444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The quenched and tempered steel market represents a critical segment within the global steel industry, providing high-strength, wear-resistant materials essential for heavy-duty applications across construction, mining, defense, and industrial manufacturing sectors. Quenched and tempered steels undergo specialized heat treatment processes that significantly enhance their mechanical properties, including tensile strength, hardness, and impact resistance, while maintaining adequate toughness for demanding operational conditions. This market has evolved to serve industries requiring superior material performance in challenging environments where conventional steels prove inadequate.

Key market characteristics include:

The market benefits from global infrastructure investment, mining sector expansion, and increasing demand for durable materials in harsh operating environments, positioning quenched and tempered steels as essential components in heavy industry applications.

Quenched and tempered steel refers to carbon and low-alloy steels that have undergone a specific two-stage heat treatment process to achieve optimal mechanical properties. The quenching process involves rapid cooling from high temperatures to form hard martensitic structures, followed by tempering at lower temperatures to reduce brittleness while maintaining strength and hardness characteristics.

The fundamental aspects include:

Primary applications encompass:

The combination of high strength, excellent toughness, and superior wear resistance makes quenched and tempered steel indispensable for applications where material failure could result in significant operational disruption or safety concerns.

The global quenched & tempered steel market has demonstrated steady growth driven by infrastructure development, mining sector expansion, and increasing demand for high-performance materials in industrial applications. The market benefits from technological advancements in steel production, growing emphasis on equipment durability, and expanding applications in emerging economies with significant infrastructure investment programs.

Market highlights include:

The market faces challenges including raw material price volatility, energy costs for heat treatment processes, and competition from alternative high-strength materials. However, opportunities exist in renewable energy infrastructure, advanced manufacturing applications, and emerging market infrastructure development programs.

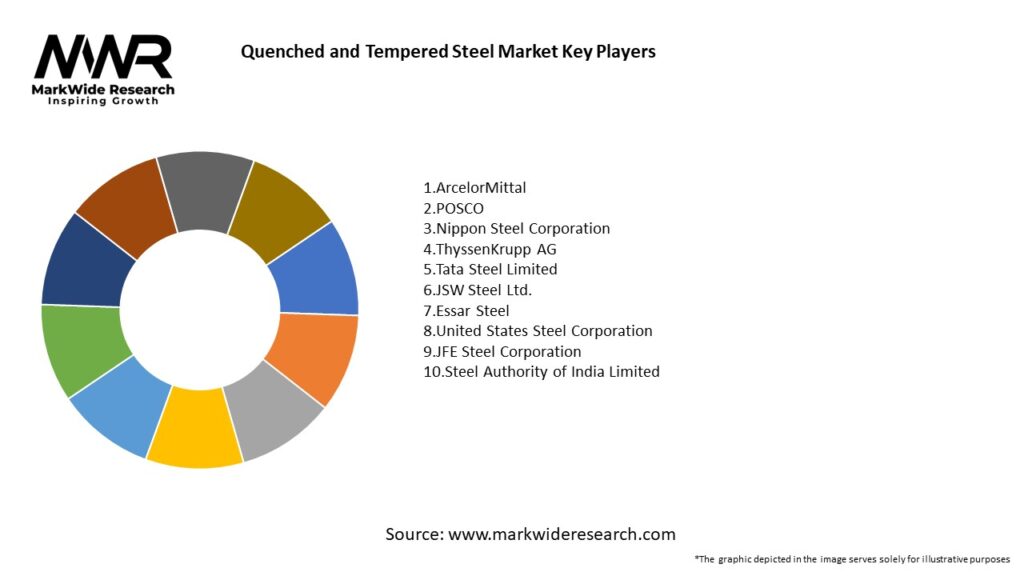

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

The quenched and tempered steel market exhibits distinctive characteristics reflecting global industrial development patterns, infrastructure investment priorities, and evolving performance requirements across key application sectors.

Critical market metrics:

Key market dynamics:

The market demonstrates resilience through diversified application portfolio and essential role in global infrastructure development, while technological advancement continues driving material property improvements and new application opportunities.

Several powerful drivers propel the quenched and tempered steel market forward, creating sustained demand across industrial sectors and establishing strong foundations for continued market expansion.

Primary Growth Catalysts:

1. Global Infrastructure Development Massive infrastructure investment programs drive substantial steel demand:

2. Mining Industry Expansion Global resource demand drives mining equipment requirements:

3. Construction Equipment Market Growth Construction industry modernization drives equipment demand:

4. Defense and Security Spending Military modernization programs create specialized material demand:

5. Industrial Manufacturing Evolution Advanced manufacturing demands high-performance materials:

Despite favorable growth conditions, the quenched and tempered steel market confronts several significant restraints that could impact expansion potential and require strategic navigation by industry participants.

Key Growth Limitations:

1. Raw Material and Energy Cost Pressures Production cost factors create margin pressures and pricing challenges:

2. Environmental and Regulatory Constraints Increasing environmental regulations create compliance challenges:

3. Competition from Alternative Materials Substitute materials threaten market share in specific applications:

4. Economic Cyclicality and Market Volatility Economic factors create demand uncertainty and planning challenges:

5. Technical and Processing Challenges Manufacturing complexity creates operational and quality risks:

The quenched and tempered steel market presents numerous attractive opportunities for growth and innovation, driven by infrastructure development, technological advancement, and expanding applications in emerging industry sectors.

Emerging Growth Areas:

1. Renewable Energy Infrastructure Clean energy transition creates substantial market opportunities:

2. Emerging Market Infrastructure Development Developing economies present significant growth potential:

3. Advanced Manufacturing Applications Industrial modernization creates specialized material demand:

4. Marine and Offshore Applications Ocean economy expansion drives material demand:

5. Defense and Security Applications Security concerns drive specialized material demand:

The quenched & tempered steel market operates within a complex ecosystem characterized by cyclical demand patterns, technical specification requirements, and close integration between steel producers and end-user equipment manufacturers.

Industry Ecosystem Factors:

Supply Chain Integration: The market features strong vertical integration between raw material suppliers, steel producers, and equipment manufacturers, enabling quality control, technical collaboration, and cost optimization throughout the value chain. Long-term supply agreements provide stability for both producers and customers while facilitating joint product development programs.

Quality and Certification Systems: Stringent quality requirements, particularly in defense and critical infrastructure applications, drive comprehensive testing and certification programs. International standards including ASTM, EN, and JIS specifications ensure material compatibility and performance consistency across global markets.

Technical Service and Support: Steel producers provide extensive technical support including metallurgical consultation, application engineering, and failure analysis services. This technical partnership approach builds customer loyalty while enabling optimized material selection and application development.

Research and Development Collaboration: Collaborative R&D programs between steel producers, equipment manufacturers, and end-users accelerate new grade development and application optimization. University partnerships and industry research consortiums advance fundamental understanding of material behavior and processing technologies.

Cyclical Market Management: Industry participants manage demand cyclicality through flexible production systems, inventory management strategies, and diversified customer portfolios spanning multiple end-use sectors with different economic cycles.

Sustainability Integration: Environmental considerations increasingly influence material selection, production processes, and end-of-life management. Recycling programs and sustainable production methods become competitive differentiators and regulatory compliance requirements.

The global quenched and tempered steel market exhibits distinct regional characteristics reflecting local industrial development patterns, infrastructure investment priorities, and manufacturing capabilities across major geographic markets.

Asia-Pacific Market Dominance: The region commands over 45% of global market share, driven by:

Key country contributions:

North America Market Characteristics: Mature market with stable demand patterns:

Market dynamics include:

European Market Position: Mature market focusing on high-value applications:

Key regional characteristics:

Other Regional Markets: Emerging opportunities in developing regions:

Leading companies in the Quenched and Tempered Steel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

The quenched and tempered steel market demonstrates sophisticated segmentation across multiple dimensions, enabling targeted strategies and specialized solutions for diverse application requirements and performance specifications.

Application-Based Segmentation:

Construction Equipment (35-40% Market Share):

Mining Equipment (25-30% Market Share):

Defense and Military (15-20% Market Share):

Industrial and Manufacturing (10-15% Market Share):

Strength Grade Segmentation:

Standard Strength (400-500 MPa):

High Strength (500-700 MPa):

Ultra-High Strength (700+ MPa):

Product Form Segmentation:

Construction Equipment Applications (35-40% Market Share): This segment represents the largest and most diverse application area for quenched and tempered steel, driven by global infrastructure development and equipment modernization trends. Construction equipment manufacturers require materials with excellent strength-to-weight ratios, impact resistance, and weldability for productive and reliable machinery operation. Key applications include excavator buckets and arms where wear resistance and toughness are critical for productivity and maintenance cost control. The segment benefits from equipment replacement cycles and infrastructure investment programs while facing competitive pressure to reduce material costs without compromising performance.

Mining Equipment Applications (25-30% Market Share): Mining applications demand exceptional wear resistance and durability for equipment operating in highly abrasive environments with minimal maintenance opportunities. Ultra-large mining equipment requires specialized steel grades with superior mechanical properties and dimensional stability for components including dragline buckets, haul truck bodies, and crusher assemblies. This segment shows strong correlation with commodity price cycles and mining industry capital investment patterns. Growth drivers include increasing mining depths requiring more durable equipment and emerging market resource development creating new equipment demand.

Defense and Military Applications (15-20% Market Share): Defense applications require the highest performance grades with stringent quality requirements and extensive certification processes. Military equipment must withstand extreme conditions including blast loads, ballistic impacts, and harsh environmental exposure while maintaining structural integrity. This segment commands premium pricing due to specialized requirements and limited supplier qualification processes. Market drivers include military modernization programs, homeland security infrastructure, and international peacekeeping equipment requirements. Long development cycles and extensive testing requirements create barriers to entry but provide stable long-term relationships for qualified suppliers.

Industrial and Manufacturing Applications (10-15% Market Share): Industrial applications encompass diverse end uses requiring specialized material properties and processing techniques. This segment includes pressure vessels, heavy machinery, and specialized equipment requiring precise material specifications and quality certification. Applications often involve custom specifications and low-volume production requiring flexible manufacturing capabilities and technical support services. Growth opportunities exist in renewable energy equipment, advanced manufacturing systems, and specialized industrial processes requiring high-performance materials.

For Steel Producers and Manufacturers: Participation in the quenched and tempered steel market provides access to premium applications with substantial value creation potential:

For Equipment Manufacturers and OEMs: The market offers critical material solutions enabling superior product performance:

For End-User Industries: Industries utilizing quenched and tempered steel gain operational advantages through:

For Investors and Financial Stakeholders: Market participation provides exposure to industrial growth trends and infrastructure development:

Strengths: The quenched and tempered steel market benefits from several fundamental advantages supporting competitive positioning and growth potential:

Weaknesses: Market participants face inherent challenges requiring strategic attention and mitigation:

Opportunities: Emerging trends create substantial growth potential across multiple sectors:

Threats: External challenges require continuous monitoring and strategic responses:

Technology and Manufacturing Trends:

Advanced Metallurgy and Grade Development: Steel producers are investing in sophisticated alloy design and heat treatment optimization to develop specialized grades with enhanced properties for specific applications. Computer modeling and simulation techniques accelerate development while reducing experimental costs and time-to-market for new grades.

Process Automation and Industry 4.0: Implementation of automated heat treatment systems, real-time process monitoring, and predictive quality control improves manufacturing consistency while reducing labor requirements and energy consumption. Digital technologies enable precise process control and quality optimization.

Sustainable Production Methods: Environmental concerns drive development of more efficient production processes, waste reduction initiatives, and circular economy principles including increased scrap utilization and energy recovery systems. Carbon footprint reduction becomes increasingly important for customer selection and regulatory compliance.

Quality Enhancement Technologies: Advanced testing and inspection technologies including non-destructive testing, automated dimensional inspection, and statistical process control ensure consistent quality while reducing defect rates and customer quality issues.

Market and Application Trends:

Customization and Application Engineering: Markets evolve toward specialized solutions requiring close collaboration between producers and customers. Technical support services and application engineering capabilities become key competitive differentiators beyond basic material properties.

Supply Chain Integration: Closer relationships between steel producers and equipment manufacturers through long-term agreements, technical partnerships, and sometimes vertical integration to optimize costs and ensure supply security.

Geographic Expansion: Companies expand manufacturing presence in growth markets while optimizing supply chains for cost-effectiveness and customer proximity. Emerging markets present significant opportunities for market development and capacity investment.

Digital Customer Engagement: Implementation of digital platforms for customer service, technical support, and order management improves efficiency while enabling better customer relationships and market intelligence gathering.

Technology and Process Innovations: Recent developments demonstrate continuous advancement in quenched and tempered steel technology and manufacturing capabilities:

Advanced Heat Treatment Technologies: Development of more precise and energy-efficient heat treatment processes using advanced furnace designs, automated temperature control systems, and improved quenching media formulations. These innovations enhance material properties while reducing energy consumption and production costs.

Alloy Development Programs: Introduction of new steel grades optimized for specific applications including ultra-high strength grades for defense applications and specialized compositions for marine environments with enhanced corrosion resistance while maintaining mechanical properties.

Digital Process Integration: Implementation of artificial intelligence and machine learning technologies for process optimization, quality prediction, and predictive maintenance. Real-time monitoring systems enable immediate process adjustments to maintain quality consistency and reduce waste.

Strategic Business Developments: Industry consolidation and capacity expansion activities reshape competitive dynamics:

Market Access and Infrastructure Developments: Infrastructure improvements and market development initiatives support industry growth:

Strategic Recommendations for Market Participants:

For Steel Producers and Manufacturers:

Technology Investment Priority: Focus investment on advanced heat treatment technologies, process automation, and quality control systems to maintain competitive differentiation and operational efficiency. Develop specialized grades for high-growth applications while optimizing production processes for cost competitiveness.

Market Diversification Strategy: Expand beyond traditional mining and construction applications into growing sectors including renewable energy, defense modernization, and advanced manufacturing. Develop technical expertise and customer relationships in emerging application areas while maintaining strength in core markets.

Geographic Expansion Planning: Establish production presence in high-growth emerging markets while optimizing global supply chain efficiency. Consider strategic partnerships or joint ventures to accelerate market entry and reduce investment risks in new geographic markets.

Sustainability Leadership Development: Invest in sustainable production technologies, energy efficiency improvements, and circular economy initiatives to meet regulatory requirements and customer preferences. Develop environmental credentials as competitive differentiators in environmentally conscious markets.

Customer Partnership Enhancement: Strengthen technical collaboration with key customers through application engineering support, joint development programs, and integrated supply chain solutions. Build competitive moats through deep customer relationships and customized solutions.

For Equipment Manufacturers and End Users:

Supplier Relationship Strategy: Develop strategic partnerships with steel suppliers for material optimization, technical support, and supply security. Consider long-term supply agreements to ensure availability and price stability for critical materials.

Material Selection Optimization: Work closely with steel suppliers to optimize material specifications for specific applications, balancing performance requirements with cost considerations. Invest in internal technical expertise for material evaluation and selection.

Supply Chain Risk Management: Diversify supplier base and develop contingency plans for supply disruptions. Consider regional sourcing strategies to reduce transportation costs and supply chain risks while maintaining quality standards.

Innovation Collaboration: Participate in joint development programs with steel suppliers for new applications and improved material solutions. Share application requirements and performance feedback to accelerate material development and optimization.

General Industry Strategies:

Digital Transformation Implementation: Adopt digital technologies for improved operational efficiency, customer service, and market intelligence. Implement predictive analytics and automation technologies to optimize operations and reduce costs.

Talent Development Investment: Develop workforce capabilities in advanced metallurgy, digital technologies, and customer service. Address skilled labor shortages through training programs and university partnerships.

Market Intelligence Development: Maintain comprehensive market monitoring and competitive analysis capabilities to identify emerging opportunities and threats. Develop customer relationship management systems for improved account management and business development.

Risk Management Enhancement: Develop comprehensive risk management strategies addressing raw material price volatility, economic cyclicality, and regulatory changes. Implement financial hedging strategies and operational flexibility to manage market volatility.

Market Growth Projections and Trends: The quenched & tempered steel market outlook remains positive, supported by long-term infrastructure development trends, industrial modernization, and expanding applications across emerging technology sectors.

Quantitative Growth Expectations:

Application Sector Evolution:

Infrastructure and Construction Sector: Long-term growth supported by global urbanization trends, infrastructure modernization in developed markets, and massive development programs in emerging economies. Government infrastructure stimulus programs and climate adaptation projects create sustained demand for construction equipment and materials.

Mining and Resources Sector: Growth driven by increasing global resource demand, deeper mining operations requiring more durable equipment, and emerging market resource development. Transition to renewable energy creates demand for critical mineral extraction equipment while traditional mining continues supporting global commodity needs.

Defense and Security Sector: Steady growth supported by military modernization programs, homeland security infrastructure development, and international peacekeeping equipment requirements. Geopolitical tensions and security concerns drive continued investment in advanced defense systems and protective infrastructure.

Industrial and Manufacturing Sector: Expanding opportunities in advanced manufacturing, automation equipment, and specialized industrial processes. Industry 4.0 implementation creates demand for precision components and high-performance structural materials supporting automated manufacturing systems.

Technology Development Directions:

Advanced Materials Engineering: Continued development of specialized steel grades with enhanced properties including improved wear resistance, corrosion resistance, and strength-to-weight ratios. Computer-aided alloy design and advanced testing methods accelerate development while optimizing material performance for specific applications.

Manufacturing Process Innovation: Implementation of advanced heat treatment technologies, automated production systems, and quality control methods improve manufacturing efficiency and consistency. Energy-efficient processes and waste reduction technologies address environmental concerns while reducing operational costs.

Digital Integration and Automation: Advanced manufacturing technologies including IoT integration, predictive maintenance, and real-time quality monitoring optimize production operations and customer service delivery. Digital customer engagement platforms improve market intelligence and relationship management.

Sustainability Technology Advancement: Development of more sustainable production methods, increased recycling capabilities, and circular economy business models address environmental regulations and customer preferences while creating competitive advantages.

Market Structure Evolution: Industry structure will continue developing through strategic initiatives and technological advancement:

Emerging Application Opportunities:

Renewable Energy Infrastructure: Wind turbine components, solar panel mounting systems, and energy storage infrastructure create new market segments requiring specialized materials and manufacturing capabilities.

Electric Vehicle Infrastructure: Charging station construction and electric vehicle manufacturing create opportunities for high-strength materials in both infrastructure and vehicle applications.

Advanced Manufacturing Systems: Robotics, automation equipment, and additive manufacturing systems require precision components and structural materials with specialized properties.

Space and Aerospace Applications: Growing space industry and advanced aerospace programs create high-value niche markets for specialized steel grades with exceptional performance requirements.

The quenched and tempered steel market represents a critical segment of the global steel industry, providing essential high-performance materials for infrastructure development, resource extraction, and advanced manufacturing applications across diverse industrial sectors worldwide.

Market Position and Competitive Dynamics: The market maintains strong fundamentals based on essential applications in construction equipment, mining machinery, and defense systems where material performance directly impacts operational efficiency and safety. Premium positioning enables value-based pricing strategies while technical expertise and quality certification create competitive barriers protecting market participants from commodity price pressures.

Growth Drivers and Market Fundamentals: Long-term market growth is supported by multiple structural trends including global infrastructure development, industrial modernization, and emerging applications in renewable energy and advanced manufacturing sectors. The market benefits from economic development patterns requiring durable equipment and infrastructure while geographic diversification reduces dependence on single markets or economic cycles.

Strategic Success Factors: Companies succeeding in the quenched and tempered steel market must balance multiple strategic imperatives including technology leadership, operational efficiency, customer partnership development, and geographic market optimization. Success requires continuous investment in manufacturing capabilities, technical expertise, and customer service while maintaining cost competitiveness and quality leadership.

Key Strategic Imperatives:

Technology and Innovation Leadership: Continuous investment in advanced metallurgy, manufacturing process improvement, and quality enhancement maintains competitive differentiation and enables premium market positioning in high-value applications.

Customer Partnership Excellence: Deep collaboration with equipment manufacturers and end-users through technical support, application engineering, and joint development programs builds competitive advantages and market barriers while accelerating new application development.

Operational Excellence and Efficiency: Manufacturing efficiency optimization, quality consistency improvement, and cost management enable profitable growth while meeting demanding customer requirements and competitive market conditions.

Market Diversification and Growth: Geographic expansion into emerging markets and application diversification into growing sectors reduces market risks while capturing growth opportunities in infrastructure development and industrial modernization.

Sustainability and Environmental Leadership: Environmental responsibility through sustainable production methods, energy efficiency improvement, and circular economy initiatives becomes increasingly important for regulatory compliance and customer preference while creating competitive differentiation.

Future Market Positioning: The quenched and tempered steel market is well-positioned to benefit from global trends toward infrastructure development, industrial automation, and advanced manufacturing while maintaining essential roles in traditional applications. Market participants with technology leadership, operational excellence, and strategic customer partnerships will capture growth opportunities while defending market positions against alternative materials and competitive pressures.

Investment and Development Priorities: Strategic investment priorities should focus on advanced manufacturing technologies, sustainable production methods, and technical capability enhancement to maintain competitive advantages. Geographic expansion into high-growth markets and application development in emerging sectors provide growth opportunities while diversification reduces market concentration risks.

Long-term Market Outlook: The market outlook remains favorable despite cyclical challenges, with fundamental demand drivers supporting sustained growth across multiple application sectors and geographic regions. Success requires strategic balance between maintaining leadership in established applications and developing capabilities for emerging opportunities while managing economic cyclicality and competitive pressures.

The quenched and tempered steel market’s evolution toward higher performance applications, sustainable production methods, and global market development creates opportunities for companies that can combine metallurgical expertise with operational excellence, customer focus, and strategic vision to capitalize on infrastructure development trends and industrial modernization requirements driving long-term market growth.

What is quenched and tempered steel?

Quenched and tempered steel is a type of steel that has undergone a heat treatment process to enhance its strength and toughness. This process involves heating the steel to a high temperature, quenching it in water or oil, and then tempering it to achieve desired mechanical properties.

Who are the key players in the quenched and tempered steel market?

Key players in the quenched and tempered steel market include companies such as ArcelorMittal, Thyssenkrupp, and Nucor Corporation, among others.

What are the main drivers of growth in the quenched and tempered steel market?

The growth of the quenched and tempered steel market is driven by increasing demand from the construction and automotive industries, where high-strength materials are essential for safety and durability. Additionally, the rise in infrastructure projects globally contributes to market expansion.

What challenges does the quenched and tempered steel market face?

Challenges in the quenched and tempered steel market include fluctuations in raw material prices and stringent environmental regulations that impact production processes. These factors can affect profitability and operational efficiency for manufacturers.

What opportunities exist for the future of the quenched and tempered steel market?

Opportunities in the quenched and tempered steel market include advancements in manufacturing technologies and the growing trend towards lightweight materials in automotive applications. Additionally, increasing investments in renewable energy infrastructure present new avenues for growth.

What trends are shaping the quenched and tempered steel market?

Current trends in the quenched and tempered steel market include a shift towards more sustainable production methods and the development of high-performance steel grades. Innovations in alloy compositions are also enhancing the material’s properties for specialized applications.

Quenched and Tempered Steel Market

| Segmentation Details | Description |

|---|---|

| By Product | Flat Steel, Long Steel, Plates |

| By Process | Quenching and Tempering, Normalizing and Tempering, Annealing |

| By End-Use Industry | Automotive, Construction, Mining, Aerospace, Energy & Power |

| By Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Quenched and Tempered Steel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at