444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar e-learning LMS industry market represents a rapidly evolving educational technology landscape that has transformed how institutions and organizations deliver digital learning experiences. This dynamic sector encompasses comprehensive learning management systems designed to facilitate online education, corporate training, and skill development programs across various sectors in Qatar. The market demonstrates remarkable growth momentum, driven by the nation’s commitment to digital transformation and educational excellence as outlined in Qatar National Vision 2030.

Digital learning adoption has accelerated significantly, with educational institutions reporting 78% increased engagement in online learning platforms compared to traditional methods. The market encompasses diverse stakeholders including universities, schools, government agencies, and private corporations seeking to enhance their training capabilities through sophisticated LMS solutions. Qatar’s strategic focus on becoming a knowledge-based economy has positioned the e-learning LMS market as a critical component of the nation’s educational infrastructure development.

Technological advancement continues to shape market dynamics, with cloud-based solutions gaining 65% market preference among educational institutions. The integration of artificial intelligence, mobile learning capabilities, and interactive content delivery systems has enhanced the overall learning experience, making Qatar’s e-learning ecosystem increasingly competitive on a global scale.

The Qatar e-learning LMS industry market refers to the comprehensive ecosystem of learning management systems, educational technology platforms, and digital learning solutions specifically designed to serve Qatar’s educational and corporate training needs. This market encompasses software platforms that enable institutions to create, deliver, track, and manage educational content and training programs through digital channels.

Learning Management Systems in Qatar’s context represent sophisticated platforms that integrate various educational tools including content management, student assessment, progress tracking, and collaborative learning features. These systems serve multiple sectors including higher education institutions, K-12 schools, government training programs, and corporate learning initiatives across Qatar’s diverse economic landscape.

Market participants include both international technology providers and local solution developers who customize platforms to meet specific cultural, linguistic, and regulatory requirements within Qatar’s educational framework. The market emphasizes Arabic language support, Islamic educational content integration, and compliance with Qatar’s educational standards and policies.

Qatar’s e-learning LMS market demonstrates exceptional growth potential, driven by substantial government investment in educational technology and widespread digital transformation initiatives across public and private sectors. The market benefits from strong governmental support through the Ministry of Education and Higher Education’s strategic digitization programs, creating favorable conditions for sustained expansion.

Key market drivers include increasing demand for flexible learning solutions, growing corporate training requirements, and the need for scalable educational delivery systems. Educational institutions report 82% satisfaction rates with current LMS implementations, indicating strong market acceptance and potential for further adoption. The market shows particular strength in higher education and corporate training segments, with emerging opportunities in K-12 education and government training programs.

Competitive landscape features a mix of international technology giants and regional solution providers, each offering specialized capabilities tailored to Qatar’s unique educational requirements. Market consolidation trends suggest increasing collaboration between global platforms and local content developers to create comprehensive solutions that address specific market needs.

Strategic market insights reveal several critical trends shaping Qatar’s e-learning LMS landscape:

Market maturation indicates shifting preferences toward comprehensive platforms offering integrated solutions rather than standalone learning tools. This trend reflects institutions’ desire for streamlined operations and improved learning outcomes through cohesive educational technology ecosystems.

Government investment serves as the primary catalyst for Qatar’s e-learning LMS market expansion. The Ministry of Education and Higher Education’s comprehensive digitization strategy allocates substantial resources toward educational technology infrastructure development, creating sustained demand for advanced LMS solutions across all educational levels.

Demographic advantages significantly influence market growth, with Qatar’s young, tech-savvy population demonstrating high adoption rates for digital learning platforms. Educational institutions report 89% student satisfaction with interactive online learning experiences, driving continued investment in platform enhancement and expansion.

Corporate training requirements fuel market demand as Qatar’s diversifying economy necessitates continuous workforce development. Companies across sectors including energy, finance, healthcare, and technology invest heavily in LMS platforms to maintain competitive advantages through employee skill enhancement programs.

Infrastructure development supports market growth through Qatar’s advanced telecommunications network and widespread internet connectivity. The nation’s robust digital infrastructure enables seamless delivery of sophisticated e-learning experiences, encouraging broader platform adoption across various user segments.

Cultural adaptation needs create unique market opportunities for LMS providers who can effectively integrate Islamic educational principles, Arabic language support, and culturally relevant content delivery mechanisms into their platforms.

Implementation costs present significant challenges for smaller educational institutions and organizations considering LMS adoption. Comprehensive platform deployment requires substantial initial investment in software licensing, hardware infrastructure, and staff training, potentially limiting market penetration among budget-conscious institutions.

Technical complexity creates barriers for institutions lacking sufficient IT expertise to manage sophisticated LMS implementations. Many organizations struggle with system integration, user management, and ongoing platform maintenance, requiring additional investment in technical support services.

Cultural resistance occasionally impedes adoption rates, particularly among traditional educational institutions preferring conventional teaching methods. Some educators and administrators express concerns about digital learning effectiveness compared to face-to-face instruction, slowing comprehensive platform integration.

Language limitations restrict market growth when international LMS providers fail to offer adequate Arabic language support or culturally appropriate content frameworks. This challenge particularly affects platforms targeting K-12 education and government training programs requiring extensive Arabic language capabilities.

Regulatory compliance requirements create additional complexity for LMS providers seeking to serve Qatar’s educational market. Platforms must meet specific data privacy, content standards, and educational quality requirements, potentially increasing development costs and implementation timelines.

Artificial intelligence integration presents substantial opportunities for LMS providers to differentiate their offerings through personalized learning experiences, automated content curation, and intelligent assessment capabilities. Educational institutions show increasing interest in AI-powered platforms that adapt to individual learning styles and preferences.

Mobile-first development creates significant market potential as Qatar’s mobile penetration rates exceed 95% of the population. LMS providers focusing on mobile-optimized platforms can capture growing demand for flexible, accessible learning solutions that accommodate busy professional and student schedules.

Corporate partnership opportunities emerge as Qatar’s major corporations seek comprehensive training solutions for their workforce development initiatives. Strategic partnerships between LMS providers and industry leaders can create customized platforms addressing specific sector requirements and training objectives.

Government contract potential offers substantial revenue opportunities for LMS providers capable of meeting public sector requirements. Qatar’s government agencies increasingly seek digital training solutions for employee development, creating demand for secure, compliant, and scalable learning platforms.

Regional expansion possibilities allow successful Qatar-based LMS implementations to serve as launching points for broader GCC market penetration. Providers establishing strong positions in Qatar can leverage their experience to expand throughout the Gulf region’s similar educational technology markets.

Supply-demand equilibrium in Qatar’s e-learning LMS market reflects strong demand growth outpacing current supply capabilities, creating favorable conditions for new market entrants and existing provider expansion. Educational institutions report 73% increased demand for advanced LMS features compared to previous years, indicating robust market momentum.

Competitive intensity increases as international technology companies recognize Qatar’s market potential and establish local partnerships to enhance their service delivery capabilities. This competition drives innovation and improves platform quality while potentially reducing costs for end users.

Technology evolution continuously reshapes market dynamics through emerging capabilities including virtual reality integration, blockchain-based credentialing, and advanced analytics platforms. These innovations create new market segments while potentially disrupting existing solution categories.

Regulatory environment influences market dynamics through evolving educational standards and data protection requirements. MarkWide Research analysis indicates that regulatory compliance capabilities increasingly determine platform selection decisions among institutional buyers.

Economic factors impact market dynamics through Qatar’s economic diversification efforts, which create new training requirements across emerging industries while maintaining strong demand in traditional sectors like energy and construction.

Primary research methodology employed comprehensive stakeholder interviews with educational institution administrators, corporate training managers, government officials, and LMS technology providers to gather firsthand insights into market trends, challenges, and opportunities within Qatar’s e-learning landscape.

Secondary research analysis incorporated extensive review of government publications, educational policy documents, industry reports, and academic studies focusing on Qatar’s educational technology adoption patterns and digital transformation initiatives across various sectors.

Market segmentation analysis utilized both quantitative and qualitative approaches to identify distinct user categories, application areas, and technology preferences within Qatar’s e-learning LMS market. This methodology enabled comprehensive understanding of market structure and growth potential across different segments.

Competitive landscape assessment involved detailed analysis of major LMS providers operating in Qatar, including evaluation of their market positioning, technology capabilities, pricing strategies, and customer satisfaction levels to provide comprehensive market intelligence.

Data validation processes ensured research accuracy through cross-referencing multiple sources, expert consultation, and statistical analysis to verify market trends and projections presented in this comprehensive market analysis.

Doha metropolitan area dominates Qatar’s e-learning LMS market, accounting for approximately 68% of total platform implementations due to the concentration of major educational institutions, corporate headquarters, and government agencies. The capital region benefits from advanced infrastructure and high technology adoption rates among its diverse population.

Northern Qatar regions show emerging market potential, particularly in industrial training applications supporting the energy and petrochemical sectors. Companies operating in these areas increasingly adopt LMS platforms for safety training, technical skill development, and regulatory compliance programs.

Southern Qatar development creates new market opportunities as infrastructure projects and economic zones expand educational and training requirements. The region’s growing population and industrial development drive demand for scalable learning solutions supporting workforce development initiatives.

Western coastal areas demonstrate specialized market needs, particularly in maritime and logistics training applications. LMS providers serving these regions focus on industry-specific content and mobile-accessible platforms accommodating shift-based work schedules.

Eastern region growth reflects expanding residential and commercial development, creating demand for educational technology solutions supporting new schools, training centers, and corporate facilities establishing operations in these developing areas.

Market leadership features a diverse ecosystem of international technology providers and regional specialists competing across different market segments:

Competitive differentiation increasingly focuses on Arabic language support, cultural customization capabilities, and integration with Qatar’s educational standards. Providers demonstrating strong local partnerships and customer support capabilities gain competitive advantages in this relationship-focused market.

By Deployment Model:

By End-user Segment:

By Application Area:

Higher Education Category demonstrates the most mature market adoption, with universities and colleges implementing comprehensive LMS platforms supporting diverse academic programs. These institutions prioritize advanced features including research collaboration tools, thesis management systems, and international student support capabilities.

Corporate Training Category shows the highest growth potential, driven by Qatar’s economic diversification and workforce development priorities. Companies report 84% improvement in training efficiency through LMS implementation, encouraging broader adoption across various industry sectors.

K-12 Education Category represents emerging opportunities as schools modernize their teaching methodologies and embrace digital learning tools. This segment requires specialized features including parental engagement tools, age-appropriate content management, and Arabic language curriculum support.

Government Training Category focuses on specialized requirements including security compliance, Arabic language priority, and integration with existing government systems. This segment values reliability, data protection, and comprehensive reporting capabilities for training program management.

Professional Certification Category addresses growing demand for continuous learning and skill validation across various professions. LMS platforms serving this category emphasize credentialing capabilities, industry partnerships, and flexible learning schedules accommodating working professionals.

Educational institutions benefit from enhanced learning delivery capabilities, improved student engagement metrics, and streamlined administrative processes through comprehensive LMS implementation. Institutions report 67% reduction in administrative overhead while maintaining higher educational quality standards.

Corporate organizations gain competitive advantages through improved employee skill development, reduced training costs, and better compliance management. Companies utilizing advanced LMS platforms demonstrate superior workforce adaptability and performance metrics compared to traditional training approaches.

Students and learners enjoy flexible learning schedules, personalized educational experiences, and improved access to diverse learning resources. Mobile-optimized platforms enable learning continuity regardless of location or time constraints, supporting Qatar’s mobile-first population preferences.

Technology providers access substantial market opportunities through Qatar’s growing demand for educational technology solutions. Successful providers establish strong market positions that can serve as foundations for regional expansion throughout the GCC market.

Government stakeholders achieve educational policy objectives through improved learning outcomes, enhanced educational accessibility, and better alignment with Qatar National Vision 2030 goals. Digital learning platforms support the nation’s knowledge economy development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as the dominant trend shaping Qatar’s e-learning LMS market, with platforms incorporating intelligent tutoring systems, automated content curation, and predictive analytics to enhance learning outcomes. Educational institutions report significant interest in AI-powered personalization capabilities.

Mobile-First Design becomes essential as learners increasingly prefer smartphone and tablet access to educational content. LMS providers prioritize responsive design and mobile app development to accommodate Qatar’s high mobile device penetration rates and user preferences.

Microlearning Approaches gain popularity as organizations recognize the effectiveness of bite-sized learning modules for busy professionals and students. This trend drives demand for platforms supporting modular content delivery and flexible learning path customization.

Social Learning Features become standard platform requirements as institutions recognize the value of collaborative learning experiences. Discussion forums, peer assessment tools, and group project capabilities enhance engagement and learning effectiveness.

Analytics and Reporting capabilities increasingly influence platform selection decisions as institutions seek detailed insights into learning progress, engagement patterns, and outcome measurements. MWR research indicates growing demand for comprehensive dashboard and reporting functionalities.

Government digitization initiatives accelerate market development through substantial investment in educational technology infrastructure and comprehensive policy support for digital learning adoption across all educational levels in Qatar.

Strategic partnerships between international LMS providers and local educational institutions create customized solutions addressing specific market requirements while building long-term relationships supporting sustained market growth.

Technology advancement in areas including virtual reality, augmented reality, and blockchain credentialing creates new market opportunities while potentially disrupting existing platform categories and competitive dynamics.

Regional collaboration initiatives among GCC countries promote standardization and interoperability of educational technology platforms, creating opportunities for successful Qatar implementations to expand throughout the broader regional market.

Corporate investment in employee development programs drives demand for sophisticated LMS platforms supporting diverse training requirements across Qatar’s evolving economic landscape and workforce development priorities.

Market entry strategies should prioritize local partnership development and cultural customization capabilities to succeed in Qatar’s relationship-focused educational technology market. Providers must demonstrate understanding of local educational requirements and Arabic language support capabilities.

Technology investment should focus on mobile optimization, AI integration, and analytics capabilities to meet evolving user expectations and competitive requirements. Platforms lacking these capabilities may struggle to maintain market relevance.

Customer support infrastructure requires significant investment in local presence and Arabic language capabilities to serve Qatar’s market effectively. Remote support models may prove insufficient for complex institutional implementations.

Pricing strategies should consider Qatar’s diverse institutional landscape, offering flexible models accommodating both large universities and smaller training organizations. Subscription-based models with scalable features may prove most effective.

Compliance preparation becomes essential as Qatar’s regulatory environment evolves. Providers should invest in understanding and meeting local data protection, educational standards, and content requirements to avoid market access barriers.

Market expansion projections indicate continued strong growth driven by sustained government investment, increasing corporate training requirements, and growing recognition of digital learning effectiveness. The market demonstrates resilience and long-term growth potential aligned with Qatar’s economic diversification objectives.

Technology evolution will likely focus on enhanced personalization through AI, improved mobile experiences, and integration with emerging technologies including virtual and augmented reality. These developments will create new market segments while potentially disrupting existing platform categories.

Competitive landscape evolution suggests increasing consolidation as successful providers expand their market presence while smaller players may struggle to compete with comprehensive platform offerings. Strategic partnerships and acquisitions may reshape market dynamics.

Regional integration opportunities may emerge as Qatar’s successful LMS implementations serve as models for broader GCC market expansion. Providers establishing strong Qatar positions may leverage this experience for regional growth strategies.

MarkWide Research projections indicate the market will continue expanding at robust growth rates through the forecast period, driven by sustained demand across educational and corporate segments, technological advancement, and supportive government policies promoting digital learning adoption throughout Qatar’s economy.

Qatar’s e-learning LMS industry market represents a dynamic and rapidly evolving sector with substantial growth potential driven by strong government support, advanced infrastructure, and increasing recognition of digital learning benefits across educational and corporate segments. The market demonstrates resilience and adaptability while maintaining focus on cultural relevance and local requirements.

Strategic opportunities abound for LMS providers capable of delivering comprehensive solutions addressing Qatar’s unique educational landscape, including Arabic language support, cultural customization, and integration with existing institutional systems. Success requires understanding of local market dynamics and commitment to long-term relationship building.

Future market development will likely emphasize technological innovation, particularly in AI integration, mobile optimization, and analytics capabilities, while maintaining focus on educational effectiveness and user engagement. The market’s alignment with Qatar National Vision 2030 ensures continued policy support and investment in educational technology infrastructure, creating favorable conditions for sustained growth and development in this critical sector.

What is E-Learning LMS?

E-Learning LMS refers to Learning Management Systems that facilitate online education and training. These platforms enable the delivery, tracking, and management of educational courses and training programs across various sectors.

What are the key players in the Qatar E-Learning LMS Industry Market?

Key players in the Qatar E-Learning LMS Industry include companies like Blackboard, Moodle, and Edmodo, which provide comprehensive solutions for educational institutions and corporate training, among others.

What are the growth factors driving the Qatar E-Learning LMS Industry Market?

The growth of the Qatar E-Learning LMS Industry is driven by increasing demand for flexible learning solutions, the rise of digital education, and government initiatives promoting online learning in schools and universities.

What challenges does the Qatar E-Learning LMS Industry Market face?

Challenges in the Qatar E-Learning LMS Industry include issues related to internet connectivity, the need for user training, and resistance to adopting new technologies among traditional educational institutions.

What opportunities exist in the Qatar E-Learning LMS Industry Market?

Opportunities in the Qatar E-Learning LMS Industry include the potential for personalized learning experiences, the integration of artificial intelligence in educational tools, and the expansion of corporate training programs.

What trends are shaping the Qatar E-Learning LMS Industry Market?

Trends in the Qatar E-Learning LMS Industry include the increasing use of mobile learning applications, gamification in educational content, and the growing emphasis on data analytics to improve learning outcomes.

Qatar E-Learning LMS Industry Market

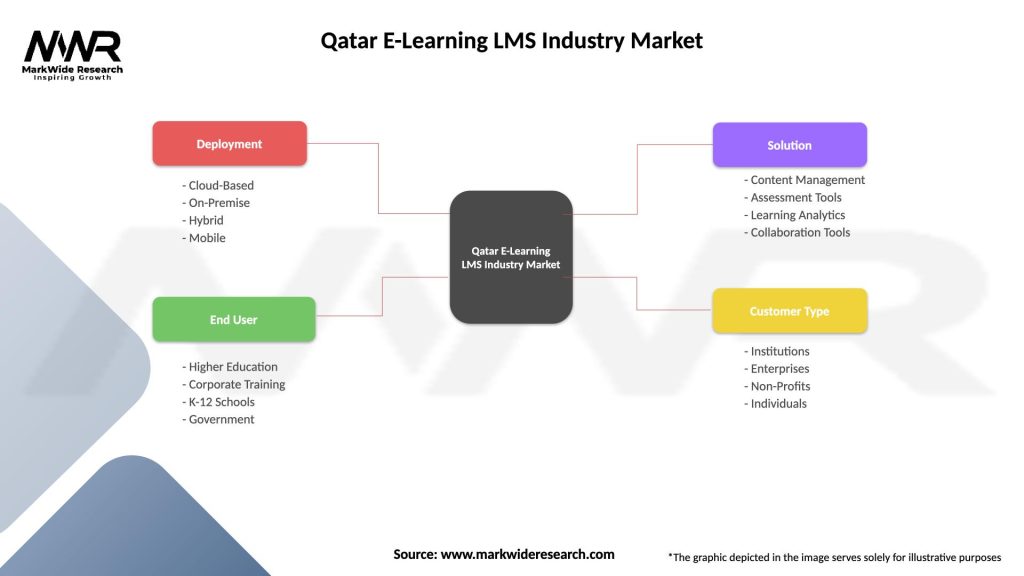

| Segmentation Details | Description |

|---|---|

| Deployment | Cloud-Based, On-Premise, Hybrid, Mobile |

| End User | Higher Education, Corporate Training, K-12 Schools, Government |

| Solution | Content Management, Assessment Tools, Learning Analytics, Collaboration Tools |

| Customer Type | Institutions, Enterprises, Non-Profits, Individuals |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar E-Learning LMS Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at