444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar hair care industry market represents a dynamic and rapidly evolving sector within the broader Middle Eastern beauty and personal care landscape. This market encompasses a comprehensive range of products including shampoos, conditioners, hair styling products, hair treatments, and specialized hair care solutions designed to meet the diverse needs of Qatar’s multicultural population. Market dynamics indicate robust growth driven by increasing consumer awareness about hair health, rising disposable incomes, and evolving beauty standards influenced by both traditional preferences and international trends.

Consumer preferences in Qatar’s hair care market reflect a unique blend of regional traditions and global beauty influences. The market serves a diverse demographic including Qatari nationals, expatriate communities from various regions, and a growing population of young professionals who prioritize premium hair care products. Growth projections suggest the market is expanding at a compound annual growth rate of 6.2%, driven by increasing urbanization, lifestyle changes, and heightened focus on personal grooming and appearance.

Product innovation continues to shape market development, with manufacturers introducing specialized formulations tailored to the region’s climate conditions and diverse hair types. The market benefits from Qatar’s strategic position as a regional hub, facilitating easy access to international brands while supporting the growth of local and regional hair care manufacturers.

The Qatar hair care industry market refers to the comprehensive ecosystem of businesses, products, and services dedicated to hair maintenance, styling, and treatment within Qatar’s borders. This market encompasses manufacturing, distribution, retail, and professional salon services that cater to hair care needs across all demographic segments. Market scope includes both mass-market and premium product categories, ranging from basic cleansing and conditioning products to advanced hair treatment solutions and professional-grade styling products.

Industry definition extends beyond traditional product sales to include professional services, hair care education, and the growing segment of organic and natural hair care solutions. The market serves as a critical component of Qatar’s broader beauty and wellness industry, contributing to economic diversification efforts and supporting both local entrepreneurship and international brand presence in the region.

Market performance in Qatar’s hair care industry demonstrates consistent growth momentum, supported by favorable demographic trends and increasing consumer sophistication. The market benefits from a young, affluent population with 72% of consumers aged between 18-45 years, representing the primary target demographic for hair care products. Premium segment growth has been particularly notable, with luxury and specialized hair care products gaining significant market traction.

Key market drivers include rising beauty consciousness, increased exposure to international beauty trends through social media, and growing awareness of hair health importance. The market has shown resilience through various economic cycles, with consistent annual growth rates reflecting the essential nature of hair care products in daily routines. Digital transformation has also played a crucial role, with online sales channels experiencing rapid expansion of 28% in recent years.

Competitive landscape features a mix of international beauty giants, regional players, and emerging local brands, creating a dynamic environment that drives innovation and competitive pricing. The market’s future outlook remains positive, supported by ongoing economic development, population growth, and increasing focus on personal care and wellness.

Consumer behavior analysis reveals several critical insights shaping Qatar’s hair care market dynamics. MarkWide Research data indicates that Qatari consumers demonstrate strong brand loyalty while remaining open to trying innovative products that address specific hair concerns related to the region’s climate conditions.

Economic prosperity serves as a fundamental driver for Qatar’s hair care market expansion. The nation’s strong economic foundation, supported by energy resources and diversification initiatives, has created a consumer base with substantial purchasing power for premium hair care products. Rising disposable incomes enable consumers to explore higher-end product categories and invest in comprehensive hair care routines.

Demographic advantages significantly contribute to market growth, with Qatar’s young population demonstrating high engagement with beauty and personal care trends. The country’s expatriate community, representing diverse cultural backgrounds, creates demand for varied product types and specialized formulations. Urbanization trends and modern lifestyle adoption further accelerate market development.

Beauty consciousness evolution reflects changing social attitudes toward personal grooming and self-care. Increased exposure to international beauty standards through media and travel has elevated consumer expectations for product quality and effectiveness. Social media influence continues to drive product awareness and create trends that stimulate market demand.

Climate considerations create unique market opportunities, as Qatar’s environmental conditions require specialized hair care solutions. Products offering protection against heat, humidity, and UV exposure find strong market acceptance. Professional salon growth also supports retail market expansion through product recommendations and cross-selling opportunities.

Regulatory challenges present certain constraints for Qatar’s hair care market development. Import regulations, product certification requirements, and compliance with local standards can create barriers for new market entrants and product launches. Cultural sensitivities around certain ingredients or marketing approaches require careful navigation by international brands.

Market saturation in certain product categories creates intense competition and pricing pressure. The presence of numerous established brands makes it challenging for new entrants to gain market share without significant investment in marketing and distribution. Consumer price sensitivity in mass-market segments limits premium pricing strategies for certain product categories.

Supply chain complexities can impact product availability and pricing, particularly for imported products that constitute a significant portion of the market. Economic volatility in global markets can affect consumer spending patterns on non-essential items, including premium hair care products.

Climate-related challenges also create product performance expectations that can be difficult to meet consistently. The harsh environmental conditions require specialized formulations that may increase production costs and limit product shelf life.

Digital transformation presents substantial opportunities for Qatar’s hair care market expansion. E-commerce platforms and digital marketing channels offer new avenues for brand building and customer engagement. Personalization trends create opportunities for customized hair care solutions based on individual needs and preferences.

Sustainable product development represents a growing opportunity as environmentally conscious consumers seek eco-friendly alternatives. Natural and organic formulations align with global wellness trends and offer differentiation opportunities for brands willing to invest in sustainable practices.

Professional service integration offers opportunities for brands to expand beyond retail into service provision. Educational initiatives and hair care consultancy services can build brand loyalty while addressing specific consumer needs. Technology integration through smart devices and AI-powered recommendations creates new market segments.

Regional expansion opportunities exist for successful brands to leverage Qatar as a launching pad for broader Middle Eastern market penetration. Cultural product adaptation for specific demographic segments within Qatar’s diverse population offers niche market development possibilities.

Competitive intensity characterizes Qatar’s hair care market, with established international brands competing alongside emerging local and regional players. Innovation cycles drive continuous product development, with brands investing in research and development to address evolving consumer needs and preferences.

Consumer education plays an increasingly important role in market dynamics, as informed consumers demand transparency about ingredients, manufacturing processes, and product benefits. Brand authenticity and corporate social responsibility initiatives influence purchasing decisions, particularly among younger demographics.

Distribution channel evolution reflects changing shopping behaviors, with traditional retail complemented by online platforms and direct-to-consumer models. Omnichannel strategies become essential for brands seeking to maintain market relevance and accessibility.

Price competition remains significant across all market segments, driving efficiency improvements and value proposition refinement. Seasonal demand patterns influence inventory management and marketing strategies, with certain products experiencing higher demand during specific periods.

Comprehensive market analysis for Qatar’s hair care industry employs multiple research methodologies to ensure data accuracy and insight reliability. Primary research includes consumer surveys, industry expert interviews, and retail partner consultations to gather firsthand market intelligence and trend identification.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and competitive positioning. Data triangulation methods ensure information accuracy by cross-referencing multiple sources and validating findings through different research approaches.

Market segmentation analysis utilizes demographic data, purchasing behavior patterns, and product category performance metrics to identify distinct consumer groups and their specific needs. Trend analysis incorporates social media monitoring, beauty industry publications, and international market developments to predict future market directions.

Quantitative analysis includes statistical modeling, growth rate calculations, and market share assessments based on available sales data and industry benchmarks. Qualitative insights are gathered through focus groups, in-depth interviews, and observational research to understand consumer motivations and preferences.

Doha metropolitan area dominates Qatar’s hair care market, accounting for approximately 78% of total market activity. The capital city’s concentration of shopping centers, salons, and affluent consumers creates the primary market hub for both premium and mass-market hair care products. Urban lifestyle factors in Doha drive higher product consumption rates and trend adoption.

Northern regions including Al Rayyan and Al Wakrah represent emerging market opportunities with growing residential developments and increasing consumer spending power. These areas show rapid growth potential as infrastructure development and population expansion continue.

Industrial areas such as Mesaieed and Ras Laffan present unique market characteristics, with consumer preferences influenced by working demographics and lifestyle patterns. Expatriate communities in these regions create demand for diverse product types reflecting various cultural backgrounds.

Coastal regions demonstrate specific product preferences related to humidity and saltwater exposure, creating opportunities for specialized formulations. Tourism areas contribute to market dynamics through temporary population increases and exposure to international beauty trends.

Market leadership in Qatar’s hair care industry is shared among several key players, each bringing distinct strengths and market positioning strategies. The competitive environment fosters innovation and drives continuous improvement in product quality and customer service.

Product category segmentation reveals distinct market dynamics across different hair care product types. Shampoo and conditioner products represent the largest market segment, accounting for approximately 45% of total market volume. This segment benefits from daily usage patterns and broad consumer adoption across all demographic groups.

By Product Type:

By Price Segment:

Shampoo category demonstrates the strongest market performance with consistent growth driven by daily usage patterns and continuous product innovation. Sulfate-free formulations gain increasing popularity as consumers become more ingredient-conscious. Specialized shampoos targeting specific hair concerns show particularly strong growth rates.

Hair styling products experience seasonal demand variations, with higher sales during social seasons and special events. Heat protection products show growing demand as styling tool usage increases. Natural hold products appeal to consumers seeking flexible styling options without chemical buildup.

Hair treatment segment represents the fastest-growing category, with annual growth rates exceeding 8.5%. Anti-aging hair care emerges as a significant trend, addressing concerns about hair thinning and loss of vitality. Scalp care products gain recognition as consumers understand the importance of scalp health for overall hair condition.

Color care products benefit from increasing hair coloring trends and the need for specialized maintenance products. UV protection formulations address specific regional climate concerns while maintaining color vibrancy and hair health.

Manufacturers benefit from Qatar’s stable economic environment and growing consumer market, providing opportunities for sustainable business growth and market expansion. Regulatory stability and government support for business development create favorable conditions for long-term investment and planning.

Retailers gain from increasing consumer spending on personal care products and the opportunity to develop specialized beauty retail concepts. E-commerce growth offers additional revenue channels and customer reach expansion possibilities.

Consumers benefit from increased product variety, competitive pricing, and access to international beauty innovations. Quality improvements driven by market competition ensure better product performance and value for money.

Professional service providers including salons and beauty centers benefit from complementary product sales and enhanced service offerings. Education and training opportunities provided by manufacturers support professional development and service quality improvement.

Investors find attractive opportunities in Qatar’s growing beauty market, supported by favorable demographics and economic stability. Market growth potential and diversification opportunities make the sector appealing for various investment strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution emerges as a dominant trend in Qatar’s hair care market, with consumers seeking products tailored to their specific hair types, concerns, and lifestyle needs. AI-powered recommendations and custom formulation services gain traction among tech-savvy consumers willing to invest in personalized solutions.

Sustainability consciousness drives significant changes in product development and packaging approaches. Eco-friendly formulations and recyclable packaging become important differentiators, with 35% of consumers indicating willingness to pay premium prices for sustainable products.

Clean beauty movement influences ingredient transparency and natural product development. Chemical-free formulations and organic ingredients appeal to health-conscious consumers seeking safer alternatives for daily hair care routines.

Multi-functional products gain popularity as consumers seek efficiency and convenience in their beauty routines. All-in-one solutions that combine cleansing, conditioning, and treatment benefits address busy lifestyle needs while reducing product complexity.

Social media influence continues to shape product discovery and brand engagement, with influencer partnerships and user-generated content driving purchase decisions. Virtual try-on technologies and augmented reality applications enhance online shopping experiences.

Product innovation acceleration characterizes recent industry developments, with manufacturers investing heavily in research and development to address specific regional needs. Climate-adapted formulations designed for Middle Eastern environmental conditions represent significant advancement in product effectiveness.

Digital transformation initiatives have revolutionized customer engagement and sales channels. MWR analysis indicates that brands implementing comprehensive digital strategies achieve higher customer retention rates and improved market positioning.

Sustainability initiatives gain momentum across the industry, with major brands committing to environmental responsibility through packaging reduction, ingredient sourcing improvements, and carbon footprint minimization efforts.

Professional service integration creates new business models combining product sales with expert consultation and personalized service delivery. Salon partnerships and professional education programs strengthen brand relationships with both service providers and end consumers.

Regulatory compliance enhancements ensure product safety and quality standards while facilitating market access for international brands. Certification processes and quality assurance measures build consumer confidence and support market growth.

Market entry strategies should prioritize understanding local consumer preferences and cultural nuances while leveraging Qatar’s position as a regional hub for broader market expansion. Partnership approaches with established local distributors can accelerate market penetration and reduce entry barriers.

Product development focus should address climate-specific needs while incorporating global beauty trends and innovation. Formulation adaptation for regional environmental conditions can create competitive advantages and improve customer satisfaction.

Digital investment in e-commerce platforms, social media marketing, and customer engagement technologies represents essential growth strategies. Omnichannel approaches that integrate online and offline experiences can maximize market reach and customer convenience.

Sustainability integration should be considered a long-term strategic priority rather than a short-term marketing tactic. Authentic commitment to environmental responsibility can build brand loyalty and differentiate products in competitive markets.

Professional channel development through salon partnerships and beauty professional education can create additional revenue streams while building brand credibility and market presence.

Growth trajectory for Qatar’s hair care market remains positive, supported by favorable demographic trends, economic stability, and increasing beauty consciousness. Market expansion is expected to continue at a steady pace of 6.8% annually over the next five years, driven by innovation and consumer education.

Technology integration will play an increasingly important role in market development, with smart beauty devices, personalized recommendations, and virtual consultation services becoming mainstream offerings. Digital natives will drive adoption of technology-enhanced beauty solutions.

Sustainability trends will reshape product development and marketing strategies, with environmentally conscious consumers driving demand for eco-friendly alternatives. Circular economy principles may influence packaging design and product lifecycle management.

Regional market integration presents opportunities for successful brands to expand beyond Qatar into broader Middle Eastern markets. Cross-border e-commerce and regional distribution networks will facilitate market expansion strategies.

Innovation focus will continue to drive competitive differentiation, with brands investing in research and development to address evolving consumer needs and preferences. Collaborative approaches between manufacturers, retailers, and service providers will create comprehensive beauty ecosystems.

Qatar’s hair care industry market represents a dynamic and promising sector within the broader Middle Eastern beauty landscape. The market benefits from strong economic fundamentals, favorable demographics, and increasing consumer sophistication that drives demand for quality hair care products and services. Growth momentum continues to build as brands adapt to local preferences while incorporating global beauty innovations.

Market opportunities abound for companies willing to invest in understanding local consumer needs, developing climate-appropriate products, and building strong distribution networks. The combination of traditional retail channels and emerging digital platforms creates multiple pathways for market success and customer engagement.

Future success in Qatar’s hair care market will depend on brands’ ability to balance global expertise with local market knowledge, sustainability with performance, and innovation with accessibility. Companies that can navigate these dynamics while building authentic relationships with consumers and professional partners will be well-positioned for long-term growth and market leadership in this evolving and exciting market segment.

What is Hair Care?

Hair care refers to the practices and products used to maintain and enhance the health and appearance of hair. This includes a variety of products such as shampoos, conditioners, styling agents, and treatments tailored for different hair types and concerns.

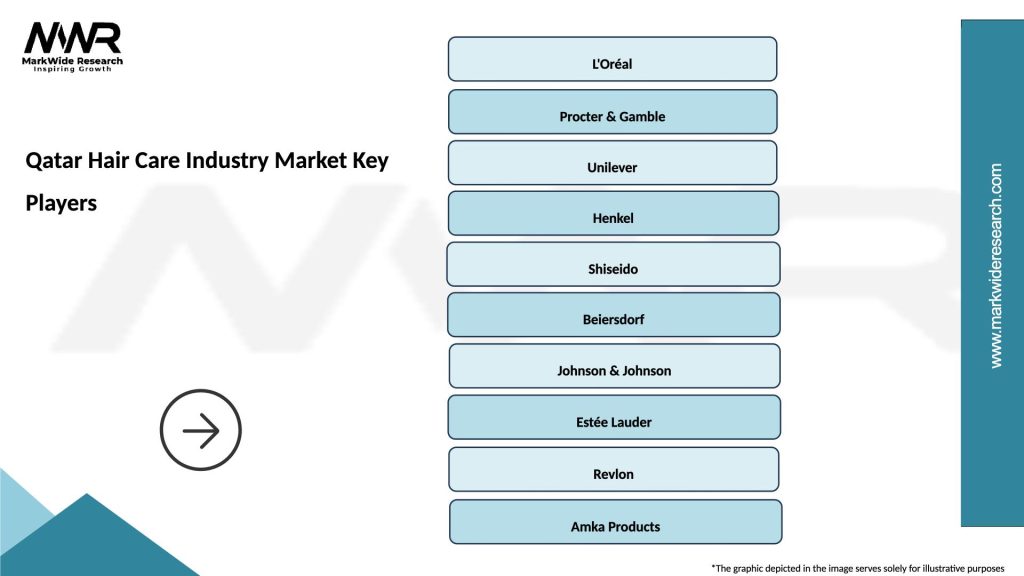

What are the key players in the Qatar Hair Care Industry Market?

Key players in the Qatar Hair Care Industry Market include companies like L’Oréal, Procter & Gamble, and Unilever, which offer a wide range of hair care products. Additionally, local brands are emerging, contributing to the competitive landscape among others.

What are the growth factors driving the Qatar Hair Care Industry Market?

The Qatar Hair Care Industry Market is driven by increasing consumer awareness about personal grooming, a growing population, and rising disposable incomes. Additionally, the influence of social media and beauty trends is encouraging consumers to invest in premium hair care products.

What challenges does the Qatar Hair Care Industry Market face?

The Qatar Hair Care Industry Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences. Additionally, the market must navigate regulatory requirements and sustainability concerns.

What opportunities exist in the Qatar Hair Care Industry Market?

Opportunities in the Qatar Hair Care Industry Market include the growing demand for organic and natural hair care products, as well as the potential for e-commerce growth. Innovations in product formulations and personalized hair care solutions also present avenues for expansion.

What trends are shaping the Qatar Hair Care Industry Market?

Trends shaping the Qatar Hair Care Industry Market include the rise of clean beauty, increased focus on sustainability, and the popularity of multifunctional hair care products. Additionally, the integration of technology in product development and marketing strategies is becoming more prevalent.

Qatar Hair Care Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoos, Conditioners, Hair Oils, Styling Products |

| End User | Salons, Individual Consumers, Retailers, Distributors |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Formulation | Organic, Sulfate-Free, Herbal, Chemical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Hair Care Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at