444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The proximity sensors market has been experiencing steady growth in recent years. Proximity sensors are devices that can detect the presence or absence of an object within a certain range without any physical contact. These sensors use various technologies such as electromagnetic, capacitive, inductive, and others to detect the proximity of objects. They are widely used in industries such as automotive, aerospace, manufacturing, and food and beverage, among others. The increasing demand for automation and the need for reliable and efficient object detection systems are driving the growth of the proximity sensors market.

Meaning

Proximity sensors are electronic devices that can detect the presence or absence of an object within a specified distance without the need for physical contact. These sensors work by emitting a signal, such as an electromagnetic field or a beam of light, and measuring the reflection or interruption of that signal when an object enters the proximity of the sensor. The sensor then generates an output signal that can be used to trigger an action, such as activating a switch or initiating a process. Proximity sensors are widely used in various industries for applications such as object detection, automation, and safety systems.

Executive Summary

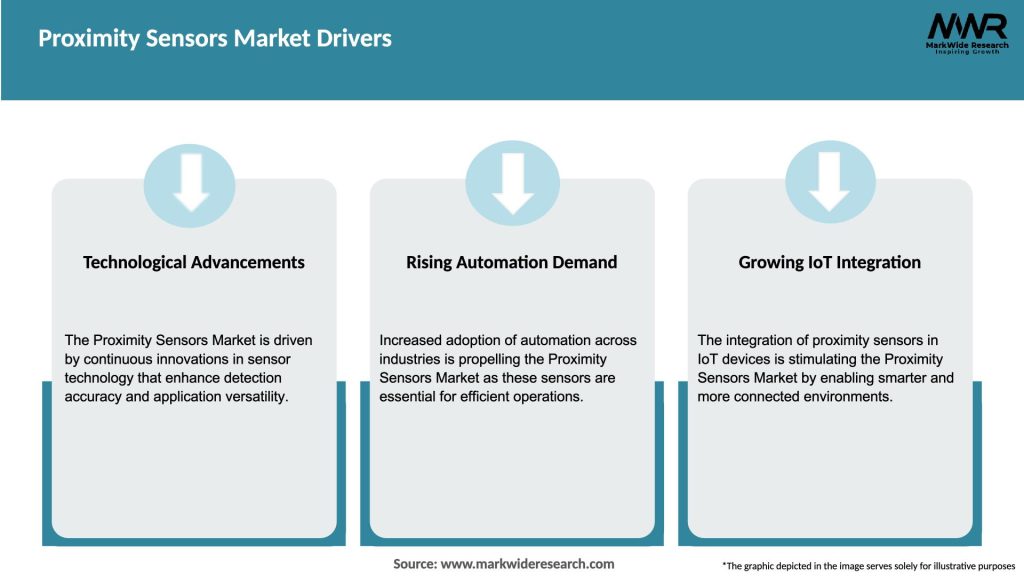

The proximity sensors market is witnessing significant growth due to the increasing adoption of automation in various industries. Proximity sensors offer several advantages over traditional contact-based sensors, such as higher reliability, faster response times, and lower maintenance requirements. These factors have led to their widespread use in industries such as automotive, manufacturing, and consumer electronics. The market is expected to continue its upward trajectory in the coming years, driven by advancements in sensor technologies, rising demand for IoT-enabled devices, and the growing trend of smart manufacturing.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the proximity sensors market:

Market Restraints

Despite the positive market growth, certain factors are restraining the growth of the proximity sensors market:

Market Opportunities

The proximity sensors market presents several opportunities for growth and innovation:

Market Dynamics

The proximity sensors market is driven by a combination of industry trends, technological advancements, and market dynamics. Key factors influencing the market dynamics include the increasing adoption of automation, advancements in sensor technologies, the rise of IoT-enabled devices, and the growing focus on safety systems. The market is characterized by intense competition, with key players focusing on product innovation, strategic partnerships, and mergers and acquisitions to gain a competitive edge. Additionally, the market is witnessing the entry of new players, which is expected to intensify the competition further.

Regional Analysis

The proximity sensors market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific is expected to dominate the market during the forecast period due to the presence of a large number of manufacturing and automotive industries in countries like China, Japan, and South Korea. The region’s strong focus on industrial automation and the growing adoption of IoT-enabled devices are driving the demand for proximity sensors. North America and Europe are also significant markets for proximity sensors, driven by the presence of key players and technological advancements in sensor technologies. Latin America and the Middle East and Africa are expected to witness steady growth due to the increasing industrialization and infrastructure development in these regions.

Competitive Landscape

Leading companies in the Proximity Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

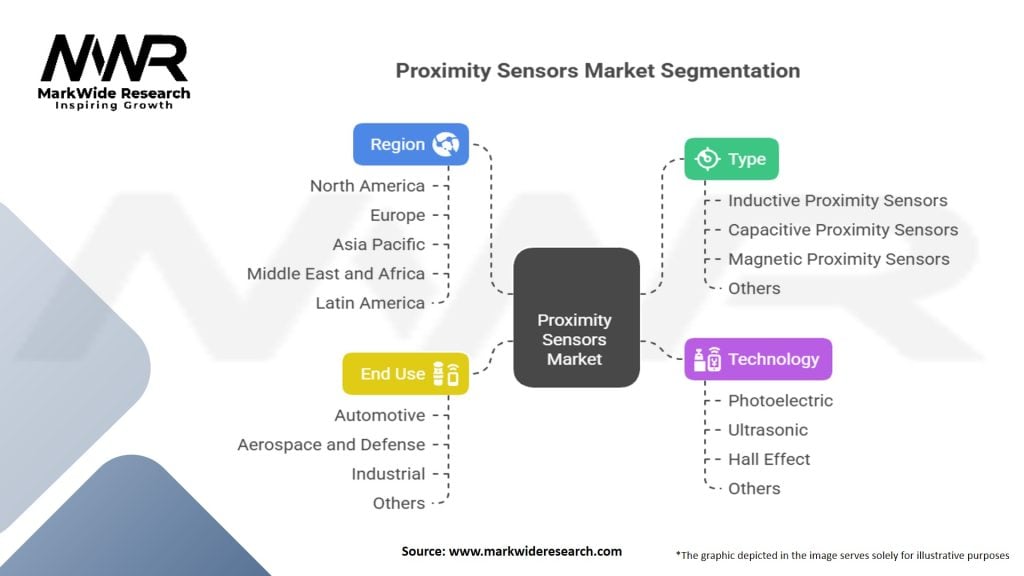

The proximity sensors market can be segmented based on technology, type, end-use industry, and region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the proximity sensors market provides an overview of the strengths, weaknesses, opportunities, and threats associated with the market:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the proximity sensors market. The initial phase of the pandemic resulted in disruptions in the global supply chain and manufacturing activities, leading to a decline in the demand for proximity sensors. However, as industries started recovering and adapting to the new normal, the demand for proximity sensors witnessed a rebound. The growing focus on automation, contactless operations, and safety measures in the post-pandemic scenario has accelerated the adoption of proximity sensors across various industries. The pandemic has highlighted the importance of proximity sensors in enabling touchless interactions, social distancing compliance, and efficient operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the proximity sensors market looks promising, with significant growth opportunities on the horizon. Advancements in sensor technologies, increasing adoption of automation, and the proliferation of IoT-enabled devices are expected to drive the market growth. The demand for proximity sensors is likely to witness a surge in industries such as automotive, manufacturing, aerospace, and consumer electronics. The market is expected to witness increased competition, leading to product innovations, collaborations, and strategic partnerships among key players. Emerging markets are expected to offer growth prospects, driven by industrialization and infrastructure development. Overall, the proximity sensors market is poised for steady growth in the coming years.

Conclusion

The proximity sensors market is experiencing steady growth due to the increasing adoption of automation and the demand for reliable and efficient object detection systems. Proximity sensors are widely used in industries such as automotive, manufacturing, aerospace, and food and beverage, among others. The market is driven by factors such as advancements in sensor technologies, rising demand for IoT-enabled devices, and the focus on safety systems.

The market offers opportunities for industry participants and stakeholders through product innovation, expansion into emerging markets, and strategic collaborations. However, challenges such as the high cost of advanced sensors and lack of standardization need to be addressed. The future of the proximity sensors market looks promising, with advancements in technology and increasing industrial automation driving market growth.

What are proximity sensors?

Proximity sensors are devices that detect the presence or absence of an object within a certain range without physical contact. They are widely used in various applications, including industrial automation, automotive systems, and consumer electronics.

What are the key companies in the Proximity Sensors Market?

Key companies in the Proximity Sensors Market include Omron Corporation, Honeywell International Inc., Siemens AG, and Texas Instruments, among others.

What are the main drivers of growth in the Proximity Sensors Market?

The main drivers of growth in the Proximity Sensors Market include the increasing demand for automation in manufacturing, the rise of smart home technologies, and the growing need for safety and security systems in various industries.

What challenges does the Proximity Sensors Market face?

The Proximity Sensors Market faces challenges such as the high cost of advanced sensors, competition from alternative sensing technologies, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the Proximity Sensors Market?

Opportunities in the Proximity Sensors Market include the expansion of the Internet of Things (IoT), advancements in sensor technology, and increasing applications in sectors like healthcare and automotive.

What trends are shaping the Proximity Sensors Market?

Trends shaping the Proximity Sensors Market include the integration of artificial intelligence for enhanced sensing capabilities, the development of miniaturized sensors for compact devices, and the growing focus on energy-efficient solutions.

Proximity Sensors Market

| Segmentation | Details |

|---|---|

| Type | Inductive Proximity Sensors, Capacitive Proximity Sensors, Magnetic Proximity Sensors, Others |

| Technology | Photoelectric, Ultrasonic, Hall Effect, Others |

| End Use | Automotive, Aerospace and Defense, Industrial, Others |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Proximity Sensors Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at