444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar waste management market represents a rapidly evolving sector driven by the nation’s ambitious sustainability goals and Vision 2030 objectives. As Qatar continues its transformation into a knowledge-based economy, the demand for comprehensive waste management solutions has intensified significantly. The market encompasses various segments including municipal solid waste, industrial waste, hazardous waste, and construction debris management, with growing emphasis on circular economy principles.

Market dynamics in Qatar’s waste management sector are characterized by substantial government investment in infrastructure development and technological advancement. The country’s rapid urbanization and population growth have created unprecedented challenges in waste generation, with per capita waste production increasing at 8.5% annually. This growth trajectory has necessitated innovative approaches to waste collection, treatment, and disposal across residential, commercial, and industrial sectors.

Technological integration plays a pivotal role in shaping Qatar’s waste management landscape, with smart waste collection systems, IoT-enabled monitoring, and advanced recycling technologies gaining significant traction. The market demonstrates strong adoption of sustainable practices, with recycling rates improving by 12% over the past three years. Government initiatives and regulatory frameworks continue to drive market expansion, positioning Qatar as a regional leader in sustainable waste management practices.

The Qatar waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the collection, treatment, recycling, and disposal of various waste streams generated across the country. This market encompasses both public and private sector initiatives aimed at managing municipal solid waste, industrial byproducts, hazardous materials, and construction debris through environmentally sustainable and economically viable methods.

Waste management in Qatar’s context extends beyond traditional collection and disposal services to include advanced sorting facilities, waste-to-energy plants, recycling centers, and innovative treatment technologies. The market integrates circular economy principles, emphasizing resource recovery, material reuse, and environmental protection while supporting the nation’s broader sustainability objectives and economic diversification goals.

Qatar’s waste management market demonstrates remarkable growth potential driven by rapid urbanization, industrial expansion, and stringent environmental regulations. The sector benefits from substantial government support through the National Vision 2030 framework, which prioritizes environmental sustainability and resource efficiency. Key market segments include municipal waste management, industrial waste treatment, and specialized hazardous waste handling services.

Market participants range from established international waste management companies to innovative local service providers, creating a competitive landscape that fosters technological advancement and service quality improvements. The integration of smart technologies and digital solutions has enhanced operational efficiency by 25% across major facilities, while public-private partnerships continue to drive infrastructure development and service expansion.

Regulatory compliance remains a critical market driver, with Qatar’s Ministry of Municipality and Environment implementing comprehensive waste management standards that align with international best practices. The market shows strong momentum toward achieving 70% waste diversion from landfills by 2030, supported by investments in recycling infrastructure and waste-to-energy technologies.

Strategic market insights reveal several transformative trends shaping Qatar’s waste management sector:

Government initiatives serve as the primary catalyst for Qatar’s waste management market expansion, with the National Environment and Climate Change Strategy providing comprehensive policy framework and financial support. The Qatar National Vision 2030 emphasizes environmental sustainability, driving substantial investments in waste management infrastructure and technology adoption across all sectors.

Rapid urbanization and population growth continue to generate increased waste volumes, with residential waste generation growing at 6.2% annually. This demographic trend, combined with expanding commercial and industrial activities, creates sustained demand for comprehensive waste management services and infrastructure development throughout the country.

Environmental regulations and compliance requirements drive market growth through mandatory waste segregation, recycling targets, and landfill diversion goals. The implementation of extended producer responsibility programs and waste reduction mandates creates new business opportunities while encouraging innovation in waste treatment and resource recovery technologies.

Economic diversification efforts under Qatar’s National Development Strategy promote sustainable industries and circular economy principles, generating demand for specialized waste management services in manufacturing, petrochemicals, and construction sectors. These initiatives support job creation and technology transfer while reducing environmental impact.

High capital requirements for advanced waste management infrastructure present significant barriers to market entry, particularly for smaller service providers and technology companies. The substantial investments needed for treatment facilities, collection equipment, and technology systems limit market participation and may slow overall sector development.

Technical complexity associated with hazardous waste management and specialized treatment processes requires extensive expertise and regulatory compliance, creating operational challenges for market participants. The need for continuous staff training and technology updates adds to operational costs and complexity.

Limited landfill capacity and geographical constraints pose ongoing challenges for waste disposal, necessitating expensive alternative treatment methods and long-term planning considerations. The scarcity of suitable land for new facilities requires innovative solutions and regional cooperation initiatives.

Public awareness and behavioral change requirements slow the adoption of waste segregation and recycling programs, impacting the effectiveness of comprehensive waste management strategies. Educational initiatives and community engagement programs require sustained investment and coordination across multiple stakeholders.

Waste-to-energy projects present substantial opportunities for market expansion, with Qatar’s abundant energy demand and commitment to renewable energy sources creating favorable conditions for innovative treatment technologies. The potential for converting municipal and industrial waste into electricity and heat offers attractive returns on investment while supporting sustainability goals.

Smart city initiatives across Qatar create opportunities for integrated waste management solutions incorporating IoT sensors, data analytics, and automated collection systems. These technological advances can improve operational efficiency by 30% while reducing costs and environmental impact through optimized routing and predictive maintenance.

Regional cooperation and export opportunities emerge as Qatar develops expertise in waste management technologies and services, positioning the country as a regional hub for environmental solutions. Knowledge transfer and technology export to neighboring GCC countries offer significant growth potential for established market participants.

Circular economy development creates new business models focused on material recovery, recycling, and resource reuse, generating revenue streams from waste materials while reducing disposal costs. These opportunities align with global sustainability trends and Qatar’s economic diversification objectives.

Supply chain integration characterizes Qatar’s waste management market dynamics, with increasing coordination between collection, treatment, and disposal services creating more efficient and cost-effective operations. This integration enables better resource utilization and improved service quality while reducing environmental impact through optimized logistics and processing.

Technology convergence drives market evolution through the combination of traditional waste management practices with digital solutions, automation, and advanced treatment technologies. The adoption of artificial intelligence and machine learning systems has improved sorting accuracy by 40% in major facilities, while reducing operational costs and enhancing material recovery rates.

Competitive dynamics intensify as international companies establish local presence while domestic providers expand service offerings and technical capabilities. This competition fosters innovation and service quality improvements while driving down costs and expanding market access for various customer segments.

Regulatory evolution continues to shape market dynamics through updated environmental standards, waste reduction targets, and extended producer responsibility requirements. These regulatory changes create both challenges and opportunities for market participants while ensuring alignment with international best practices and sustainability objectives.

Primary research methodology encompasses comprehensive interviews with key industry stakeholders, including waste management service providers, government officials, technology suppliers, and end-users across various sectors. This approach ensures accurate representation of market conditions, challenges, and opportunities while capturing diverse perspectives on industry trends and developments.

Secondary research involves extensive analysis of government publications, industry reports, regulatory documents, and academic studies related to Qatar’s waste management sector. This research foundation provides historical context, regulatory framework understanding, and comparative analysis with regional and international markets.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure accuracy and reliability of market insights. The methodology incorporates both quantitative and qualitative research approaches to provide comprehensive market understanding and strategic recommendations.

Market segmentation analysis utilizes detailed categorization by waste type, service category, end-user sector, and geographic distribution to identify specific growth opportunities and market dynamics. This granular approach enables precise market sizing and trend analysis across different industry segments.

Doha metropolitan area dominates Qatar’s waste management market, accounting for approximately 65% of total waste generation and service demand. The capital region benefits from advanced infrastructure, concentrated population, and diverse economic activities that drive comprehensive waste management requirements across residential, commercial, and industrial sectors.

Northern regions including Al Rayyan and Umm Salal experience rapid growth in waste management demand due to expanding residential developments and industrial activities. These areas present significant opportunities for service expansion and infrastructure development, with waste generation increasing at 9.5% annually driven by population growth and economic development.

Southern industrial zones around Mesaieed and Ras Laffan generate substantial volumes of industrial and hazardous waste requiring specialized treatment and disposal services. These regions drive demand for advanced waste management technologies and create opportunities for specialized service providers with technical expertise and regulatory compliance capabilities.

Western coastal areas focus primarily on municipal waste management with growing emphasis on tourism-related waste streams and environmental protection initiatives. The development of sustainable tourism infrastructure creates demand for innovative waste management solutions that balance economic development with environmental conservation.

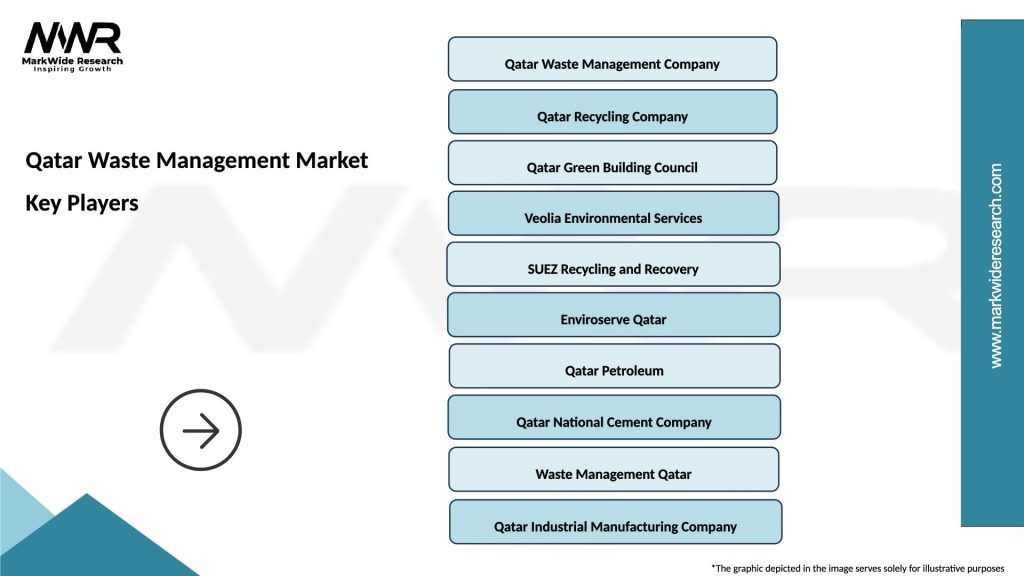

Market leadership in Qatar’s waste management sector is characterized by a mix of international companies and local service providers, each bringing unique capabilities and market positioning:

By Waste Type:

By Service Type:

By End-User:

Municipal waste management represents the largest market segment, driven by Qatar’s growing population and urbanization trends. This category benefits from government contracts and long-term service agreements, providing stable revenue streams for established providers. The integration of smart collection systems and route optimization technologies has improved operational efficiency by 22% in major municipalities.

Industrial waste management shows strong growth potential due to Qatar’s expanding manufacturing and petrochemical sectors. This segment requires specialized expertise and advanced treatment technologies, creating opportunities for technical service providers. The emphasis on circular economy principles drives demand for resource recovery and material reuse services within industrial operations.

Hazardous waste management represents a specialized high-value segment requiring extensive regulatory compliance and technical expertise. This category benefits from strict environmental regulations and growing industrial activity, with service providers commanding premium pricing for specialized treatment and disposal services.

Construction waste management experiences significant growth driven by Qatar’s ongoing infrastructure development and construction activities. This segment requires efficient logistics and material recovery capabilities, with recycling rates improving to 45% for construction materials through advanced sorting and processing technologies.

Service providers benefit from stable long-term contracts, government support, and growing market demand that ensures sustainable business growth and profitability. The regulatory framework provides clear guidelines and standards that facilitate business planning and investment decisions while creating barriers to entry that protect established market participants.

Technology suppliers gain access to a rapidly modernizing market with strong demand for innovative solutions and advanced equipment. Qatar’s commitment to sustainability and technological advancement creates opportunities for equipment manufacturers, software developers, and engineering service providers to establish long-term partnerships and expand their regional presence.

Government entities achieve environmental objectives, regulatory compliance, and public health improvements through effective waste management partnerships. The development of local expertise and infrastructure supports economic diversification goals while reducing dependence on landfill disposal and improving overall environmental quality.

End-users receive improved service quality, environmental benefits, and cost-effective waste management solutions that support their operational objectives and sustainability commitments. The availability of comprehensive waste management services enables businesses and residents to focus on core activities while ensuring regulatory compliance and environmental responsibility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend, with waste management companies implementing IoT sensors, GPS tracking, and data analytics to optimize collection routes and improve operational efficiency. This technological integration has reduced fuel consumption by 18% across major operators while enhancing customer service and environmental performance.

Circular economy adoption gains momentum as businesses and government entities prioritize resource recovery and waste reduction initiatives. This trend drives investment in advanced sorting technologies, material recovery facilities, and innovative recycling processes that convert waste streams into valuable resources and revenue opportunities.

Sustainability reporting becomes increasingly important as organizations face growing pressure to demonstrate environmental responsibility and regulatory compliance. This trend creates demand for comprehensive waste management data, performance metrics, and sustainability consulting services that support corporate environmental objectives.

Public-private collaboration intensifies through strategic partnerships that combine government policy support with private sector innovation and efficiency. These collaborations accelerate infrastructure development, technology adoption, and service quality improvements while sharing risks and optimizing resource utilization across the waste management value chain.

Infrastructure expansion continues with the development of new waste treatment facilities, recycling centers, and transfer stations across Qatar. Recent projects include advanced material recovery facilities and waste-to-energy plants that enhance processing capacity while supporting circular economy objectives and renewable energy goals.

Technology partnerships between international companies and local providers accelerate knowledge transfer and capability development. These collaborations bring advanced waste management technologies to Qatar while building local expertise and creating opportunities for technology adaptation and innovation.

Regulatory updates strengthen environmental standards and waste management requirements, driving market evolution and compliance investments. Recent policy developments include extended producer responsibility programs, plastic waste reduction initiatives, and enhanced recycling targets that reshape market dynamics and business strategies.

According to MarkWide Research, strategic investments in research and development activities focus on developing locally adapted waste management solutions that address Qatar’s specific environmental conditions and regulatory requirements. These initiatives support technology localization and create competitive advantages for market participants.

Market participants should prioritize technology integration and digital transformation initiatives to improve operational efficiency and competitive positioning. Investment in IoT systems, data analytics, and automated processing equipment can significantly enhance service quality while reducing operational costs and environmental impact.

Strategic partnerships with government entities and international technology providers offer opportunities for market expansion and capability development. These collaborations can accelerate access to advanced technologies, regulatory support, and funding opportunities while sharing risks and optimizing resource utilization.

Workforce development initiatives should focus on building local technical expertise and operational capabilities to reduce dependency on expatriate workers and imported knowledge. Training programs and knowledge transfer activities can create sustainable competitive advantages while supporting Qatar’s human capital development objectives.

Sustainability focus should guide business strategy development, with emphasis on circular economy principles, resource recovery, and environmental performance improvements. Companies that demonstrate strong environmental credentials and regulatory compliance will benefit from preferred vendor status and long-term contract opportunities.

Market expansion is expected to continue driven by population growth, economic development, and strengthening environmental regulations. The waste management sector will benefit from sustained government investment and growing private sector participation, creating opportunities for service diversification and geographic expansion across the region.

Technology evolution will accelerate with the adoption of artificial intelligence, robotics, and advanced automation systems that enhance processing efficiency and reduce operational costs. MWR analysis indicates that smart waste management technologies will achieve 85% adoption rates among major service providers within the next five years.

Circular economy integration will become increasingly important as Qatar pursues resource efficiency and sustainability objectives. The development of comprehensive material recovery systems and waste-to-resource conversion technologies will create new revenue streams while reducing environmental impact and supporting economic diversification goals.

Regional leadership positioning will emerge as Qatar develops expertise and infrastructure that can serve broader GCC markets. The country’s investment in advanced waste management capabilities and regulatory frameworks will create opportunities for technology export and knowledge transfer to neighboring countries seeking similar environmental solutions.

Qatar’s waste management market represents a dynamic and rapidly evolving sector with substantial growth potential driven by government support, technological advancement, and increasing environmental awareness. The market benefits from strong regulatory frameworks, sustained investment, and growing demand across residential, commercial, and industrial segments.

Key success factors include technology integration, regulatory compliance, and strategic partnerships that enable market participants to capitalize on emerging opportunities while addressing operational challenges. The emphasis on circular economy principles and sustainability creates new business models and revenue streams that support long-term market growth and environmental objectives.

Future prospects remain positive with continued government support, technological innovation, and regional expansion opportunities positioning Qatar as a leader in sustainable waste management practices. The market’s evolution toward smart, integrated solutions will drive efficiency improvements and environmental benefits while supporting the nation’s broader economic and sustainability goals through comprehensive waste management strategies.

What is Waste Management?

Waste management refers to the collection, transportation, processing, recycling, and disposal of waste materials. It encompasses various methods and technologies aimed at reducing waste’s environmental impact and promoting sustainability.

What are the key players in the Qatar Waste Management Market?

Key players in the Qatar Waste Management Market include Veolia, Qatari Diar, and Qatar Waste Management Company, among others. These companies are involved in various waste management services, including recycling, landfill management, and waste-to-energy solutions.

What are the growth factors driving the Qatar Waste Management Market?

The growth of the Qatar Waste Management Market is driven by increasing urbanization, government initiatives for sustainable waste management, and rising public awareness about environmental issues. Additionally, the expansion of infrastructure projects contributes to the demand for effective waste management solutions.

What challenges does the Qatar Waste Management Market face?

The Qatar Waste Management Market faces challenges such as inadequate waste segregation practices, limited recycling facilities, and the high cost of advanced waste management technologies. These factors can hinder the efficiency and effectiveness of waste management operations.

What opportunities exist in the Qatar Waste Management Market?

Opportunities in the Qatar Waste Management Market include the development of innovative recycling technologies, the implementation of waste-to-energy projects, and the potential for public-private partnerships. These initiatives can enhance waste management efficiency and promote sustainability.

What trends are shaping the Qatar Waste Management Market?

Trends in the Qatar Waste Management Market include the increasing adoption of smart waste management technologies, the focus on circular economy practices, and the integration of sustainability into waste management strategies. These trends aim to improve waste reduction and resource recovery.

Qatar Waste Management Market

| Segmentation Details | Description |

|---|---|

| Service Type | Collection, Recycling, Treatment, Disposal |

| Waste Type | Municipal Solid Waste, Hazardous Waste, Industrial Waste, E-Waste |

| Technology | Landfill, Incineration, Anaerobic Digestion, Composting |

| End User | Government, Commercial, Residential, Healthcare |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at