444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The private motor insurance market serves as a cornerstone of the insurance industry, providing essential coverage for individuals and families against risks associated with owning and operating motor vehicles. Private motor insurance policies offer financial protection against damages, losses, and liabilities arising from accidents, theft, natural disasters, and other unforeseen events involving private cars, motorcycles, and other personal vehicles. With millions of vehicles on the road globally, private motor insurance plays a crucial role in safeguarding the financial well-being of vehicle owners and ensuring compliance with legal requirements.

Meaning

Private motor insurance, also known as auto insurance or car insurance, refers to a type of insurance policy designed to protect individuals and families against financial losses resulting from accidents, theft, or damages involving their personal vehicles. These insurance policies typically provide coverage for physical damage to the insured vehicle, bodily injury or property damage liability to third parties, medical expenses, and other related expenses. Private motor insurance is a legal requirement in many countries, mandating vehicle owners to have minimum insurance coverage to operate their vehicles legally on public roads.

Executive Summary

The private motor insurance market is a fundamental component of the insurance industry, offering essential coverage for individuals and families who own and operate motor vehicles. These insurance policies provide financial protection against a wide range of risks, including accidents, theft, vandalism, and natural disasters, ensuring peace of mind and financial security for vehicle owners. Despite facing challenges such as regulatory changes, market competition, and technological disruptions, the private motor insurance market continues to witness steady growth driven by factors such as increasing vehicle ownership, urbanization, and economic development. Understanding the key market insights, drivers, restraints, and opportunities is essential for insurers and stakeholders to navigate the dynamic landscape of private motor insurance effectively.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The private motor insurance market operates within a dynamic environment influenced by factors such as economic conditions, regulatory changes, technological advancements, consumer preferences, and competitive pressures. These dynamics shape market behavior, product innovation, distribution strategies, and customer engagement approaches, requiring insurers to adapt, innovate, and differentiate themselves effectively to succeed in the marketplace.

Regional Analysis

The private motor insurance market exhibits regional variations influenced by factors such as economic development, regulatory frameworks, vehicle ownership rates, insurance penetration levels, and cultural preferences. While mature markets such as North America and Europe have well-established private motor insurance ecosystems, emerging markets in Asia-Pacific, Latin America, and Africa offer growth opportunities driven by increasing vehicle ownership, urbanization, and rising middle-class populations.

Competitive Landscape

Leading Companies in the Private Motor Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

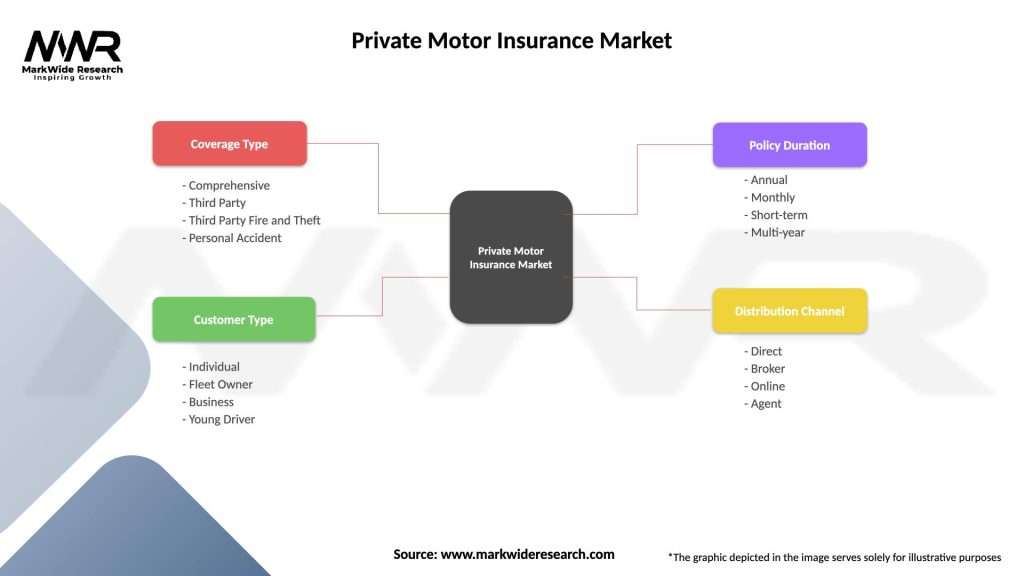

Segmentation

The private motor insurance market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants

SWOT Analysis

A SWOT analysis of the private motor insurance market reveals:

Understanding these factors enables insurers and stakeholders to capitalize on strengths, address weaknesses, seize opportunities, and mitigate threats effectively, driving sustainable growth and value creation in the private motor insurance market.

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significant implications for the private motor insurance market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The private motor insurance market is poised for continued growth and innovation, driven by factors such as increasing vehicle ownership, regulatory mandates, technological advancements, and changing consumer preferences. Despite facing challenges such as premium affordability concerns, claims experience challenges, and regulatory constraints, the market offers opportunities for insurers and stakeholders to innovate, collaborate, and differentiate themselves effectively. By understanding key market insights, drivers, restraints, and opportunities, insurers can navigate the dynamic landscape of private motor insurance, capitalize on emerging trends, and drive sustainable growth, innovation, and value creation in the future.

Conclusion

The private motor insurance market serves as a critical pillar of the insurance industry, providing essential coverage and financial protection for vehicle owners against risks associated with owning and operating personal vehicles. Despite facing challenges such as premium affordability concerns, claims experience challenges, and regulatory constraints, the market continues to witness steady growth and innovation, driven by factors such as increasing vehicle ownership, regulatory mandates, technological advancements, and changing consumer preferences. By understanding key market insights, drivers, restraints, and opportunities, insurers and stakeholders can navigate the dynamic landscape of private motor insurance effectively, drive sustainable growth and innovation, and ensure financial security and peace of mind for vehicle owners and consumers alike.

What is Private Motor Insurance?

Private Motor Insurance refers to coverage that protects individuals against financial loss in the event of accidents, theft, or damage to their personal vehicles. It typically includes liability, collision, and comprehensive coverage options.

What are the key players in the Private Motor Insurance Market?

Key players in the Private Motor Insurance Market include companies like State Farm, Allstate, and Geico, which offer a range of policies tailored to individual needs. These companies compete on factors such as pricing, customer service, and coverage options, among others.

What are the main drivers of growth in the Private Motor Insurance Market?

The growth of the Private Motor Insurance Market is driven by increasing vehicle ownership, rising awareness of road safety, and the growing need for financial protection against accidents. Additionally, advancements in technology are enabling more personalized insurance solutions.

What challenges does the Private Motor Insurance Market face?

The Private Motor Insurance Market faces challenges such as regulatory changes, increasing competition, and the impact of climate change on vehicle damage. These factors can lead to fluctuating premiums and affect overall market stability.

What opportunities exist in the Private Motor Insurance Market?

Opportunities in the Private Motor Insurance Market include the integration of telematics for usage-based insurance, the rise of electric vehicles, and the potential for innovative coverage options tailored to new consumer behaviors. These trends can enhance customer engagement and satisfaction.

What trends are shaping the Private Motor Insurance Market?

Trends in the Private Motor Insurance Market include the increasing use of digital platforms for policy management, the rise of on-demand insurance products, and a focus on sustainability in underwriting practices. These trends reflect changing consumer preferences and technological advancements.

Private Motor Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Comprehensive, Third Party, Third Party Fire and Theft, Personal Accident |

| Customer Type | Individual, Fleet Owner, Business, Young Driver |

| Policy Duration | Annual, Monthly, Short-term, Multi-year |

| Distribution Channel | Direct, Broker, Online, Agent |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Private Motor Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at