444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar cloud managed services market represents a rapidly evolving sector within the nation’s digital transformation landscape. As Qatar continues its ambitious journey toward becoming a knowledge-based economy, organizations across various industries are increasingly adopting cloud managed services to enhance operational efficiency and reduce infrastructure costs. The market encompasses comprehensive IT service offerings including cloud infrastructure management, application services, security management, and data backup solutions.

Digital transformation initiatives across Qatar’s public and private sectors are driving unprecedented demand for cloud managed services. The country’s strategic focus on diversifying its economy beyond oil and gas has created substantial opportunities for cloud service providers. Organizations are experiencing significant operational improvements of up to 40% efficiency gains through cloud managed services adoption, particularly in sectors such as healthcare, education, and government services.

Government support through Qatar National Vision 2030 and various digital initiatives has accelerated market growth. The increasing complexity of IT infrastructure and the need for specialized expertise have positioned cloud managed services as essential components of modern business operations. Enterprise adoption rates have reached approximately 65% among large organizations, with small and medium enterprises showing growing interest in managed cloud solutions.

The Qatar cloud managed services market refers to the comprehensive ecosystem of third-party service providers offering end-to-end management of cloud infrastructure, applications, and related IT services for organizations operating within Qatar’s business environment.

Cloud managed services encompass a broad spectrum of offerings designed to help organizations leverage cloud technologies without maintaining extensive in-house expertise. These services include infrastructure monitoring, application management, security oversight, data backup and recovery, performance optimization, and compliance management. Service providers assume responsibility for day-to-day operations, allowing client organizations to focus on core business activities while benefiting from advanced cloud capabilities.

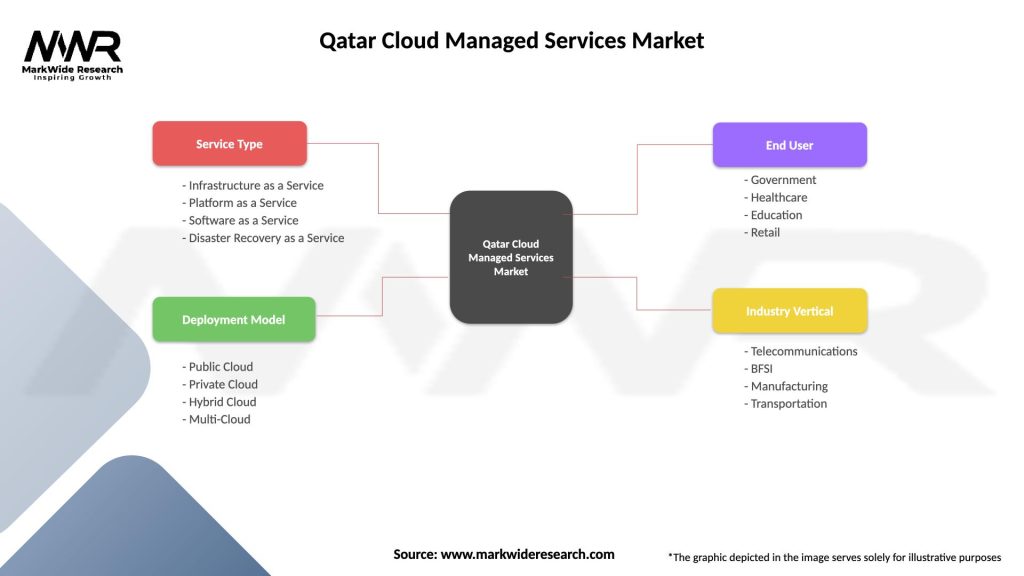

The market structure includes various service models such as Infrastructure as a Service (IaaS) management, Platform as a Service (PaaS) administration, and Software as a Service (SaaS) support. Providers offer flexible engagement models ranging from fully managed services to hybrid arrangements where organizations retain control over specific aspects of their cloud environment while outsourcing others to specialized providers.

Qatar’s cloud managed services market is experiencing robust expansion driven by accelerating digital transformation initiatives and increasing recognition of cloud technology benefits. The market demonstrates strong momentum across multiple sectors, with government entities, financial institutions, and healthcare organizations leading adoption efforts. Service provider capabilities have evolved significantly, offering sophisticated solutions that address complex regulatory requirements and industry-specific needs.

Market dynamics indicate growing preference for hybrid cloud models, combining public and private cloud elements to optimize performance, security, and cost-effectiveness. Organizations are increasingly seeking comprehensive managed services that extend beyond basic infrastructure management to include advanced analytics, artificial intelligence integration, and strategic consulting services. The market shows particularly strong growth in sectors prioritizing digital innovation and operational efficiency.

Competitive landscape features both international cloud service providers and regional specialists, creating a diverse ecosystem of service options. Local providers are gaining market share by offering specialized knowledge of regional regulations, cultural considerations, and Arabic language support. The market benefits from Qatar’s strategic location as a regional hub, attracting investments in data center infrastructure and cloud service capabilities.

Strategic market insights reveal several critical trends shaping Qatar’s cloud managed services landscape:

Digital transformation acceleration represents the primary driver of Qatar’s cloud managed services market growth. Organizations across all sectors are modernizing their IT infrastructure to support digital business models, enhance customer experiences, and improve operational efficiency. The complexity of managing modern cloud environments has created substantial demand for specialized managed services that can deliver enterprise-grade capabilities without requiring extensive internal expertise.

Government initiatives supporting Qatar National Vision 2030 are creating significant market opportunities. Public sector digitization projects, smart city developments, and e-government services require sophisticated cloud infrastructure management. The government’s commitment to becoming a knowledge-based economy has resulted in substantial investments in digital infrastructure and services, directly benefiting cloud managed service providers.

Cost optimization pressures are driving organizations to seek more efficient IT service delivery models. Cloud managed services enable organizations to convert capital expenditures to operational expenses while accessing advanced capabilities that would be prohibitively expensive to develop internally. Total cost reductions of approximately 25-35% are commonly achieved through managed services adoption, making these solutions attractive to cost-conscious organizations.

Skills shortage in cloud technologies is accelerating managed services adoption. Qatar’s rapidly evolving technology landscape has created demand for specialized skills that exceed local availability. Managed service providers offer access to global expertise and best practices, enabling organizations to implement and maintain sophisticated cloud environments without extensive recruitment and training investments.

Data sovereignty concerns present significant challenges for cloud managed services adoption in Qatar. Organizations, particularly in government and regulated industries, express concerns about data location, access controls, and compliance with local regulations. These concerns can slow adoption rates and require service providers to invest in local infrastructure and specialized compliance capabilities.

Security apprehensions continue to influence market dynamics, with some organizations hesitant to entrust critical systems and data to external providers. Despite advances in cloud security technologies, concerns about data breaches, unauthorized access, and loss of control over security measures can limit market growth. Organizations often require extensive security assessments and certifications before engaging managed service providers.

Integration complexity with existing legacy systems poses challenges for organizations considering cloud managed services. Many Qatar-based organizations operate complex IT environments with significant investments in on-premises infrastructure. The complexity and cost of integrating cloud managed services with existing systems can create barriers to adoption, particularly for organizations with limited technical resources.

Vendor dependency risks concern organizations evaluating managed services options. The potential for vendor lock-in, service disruptions, and limited flexibility in changing providers can influence decision-making processes. Organizations seek assurances regarding data portability, service continuity, and exit strategies before committing to comprehensive managed services arrangements.

Emerging technology integration presents substantial opportunities for cloud managed service providers in Qatar. The growing interest in artificial intelligence, machine learning, Internet of Things, and blockchain technologies creates demand for specialized managed services that can support these advanced capabilities. Providers offering integrated solutions combining traditional cloud management with emerging technology expertise are well-positioned for growth.

Industry-specific solutions represent significant market opportunities, particularly in Qatar’s priority sectors such as healthcare, education, and financial services. Each industry has unique regulatory requirements, operational challenges, and technology needs that create opportunities for specialized managed service offerings. Providers developing deep industry expertise and tailored solutions can command premium pricing and build sustainable competitive advantages.

Small and medium enterprise market expansion offers considerable growth potential. While large organizations have led cloud adoption, SMEs represent an underserved market segment with growing technology needs. Managed service providers offering scalable, cost-effective solutions designed for smaller organizations can tap into this expanding market opportunity.

Regional expansion opportunities exist as Qatar’s strategic location and advanced infrastructure position it as a regional hub for cloud services. Providers establishing operations in Qatar can serve broader Middle East markets while benefiting from the country’s business-friendly environment and strategic location. Regional market penetration rates suggest significant untapped potential across neighboring countries.

Competitive dynamics in Qatar’s cloud managed services market reflect a balance between global providers and regional specialists. International companies bring extensive resources, proven methodologies, and global best practices, while local providers offer cultural understanding, regulatory expertise, and personalized service approaches. This competition drives innovation and service quality improvements across the market.

Technology evolution continues to reshape market dynamics as cloud platforms become more sophisticated and service provider capabilities expand. The integration of artificial intelligence, automation, and advanced analytics into managed services is creating new value propositions and competitive differentiators. Providers investing in next-generation capabilities are gaining market share and commanding premium pricing.

Customer expectations are evolving toward more strategic partnerships rather than traditional vendor relationships. Organizations seek managed service providers that can serve as trusted advisors, offering strategic guidance on technology roadmaps, digital transformation initiatives, and business optimization opportunities. This shift is creating opportunities for providers with strong consulting capabilities and industry expertise.

Regulatory environment changes continue to influence market dynamics, with increasing emphasis on data protection, cybersecurity, and compliance requirements. According to MarkWide Research analysis, providers demonstrating strong compliance capabilities and regulatory expertise are experiencing higher growth rates of approximately 15-20% compared to competitors with limited regulatory focus.

Comprehensive market analysis for Qatar’s cloud managed services market employed multiple research methodologies to ensure accuracy and completeness. Primary research included structured interviews with key market participants, including service providers, enterprise customers, and industry experts. These interviews provided insights into market trends, challenges, opportunities, and competitive dynamics from multiple stakeholder perspectives.

Secondary research encompassed analysis of industry reports, government publications, company financial statements, and regulatory documents. This research provided quantitative data on market size, growth rates, and competitive positioning while offering historical context for current market conditions. Industry databases and trade publications contributed additional market intelligence and trend analysis.

Market segmentation analysis examined various dimensions including service types, industry verticals, organization sizes, and deployment models. This segmentation approach enabled detailed understanding of market dynamics across different customer segments and service categories. Regional analysis considered Qatar’s unique economic, regulatory, and cultural factors influencing cloud adoption patterns.

Validation processes included cross-referencing data sources, conducting follow-up interviews with key stakeholders, and comparing findings with broader regional market trends. This validation approach ensured research accuracy and reliability while identifying potential data inconsistencies or market anomalies requiring further investigation.

Doha metropolitan area dominates Qatar’s cloud managed services market, accounting for approximately 75% of total market activity. The capital city’s concentration of government offices, financial institutions, and multinational corporations creates substantial demand for sophisticated cloud managed services. Major service providers maintain primary operations in Doha to serve this concentrated customer base and access skilled workforce resources.

Industrial zones including Mesaieed and Ras Laffan represent growing market segments as energy and petrochemical companies modernize their IT infrastructure. These organizations require specialized managed services that can support industrial applications, comply with safety regulations, and integrate with operational technology systems. The unique requirements of industrial customers are creating opportunities for specialized service providers.

Northern regions including Al Khor and Al Shamal show increasing cloud adoption as economic diversification initiatives expand beyond traditional energy sectors. Government investments in infrastructure development and new business zones are creating demand for cloud managed services to support emerging industries and commercial activities.

Regional connectivity advantages position Qatar as a strategic hub for cloud services serving broader Middle East markets. The country’s advanced telecommunications infrastructure, strategic location, and political stability make it attractive for regional cloud service delivery. Cross-border service delivery represents approximately 20% of provider revenues, indicating significant regional market integration.

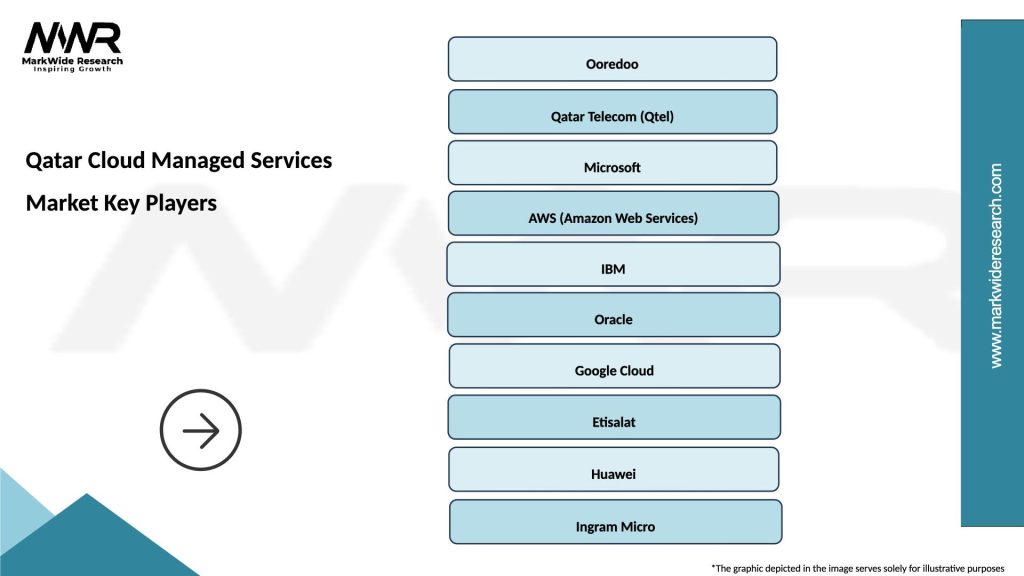

Market leadership in Qatar’s cloud managed services sector includes both international technology giants and specialized regional providers:

Competitive differentiation strategies focus on industry specialization, regulatory compliance expertise, and local market understanding. Providers are investing in sector-specific solutions, obtaining relevant certifications, and building partnerships with local organizations to enhance their competitive positioning.

By Service Type:

By Deployment Model:

By Organization Size:

Government sector represents the largest market category, driven by extensive digitization initiatives and e-government service development. Government organizations require specialized managed services that address regulatory compliance, data sovereignty, and security requirements. Public sector adoption rates have reached approximately 70% among major government entities, with continued expansion expected as digital transformation initiatives progress.

Financial services category demonstrates strong growth as banks and financial institutions modernize their technology infrastructure. The sector’s stringent regulatory requirements and security needs create demand for specialized managed services with deep compliance expertise. Digital banking initiatives and fintech integration are driving additional service requirements beyond traditional infrastructure management.

Healthcare sector shows increasing adoption of cloud managed services to support electronic health records, telemedicine, and medical imaging applications. The sector’s unique requirements for data privacy, regulatory compliance, and system reliability create opportunities for specialized healthcare-focused managed service providers.

Education category is experiencing rapid growth as educational institutions implement digital learning platforms and administrative systems. The shift toward online and hybrid learning models has accelerated demand for reliable, scalable cloud managed services that can support diverse educational applications and user populations.

Cost optimization represents a primary benefit for organizations adopting cloud managed services. Clients typically achieve operational cost reductions of 20-40% through improved efficiency, reduced infrastructure investments, and optimized resource utilization. Managed services enable organizations to convert fixed IT costs to variable expenses while accessing enterprise-grade capabilities without substantial capital investments.

Enhanced security and compliance capabilities provide significant value for organizations operating in regulated industries. Managed service providers offer specialized security expertise, continuous monitoring, and compliance management that would be expensive and complex to develop internally. This enhanced security posture reduces risk exposure and supports regulatory compliance requirements.

Access to expertise enables organizations to leverage advanced cloud capabilities without extensive internal skill development. Managed service providers offer access to certified professionals, proven methodologies, and global best practices that accelerate cloud adoption and optimization. This expertise access is particularly valuable in Qatar’s competitive talent market.

Scalability and flexibility benefits allow organizations to adapt quickly to changing business requirements. Cloud managed services provide elastic capacity, rapid deployment capabilities, and flexible service models that support business growth and seasonal variations. Organizations can scale services up or down based on actual needs without long-term commitments or infrastructure investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is becoming a defining trend in Qatar’s cloud managed services market. Providers are incorporating AI-powered automation, predictive analytics, and intelligent monitoring capabilities into their service offerings. This integration enables proactive issue resolution, optimized resource allocation, and enhanced service quality while reducing operational costs.

Edge computing adoption is gaining momentum as organizations seek to reduce latency and improve performance for critical applications. Managed service providers are expanding their offerings to include edge infrastructure management, supporting applications requiring real-time processing and low-latency connectivity. This trend is particularly relevant for industrial IoT and smart city applications.

Multi-cloud strategies are becoming increasingly common as organizations seek to avoid vendor lock-in and optimize performance across different cloud platforms. MWR research indicates that approximately 55% of enterprises are adopting multi-cloud approaches, creating demand for managed services that can span multiple cloud environments and provide unified management capabilities.

Security-first approaches are reshaping service delivery models as cybersecurity becomes a top priority for organizations. Managed service providers are integrating advanced security capabilities into all service offerings rather than treating security as a separate add-on service. This trend includes zero-trust architectures, continuous security monitoring, and automated threat response capabilities.

Data center investments by major cloud providers are expanding local infrastructure capabilities and reducing latency for Qatar-based customers. Recent announcements of new data center facilities and capacity expansions demonstrate provider commitment to the local market and support for data sovereignty requirements.

Partnership formations between international cloud providers and local telecommunications companies are creating new service delivery models and market opportunities. These partnerships combine global cloud expertise with local market knowledge and customer relationships, enhancing service quality and market reach.

Regulatory developments including new data protection laws and cybersecurity requirements are shaping service provider capabilities and market dynamics. Providers are investing in compliance capabilities and obtaining relevant certifications to address evolving regulatory requirements and customer concerns.

Skills development initiatives by government and private sector organizations are addressing the local talent shortage through training programs, certifications, and educational partnerships. These initiatives aim to build local cloud expertise and reduce dependency on international talent while supporting market growth.

Service providers should focus on developing industry-specific expertise and solutions to differentiate themselves in the competitive market. Deep understanding of sector requirements, regulatory compliance needs, and operational challenges will enable providers to command premium pricing and build sustainable competitive advantages. Investment in local talent development and Arabic language capabilities will enhance market positioning.

Organizations evaluating cloud managed services should prioritize providers with strong security credentials, regulatory compliance expertise, and local market presence. Comprehensive due diligence processes should assess provider capabilities, financial stability, and cultural fit. Organizations should also consider hybrid engagement models that balance external expertise with internal control requirements.

Government entities should continue supporting market development through favorable policies, infrastructure investments, and skills development initiatives. Clear regulatory frameworks and data sovereignty guidelines will provide certainty for both providers and customers while supporting market growth. Public sector leadership in cloud adoption will encourage private sector investment and innovation.

Investment opportunities exist in specialized managed service providers focusing on specific industries or emerging technologies. The market’s growth trajectory and government support create favorable conditions for new entrants with differentiated value propositions. Partnership opportunities with established providers may offer lower-risk entry strategies for new market participants.

Market evolution toward more sophisticated, AI-powered managed services will continue as organizations seek greater automation and intelligence in their cloud operations. The integration of machine learning, predictive analytics, and automated remediation capabilities will become standard features rather than premium add-ons. This evolution will enable more proactive service delivery and improved customer outcomes.

Industry consolidation may occur as smaller providers struggle to compete with the scale and capabilities of larger competitors. However, specialized providers focusing on specific industries or technologies may find sustainable niches within the broader market. Strategic partnerships and acquisitions will likely reshape the competitive landscape over the forecast period.

Regional expansion opportunities will grow as Qatar’s position as a regional hub strengthens and cross-border service delivery becomes more common. Providers establishing strong positions in Qatar will be well-positioned to serve broader Middle East markets, leveraging local infrastructure and expertise to support regional growth strategies.

Technology advancement will continue driving market evolution, with emerging technologies like quantum computing, advanced AI, and next-generation networking creating new service opportunities. According to MarkWide Research projections, the market is expected to maintain robust growth momentum with expansion rates of approximately 12-15% annually over the next five years, driven by continued digital transformation initiatives and technology adoption.

Qatar’s cloud managed services market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation initiatives, government support, and increasing recognition of cloud technology benefits. The market demonstrates strong fundamentals including supportive regulatory environment, advanced infrastructure, and growing demand across multiple industry sectors.

Key success factors for market participants include developing deep industry expertise, maintaining strong security and compliance capabilities, and building local market presence while leveraging global best practices. The competitive landscape rewards providers that can combine technical excellence with cultural understanding and regulatory expertise specific to Qatar’s business environment.

Future growth prospects remain positive as organizations continue modernizing their IT infrastructure and adopting cloud-first strategies. The integration of emerging technologies, expansion of edge computing capabilities, and evolution toward more intelligent, automated service delivery models will create new opportunities for innovative providers. Qatar’s strategic position as a regional hub and continued government support for digital transformation initiatives provide a strong foundation for sustained market growth and development.

What is Cloud Managed Services?

Cloud Managed Services refer to the outsourcing of management responsibilities for cloud-based services and infrastructure. This includes services such as cloud storage, cloud computing, and cloud security, allowing businesses to focus on their core operations while leveraging cloud technology.

What are the key players in the Qatar Cloud Managed Services Market?

Key players in the Qatar Cloud Managed Services Market include Ooredoo, Vodafone Qatar, and Microsoft, among others. These companies provide a range of cloud solutions tailored to various industries, enhancing operational efficiency and scalability.

What are the main drivers of growth in the Qatar Cloud Managed Services Market?

The main drivers of growth in the Qatar Cloud Managed Services Market include the increasing demand for digital transformation, the need for cost-effective IT solutions, and the rising adoption of cloud technologies across various sectors such as healthcare, finance, and education.

What challenges does the Qatar Cloud Managed Services Market face?

Challenges in the Qatar Cloud Managed Services Market include concerns over data security and privacy, regulatory compliance issues, and the need for skilled professionals to manage complex cloud environments. These factors can hinder the adoption of cloud services by some organizations.

What opportunities exist in the Qatar Cloud Managed Services Market?

Opportunities in the Qatar Cloud Managed Services Market include the growing trend of remote work, which increases the demand for cloud solutions, and the potential for innovation in areas like artificial intelligence and machine learning. These trends can lead to new service offerings and enhanced customer experiences.

What trends are shaping the Qatar Cloud Managed Services Market?

Trends shaping the Qatar Cloud Managed Services Market include the shift towards hybrid cloud solutions, increased focus on cybersecurity measures, and the integration of advanced technologies such as IoT and big data analytics. These trends are driving the evolution of cloud services to meet changing business needs.

Qatar Cloud Managed Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Infrastructure as a Service, Platform as a Service, Software as a Service, Disaster Recovery as a Service |

| Deployment Model | Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud |

| End User | Government, Healthcare, Education, Retail |

| Industry Vertical | Telecommunications, BFSI, Manufacturing, Transportation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Cloud Managed Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at