444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar used car market represents a dynamic and rapidly evolving automotive sector that has experienced substantial transformation in recent years. Market dynamics indicate significant growth potential driven by changing consumer preferences, economic diversification initiatives, and evolving mobility patterns across the nation. The market demonstrates remarkable resilience with a projected growth rate of 8.2% CAGR over the forecast period, reflecting strong underlying demand fundamentals.

Consumer behavior patterns in Qatar’s used car market reveal increasing sophistication in purchasing decisions, with buyers prioritizing value retention, fuel efficiency, and advanced technology features. The market benefits from a robust automotive infrastructure, established dealer networks, and growing digital platforms that facilitate seamless transactions between buyers and sellers.

Regional characteristics unique to Qatar include high disposable income levels, preference for luxury and premium vehicles, and strong demand for SUVs and crossovers suited to local driving conditions. The market maintains approximately 42% market penetration for pre-owned vehicles relative to new car sales, indicating substantial room for continued expansion and development.

The Qatar used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and servicing of pre-owned vehicles within Qatar’s automotive sector. This market includes various stakeholders such as authorized dealers, independent retailers, online platforms, financial institutions, and individual sellers who facilitate the exchange of previously owned automobiles.

Market scope encompasses diverse vehicle categories including passenger cars, luxury vehicles, SUVs, commercial vehicles, and specialty automobiles that have been previously registered and operated. The market operates through multiple channels including traditional dealerships, digital marketplaces, auction platforms, and direct consumer-to-consumer transactions.

Value proposition centers on providing cost-effective mobility solutions while maintaining quality standards through certified pre-owned programs, comprehensive vehicle inspections, and warranty offerings that enhance consumer confidence in used vehicle purchases.

Strategic analysis of Qatar’s used car market reveals a sector characterized by strong fundamentals, evolving consumer preferences, and significant growth opportunities. The market benefits from favorable economic conditions, supportive regulatory frameworks, and increasing acceptance of pre-owned vehicles among quality-conscious consumers.

Key performance indicators demonstrate robust market health with used car transactions showing consistent year-over-year growth of 12.5% and increasing average transaction values reflecting premium vehicle preferences. Digital transformation initiatives have enhanced market accessibility, with online platforms accounting for approximately 35% of total market transactions.

Competitive landscape features established automotive groups, emerging digital platforms, and specialized used car retailers competing on service quality, vehicle selection, and customer experience. Market consolidation trends indicate growing importance of scale economies and integrated service offerings.

Future prospects remain highly favorable with anticipated market expansion driven by population growth, economic diversification, and evolving mobility preferences that favor flexible vehicle ownership models and sustainable transportation solutions.

Market intelligence reveals several critical insights that define Qatar’s used car market landscape and growth trajectory:

Economic prosperity serves as a fundamental driver for Qatar’s used car market, with high per capita income levels enabling consumers to pursue quality pre-owned vehicles that offer superior value propositions compared to new car alternatives. Strong economic fundamentals support sustained consumer spending on automotive purchases and related services.

Population growth and demographic expansion create continuous demand for personal mobility solutions, with expatriate communities and young professionals representing key consumer segments seeking cost-effective transportation options. Urban development initiatives and infrastructure improvements further stimulate vehicle demand across diverse market segments.

Digital transformation revolutionizes market accessibility through sophisticated online platforms that streamline vehicle discovery, comparison, and transaction processes. Advanced search capabilities, virtual inspection tools, and integrated financing solutions enhance consumer experience and market participation rates.

Regulatory support through consumer protection frameworks, standardized vehicle inspection protocols, and transparent pricing mechanisms builds market confidence and encourages participation from both buyers and sellers. Government initiatives promoting automotive sector development contribute to market growth and sophistication.

Financial innovation including flexible financing options, competitive interest rates, and streamlined approval processes makes vehicle ownership more accessible to diverse consumer segments. Partnership between financial institutions and automotive retailers creates comprehensive solutions that support market expansion.

High vehicle depreciation rates in certain segments create challenges for consumers seeking value retention, particularly affecting luxury vehicles and rapidly evolving technology platforms. Depreciation concerns influence purchasing decisions and resale timing strategies among market participants.

Limited vehicle history transparency in some market segments creates information asymmetries that may discourage potential buyers concerned about hidden defects, accident history, or maintenance irregularities. Establishing comprehensive vehicle history databases requires continued investment and industry cooperation.

Seasonal demand fluctuations related to climate conditions, holiday periods, and economic cycles create periodic market volatility that affects inventory management and pricing strategies. Dealers must navigate demand variability while maintaining operational efficiency and profitability.

Regulatory compliance requirements including emissions standards, safety certifications, and import regulations create operational complexities and compliance costs that may impact market accessibility for certain vehicle categories or price segments.

Competition from new vehicles through attractive financing offers, manufacturer incentives, and warranty coverage creates competitive pressure on used car values and market share, requiring differentiated value propositions and service excellence.

Digital marketplace expansion presents significant opportunities for market growth through enhanced online platforms, mobile applications, and integrated service ecosystems that streamline the entire vehicle purchase and ownership experience. Technology adoption enables market reach expansion and operational efficiency improvements.

Certified pre-owned programs offer substantial growth potential by addressing consumer quality concerns through comprehensive inspection processes, extended warranties, and brand-backed assurance programs. These initiatives can command premium pricing while building long-term customer relationships.

Cross-border trade opportunities with neighboring GCC countries create potential for market expansion through vehicle imports, exports, and regional distribution networks. Harmonized regulations and trade agreements could facilitate increased regional integration and market access.

Sustainable mobility solutions including hybrid and electric vehicle segments present emerging opportunities as environmental consciousness grows and charging infrastructure develops. Early market positioning in sustainable vehicle categories offers competitive advantages.

Value-added services such as comprehensive maintenance packages, insurance integration, vehicle customization, and lifestyle services create additional revenue streams while enhancing customer satisfaction and retention rates.

Supply-demand equilibrium in Qatar’s used car market reflects complex interactions between vehicle availability, consumer preferences, economic conditions, and competitive dynamics. Market participants continuously adjust inventory levels, pricing strategies, and service offerings to maintain optimal market positioning.

Price discovery mechanisms operate through multiple channels including dealer networks, online platforms, auction systems, and direct negotiations that establish fair market values based on vehicle condition, age, mileage, and feature sets. Transparent pricing enhances market efficiency and consumer confidence.

Seasonal patterns influence market activity with peak demand periods typically occurring during favorable weather months and coinciding with salary cycles, bonus payments, and holiday seasons. Understanding seasonal dynamics enables optimized inventory management and marketing strategies.

Technology integration transforms traditional market operations through digital tools that enhance vehicle inspection, valuation, financing, and transaction processing. Advanced analytics and artificial intelligence applications improve market efficiency and customer experience quality.

Competitive intensity drives continuous innovation in service delivery, customer experience, and value proposition development as market participants seek differentiation and market share growth in an increasingly sophisticated marketplace.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Qatar’s used car market dynamics. Primary research includes extensive stakeholder interviews, consumer surveys, and industry expert consultations that provide firsthand market intelligence and trend identification.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and regulatory filings to establish market context and validate primary research findings. Data triangulation ensures accuracy and completeness of market assessments and projections.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth trajectories and identify key performance indicators. Mathematical models incorporate multiple variables including economic indicators, demographic trends, and industry-specific factors.

Qualitative assessment examines market dynamics, competitive positioning, consumer behavior patterns, and regulatory impacts through structured analysis frameworks that provide strategic insights and actionable recommendations for market participants.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and continuous monitoring of market developments that may impact findings and conclusions.

Doha metropolitan area dominates Qatar’s used car market with approximately 78% market concentration, reflecting the capital’s economic significance, population density, and commercial activity levels. The region benefits from extensive dealer networks, service infrastructure, and consumer accessibility that support robust market development.

Northern regions including Al Rayyan and Umm Salal demonstrate growing market presence driven by residential development, industrial expansion, and improved transportation infrastructure. These areas show 15% annual growth in used car transactions as urbanization progresses and economic activity diversifies.

Southern territories encompassing Al Wakrah and Mesaieed contribute to market growth through industrial development, port activities, and residential expansion that create demand for both personal and commercial vehicles. The region benefits from proximity to major infrastructure projects and economic zones.

Western areas including Dukhan and surrounding communities represent emerging market opportunities supported by energy sector activities, tourism development, and infrastructure investments that stimulate vehicle demand across diverse consumer segments.

Regional connectivity through improved road networks, transportation hubs, and logistics infrastructure facilitates market integration and enables efficient vehicle distribution across Qatar’s geographic regions, supporting overall market growth and accessibility.

Market leadership in Qatar’s used car sector features established automotive groups and emerging digital platforms that compete on service quality, vehicle selection, and customer experience excellence:

Competitive strategies emphasize service differentiation, technology adoption, and customer relationship management to build market share and sustainable competitive advantages in an evolving marketplace.

By Vehicle Type:

By Age Category:

By Price Range:

Luxury vehicle segment demonstrates exceptional performance with 23% annual growth driven by strong demand for premium brands including Mercedes-Benz, BMW, Audi, and Lexus. This category benefits from high residual values, comprehensive certified pre-owned programs, and affluent consumer base seeking prestige and advanced technology features.

SUV and crossover category maintains market leadership with robust demand reflecting consumer preferences for versatility, safety, and commanding road presence. Popular models include Toyota Land Cruiser, Nissan Patrol, and various premium SUV offerings that retain strong resale values.

Sedan segment shows steady performance with emphasis on fuel efficiency, reliability, and value retention. Japanese brands including Toyota Camry, Honda Accord, and Nissan Altima demonstrate strong market acceptance and consistent demand patterns.

Commercial vehicle category experiences growing demand driven by business expansion, logistics requirements, and construction activities. Light commercial vehicles and pickup trucks serve diverse applications from delivery services to industrial operations.

Electric and hybrid segment represents emerging opportunity with increasing consumer interest in sustainable mobility solutions, though market penetration remains limited by charging infrastructure and model availability considerations.

Dealers and retailers benefit from expanding market opportunities, diverse revenue streams, and growing consumer acceptance of used vehicles that enable sustainable business growth and profitability. Digital transformation initiatives enhance operational efficiency and customer reach capabilities.

Financial institutions gain access to growing financing opportunities with attractive risk-return profiles, enabling portfolio diversification and customer relationship expansion through integrated automotive financial services.

Consumers enjoy access to quality pre-owned vehicles at competitive prices with comprehensive service support, warranty coverage, and financing options that make vehicle ownership more accessible and affordable.

Technology providers find expanding opportunities to deliver innovative solutions including digital platforms, valuation tools, inspection technologies, and customer management systems that enhance market efficiency and user experience.

Service providers including insurance companies, maintenance facilities, and logistics operators benefit from increased business volumes and opportunities for service integration that create comprehensive customer solutions.

Government stakeholders achieve economic diversification objectives, increased tax revenues, and enhanced consumer protection through regulated market development that supports overall economic growth and stability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Qatar’s used car market with sophisticated online platforms, mobile applications, and virtual showroom experiences that enhance customer convenience and market accessibility. MarkWide Research indicates that digital channels now facilitate approximately 45% of initial vehicle research activities.

Certified pre-owned programs gain prominence as consumers seek quality assurance and warranty coverage for used vehicle purchases. Manufacturer-backed certification programs provide comprehensive inspections, reconditioning services, and extended warranty coverage that command premium pricing.

Subscription-based models emerge as alternative ownership structures that provide flexibility and convenience for consumers seeking access to vehicles without traditional purchase commitments. These models appeal particularly to expatriate communities and young professionals.

Sustainability focus influences consumer preferences toward fuel-efficient vehicles, hybrid technology, and environmentally conscious transportation solutions that align with Qatar’s environmental objectives and global sustainability trends.

Integrated service ecosystems develop as market participants expand beyond traditional sales activities to offer comprehensive solutions including financing, insurance, maintenance, and lifestyle services that enhance customer relationships and revenue diversification.

Regulatory enhancements include implementation of standardized vehicle inspection protocols, consumer protection frameworks, and transparent pricing mechanisms that build market confidence and encourage participation from quality-conscious consumers.

Technology investments by major market participants focus on digital platform development, artificial intelligence applications, and data analytics capabilities that improve operational efficiency, customer experience, and competitive positioning.

Partnership formations between automotive retailers, financial institutions, and technology providers create integrated service offerings that streamline customer experience and expand market accessibility through collaborative business models.

Infrastructure development including expanded showroom facilities, service centers, and digital capabilities supports market growth and enhances customer service quality across Qatar’s geographic regions.

International expansion initiatives by leading market participants explore regional opportunities and cross-border trade relationships that leverage Qatar’s strategic location and economic partnerships within the GCC region.

Market participants should prioritize digital transformation initiatives that enhance customer experience, operational efficiency, and competitive differentiation in an increasingly technology-driven marketplace. Investment in sophisticated online platforms and mobile applications will be essential for sustained market leadership.

Quality assurance programs represent critical success factors for building consumer confidence and commanding premium pricing. Comprehensive vehicle inspection processes, certification programs, and warranty offerings should be central to competitive strategies.

Geographic expansion beyond Doha metropolitan area offers significant growth opportunities as Qatar’s regional development accelerates. Establishing presence in emerging markets while maintaining service quality standards will support long-term market share growth.

Service integration through comprehensive customer solutions including financing, insurance, maintenance, and lifestyle services creates competitive advantages and revenue diversification opportunities that enhance customer relationships and business sustainability.

Sustainability positioning should anticipate growing consumer interest in environmentally conscious transportation solutions. Early market positioning in hybrid and electric vehicle segments offers competitive advantages as infrastructure development progresses.

Market trajectory for Qatar’s used car sector remains highly positive with sustained growth expected across multiple market segments and geographic regions. MWR analysis projects continued market expansion driven by economic prosperity, population growth, and evolving consumer preferences that favor quality pre-owned vehicles.

Technology integration will accelerate with advanced digital platforms, artificial intelligence applications, and data analytics becoming standard market features that enhance efficiency, transparency, and customer experience quality. Virtual reality showrooms and augmented reality inspection tools may revolutionize traditional market operations.

Regulatory evolution toward enhanced consumer protection, environmental standards, and market transparency will create opportunities for quality-focused market participants while potentially challenging operators with substandard practices or service quality.

Regional integration with GCC countries offers substantial expansion opportunities through harmonized regulations, cross-border trade facilitation, and regional distribution networks that leverage economies of scale and market diversification benefits.

Sustainable mobility trends will gain momentum with projected 25% annual growth in hybrid and electric vehicle segments as charging infrastructure develops and environmental consciousness increases among consumers seeking responsible transportation solutions.

Qatar’s used car market represents a dynamic and rapidly evolving sector characterized by strong fundamentals, growing consumer sophistication, and significant expansion opportunities. The market benefits from favorable economic conditions, supportive regulatory frameworks, and increasing acceptance of pre-owned vehicles among quality-conscious consumers seeking value and reliability.

Strategic positioning for market success requires emphasis on digital transformation, quality assurance, customer service excellence, and integrated solution offerings that address evolving consumer needs and preferences. Market participants who invest in technology, maintain high service standards, and develop comprehensive customer relationships will achieve sustainable competitive advantages.

Future prospects remain exceptionally favorable with continued market growth expected across diverse segments and geographic regions. The combination of economic prosperity, demographic expansion, infrastructure development, and evolving mobility preferences creates a robust foundation for sustained market development and participant success in Qatar’s thriving used car marketplace.

What is Used Car?

Used cars refer to vehicles that have had previous owners and are sold in the secondary market. In Qatar, the used car market is characterized by a diverse range of vehicles, including sedans, SUVs, and luxury cars, catering to various consumer preferences.

What are the key players in the Qatar Used Car Market?

Key players in the Qatar Used Car Market include companies like Qatar Automobiles Company, Al-Futtaim Motors, and CarSwitch, which provide platforms for buying and selling used vehicles, among others.

What are the growth factors driving the Qatar Used Car Market?

The Qatar Used Car Market is driven by factors such as increasing consumer demand for affordable vehicles, the availability of financing options, and a growing population seeking personal transportation solutions.

What challenges does the Qatar Used Car Market face?

Challenges in the Qatar Used Car Market include fluctuating vehicle prices, competition from new car sales, and concerns over vehicle condition and reliability, which can affect consumer trust.

What opportunities exist in the Qatar Used Car Market?

Opportunities in the Qatar Used Car Market include the potential for online sales platforms, increased demand for certified pre-owned vehicles, and the growth of eco-friendly used cars as consumers become more environmentally conscious.

What trends are shaping the Qatar Used Car Market?

Trends in the Qatar Used Car Market include the rise of digital marketplaces for vehicle sales, a shift towards electric and hybrid used cars, and an increasing focus on vehicle history transparency to enhance buyer confidence.

Qatar Used Car Market

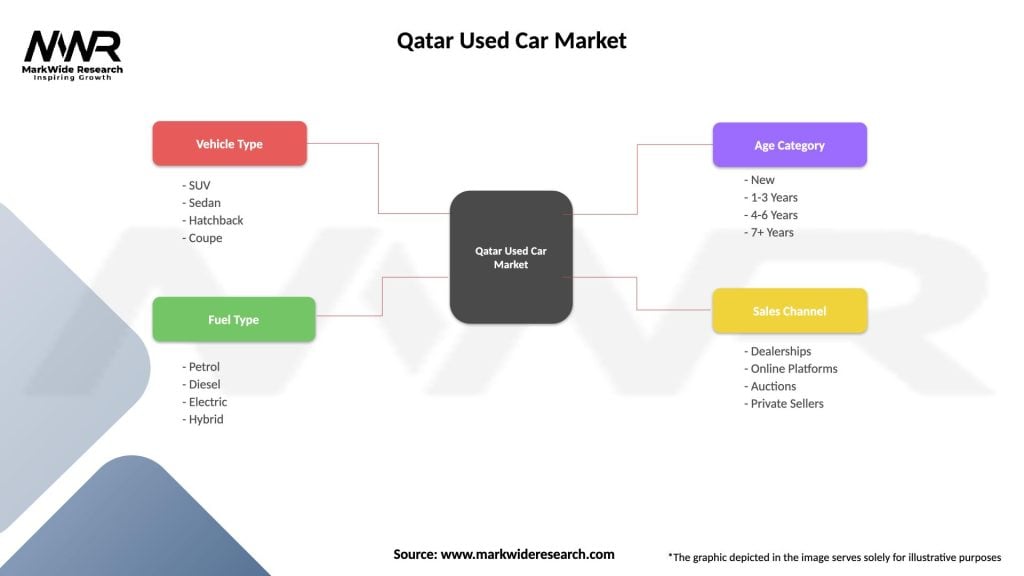

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sellers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at