444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar ecommerce market represents one of the most dynamic and rapidly evolving digital commerce landscapes in the Middle East region. This thriving marketplace has experienced unprecedented growth driven by increasing internet penetration, smartphone adoption, and changing consumer behaviors accelerated by digital transformation initiatives. Qatar’s ecommerce sector has demonstrated remarkable resilience and adaptability, particularly following the global shift toward online shopping preferences.

Digital commerce adoption in Qatar has reached significant milestones, with online retail penetration rates showing substantial year-over-year growth of approximately 28% annually. The market encompasses various segments including fashion and apparel, electronics and consumer goods, food and grocery delivery, healthcare products, and digital services. Government initiatives supporting digital economy development have created a favorable environment for both local and international ecommerce players to establish strong market presence.

Consumer spending patterns have shifted dramatically toward online channels, with mobile commerce accounting for over 65% of total digital transactions. The market benefits from high disposable income levels, advanced telecommunications infrastructure, and a tech-savvy population that readily embraces new digital shopping experiences. Cross-border ecommerce has also gained significant traction, connecting Qatari consumers with global marketplaces and international brands.

The Qatar ecommerce market refers to the comprehensive ecosystem of online commercial activities, digital marketplaces, and electronic transactions conducted within Qatar’s borders, encompassing both business-to-consumer and business-to-business digital commerce operations across multiple industry verticals and service categories.

This digital marketplace includes various components such as online retail platforms, mobile commerce applications, digital payment systems, logistics and fulfillment networks, and supporting technological infrastructure. The market encompasses traditional retailers with digital presence, pure-play online merchants, marketplace platforms, and emerging direct-to-consumer brands leveraging digital channels for customer acquisition and retention.

Ecommerce activities in Qatar span multiple touchpoints including web-based shopping portals, mobile applications, social commerce platforms, and omnichannel retail experiences that integrate online and offline customer interactions. The market also includes supporting services such as digital marketing, customer analytics, cybersecurity solutions, and financial technology services that enable seamless online transactions.

Qatar’s ecommerce landscape has emerged as a regional leader in digital commerce adoption, driven by favorable demographic trends, government support for digital transformation, and robust technological infrastructure. The market demonstrates strong growth momentum across multiple segments, with particular strength in mobile commerce, luxury goods, and cross-border shopping experiences.

Key market characteristics include high smartphone penetration rates exceeding 95% of the population, advanced logistics capabilities, and sophisticated payment infrastructure supporting various digital transaction methods. The market benefits from a young, affluent consumer base with strong purchasing power and increasing preference for convenient online shopping experiences.

Strategic developments include the expansion of local marketplace platforms, increased investment in last-mile delivery solutions, and growing adoption of emerging technologies such as artificial intelligence, augmented reality, and voice commerce. International players continue to recognize Qatar as a strategic market for regional expansion, while local entrepreneurs are developing innovative solutions tailored to regional preferences and cultural considerations.

Market dynamics reveal several critical insights that shape the competitive landscape and growth trajectory of Qatar’s ecommerce sector:

Digital infrastructure development serves as a fundamental driver, with Qatar’s advanced telecommunications network providing reliable high-speed internet connectivity that supports seamless online shopping experiences. The country’s investment in 5G technology and fiber-optic networks creates an optimal environment for bandwidth-intensive ecommerce applications and emerging technologies.

Government initiatives promoting digital transformation have accelerated ecommerce adoption through supportive policies, regulatory frameworks, and investment in digital economy infrastructure. The Qatar National Vision 2030 emphasizes technology-driven economic diversification, creating favorable conditions for ecommerce growth and innovation.

Demographic advantages include a young, educated population with high digital literacy rates and strong purchasing power. The expatriate community, representing a significant portion of the population, brings diverse shopping preferences and familiarity with international ecommerce platforms, driving demand for varied product offerings and shopping experiences.

Changing consumer behaviors accelerated by global events have permanently shifted shopping preferences toward online channels. Consumers increasingly value convenience, product variety, competitive pricing, and personalized shopping experiences that ecommerce platforms can deliver more effectively than traditional retail formats.

Cultural preferences for traditional shopping experiences, particularly for certain product categories such as fresh food, luxury items, and culturally significant purchases, continue to limit full ecommerce adoption. Many consumers still prefer physical inspection and personal interaction for high-value or culturally important purchases.

Logistics challenges include the complexity of last-mile delivery in certain areas, temperature-controlled shipping requirements for specific products, and the cost of maintaining rapid delivery expectations across the country. Geographic constraints and infrastructure limitations in some regions can impact delivery efficiency and customer satisfaction.

Cybersecurity concerns remain a significant barrier for some consumer segments, particularly regarding payment security, data privacy, and protection of personal information. Building consumer trust in digital transactions requires ongoing investment in security infrastructure and consumer education initiatives.

Regulatory compliance requirements across different product categories, import regulations, and evolving digital commerce laws create complexity for both local and international ecommerce operators. Navigating regulatory frameworks while maintaining operational efficiency requires significant resources and expertise.

Emerging technology integration presents substantial opportunities for market differentiation and enhanced customer experiences. Technologies such as augmented reality for virtual product trials, artificial intelligence for personalized recommendations, and voice commerce for hands-free shopping represent significant growth potential.

Niche market development offers opportunities for specialized ecommerce platforms focusing on specific consumer segments, cultural preferences, or product categories. Local entrepreneurs can leverage deep market knowledge to create tailored solutions that address unique regional needs and preferences.

B2B ecommerce expansion represents an underexplored opportunity, with significant potential for digital transformation in business procurement, supply chain management, and inter-company transactions. The business sector’s growing recognition of digital efficiency benefits creates opportunities for specialized B2B platforms.

Sustainability initiatives provide opportunities for differentiation through eco-friendly packaging, carbon-neutral delivery options, and sustainable product offerings. Environmentally conscious consumers increasingly seek retailers that align with their values, creating competitive advantages for sustainability-focused ecommerce operations.

Competitive intensity continues to increase as both local and international players vie for market share through aggressive pricing strategies, enhanced customer experiences, and innovative service offerings. The market demonstrates healthy competition that drives continuous improvement in service quality and operational efficiency.

Technology evolution rapidly transforms customer expectations and operational capabilities. Platforms must continuously invest in technological upgrades, user experience improvements, and backend infrastructure to remain competitive and meet evolving consumer demands.

Consumer behavior shifts toward omnichannel experiences require retailers to integrate online and offline touchpoints seamlessly. Successful market participants demonstrate ability to provide consistent brand experiences across multiple channels while leveraging data insights to optimize customer journeys.

Supply chain optimization becomes increasingly critical as delivery speed and reliability expectations rise. Market leaders invest heavily in fulfillment infrastructure, inventory management systems, and logistics partnerships to maintain competitive advantages in customer satisfaction and operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Qatar’s ecommerce landscape. Primary research includes consumer surveys, industry expert interviews, and stakeholder consultations to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory filings to establish market context and historical trends. Data triangulation from multiple sources ensures reliability and accuracy of market insights and projections.

Quantitative analysis utilizes statistical modeling, trend analysis, and market sizing methodologies to establish growth patterns and market dynamics. Consumer behavior analysis incorporates digital analytics, transaction data, and demographic studies to understand purchasing patterns and preferences.

Qualitative research includes focus groups, in-depth interviews, and ethnographic studies to understand cultural factors, consumer motivations, and market barriers. This approach provides nuanced insights into consumer psychology and decision-making processes that quantitative data alone cannot capture.

Doha metropolitan area dominates the ecommerce landscape, accounting for approximately 75% of total online transactions due to high population density, advanced infrastructure, and concentrated commercial activity. The capital region benefits from superior logistics networks, faster delivery capabilities, and higher concentration of tech-savvy consumers.

Northern regions including Al Rayyan and Umm Salal show strong growth potential with increasing urbanization and infrastructure development. These areas demonstrate growing ecommerce adoption rates as residential developments expand and connectivity improves, creating opportunities for market expansion.

Industrial zones present significant B2B ecommerce opportunities, with companies increasingly adopting digital procurement and supply chain management solutions. The concentration of manufacturing and logistics operations in these areas creates demand for specialized business-to-business ecommerce platforms.

Coastal and southern regions represent emerging markets with developing infrastructure and growing consumer bases. While currently representing smaller market shares, these areas show promising growth trajectories as connectivity and logistics capabilities expand to serve distributed populations.

Market leadership is distributed among several key players, each bringing unique strengths and market positioning strategies:

Competitive strategies focus on differentiation through customer experience, delivery speed, product selection, and pricing competitiveness. Market participants invest heavily in technology infrastructure, logistics capabilities, and customer acquisition to maintain market position and drive growth.

By Product Category:

By Business Model:

By Consumer Demographics:

Fashion and Apparel maintains market leadership through strong consumer preference for international brands, seasonal shopping patterns, and social media influence on purchasing decisions. The segment benefits from high return customer rates and strong brand loyalty, with luxury and premium segments showing particular strength.

Electronics and Technology demonstrates consistent growth driven by frequent product innovation cycles, competitive pricing advantages online, and detailed product information availability. Consumer electronics, smartphones, and home automation products lead category performance with strong conversion rates.

Food and Grocery represents the fastest-growing segment, accelerated by convenience demand and improved cold-chain logistics capabilities. Quick commerce and same-day delivery services drive adoption, while subscription models for regular purchases gain traction among busy professionals and families.

Health and Beauty shows strong growth potential with increasing consumer focus on personal wellness, skincare, and premium beauty products. The segment benefits from detailed product reviews, comparison shopping capabilities, and access to international brands not available in traditional retail.

Home and Lifestyle emerges as a significant growth category driven by urbanization trends, home improvement activities, and increasing consumer interest in interior design. Furniture, home décor, and smart home products demonstrate strong online adoption rates.

Retailers and Brands benefit from expanded market reach, reduced operational costs, and enhanced customer data insights that enable personalized marketing and improved inventory management. Digital channels provide cost-effective customer acquisition and retention opportunities while enabling real-time market feedback and agile business model adaptation.

Consumers enjoy increased convenience, broader product selection, competitive pricing, and personalized shopping experiences. Online platforms provide access to international brands, detailed product information, customer reviews, and flexible delivery options that enhance overall shopping satisfaction and value.

Technology Providers find significant opportunities in supporting ecommerce infrastructure, payment processing, logistics optimization, and customer experience enhancement. The growing market creates demand for specialized solutions in areas such as cybersecurity, data analytics, and mobile application development.

Logistics and Delivery Services experience increased demand for last-mile delivery, warehousing, and fulfillment services. The growth in ecommerce creates opportunities for specialized logistics providers, technology-enabled delivery solutions, and value-added services such as installation and assembly.

Financial Services benefit from increased digital payment processing, lending opportunities for ecommerce businesses, and demand for innovative financial products such as buy-now-pay-later services and digital wallets. The sector supports ecommerce growth while expanding its own digital service offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile Commerce Dominance continues to strengthen with advanced mobile applications, progressive web apps, and mobile-optimized checkout processes driving the majority of ecommerce transactions. Retailers prioritize mobile-first design strategies and leverage mobile-specific features such as push notifications and location-based services.

Social Commerce Integration gains momentum as platforms integrate shopping capabilities directly into social media experiences. Influencer marketing, live streaming commerce, and social proof mechanisms become essential components of successful ecommerce strategies, particularly for fashion and lifestyle brands.

Artificial Intelligence Implementation transforms customer experiences through personalized recommendations, chatbot customer service, dynamic pricing, and predictive inventory management. AI-driven solutions enhance operational efficiency while providing more relevant and engaging customer interactions.

Sustainability Focus emerges as a key differentiator with consumers increasingly considering environmental impact in purchasing decisions. Ecommerce platforms implement eco-friendly packaging, carbon-neutral delivery options, and sustainable product certifications to meet growing environmental consciousness.

Quick Commerce Expansion accelerates with ultra-fast delivery services for essential items, groceries, and convenience products. The trend toward immediate gratification drives investment in micro-fulfillment centers, dark stores, and on-demand delivery networks.

Platform Consolidation continues as larger players acquire smaller specialized platforms to expand market coverage and enhance service capabilities. Strategic acquisitions focus on technology assets, customer bases, and specialized expertise in emerging market segments.

Infrastructure Investment accelerates with major players establishing local fulfillment centers, distribution hubs, and last-mile delivery networks. According to MarkWide Research analysis, infrastructure development represents a critical success factor for long-term market leadership and customer satisfaction.

Payment Innovation advances through integration of digital wallets, cryptocurrency options, and buy-now-pay-later services. Financial technology partnerships enable more flexible payment options while maintaining security and regulatory compliance standards.

Cross-Border Facilitation improves through streamlined customs processes, international shipping partnerships, and localized customer service capabilities. Enhanced cross-border ecommerce infrastructure connects Qatari consumers with global marketplaces more efficiently.

Regulatory Framework Evolution includes updated consumer protection laws, data privacy regulations, and digital commerce standards that provide clearer operational guidelines while maintaining market innovation flexibility.

Market participants should prioritize mobile-first strategies given the dominance of mobile commerce in Qatar’s market. Investment in responsive design, mobile app development, and mobile payment integration represents essential competitive requirements rather than optional enhancements.

Customer experience optimization through personalization, rapid delivery, and seamless omnichannel integration will differentiate successful players from competitors. Companies should leverage data analytics to understand customer preferences and optimize touchpoints across the entire customer journey.

Local market adaptation requires understanding cultural preferences, seasonal patterns, and regional shopping behaviors. Successful international players demonstrate ability to adapt global best practices to local market conditions while maintaining operational efficiency and brand consistency.

Technology investment in emerging areas such as artificial intelligence, augmented reality, and voice commerce will create competitive advantages and enhanced customer experiences. Early adoption of innovative technologies can establish market leadership positions before widespread adoption occurs.

Partnership strategies with local logistics providers, payment processors, and technology vendors can accelerate market entry and operational efficiency. Strategic partnerships enable faster scaling while leveraging local expertise and established relationships.

Growth trajectory remains strongly positive with continued expansion expected across all major ecommerce segments. MWR projections indicate sustained growth momentum driven by increasing digital adoption, infrastructure improvements, and evolving consumer preferences toward online shopping convenience.

Technology evolution will continue transforming the ecommerce landscape through advanced AI implementation, immersive shopping experiences, and seamless integration of online and offline channels. Virtual and augmented reality technologies are expected to become mainstream tools for product visualization and customer engagement.

Market maturation will likely lead to increased specialization, with platforms focusing on specific customer segments, product categories, or service models. Niche players may find success by addressing underserved market segments or providing specialized expertise in particular areas.

Regional integration opportunities may emerge as Qatar strengthens its position as a regional ecommerce hub, facilitating cross-border trade and serving as a gateway for international brands entering the Middle East market. Strategic geographic positioning supports expansion into broader regional markets.

Sustainability initiatives will become increasingly important competitive factors as environmental consciousness grows among consumers and regulatory requirements evolve. Companies investing early in sustainable practices may gain significant competitive advantages in future market conditions.

The Qatar ecommerce market represents a dynamic and rapidly evolving landscape with substantial growth potential driven by favorable demographics, advanced infrastructure, and strong government support for digital transformation. The market demonstrates remarkable resilience and adaptability, with mobile commerce leading adoption trends and innovative technologies enhancing customer experiences.

Key success factors include mobile-first strategies, customer experience optimization, local market adaptation, and strategic technology investments. Market participants who effectively combine global best practices with local market understanding are positioned to capture significant opportunities in this expanding digital commerce ecosystem.

Future prospects remain highly positive with continued growth expected across all major segments, driven by increasing digital adoption, infrastructure improvements, and evolving consumer preferences. The market’s evolution toward greater specialization, sustainability focus, and regional integration creates diverse opportunities for both established players and emerging market entrants to build successful, sustainable businesses in Qatar’s thriving ecommerce landscape.

What is Ecommerce?

Ecommerce refers to the buying and selling of goods and services over the internet. It encompasses various online business models, including B2C, B2B, and C2C transactions, and is a significant component of the retail landscape in Qatar.

What are the key players in the Qatar Ecommerce Market?

Key players in the Qatar Ecommerce Market include companies like Souq.com, Monoprix, and Carrefour, which offer a wide range of products online. Additionally, local startups are emerging, contributing to the competitive landscape among others.

What are the growth factors driving the Qatar Ecommerce Market?

The Qatar Ecommerce Market is driven by factors such as increasing internet penetration, a growing young population, and a shift towards online shopping due to convenience. Additionally, the rise of mobile commerce is enhancing consumer access to ecommerce platforms.

What challenges does the Qatar Ecommerce Market face?

Challenges in the Qatar Ecommerce Market include logistical issues related to delivery, competition from traditional retail, and concerns over cybersecurity. These factors can hinder the growth and adoption of ecommerce solutions.

What opportunities exist in the Qatar Ecommerce Market?

Opportunities in the Qatar Ecommerce Market include the expansion of digital payment solutions, the potential for niche markets, and the increasing demand for personalized shopping experiences. These trends can lead to innovative business models and services.

What trends are shaping the Qatar Ecommerce Market?

Trends in the Qatar Ecommerce Market include the rise of social commerce, the integration of artificial intelligence for personalized shopping, and the growing importance of sustainability in product offerings. These trends are influencing consumer behavior and business strategies.

Qatar Ecommerce Market

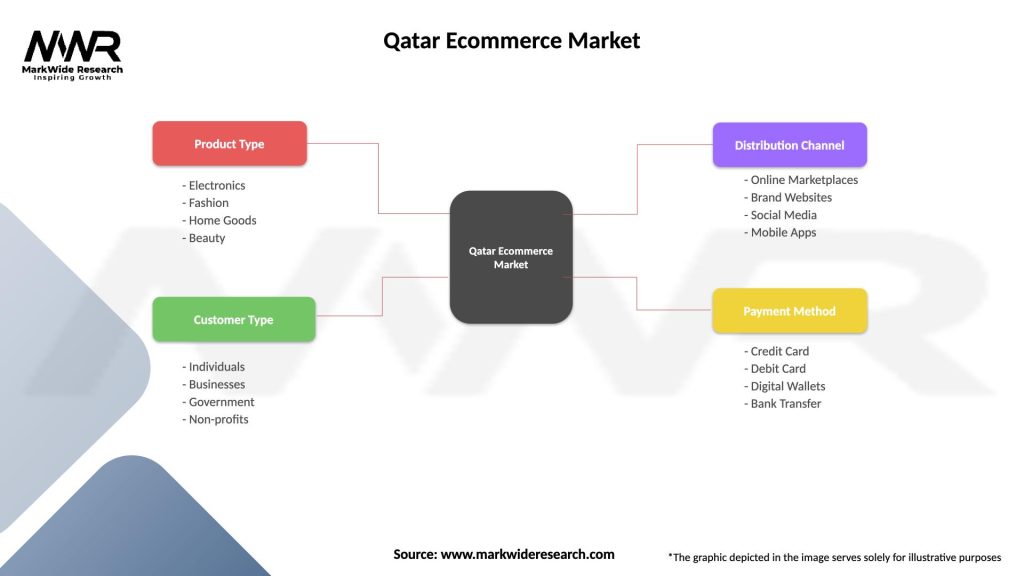

| Segmentation Details | Description |

|---|---|

| Product Type | Electronics, Fashion, Home Goods, Beauty |

| Customer Type | Individuals, Businesses, Government, Non-profits |

| Distribution Channel | Online Marketplaces, Brand Websites, Social Media, Mobile Apps |

| Payment Method | Credit Card, Debit Card, Digital Wallets, Bank Transfer |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Ecommerce Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at