444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global rare earth metals market is expected to grow at a CAGR of 8.6% during the forecast period of 2021-2026. Rare earth metals are a group of seventeen elements that include cerium, dysprosium, erbium, europium, gadolinium, holmium, lanthanum, lutetium, neodymium, praseodymium, promethium, samarium, scandium, terbium, thulium, ytterbium, and yttrium. These metals are widely used in the manufacture of various high-tech products such as smartphones, electric vehicles, wind turbines, and medical equipment.

Rare earth metals are called so because of their scarcity in the Earth’s crust. They are often found together with other minerals and are difficult to extract. These metals are critical to the manufacturing of high-tech products and are used in small quantities, but their importance cannot be overstated.

Executive Summary

The global rare earth metals market is expected to reach a value of USD 11.28 billion by 2026. The market is driven by the growing demand for high-tech products such as smartphones, electric vehicles, and medical equipment. The market is characterized by the dominance of China, which accounts for over 80% of the global production of rare earth metals. The increasing demand for renewable energy sources and the growing focus on reducing carbon emissions are expected to drive the growth of the market during the forecast period.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The global rare earth metals market is expected to grow at a CAGR of 8.6% during the forecast period of 2021-2026. The following are some of the key market insights:

Market Drivers

The following are some of the key market drivers that are expected to drive the growth of the global rare earth metals market during the forecast period:

The growing demand for high-tech products such as smartphones, electric vehicles, and medical equipment is expected to drive the growth of the global rare earth metals market during the forecast period. Rare earth metals are widely used in the manufacture of these products, and the increasing demand for them is expected to drive the demand for rare earth metals.

The increasing demand for renewable energy sources such as wind and solar power is expected to drive the growth of the global rare earth metals market during the forecast period. Rare earth metals are used in the manufacture of wind turbines and solar panels, and the increasing demand for these energy sources is expected to drive the demand for rare earth metals.

The growing focus on reducing carbon emissions is expected to drive the growth of the global rare earth metals market during the forecast period. Rare earth metals are used in the manufacture of electric vehicles, which are considered to be a more environmentally friendly alternative to traditional gasoline-powered vehicles. The increasing demand for electric vehicles is expected to drive the demand for rare earth metals.

Market Restraints

The following are some of the key market restraints that are expected to challenge the growth of the global rare earth metals market during the forecast period:

The high cost of production is expected to be a major challenge for the growth of the global rare earth metals market during the forecast period. The mining and processing of rare earth metals are expensive, and the high cost of production is likely to make rare earth metals more expensive for end-users.

The environmental impact of rare earth metal mining and processing is expected to be a major challenge for the growth of the global rare earth metals market during the forecast period. The mining and processing of rare earth metals can have a significant impact on the environment, and there is growing concern about the sustainability of rare earth metal production.

Market Opportunities

The following are some of the key market opportunities that are expected to drive the growth of the global rare earth metals market during the forecast period:

The development of new applications for rare earth metals is expected to drive the growth of the global rare earth metals market during the forecast period. Rare earth metals have unique properties that make them suitable for a wide range of applications, and the development of new applications is likely to drive the demand for rare earth metals.

The diversification of supply is expected to be a major opportunity for the growth of the global rare earth metals market during the forecast period. Currently, China dominates the global production of rare earth metals, and there is growing concern about the country’s control over the supply and pricing of rare earth metals. The diversification of supply is likely to reduce the risk of supply chain disruptions and increase the competition in the market.

Market Dynamics

The global rare earth metals market is a dynamic market that is influenced by a wide range of factors. The following are some of the key market dynamics that are expected to shape the growth of the market during the forecast period:

The supply and demand dynamics are expected to be a major driver of the global rare earth metals market during the forecast period. The increasing demand for rare earth metals is likely to drive the production of rare earth metals, which, in turn, is likely to increase the supply of rare earth metals.

Government regulations are expected to be a major driver of the global rare earth metals market during the forecast period. Many countries have implemented regulations to promote the use of renewable energy sources and reduce carbon emissions, which is likely to drive the demand for rare earth metals.

Regional Analysis

The global rare earth metals market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates the global rare earth metals market, followed by North America and Europe. China is the largest producer of rare earth metals in the world and is expected to continue to dominate the market during the forecast period.

Competitive Landscape

Leading Companies in the Rare Earth Metals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

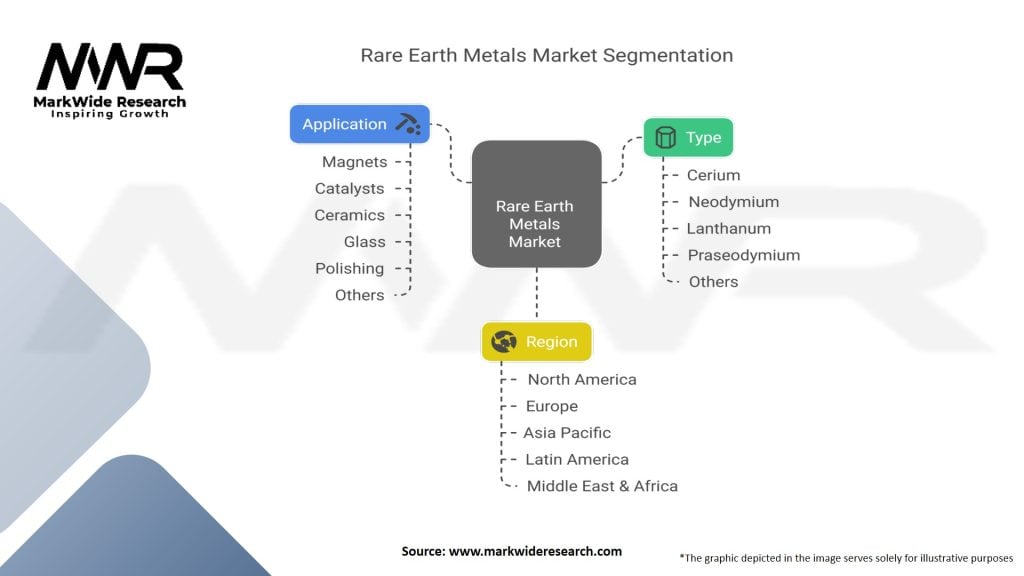

Segmentation

The global rare earth metals market is segmented by type, application, and region. By type, the market is segmented into cerium, dysprosium, erbium, europium, gadolinium, holmium, lanthanum, lutetium, neody mium, praseodymium, promethium, samarium, scandium, terbium, thulium, ytterbium, and yttrium. By application, the market is segmented into magnets, catalysts, polishing, phosphors, ceramics, glass, metallurgy, and others.

Category-wise Insights

Magnets are the largest application segment of the global rare earth metals market, accounting for over 40% of the total demand. Rare earth magnets are used in a wide range of applications such as electric vehicles, wind turbines, and medical equipment. The increasing demand for these products is likely to drive the demand for rare earth magnets during the forecast period.

Catalysts are another major application segment of the global rare earth metals market. Rare earth metals are used as catalysts in the manufacture of petroleum products, chemicals, and other industrial products. The increasing demand for these products is likely to drive the demand for rare earth metals as catalysts during the forecast period.

Rare earth metals are used in the manufacture of polishing agents for various applications such as optics, semiconductors, and jewelry. The increasing demand for these products is likely to drive the demand for rare earth metals for polishing during the forecast period.

Rare earth metals are used in the manufacture of phosphors for lighting applications such as fluorescent lamps, LEDs, and plasma displays. The increasing demand for these products is likely to drive the demand for rare earth metals for phosphors during the forecast period.

Key Benefits for Industry Participants and Stakeholders

The following are some of the key benefits for industry participants and stakeholders in the global rare earth metals market:

The growing demand for high-tech products such as smartphones, electric vehicles, and medical equipment is likely to drive the demand for rare earth metals, providing opportunities for industry participants.

The increasing demand for renewable energy sources such as wind and solar power is likely to drive the demand for rare earth metals, providing opportunities for industry participants.

The diversification of supply is likely to reduce the risk of supply chain disruptions and increase the competition in the market, providing opportunities for industry participants.

SWOT Analysis

The following is a SWOT analysis of the global rare earth metals market:

The global rare earth metals market is driven by the growing demand for high-tech products and renewable energy sources.

The high cost of production and the environmental impact of rare earth metal mining and processing are major challenges for the growth of the market.

The development of new applications and the diversification of supply provide opportunities for industry participants.

The dominance of China in the global production of rare earth metals and the risk of supply chain disruptions are major threats to the growth of the market.

Market Key Trends

The following are some of the key trends in the global rare earth metals market:

The growing demand for electric vehicles is driving the demand for rare earth metals, particularly neodymium and dysprosium, which are used in the manufacture of electric vehicle motors.

There is increasing focus on the sustainability of rare earth metal production, with efforts to reduce the environmental impact of mining and processing and to diversify the supply of rare earth metals.

Covid-19 Impact

The global rare earth metals market was impacted by the Covid-19 pandemic, with disruptions to supply chains and reduced demand for high-tech products. However, the market is expected to recover during the forecast period as the global economy recovers and demand for high-tech products and renewable energy sources.

Key Industry Developments

The following are some of the key industry developments in the global rare earth metals market:

China has been dominating the global production of rare earth metals for many years. The country’s control over the supply and pricing of rare earth metals has led to concerns among other countries, which are now looking to diversify their supply chains.

There is increasing interest in the recycling of rare earth metals, which can reduce the environmental impact of mining and processing and provide a more sustainable supply of rare earth metals.

The development of new applications for rare earth metals is likely to drive the growth of the market during the forecast period. For example, rare earth metals are being used in the development of new battery technologies.

Analyst Suggestions

The following are some of the key suggestions from industry analysts for participants in the global rare earth metals market:

Participants in the global rare earth metals market should diversify their supply chain to reduce the risk of supply chain disruptions and to increase competition in the market.

Participants in the global rare earth metals market should focus on the development of new applications for rare earth metals to increase demand for these metals.

Future Outlook

The global rare earth metals market is expected to continue to grow during the forecast period, driven by the growing demand for high-tech products and renewable energy sources. The diversification of supply and the development of new applications are likely to provide opportunities for industry participants. However, the high cost of production and the environmental impact of mining and processing are likely to be major challenges for the growth of the market.

Conclusion

The global rare earth metals market is a dynamic market that is driven by the growing demand for high-tech products and renewable energy sources. The market is characterized by the dominance of China, which accounts for over 80% of the global production of rare earth metals. The market is expected to grow during the forecast period, driven by the increasing demand for electric vehicles, wind turbines, and solar panels.

The development of new applications and the diversification of supply are likely to provide opportunities for industry participants, but the high cost of production and the environmental impact of mining and processing are likely to be major challenges for the growth of the market.

What are rare earth metals?

Rare earth metals are a group of seventeen chemical elements that are critical in various high-tech applications, including electronics, renewable energy technologies, and defense systems. They are known for their unique magnetic, luminescent, and electrochemical properties.

What are the key companies in the rare earth metals market?

Key companies in the rare earth metals market include Lynas Corporation, MP Materials, and China Northern Rare Earth Group. These companies play significant roles in the extraction, processing, and supply of rare earth metals, among others.

What are the main drivers of growth in the rare earth metals market?

The growth of the rare earth metals market is driven by increasing demand for electric vehicles, advancements in renewable energy technologies, and the rising need for high-performance magnets in various industries. These factors contribute to a robust market outlook.

What challenges does the rare earth metals market face?

The rare earth metals market faces challenges such as geopolitical tensions affecting supply chains, environmental concerns related to mining practices, and the high cost of extraction and processing. These factors can hinder market growth.

What opportunities exist in the rare earth metals market?

Opportunities in the rare earth metals market include the development of recycling technologies for rare earth elements, increasing investments in green technologies, and the potential for new mining projects in untapped regions. These factors could enhance supply and sustainability.

What trends are shaping the rare earth metals market?

Trends in the rare earth metals market include a shift towards sustainable mining practices, increased research into alternative materials, and the growing importance of supply chain transparency. These trends are influencing how companies operate and engage with stakeholders.

Rare Earth Metals Market

| Segmentation Details | Details |

|---|---|

| Type | Cerium, Neodymium, Lanthanum, Praseodymium, Others |

| Application | Magnets, Catalysts, Ceramics, Glass, Polishing, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Rare Earth Metals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at