444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The rare earth elements market is a thriving sector with significant growth potential. These elements, also known as rare earth metals, are a group of 17 chemically similar elements, including lanthanum, cerium, neodymium, and others. They possess unique properties that make them indispensable in various high-tech applications, including electronics, renewable energy, automotive, and defense industries.

Meaning

Rare earth elements (REEs) are a group of metallic elements that are widely used in modern technologies due to their exceptional magnetic, optical, and catalytic properties. Despite their name, rare earth elements are relatively abundant in the Earth’s crust, but they are typically found in low concentrations, making their extraction and refining processes challenging and costly.

Executive Summary

The rare earth elements market has experienced robust growth in recent years, driven by increasing demand for advanced technologies and the transition towards clean energy sources. The market is expected to continue its upward trajectory as the global economy recovers and new applications for rare earth elements emerge.

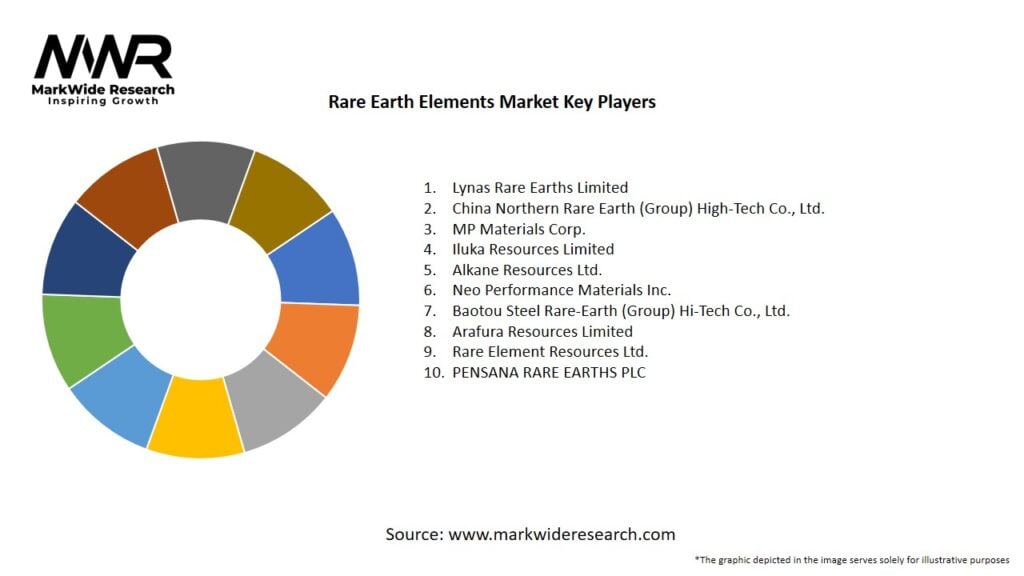

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

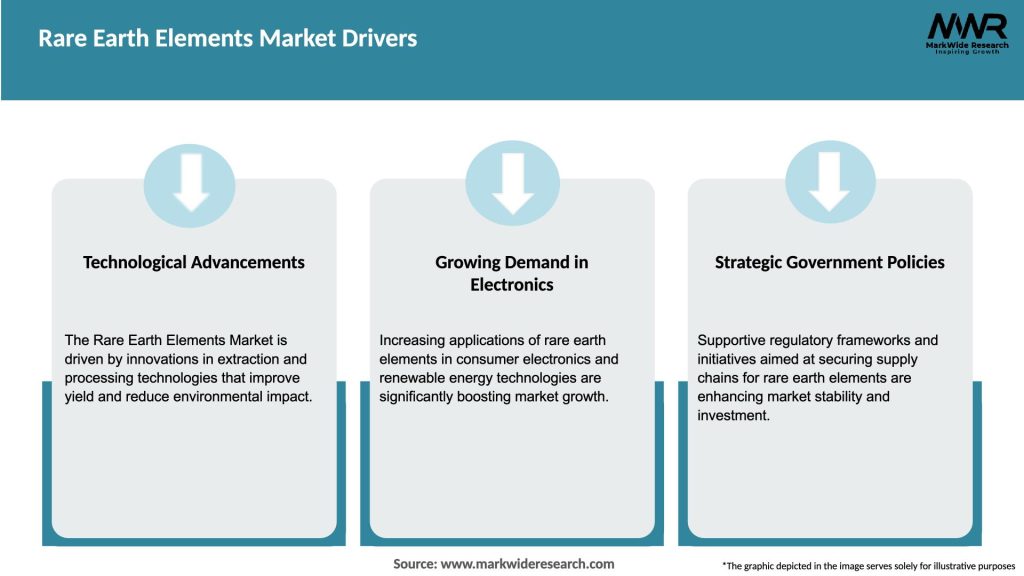

Market Drivers

The rare earth elements market is driven by several key factors:

Market Restraints

While the rare earth elements market presents promising opportunities, certain challenges hinder its growth:

Market Opportunities

The rare earth elements market presents several opportunities for growth and innovation:

Market Dynamics

The rare earth elements market is influenced by various dynamics, including supply and demand factors, technological advancements, government regulations, and geopolitical developments. These dynamics shape the market landscape and drive its growth or contraction.

The demand for rare earth elements is closely tied to technological advancements and emerging applications across industries. As new technologies emerge, the demand for these elements increases, leading to market expansion. However, the market’s growth can be hampered by supply chain disruptions, environmental concerns, and geopolitical factors that impact availability and pricing.

Regional Analysis

The global rare earth elements market is geographically segmented into regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Currently, Asia Pacific, particularly China, dominates the market due to its abundant reserves and extensive production capacities. However, efforts are underway in other regions to increase rare earth elements production and reduce dependence on a single supplier.

Competitive Landscape

Leading Companies in the Rare Earth Elements Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

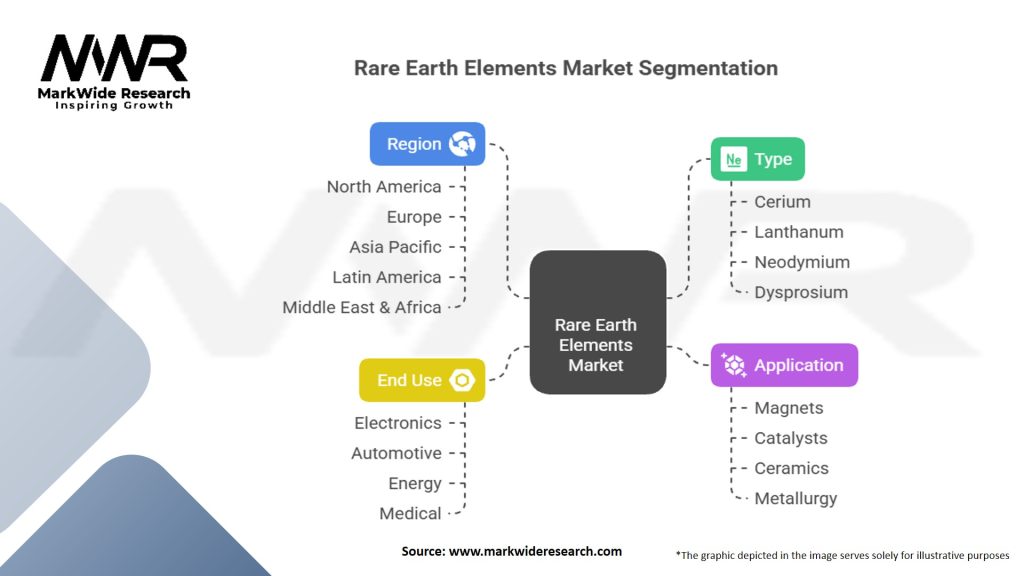

Segmentation

The rare earth elements market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the rare earth elements market can benefit from:

SWOT Analysis

A SWOT analysis of the rare earth elements market reveals the following:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The rare earth elements market is characterized by several key trends:

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the rare earth elements market. While the initial disruptions to global supply chains and manufacturing activities affected the market, the subsequent recovery and increased focus on renewable energy and technological advancements provided opportunities for growth. The pandemic highlighted the importance of rare earth elements in critical industries such as healthcare, electronics, and renewable energy, further underscoring their significance in the global economy.

Key Industry Developments

Analyst Suggestions

Industry analysts suggest the following strategies for stakeholders in the rare earth elements market:

Future Outlook

The future outlook for the rare earth elements market is optimistic, driven by increasing demand from the electronics, renewable energy, and automotive sectors. The transition towards clean energy sources and the development of advanced technologies will continue to fuel the demand for rare earth elements. Efforts to diversify supply chains, promote sustainable mining practices, and develop recycling technologies are expected to shape the market’s future landscape.

Conclusion

The rare earth elements market is a vibrant and dynamic sector, driven by the growing demand for advanced technologies and clean energy solutions. While limited supply, environmental concerns, and geopolitical factors pose challenges, the market presents significant growth opportunities for industry participants and stakeholders. By embracing sustainability, diversifying supply chains, and investing in innovation, the rare earth elements market can thrive and contribute to a more sustainable and technologically advanced future.

What are Rare Earth Elements?

Rare Earth Elements are a group of seventeen chemical elements that are critical in various high-tech applications, including electronics, renewable energy technologies, and defense systems. They are essential for manufacturing products like smartphones, electric vehicle batteries, and wind turbines.

What are the key companies in the Rare Earth Elements Market?

Key companies in the Rare Earth Elements Market include Lynas Corporation, MP Materials, and China Northern Rare Earth Group. These companies play significant roles in the extraction, processing, and supply of rare earth elements, among others.

What are the growth factors driving the Rare Earth Elements Market?

The growth of the Rare Earth Elements Market is driven by the increasing demand for electric vehicles, advancements in renewable energy technologies, and the rising need for high-performance magnets in various industries. Additionally, the push for technological innovation in consumer electronics contributes to market expansion.

What challenges does the Rare Earth Elements Market face?

The Rare Earth Elements Market faces challenges such as geopolitical tensions affecting supply chains, environmental concerns related to mining practices, and the high costs associated with extraction and processing. These factors can hinder market growth and stability.

What opportunities exist in the Rare Earth Elements Market?

Opportunities in the Rare Earth Elements Market include the development of recycling technologies for rare earth materials, increasing investments in sustainable mining practices, and the potential for new applications in emerging technologies like quantum computing and advanced batteries.

What trends are shaping the Rare Earth Elements Market?

Trends in the Rare Earth Elements Market include a shift towards sustainable sourcing, increased government support for domestic production, and innovations in extraction technologies. These trends are crucial for meeting the growing demand while addressing environmental and supply chain concerns.

Rare Earth Elements Market

| Segmentation Details | Description |

|---|---|

| Type | Cerium, Lanthanum, Neodymium, Dysprosium, Others |

| Application | Magnets, Catalysts, Ceramics, Metallurgy, Others |

| End Use | Electronics, Automotive, Energy, Medical, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Rare Earth Elements Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at