444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Qatar bakery products market represents a dynamic and rapidly evolving sector within the nation’s food and beverage industry. Market dynamics indicate substantial growth driven by increasing urbanization, changing consumer preferences, and rising disposable income levels. The market encompasses a diverse range of products including bread, pastries, cakes, cookies, and traditional Middle Eastern baked goods that cater to both local and expatriate populations.

Consumer demand for premium bakery products has witnessed remarkable expansion, with growth rates reaching 8.2% annually across various product categories. The market benefits from Qatar’s strategic position as a regional hub and its commitment to food security initiatives. Demographic shifts and lifestyle changes have created new opportunities for innovative bakery solutions, particularly in the convenience and health-conscious segments.

Infrastructure development and retail expansion have significantly enhanced market accessibility, with modern bakeries and specialty stores proliferating across urban centers. The market demonstrates strong resilience and adaptability, incorporating both traditional Arabic baking techniques and contemporary international trends to meet diverse consumer expectations.

The Qatar bakery products market refers to the comprehensive ecosystem of businesses, manufacturers, retailers, and service providers engaged in the production, distribution, and sale of baked goods within Qatar’s borders. This market encompasses both commercial bakery operations and artisanal establishments that serve the country’s diverse population with various bread products, pastries, confectionery items, and specialty baked goods.

Market scope includes traditional Arabic breads such as khubz and manakish, international bread varieties, sweet and savory pastries, celebration cakes, and innovative fusion products that blend Middle Eastern flavors with global baking trends. The definition extends to encompass the entire value chain from raw material sourcing and processing to final consumer delivery through multiple retail channels.

Industry classification covers industrial bakeries, boutique bakeries, in-store bakery departments within supermarkets, and specialized confectionery shops. The market also includes supporting services such as equipment suppliers, ingredient distributors, and packaging solutions providers that contribute to the overall bakery ecosystem in Qatar.

Market performance in Qatar’s bakery products sector demonstrates exceptional growth momentum, driven by robust economic conditions and evolving consumer preferences. The industry has successfully adapted to changing demographics while maintaining strong connections to traditional baking heritage. Key growth drivers include population expansion, tourism development, and increasing demand for premium and artisanal products.

Competitive landscape features a healthy mix of established regional players and emerging local brands, creating dynamic market conditions that foster innovation and quality improvements. The sector benefits from government support for food security initiatives and local manufacturing development. Consumer trends indicate growing preference for healthy, organic, and specialty dietary options, with 35% of consumers actively seeking healthier bakery alternatives.

Market segmentation reveals strong performance across multiple categories, with bread products maintaining the largest share while pastries and confectionery items show the highest growth rates. The market demonstrates resilience through economic cycles and continues to attract investment in modern production facilities and retail expansion projects.

Strategic analysis reveals several critical insights that define the Qatar bakery products market landscape:

Population growth serves as the primary catalyst for market expansion, with Qatar’s demographic profile showing consistent upward trends. The influx of expatriate workers and their families creates sustained demand for diverse bakery products that cater to various cultural preferences and dietary requirements. Economic prosperity and rising disposable income levels enable consumers to explore premium and specialty bakery options.

Tourism development significantly contributes to market growth, as international visitors seek both familiar and local bakery experiences. The hospitality sector’s expansion creates substantial demand for high-quality bakery products across hotels, restaurants, and catering services. Infrastructure improvements and retail modernization facilitate better product distribution and market accessibility.

Cultural integration between traditional Arabic baking traditions and international influences generates innovative product offerings that appeal to diverse consumer segments. Health and wellness trends drive demand for nutritious bakery alternatives, while convenience-focused lifestyles increase consumption of portable and ready-to-eat products. Government initiatives supporting food security and local manufacturing create favorable conditions for industry growth and investment.

Raw material costs present ongoing challenges for bakery operators, particularly given Qatar’s reliance on imported ingredients and fluctuating global commodity prices. Supply chain vulnerabilities can impact production consistency and profit margins, especially for smaller bakery businesses. Skilled labor shortages in specialized baking techniques create operational constraints and increase training costs for establishments seeking to maintain quality standards.

Regulatory complexity surrounding food safety, halal certification, and import requirements can create barriers for new market entrants and increase compliance costs for existing operators. Seasonal demand fluctuations require careful inventory management and can lead to waste issues during slower periods. Competition intensity from both local and international players puts pressure on pricing strategies and market positioning.

Climate challenges related to extreme heat and humidity can affect product quality and storage requirements, necessitating additional investment in climate-controlled facilities. Consumer price sensitivity in certain segments limits premium positioning opportunities, while changing dietary trends may reduce demand for traditional high-calorie bakery products. Economic uncertainties and global market volatility can impact consumer spending patterns and business investment decisions.

Health-focused innovation presents substantial opportunities for developing nutritious bakery products that align with growing wellness trends. The market shows strong potential for gluten-free, low-sugar, and protein-enriched options that cater to health-conscious consumers. E-commerce expansion offers new channels for reaching customers and building direct relationships through online ordering and delivery services.

Artisanal positioning creates opportunities for premium pricing and brand differentiation through handcrafted, small-batch production methods. The growing expatriate population provides opportunities for introducing authentic international bakery traditions and fusion concepts. Corporate catering and B2B services represent underexplored segments with significant growth potential in Qatar’s expanding business environment.

Sustainability initiatives offer competitive advantages through eco-friendly packaging, waste reduction programs, and locally-sourced ingredients. Technology integration opportunities include automated production systems, mobile ordering apps, and customer loyalty programs. Export potential to neighboring GCC countries leverages Qatar’s strategic location and quality reputation. Franchise development and brand licensing present scalable growth models for successful bakery concepts.

Supply and demand dynamics in Qatar’s bakery products market reflect the complex interplay between diverse consumer preferences and production capabilities. Market forces demonstrate strong demand elasticity, with consumers showing willingness to pay premium prices for quality and convenience. Competitive dynamics foster continuous innovation and service improvements as businesses strive to differentiate their offerings.

Seasonal patterns significantly influence market dynamics, with peak demand periods during Ramadan, Eid celebrations, and major cultural events creating opportunities for specialized products and increased sales volumes. According to MarkWide Research analysis, seasonal variations can represent up to 40% fluctuation in certain product categories. Price dynamics reflect input cost pressures balanced against consumer value expectations.

Distribution dynamics continue evolving with the expansion of modern retail formats and the emergence of online delivery platforms. Market consolidation trends show larger players acquiring smaller operations to achieve economies of scale, while niche players focus on specialized segments. Innovation cycles accelerate as businesses respond to changing consumer preferences and competitive pressures through new product development and service enhancements.

Primary research methodologies employed comprehensive data collection through structured interviews with industry stakeholders, including bakery owners, suppliers, distributors, and consumers across Qatar’s major urban centers. Field surveys and observational studies provided insights into consumer behavior patterns, purchasing preferences, and market trends. Expert consultations with industry professionals and regulatory authorities enhanced understanding of market dynamics and future prospects.

Secondary research incorporated analysis of government statistics, trade publications, industry reports, and regulatory documents to establish market context and validate primary findings. Data triangulation techniques ensured accuracy and reliability of market insights through cross-referencing multiple information sources. Quantitative analysis utilized statistical modeling to project market trends and identify growth opportunities.

Market segmentation analysis employed demographic, psychographic, and behavioral criteria to identify distinct consumer groups and their specific needs. Competitive intelligence gathering included analysis of pricing strategies, product portfolios, and market positioning approaches. Trend analysis incorporated global bakery industry developments and their potential impact on the Qatar market, ensuring comprehensive coverage of relevant factors influencing market evolution.

Doha metropolitan area dominates the Qatar bakery products market, accounting for approximately 75% of total consumption due to its high population density and concentration of commercial activities. The capital region features the most diverse range of bakery offerings, from traditional Arabic bakeries to international chains and artisanal establishments. Consumer sophistication in Doha drives demand for premium and specialty products.

Northern regions including Al Rayyan and Umm Salal show growing market potential as residential development expands and new communities establish. These areas demonstrate increasing demand for neighborhood bakeries and convenience-focused products. Industrial areas such as Mesaieed and Ras Laffan create specific demand patterns tied to workforce requirements and shift schedules.

Coastal regions benefit from tourism-related demand, particularly during peak travel seasons when hotels and resorts require increased bakery product supplies. The Pearl Qatar and Lusail City represent emerging high-value markets with affluent residents seeking premium bakery experiences. Rural areas maintain preference for traditional bread products while gradually adopting modern bakery offerings as accessibility improves through retail expansion.

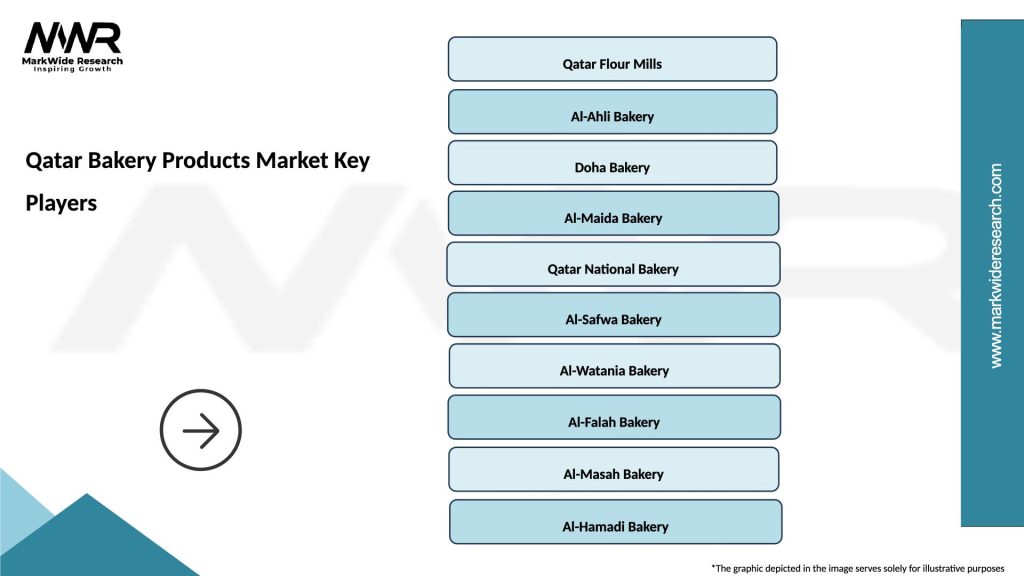

Market leadership is distributed among several key players who have established strong positions through different strategic approaches:

Competitive strategies vary significantly, with established players focusing on brand recognition and operational efficiency while newer entrants emphasize innovation and niche positioning. Market competition intensifies through promotional activities, loyalty programs, and strategic location selection.

By Product Type:

By Distribution Channel:

Bread category maintains market dominance through consistent daily consumption patterns and cultural significance in Middle Eastern cuisine. Traditional Arabic breads like khubz and pita show steady demand, while international varieties gain popularity among expatriate communities. Innovation opportunities exist in health-focused formulations and convenience packaging.

Pastry segment demonstrates the highest growth potential, driven by increasing breakfast-on-the-go consumption and afternoon tea culture adoption. French pastries and croissants appeal to affluent consumers, while Middle Eastern pastries like ma’amoul maintain cultural relevance. Seasonal demand for pastries peaks during Ramadan and holiday periods.

Cake and dessert category benefits from celebration culture and social gatherings, with custom cakes commanding premium pricing. Growing demand for individual portion desserts reflects changing lifestyle patterns and portion control awareness. Decoration trends and social media influence drive innovation in visual appeal and presentation.

Cookie segment shows strong performance in gift markets and impulse purchases, with traditional Arabic cookies competing alongside international brands. Health-conscious formulations and premium packaging create differentiation opportunities. Export potential exists for authentic Qatari and regional cookie specialties.

Manufacturers and Producers benefit from growing market demand, diverse consumer base, and premium pricing opportunities for quality products. Access to modern production facilities and technology enables efficiency improvements and capacity expansion. Government support for local manufacturing and food security initiatives provides favorable operating conditions.

Retailers and Distributors gain from expanding consumer base and increasing per-capita consumption of bakery products. Multiple distribution channels and growing e-commerce adoption create new revenue streams. Strategic partnerships with suppliers and manufacturers enable competitive positioning and margin optimization.

Consumers enjoy increased product variety, improved quality standards, and convenient access through multiple retail channels. Competitive market conditions result in better value propositions and innovative product offerings. Cultural diversity in product selection meets varied taste preferences and dietary requirements.

Investors and Financial Institutions find attractive opportunities in a growing market with strong fundamentals and government support. Stable economic conditions and population growth provide confidence in long-term returns. Franchise opportunities and brand licensing offer scalable investment models with proven concepts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration represents the most significant trend reshaping Qatar’s bakery products market. Consumers increasingly seek products with functional benefits, driving demand for whole grain, high-protein, and nutrient-enriched options. Clean label trends emphasize natural ingredients and transparent production processes, with 42% of consumers actively reading ingredient lists before purchasing.

Artisanal and craft positioning gains momentum as consumers value handmade quality and unique flavor profiles over mass-produced alternatives. Small-batch production methods and traditional techniques create premium positioning opportunities. Customization trends enable personalized products for special occasions and dietary requirements.

Digital transformation accelerates across the industry, with online ordering platforms, mobile apps, and social media marketing becoming essential business tools. Sustainability consciousness influences packaging choices and sourcing decisions, with eco-friendly options gaining consumer preference. Fusion cuisine trends blend traditional Arabic flavors with international baking techniques, creating innovative product categories that appeal to diverse consumer segments.

Technology adoption has accelerated significantly, with major bakeries investing in automated production lines and quality control systems to improve efficiency and consistency. MWR data indicates that technology investments increased by 28% among leading bakery operations. Digital point-of-sale systems and inventory management software enhance operational capabilities.

Sustainability initiatives gain prominence as businesses implement waste reduction programs, energy-efficient equipment, and eco-friendly packaging solutions. Several major players have launched comprehensive sustainability programs addressing environmental impact and social responsibility. Supply chain optimization efforts focus on local sourcing partnerships and regional ingredient procurement.

Market consolidation continues with strategic acquisitions and partnerships among key players seeking to expand market share and operational efficiency. New product launches emphasize health-conscious formulations and premium positioning. Regulatory developments include enhanced food safety standards and streamlined halal certification processes that benefit compliant operators while creating barriers for non-compliant businesses.

Strategic positioning should focus on differentiation through quality, innovation, and customer experience rather than competing solely on price. Businesses should invest in understanding diverse consumer segments and developing targeted product offerings that meet specific cultural and dietary preferences. Brand building efforts should emphasize authenticity, quality assurance, and consistent customer satisfaction.

Operational excellence requires investment in modern equipment, staff training, and quality control systems to ensure consistent product standards and efficient production processes. Supply chain diversification can reduce dependency risks while strategic partnerships with local suppliers support sustainability goals. Technology integration should prioritize customer-facing applications and operational efficiency improvements.

Market expansion strategies should consider geographic diversification within Qatar and potential regional export opportunities. E-commerce capabilities and delivery services represent essential growth channels requiring dedicated investment and expertise. Innovation focus should align with health and wellness trends while maintaining cultural relevance and taste preferences. Businesses should develop comprehensive sustainability programs that resonate with environmentally conscious consumers.

Market trajectory indicates continued robust growth driven by demographic expansion, economic prosperity, and evolving consumer preferences. The industry is positioned for sustained development through 2030, with particular strength in premium and health-focused segments. Innovation acceleration will likely focus on functional ingredients, sustainable packaging, and personalized nutrition solutions.

Competitive evolution suggests increasing market sophistication with successful players differentiating through brand strength, operational efficiency, and customer loyalty. Technology adoption will become increasingly critical for maintaining competitive advantage. MarkWide Research projects that digital integration levels will reach 85% penetration among major bakery operations by 2028.

Consumer behavior trends indicate growing sophistication and willingness to pay premium prices for quality, convenience, and health benefits. Sustainability considerations will increasingly influence purchasing decisions, while cultural authenticity remains important for traditional product categories. Market maturation will likely lead to consolidation among smaller players while creating opportunities for innovative niche concepts and specialized offerings.

Qatar’s bakery products market demonstrates exceptional growth potential supported by strong economic fundamentals, diverse consumer demographics, and evolving lifestyle preferences. The market successfully balances traditional cultural elements with modern consumer demands, creating opportunities for both established players and innovative new entrants. Strategic success requires understanding of local preferences, commitment to quality, and adaptation to changing consumer trends.

Industry outlook remains highly positive, with multiple growth drivers supporting sustained expansion across various product categories and distribution channels. The market’s resilience and adaptability position it well for continued development despite potential challenges from economic volatility and competitive pressures. Investment opportunities exist across the value chain, from production and retail to technology and sustainability initiatives.

Future success will depend on businesses’ ability to innovate while maintaining quality standards, embrace digital transformation, and develop sustainable operational practices. The Qatar bakery products market represents a dynamic and rewarding sector for stakeholders committed to excellence, innovation, and customer satisfaction in serving one of the region’s most prosperous and diverse consumer markets.

What is Bakery Products?

Bakery products refer to a variety of food items made from flour and other ingredients, typically baked in an oven. This includes bread, pastries, cakes, and cookies, which are staples in many diets and cultures.

What are the key players in the Qatar Bakery Products Market?

Key players in the Qatar Bakery Products Market include Qatar Flour Mills, Al Meera Consumer Goods Company, and Doha Bakery, among others. These companies are known for their diverse range of bakery products catering to local tastes and preferences.

What are the growth factors driving the Qatar Bakery Products Market?

The Qatar Bakery Products Market is driven by factors such as increasing urbanization, a growing population, and rising consumer demand for convenience foods. Additionally, the trend towards healthier options is influencing product development in the market.

What challenges does the Qatar Bakery Products Market face?

Challenges in the Qatar Bakery Products Market include fluctuating raw material prices and competition from imported products. Additionally, maintaining product quality and meeting consumer expectations can be demanding for local producers.

What opportunities exist in the Qatar Bakery Products Market?

Opportunities in the Qatar Bakery Products Market include the potential for innovation in gluten-free and organic products, as well as expanding distribution channels. The growing trend of online shopping also presents new avenues for reaching consumers.

What trends are shaping the Qatar Bakery Products Market?

Trends in the Qatar Bakery Products Market include a shift towards artisanal and specialty baked goods, as well as an increased focus on sustainability in packaging. Additionally, the incorporation of local flavors and ingredients is becoming more popular among consumers.

Qatar Bakery Products Market

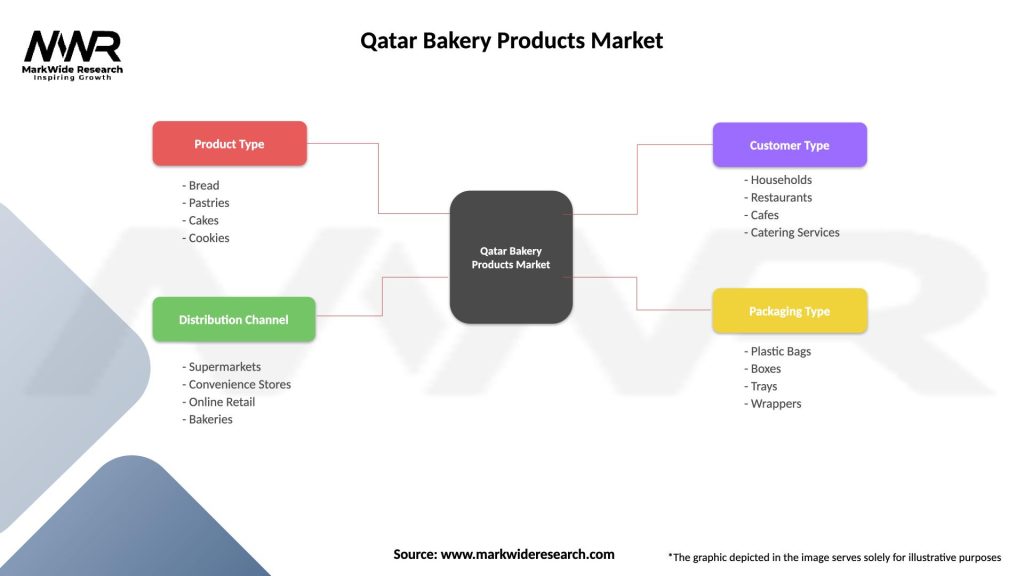

| Segmentation Details | Description |

|---|---|

| Product Type | Bread, Pastries, Cakes, Cookies |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Bakeries |

| Customer Type | Households, Restaurants, Cafes, Catering Services |

| Packaging Type | Plastic Bags, Boxes, Trays, Wrappers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Qatar Bakery Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at