. Technology providers invest significantly in compliance infrastructure to support customer requirements across different regulatory environments.

Technology Investment Priorities should focus on solutions that provide comprehensive integration capabilities, scalable architecture, and proven track records of successful implementation across similar organizational contexts. MWR analysis suggests prioritizing platforms that offer strong mobile capabilities, robust security frameworks, and extensive customization options to support diverse operational requirements.

Implementation Strategy Recommendations emphasize phased deployment approaches that minimize operational disruption while enabling gradual user adoption and system optimization. Organizations should prioritize comprehensive training programs, change management initiatives, and ongoing support structures to maximize technology investment returns and ensure successful long-term adoption.

Vendor Selection Criteria should evaluate solution functionality, integration capabilities, security features, scalability options, and total cost of ownership considerations. Due diligence processes should include reference customer interviews, proof-of-concept testing, and detailed analysis of vendor financial stability and long-term viability.

Future-Proofing Strategies require consideration of emerging technology trends, evolving customer expectations, and changing regulatory requirements that may impact solution effectiveness over time. Organizations should prioritize vendors demonstrating strong innovation capabilities, regular product updates, and commitment to continuous technology advancement.

Risk Mitigation Approaches should address cybersecurity concerns, data protection requirements, and business continuity planning through comprehensive security assessments, backup strategies, and disaster recovery procedures. Organizations must establish robust governance frameworks and ongoing monitoring capabilities to manage technology-related risks effectively.

Growth Projections indicate continued market expansion with the real estate IT sector expected to maintain robust growth momentum driven by ongoing digital transformation initiatives, increasing technology adoption rates, and evolving customer expectations. The market demonstrates strong fundamentals with projected CAGR of 8.7% supported by consistent demand across multiple geographic regions and property segments.

Technology Evolution trends suggest increasing sophistication of artificial intelligence applications, enhanced mobile capabilities, and expanded integration frameworks that will define next-generation real estate IT solutions. The convergence of IoT, blockchain, and AI technologies promises to create more intelligent, automated, and efficient property management platforms.

Market Consolidation activities are expected to continue as larger technology companies acquire specialized providers to enhance solution portfolios and expand market presence. This consolidation trend may result in more comprehensive integrated platforms while potentially reducing the number of independent vendors in certain market segments.

Emerging Market Opportunities present significant growth potential as developing regions experience rapid urbanization, expanding middle-class populations, and increasing real estate investment activity. These markets offer substantial opportunities for technology providers willing to adapt solutions to local requirements and regulatory environments.

Innovation Focus Areas will likely emphasize sustainability features, predictive analytics capabilities, and enhanced user experiences that address evolving market demands and regulatory requirements. The integration of environmental monitoring, energy management, and carbon footprint tracking capabilities will become increasingly important for competitive differentiation and customer value creation.

Market assessment reveals the real estate IT market positioned for sustained growth driven by fundamental industry transformation, evolving customer expectations, and continuous technology innovation. The sector demonstrates strong fundamentals with diverse growth opportunities across multiple geographic regions, property types, and solution categories that support long-term market expansion.

Strategic implications suggest organizations must prioritize comprehensive technology strategies that address operational efficiency, customer experience enhancement, and competitive positioning requirements. The successful implementation of real estate IT solutions requires careful planning, adequate resource allocation, and commitment to ongoing optimization and user adoption initiatives.

Future success factors will depend on technology providers’ ability to deliver innovative solutions that address evolving market demands while maintaining security, reliability, and cost-effectiveness. Organizations that embrace digital transformation initiatives and invest strategically in appropriate technology platforms will be best positioned to capitalize on emerging opportunities and maintain competitive advantages in dynamic real estate markets.

What is Real State IT?

Real State IT refers to the technology solutions and services that support the real estate industry, including property management software, real estate analytics, and digital marketing tools.

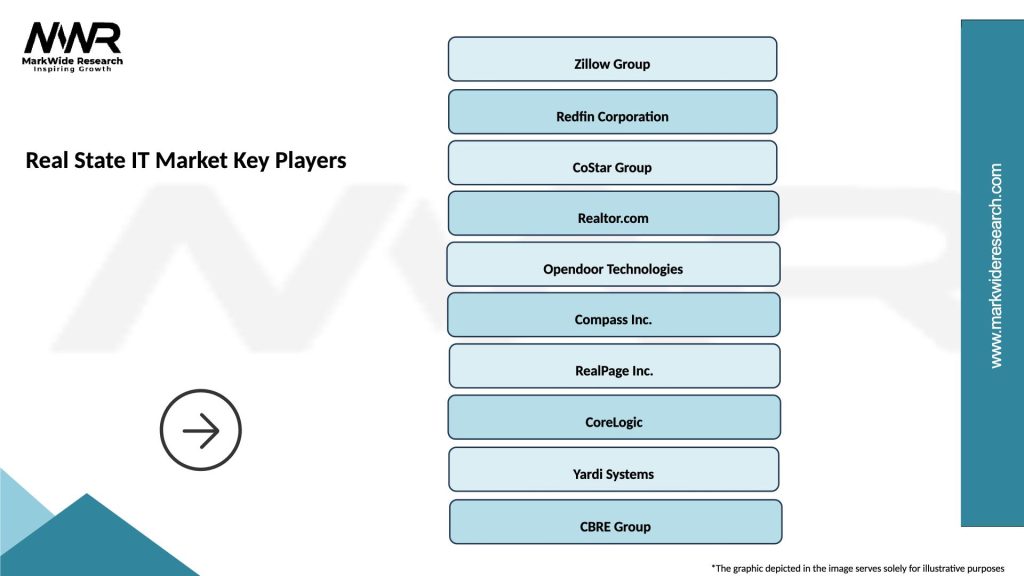

What are the key players in the Real State IT Market?

Key players in the Real State IT Market include companies like Zillow, CoStar Group, and Redfin, which provide various technology solutions for real estate transactions and management, among others.

What are the main drivers of growth in the Real State IT Market?

The main drivers of growth in the Real State IT Market include the increasing adoption of digital tools for property management, the demand for data analytics in real estate decision-making, and the rise of online property listings.

What challenges does the Real State IT Market face?

Challenges in the Real State IT Market include data privacy concerns, the need for integration with existing systems, and the rapid pace of technological change that can outstrip user adaptation.

What opportunities exist in the Real State IT Market?

Opportunities in the Real State IT Market include the expansion of smart home technologies, the growth of virtual and augmented reality for property viewing, and the increasing demand for sustainable building solutions.

What trends are shaping the Real State IT Market?

Trends shaping the Real State IT Market include the rise of artificial intelligence for property valuation, the use of blockchain for secure transactions, and the growing importance of mobile applications for real estate services.

Real State IT Market

| Segmentation Details | Description |

|---|---|

| Product Type | Property Management Software, Real Estate CRM, Listing Platforms, Virtual Tour Solutions |

| End User | Real Estate Agents, Property Managers, Developers, Investors |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile Solutions |

| Service Type | Consulting, Maintenance, Training, Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Real State IT Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at