444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Rammer market is a rapidly growing segment in the construction industry, driven by the increasing demand for efficient and powerful compacting tools. Rammer, also known as a hydraulic hammer or an impact hammer, is a construction machine used for breaking and compacting soil, rocks, and concrete surfaces. It is widely used in various applications such as road construction, building demolition, and foundation work.

Meaning

A Rammer is a heavy-duty machine that utilizes hydraulic power to deliver high-impact blows to surfaces, enabling efficient compaction and breaking of materials. It consists of a hammer mechanism attached to an excavator or a backhoe loader, providing the necessary force to accomplish tasks that would be otherwise labor-intensive and time-consuming. The ramming action of the machine helps in achieving a solid and stable foundation for construction projects.

Executive Summary

The Rammer market has witnessed significant growth in recent years, driven by the rising demand for infrastructure development across the globe. The increasing need for compacting equipment that offers high productivity and cost-efficiency has fueled the market’s expansion. Additionally, technological advancements in rammer design have resulted in more powerful and versatile machines, further boosting market growth.

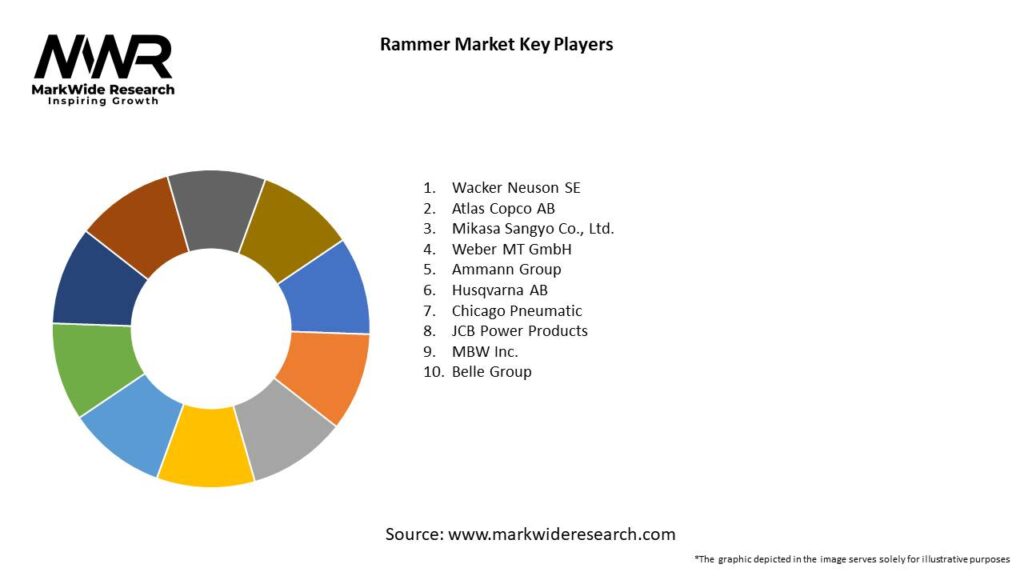

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

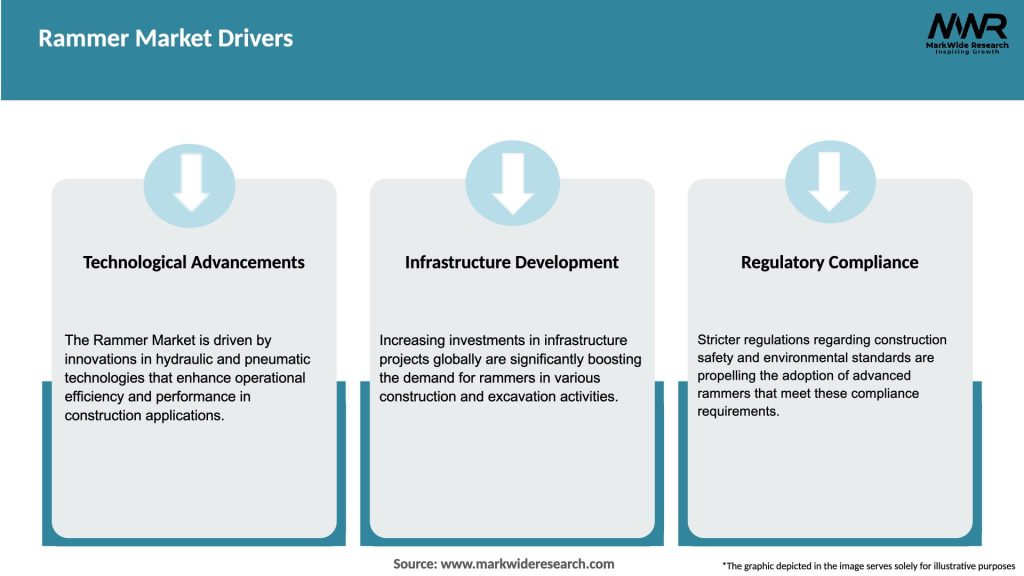

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The rammer market is driven by various factors, including infrastructure development initiatives, advancements in technology, and the need for operational efficiency in the construction industry. However, market growth is hindered by challenges such as high initial investment costs, maintenance expenses, and market competition. Despite these restraints, opportunities exist in product innovation, emerging economies, rental services, and sustainable solutions.

Regional Analysis

The rammer market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific holds a significant share of the market, driven by rapid urbanization, infrastructure development, and increasing construction activities in countries like China, India, and Japan. North America and Europe also contribute significantly to the market due to ongoing infrastructure projects and renovation activities. Latin America and the Middle East and Africa show potential for growth, driven by expanding construction industries and government investments in infrastructure development.

Competitive Landscape

Leading Companies in the Rammer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

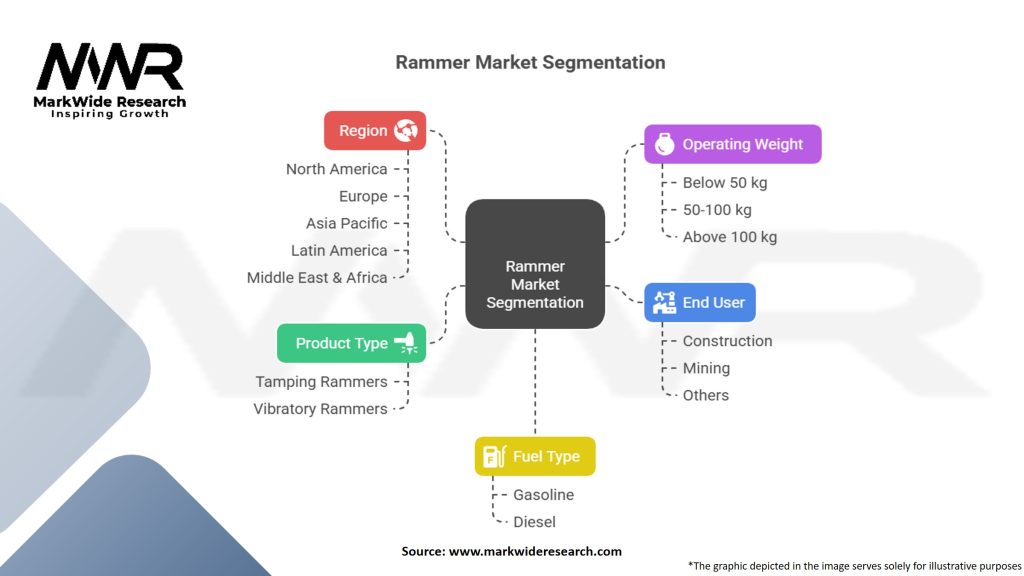

The rammer market can be segmented based on the following criteria:

Segmenting the market helps identify specific customer needs, tailor marketing strategies, and develop targeted products for different segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the rammer market, with construction projects being delayed or temporarily halted due to lockdown measures and supply chain disruptions. However, the market gradually recovered as restrictions eased and construction activities resumed. The demand for rammers remained resilient, particularly in infrastructure projects aimed at economic recovery. Manufacturers implemented strict health and safety measures to protect their employees and customers and adopted digital technologies for remote support and training.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the rammer market looks promising, with steady growth expected in the coming years. The increasing focus on infrastructure development, urbanization, and sustainability will drive market expansion. Technological advancements, such as IoT integration and hybrid power sources, will continue to reshape the industry. Manufacturers that prioritize innovation, market expansion in emerging economies, and after-sales services are likely to thrive in the competitive landscape.

Conclusion

The Rammer market is witnessing significant growth due to the increasing demand for efficient and powerful compacting tools in the construction industry. The market is driven by infrastructure development initiatives, technological advancements, and the need for operational efficiency. However, challenges such as high initial investment costs and market competition exist. Opportunities lie in product innovation, emerging economies, rental services, and sustainable solutions. Manufacturers should focus on differentiation, market expansion, after-sales services, and sustainability to stay competitive and capitalize on future market growth.

What is Rammer?

Rammer refers to a type of construction equipment used for compacting soil, asphalt, and other materials. It is commonly utilized in road construction, foundation work, and landscaping to ensure a stable and solid base.

What are the key players in the Rammer Market?

Key players in the Rammer Market include companies like Atlas Copco, Wacker Neuson, and Hitachi Construction Machinery, which are known for their innovative designs and reliable products in the construction equipment sector, among others.

What are the growth factors driving the Rammer Market?

The Rammer Market is driven by increasing infrastructure development, urbanization, and the rising demand for efficient construction processes. Additionally, advancements in technology are enhancing the performance and efficiency of rammers.

What challenges does the Rammer Market face?

The Rammer Market faces challenges such as high maintenance costs and the availability of alternative compaction methods. Additionally, fluctuating raw material prices can impact production and pricing strategies.

What opportunities exist in the Rammer Market?

Opportunities in the Rammer Market include the growing trend towards eco-friendly construction practices and the development of electric and hybrid rammers. These innovations can cater to the increasing demand for sustainable construction solutions.

What trends are shaping the Rammer Market?

Trends in the Rammer Market include the integration of smart technology for enhanced operational efficiency and the increasing focus on operator safety features. Additionally, the demand for lightweight and portable rammers is on the rise.

Rammer Market

| Segmentation | Details |

|---|---|

| Product Type | Tamping Rammers, Vibratory Rammers |

| Operating Weight | Below 50 kg, 50-100 kg, Above 100 kg |

| Fuel Type | Gasoline, Diesel |

| End User | Construction, Mining, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Rammer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at