444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar Courier, Express, and Parcel (CEP) market represents a dynamic and rapidly evolving sector within the Gulf Cooperation Council region, driven by the nation’s strategic position as a logistics hub and its ambitious economic diversification goals. Qatar’s CEP market has experienced remarkable transformation, particularly following the country’s successful hosting of the FIFA World Cup 2022, which accelerated infrastructure development and digital commerce adoption. The market encompasses traditional courier services, express delivery solutions, and comprehensive parcel management systems that serve both domestic and international shipping requirements.

Market dynamics indicate robust growth potential, with the sector benefiting from Qatar’s Vision 2030 initiatives that emphasize economic diversification and technological advancement. The CEP market growth rate has consistently outpaced regional averages, with industry analysts projecting a compound annual growth rate (CAGR) of 8.2% through the forecast period. This growth trajectory reflects increasing consumer demand for rapid delivery services, expanding e-commerce penetration, and enhanced logistics infrastructure development across the country.

Key market drivers include the nation’s strategic geographic location connecting Asia, Europe, and Africa, substantial investments in transportation infrastructure, and growing adoption of digital payment systems. The market serves diverse customer segments ranging from individual consumers seeking personal delivery services to multinational corporations requiring comprehensive supply chain solutions. Qatar’s CEP sector has demonstrated remarkable resilience and adaptability, particularly in responding to changing consumer preferences and technological innovations that continue to reshape the logistics landscape.

The Qatar Courier, Express, and Parcel (CEP) market refers to the comprehensive ecosystem of logistics services that facilitate the collection, transportation, and delivery of documents, packages, and parcels within Qatar and internationally. This market encompasses three distinct but interconnected service categories that address varying customer needs and delivery requirements across different timeframes and service levels.

Courier services represent traditional door-to-door delivery solutions that prioritize reliability and personal service, typically handling documents, small packages, and time-sensitive materials. Express services focus on speed and efficiency, offering guaranteed delivery timeframes for urgent shipments that require rapid transportation across domestic and international routes. Parcel services encompass comprehensive package handling solutions that accommodate various sizes, weights, and delivery specifications for both business and consumer applications.

The market operates through sophisticated networks combining ground transportation, air cargo capabilities, and digital tracking systems that ensure seamless service delivery. Qatar’s CEP market leverages advanced logistics technologies, including automated sorting facilities, real-time tracking systems, and integrated customer management platforms that enhance operational efficiency and customer satisfaction. This integrated approach positions Qatar as a regional logistics leader while supporting the country’s broader economic development objectives.

Qatar’s CEP market stands at the forefront of regional logistics innovation, characterized by strong growth fundamentals and strategic positioning within global trade networks. The market has evolved from traditional postal services to sophisticated logistics solutions that support Qatar’s transformation into a knowledge-based economy. Market expansion has been particularly pronounced in the express delivery segment, which accounts for approximately 42% of total market share, driven by increasing demand for rapid delivery services and e-commerce growth.

Technological advancement represents a cornerstone of market development, with leading service providers investing heavily in automation, artificial intelligence, and digital customer interfaces. The integration of smart logistics solutions has improved delivery accuracy rates to 98.5% while reducing average delivery times across domestic routes. E-commerce integration has emerged as a critical growth driver, with online retail penetration reaching 67% of the population, creating substantial demand for reliable last-mile delivery solutions.

Competitive dynamics feature a mix of international logistics giants and regional specialists, each contributing unique capabilities and service offerings. The market demonstrates strong resilience and adaptability, having successfully navigated global supply chain disruptions while maintaining service quality standards. Future growth prospects remain robust, supported by continued infrastructure investment, digital transformation initiatives, and Qatar’s strategic role in regional trade facilitation.

Strategic positioning within the Gulf region has established Qatar as a preferred logistics hub, benefiting from world-class infrastructure and favorable business regulations. The market demonstrates several key characteristics that distinguish it from regional competitors and position it for sustained growth.

Market maturity varies across different service segments, with express delivery showing the highest growth potential and traditional courier services maintaining stable demand. The integration of artificial intelligence and machine learning technologies has improved operational efficiency while reducing costs and delivery times.

E-commerce expansion serves as the primary catalyst for CEP market growth, with online retail adoption accelerating significantly across all demographic segments. The convenience and accessibility of digital shopping platforms have created unprecedented demand for reliable delivery services, particularly in the express and parcel categories. Consumer behavior shifts toward online purchasing have been reinforced by improved digital payment systems and enhanced customer protection measures.

Infrastructure development continues to support market expansion through strategic investments in transportation networks, logistics facilities, and technology systems. The completion of major infrastructure projects, including expanded airport facilities and enhanced road networks, has improved service capabilities and reduced operational costs. Government support through favorable policies and regulatory frameworks encourages private sector investment and innovation within the logistics sector.

Business digitization across various industries has increased demand for document and package delivery services, as companies adopt digital workflows and remote collaboration models. The growth of small and medium enterprises (SMEs) has created new customer segments requiring flexible and cost-effective logistics solutions. International trade growth benefits from Qatar’s strategic location and free trade agreements that facilitate cross-border commerce and logistics services.

Technological advancement enables service providers to offer enhanced capabilities, including real-time tracking, predictive delivery scheduling, and automated customer communications. The integration of Internet of Things (IoT) devices and blockchain technology improves supply chain transparency and security, addressing growing customer demands for accountability and reliability.

Operational costs present ongoing challenges for CEP service providers, particularly in areas such as fuel expenses, labor costs, and technology investments. The need to maintain competitive pricing while investing in service improvements creates pressure on profit margins and operational efficiency. Regulatory compliance requirements, while generally supportive, can create administrative burdens and operational constraints that affect service delivery and cost structures.

Geographic limitations within Qatar’s relatively small domestic market restrict growth opportunities for purely domestic services, requiring providers to focus on international services and transit operations. Seasonal demand fluctuations create capacity planning challenges and resource allocation difficulties, particularly during peak shopping periods and holiday seasons.

Competition intensity from both established international providers and emerging local companies creates pricing pressure and market share challenges. The need to differentiate services and maintain customer loyalty requires continuous investment in service quality and innovation. Technology dependency creates vulnerabilities related to system failures, cybersecurity threats, and the need for ongoing technology upgrades and maintenance.

Environmental concerns and sustainability requirements may increase operational costs and necessitate investments in cleaner transportation technologies and carbon offset programs. Skilled labor availability in specialized logistics functions can constrain growth and service quality, requiring ongoing training and development investments.

Regional expansion opportunities exist through Qatar’s strategic position as a gateway to broader Middle East and North Africa markets. The country’s excellent connectivity and logistics infrastructure provide competitive advantages for serving regional customers and facilitating cross-border trade. Service diversification into specialized logistics solutions, such as cold chain management, pharmaceutical distribution, and high-value goods handling, offers premium service opportunities with higher profit margins.

Technology integration presents numerous opportunities for service enhancement and operational optimization. The adoption of autonomous delivery vehicles, drone technology, and advanced analytics can improve efficiency while reducing costs. Sustainability initiatives align with global trends and customer preferences, creating opportunities for green logistics services and environmentally responsible operations.

Partnership development with e-commerce platforms, retail chains, and international logistics providers can expand service capabilities and market reach. Value-added services such as warehousing, inventory management, and supply chain consulting provide additional revenue streams and strengthen customer relationships.

Digital transformation opportunities include enhanced customer interfaces, predictive analytics, and automated operations that improve service quality while reducing costs. The development of integrated logistics platforms can create competitive advantages and improve customer retention. Niche market development in areas such as healthcare logistics, luxury goods delivery, and time-critical services offers growth potential with premium pricing opportunities.

Supply and demand dynamics within Qatar’s CEP market reflect the interplay between growing customer expectations and evolving service capabilities. Demand patterns show increasing preference for faster delivery options, with same-day and next-day services experiencing growth rates of 15.3% annually. Customer willingness to pay premium prices for enhanced service levels creates opportunities for revenue optimization and service differentiation.

Competitive dynamics feature intense rivalry among established players and emerging service providers, driving continuous innovation and service improvement. Market consolidation trends indicate potential for strategic acquisitions and partnerships that could reshape competitive landscapes. The entry of technology-focused startups introduces new service models and operational approaches that challenge traditional logistics paradigms.

Pricing dynamics reflect the balance between cost pressures and customer value expectations, with successful providers demonstrating ability to maintain margins through operational efficiency and service differentiation. Service evolution continues toward more integrated and comprehensive solutions that address complete customer logistics needs rather than individual transactions.

Technology adoption rates vary across different market segments, with larger commercial customers typically embracing advanced solutions more rapidly than individual consumers. The integration of artificial intelligence and machine learning technologies has improved route optimization and delivery prediction accuracy by 23%, demonstrating the value of technological investment in operational performance.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included structured interviews with industry executives, logistics managers, and key stakeholders across the CEP value chain. Survey data collection from service providers, customers, and industry experts provided quantitative insights into market trends, preferences, and growth projections.

Secondary research incorporated analysis of government statistics, industry reports, and regulatory filings to establish baseline market data and validate primary research findings. Market modeling techniques utilized historical data analysis and trend extrapolation to develop growth projections and market size estimates. Cross-validation of data sources ensured consistency and reliability of research conclusions.

Industry expert consultations provided qualitative insights into market dynamics, competitive positioning, and future development prospects. Regulatory analysis examined policy frameworks, compliance requirements, and government initiatives affecting market development. Technology assessment evaluated the impact of digital transformation and emerging technologies on service delivery and operational efficiency.

Data triangulation methods verified research findings through multiple independent sources and analytical approaches. Quality assurance protocols ensured data accuracy and research methodology consistency throughout the analysis process. The research framework incorporated both quantitative metrics and qualitative assessments to provide comprehensive market understanding.

Doha metropolitan area dominates Qatar’s CEP market, accounting for approximately 78% of total market activity due to population concentration and commercial activity density. The capital region benefits from proximity to major logistics infrastructure, including Hamad International Airport and the Port of Doha, facilitating efficient service delivery and international connectivity. Urban delivery networks in Doha feature sophisticated routing systems and multiple service points that enable rapid package processing and distribution.

Northern regions including Al Rayyan and Al Khor represent growing market segments with 12% market share, driven by residential development and industrial expansion. These areas benefit from improved transportation infrastructure and increasing commercial activity that supports CEP service demand. Service coverage in northern regions has expanded significantly, with delivery timeframes approaching urban standards through strategic facility placement and route optimization.

Southern regions encompassing Al Wakrah and Mesaieed account for 10% of market activity, with growth potential linked to industrial development and port operations. The presence of major industrial facilities and logistics centers creates demand for specialized CEP services, including time-critical deliveries and bulk shipment handling. Infrastructure connectivity between southern regions and central distribution hubs continues to improve through ongoing transportation investments.

Cross-regional connectivity benefits from Qatar’s compact geography and excellent road networks, enabling efficient service delivery across all areas. Service standardization across regions ensures consistent quality and reliability regardless of delivery location, supporting customer satisfaction and market growth.

Market leadership features a diverse mix of international logistics giants and regional specialists, each contributing unique capabilities and service offerings to Qatar’s CEP market. The competitive environment encourages innovation and service excellence while maintaining healthy market dynamics.

Competitive strategies emphasize service differentiation, technology integration, and customer relationship management. Market positioning varies from premium international services to cost-effective domestic solutions, allowing customers to select providers based on specific requirements and budget considerations. Strategic partnerships and alliance formations continue to reshape competitive dynamics and service capabilities.

Service type segmentation reveals distinct market characteristics and growth patterns across different CEP categories. Express services represent the largest segment with 42% market share, driven by business demand for time-critical deliveries and guaranteed service levels. This segment benefits from premium pricing and strong customer loyalty, particularly among commercial customers requiring reliable delivery commitments.

By customer type:

By delivery speed:

Geographic segmentation reflects service coverage and delivery capabilities across Qatar’s regions, with urban areas receiving more frequent service options and rural areas served through consolidated routing systems.

Document delivery services maintain steady demand despite digital transformation trends, with legal documents, contracts, and official paperwork requiring physical delivery. Security features and chain-of-custody protocols make this category particularly valuable for legal and financial institutions. Growth in this segment remains modest but stable, with annual growth rates of 3.2% reflecting ongoing demand for secure document handling.

Parcel delivery services experience robust growth driven by e-commerce expansion and changing consumer shopping patterns. Package size diversity ranges from small items to large appliances, requiring flexible handling capabilities and varied delivery options. This segment shows strong growth potential with increasing demand for flexible delivery scheduling and customer convenience features.

Express delivery services command premium pricing and demonstrate strong customer loyalty through reliable service performance. Time-critical shipments including medical supplies, spare parts, and business documents drive consistent demand in this high-value segment. Technology integration has improved service reliability and customer communication, supporting continued growth and market expansion.

International services benefit from Qatar’s strategic location and excellent connectivity to global markets. Cross-border commerce growth creates opportunities for specialized services including customs clearance, duty management, and international tracking capabilities. This segment requires sophisticated logistics coordination and regulatory expertise, creating barriers to entry that protect established providers.

Service providers benefit from Qatar’s growing economy and strategic position within global trade networks. Revenue growth opportunities exist across multiple service categories and customer segments, supported by favorable market conditions and infrastructure development. Operational efficiency improvements through technology adoption reduce costs while enhancing service quality and customer satisfaction.

Customers enjoy improved service options, competitive pricing, and enhanced reliability through market competition and innovation. Convenience features including flexible delivery scheduling, real-time tracking, and multiple pickup locations improve customer experience and satisfaction. Business customers benefit from integrated logistics solutions that streamline operations and reduce supply chain complexity.

Economic stakeholders benefit from job creation, infrastructure investment, and economic diversification that CEP market growth generates. Supply chain efficiency improvements support broader economic competitiveness and trade facilitation. The logistics sector contributes to Qatar’s vision of becoming a regional business hub and knowledge-based economy.

Government entities benefit from increased tax revenues, improved trade facilitation, and enhanced economic diversification through CEP market development. Infrastructure utilization of airports, ports, and transportation networks improves return on public investments. Regulatory frameworks that support market growth while ensuring service quality create positive economic outcomes and customer protection.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the CEP landscape through advanced tracking systems, automated sorting facilities, and artificial intelligence-powered route optimization. Customer interface evolution toward mobile applications and self-service platforms improves convenience while reducing operational costs. Real-time visibility and predictive delivery notifications have become standard expectations rather than premium features.

Sustainability focus drives adoption of electric vehicles, carbon-neutral delivery options, and environmentally responsible packaging solutions. Green logistics initiatives respond to customer preferences and regulatory requirements while potentially reducing long-term operational costs. According to MarkWide Research analysis, sustainability considerations influence 34% of customer delivery choices, indicating growing market importance.

Same-day delivery expansion reflects changing customer expectations and competitive pressures, with service providers investing in local distribution networks and rapid fulfillment capabilities. Micro-fulfillment centers and urban logistics hubs enable faster delivery times while managing costs and operational complexity.

Integration with e-commerce platforms creates seamless customer experiences and operational efficiencies through automated order processing and inventory management. Omnichannel logistics solutions support retailers in providing consistent service across multiple sales channels and customer touchpoints. Technology partnerships between CEP providers and e-commerce platforms continue expanding service capabilities and market reach.

Infrastructure investments continue expanding Qatar’s logistics capabilities through airport expansion, new distribution facilities, and enhanced transportation networks. Hamad International Airport cargo capacity increases support growing international express services and transit operations. Strategic facility locations optimize service delivery while reducing operational costs and environmental impact.

Technology partnerships between international CEP providers and local technology companies create innovative service solutions and operational improvements. Blockchain implementation for supply chain transparency and security addresses growing customer demands for accountability and traceability. Artificial intelligence applications in route optimization and demand forecasting improve operational efficiency and service reliability.

Regulatory developments include updated customs procedures, enhanced security protocols, and streamlined business licensing that support market growth and operational efficiency. Free trade agreements and economic partnerships expand service opportunities and reduce barriers to international commerce. Government initiatives promoting digital commerce and logistics sector development create favorable conditions for continued market expansion.

Service innovations include drone delivery trials, autonomous vehicle testing, and advanced packaging solutions that address specific customer needs and operational challenges. Cold chain capabilities expansion supports pharmaceutical and food delivery services, creating new revenue opportunities and market segments. Specialized handling services for high-value goods and sensitive materials differentiate providers and command premium pricing.

Strategic positioning should emphasize Qatar’s unique advantages as a regional logistics hub while addressing market limitations through service diversification and geographic expansion. Investment priorities should focus on technology integration, sustainability initiatives, and specialized service capabilities that create competitive differentiation and customer value.

Operational optimization through advanced analytics, automation, and process improvement can reduce costs while enhancing service quality and reliability. Customer relationship management systems and personalized service offerings strengthen customer loyalty and support premium pricing strategies. Partnership development with e-commerce platforms and international logistics providers expands service capabilities and market reach.

Market expansion opportunities exist through regional service development, specialized logistics solutions, and value-added services that address specific customer needs. Technology adoption should prioritize solutions that improve operational efficiency, customer experience, and competitive positioning. Sustainability initiatives align with market trends while potentially reducing long-term operational costs and regulatory compliance risks.

Risk management strategies should address competitive pressures, regulatory changes, and economic volatility through diversified service offerings and flexible operational models. Talent development in specialized logistics functions supports service quality and operational excellence while addressing skilled labor availability challenges.

Growth projections for Qatar’s CEP market remain positive, with MWR forecasting continued expansion driven by e-commerce growth, infrastructure development, and regional trade facilitation. Market evolution toward more integrated and technology-enabled services will create opportunities for providers that successfully adapt to changing customer expectations and operational requirements.

Technology integration will accelerate through artificial intelligence, Internet of Things applications, and advanced analytics that improve operational efficiency and customer experience. Autonomous delivery systems and drone technology may transform last-mile delivery capabilities, particularly for urban areas and time-critical shipments. Blockchain technology adoption will enhance supply chain transparency and security, addressing growing customer demands for accountability.

Sustainability requirements will increasingly influence service design and operational practices, with electric vehicles and carbon-neutral delivery options becoming standard rather than premium features. Circular economy principles may drive innovations in packaging, reverse logistics, and waste reduction that create competitive advantages while addressing environmental concerns.

Regional integration opportunities will expand as Qatar’s role as a logistics hub develops and regional trade relationships strengthen. Specialized service segments including healthcare logistics, luxury goods delivery, and time-critical services offer growth potential with premium pricing opportunities. The market outlook remains robust, supported by favorable economic conditions, infrastructure investments, and strategic positioning within global trade networks.

Qatar’s Courier, Express, and Parcel market represents a dynamic and strategically important sector within the nation’s broader economic development framework. The market demonstrates strong growth fundamentals, supported by excellent infrastructure, favorable regulatory conditions, and strategic geographic positioning that creates natural competitive advantages. Technology integration and service innovation continue driving market evolution, with providers successfully adapting to changing customer expectations and operational requirements.

Future prospects remain positive, with continued growth expected across all major service segments and customer categories. The market’s resilience and adaptability, demonstrated through successful navigation of global challenges and changing economic conditions, position it well for sustained development. Strategic investments in technology, sustainability, and specialized services will determine competitive success and market leadership in the evolving logistics landscape.

Stakeholder benefits extend beyond immediate commercial interests to include broader economic development, job creation, and infrastructure utilization that support Qatar’s vision of economic diversification and regional leadership. The CEP market’s contribution to trade facilitation, business competitiveness, and customer convenience underscores its importance within Qatar’s strategic development priorities and long-term economic success.

What is Courier, Express, and Parcel (CEP)?

Courier, Express, and Parcel (CEP) refers to services that facilitate the rapid delivery of packages and documents. These services are essential for businesses and individuals needing timely shipping solutions across various sectors, including e-commerce, retail, and logistics.

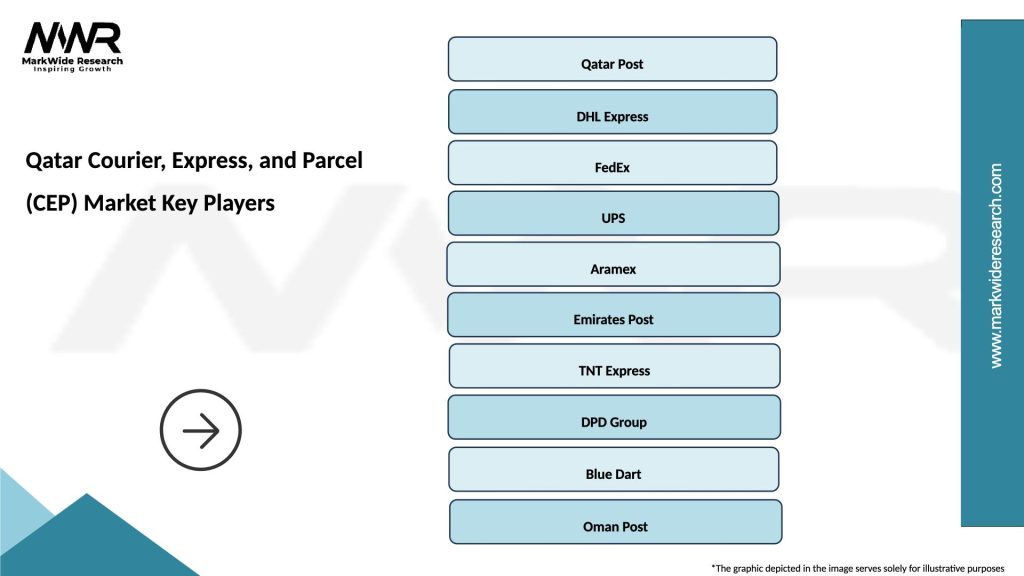

What are the key players in the Qatar Courier, Express, and Parcel (CEP) Market?

Key players in the Qatar Courier, Express, and Parcel (CEP) Market include Qatar Post, DHL, and Aramex, among others. These companies offer a range of services from standard parcel delivery to express shipping solutions tailored to customer needs.

What are the growth factors driving the Qatar Courier, Express, and Parcel (CEP) Market?

The Qatar Courier, Express, and Parcel (CEP) Market is driven by the growth of e-commerce, increasing consumer demand for fast delivery, and the expansion of logistics infrastructure. Additionally, the rise in international trade and the need for efficient supply chain solutions contribute to market growth.

What challenges does the Qatar Courier, Express, and Parcel (CEP) Market face?

The Qatar Courier, Express, and Parcel (CEP) Market faces challenges such as regulatory hurdles, competition from local and international players, and fluctuating fuel prices. These factors can impact operational costs and service efficiency.

What opportunities exist in the Qatar Courier, Express, and Parcel (CEP) Market?

Opportunities in the Qatar Courier, Express, and Parcel (CEP) Market include the potential for technological advancements in logistics, the growth of same-day delivery services, and the increasing demand for specialized delivery solutions. These trends can enhance service offerings and customer satisfaction.

What trends are shaping the Qatar Courier, Express, and Parcel (CEP) Market?

Trends shaping the Qatar Courier, Express, and Parcel (CEP) Market include the adoption of automation and digital solutions, the rise of green logistics practices, and the integration of tracking technologies. These innovations are aimed at improving efficiency and sustainability in delivery services.

Qatar Courier, Express, and Parcel (CEP) Market

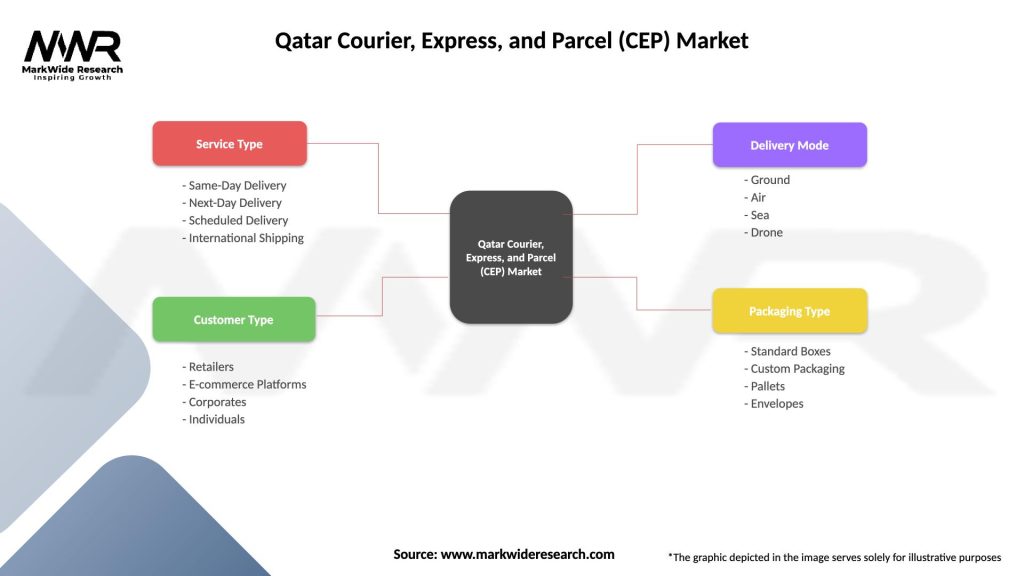

| Segmentation Details | Description |

|---|---|

| Service Type | Same-Day Delivery, Next-Day Delivery, Scheduled Delivery, International Shipping |

| Customer Type | Retailers, E-commerce Platforms, Corporates, Individuals |

| Delivery Mode | Ground, Air, Sea, Drone |

| Packaging Type | Standard Boxes, Custom Packaging, Pallets, Envelopes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Courier, Express, and Parcel (CEP) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at