444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Private Equity Market is a dynamic and influential sector within the global financial landscape, involving the investment of capital in privately held companies or the acquisition of public companies with the goal of achieving high returns. This market overview provides insight into the intricate world of private equity, offering an executive summary, key market insights, analysis of market drivers, restraints, and opportunities, and an exploration of market dynamics. Additionally, we examine regional considerations, the competitive landscape, segmentation, category-specific insights, and key benefits for industry participants and stakeholders. A SWOT analysis, insights into market trends, and an assessment of future outlook shed light on the evolving nature of the Private Equity Market.

Meaning

The Private Equity Market encompasses a broad spectrum of financial activities involving the investment of capital in privately held businesses or the acquisition of public companies to take them private. It is characterized by the use of equity, rather than debt, to fund investments. Private equity firms typically work closely with portfolio companies to improve their operations, drive growth, and ultimately enhance their value.

Executive Summary

The Private Equity Market is a dynamic and influential segment of the global financial industry, characterized by strategic investments in companies with the goal of generating substantial returns. This market overview highlights the key facets and significance of private equity within the broader financial landscape. The Private Equity Market encompasses a diverse array of investment strategies, ranging from venture capital to buyouts and impact investing. It thrives within a cyclical economic environment, capitalizing on opportunities during different economic phases while navigating regulatory complexities and fierce competition. Key market insights have highlighted the industry’s role in nurturing entrepreneurship, fostering innovation, and supporting responsible investments. The diversity of investment strategies and the market’s adaptability make it a powerful driver of economic development.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several key drivers are contributing to the growth of the Private Equity Market:

Market Restraints

Despite its growth, the Private Equity Market faces several challenges:

Market Opportunities

The Private Equity Market offers several growth opportunities for investors and firms:

Market Dynamics

Several dynamics are influencing the evolution of the Private Equity Market:

Regional Analysis

The Private Equity Market in Europe is diverse, with different regions exhibiting unique investment dynamics:

Competitive Landscape

Leading companies in the Private Equity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

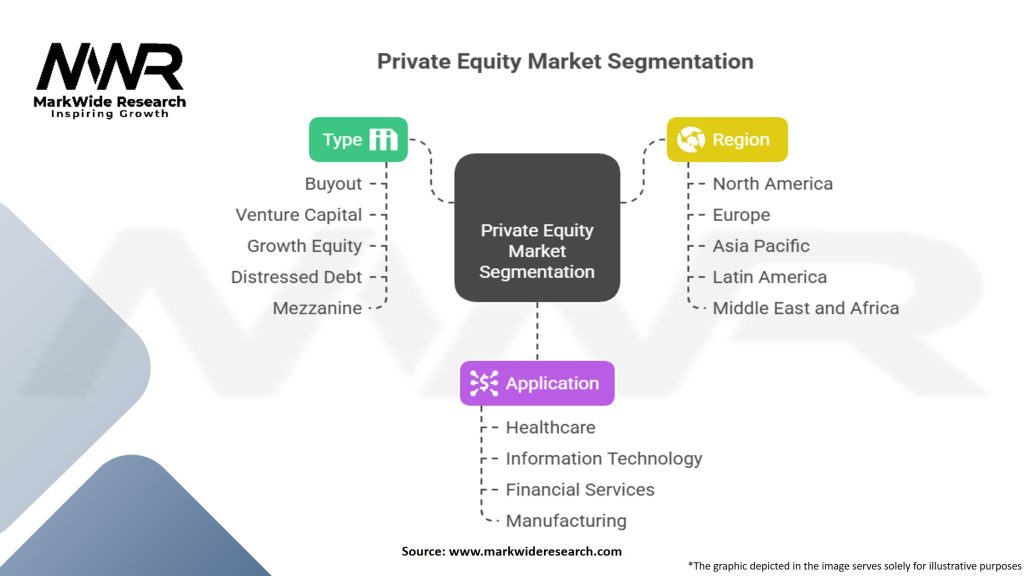

Segmentation

The Private Equity Market can be segmented based on various factors:

Category-wise Insights

Each segment of private equity offers unique investment strategies and market opportunities:

Key Benefits for Industry Participants and Stakeholders

Private equity offers numerous benefits, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic accelerated the adoption of technology-driven investment strategies, with private equity firms seeking opportunities in sectors such as healthcare, e-commerce, and technology. Additionally, firms are focusing more on risk management and restructuring opportunities due to economic uncertainties.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Private Equity Market remains positive, with continued access to substantial capital, a focus on technology-driven investments, and opportunities for global expansion. Challenges related to regulatory complexity, risk exposure, and market competition may persist but are balanced by the industry’s adaptability and commitment to innovation.

In a world where entrepreneurship, innovation, and responsible investing are highly valued, the Private Equity Market stands as a key driver of economic growth and value creation. Through its diverse investment strategies, commitment to sustainability, and ability to navigate evolving market dynamics, this market will continue to play a pivotal role in shaping the future of businesses and industries worldwide.

Conclusion

In conclusion, the Private Equity Market represents a dynamic and influential force within the global financial landscape, serving as a catalyst for innovation, entrepreneurship, and economic growth. This market overview has provided valuable insights into the intricate world of private equity, emphasizing its significance and multifaceted nature. Market drivers, including access to substantial capital, opportunities in innovation, and exit strategies, propel the Private Equity Market’s growth and activity. Challenges, such as regulatory complexities, risk factors, and market competition, require innovative solutions and strategic approaches.

Despite these challenges, the market offers promising opportunities, including investments in technology-driven companies, global expansion prospects, and the rise of impact investing. Technological advancements continue to shape the industry, enhancing due diligence, portfolio management, and risk assessment. Market trends, such as investments in technology-driven companies, the rise of impact investing, globalization, and evolving exit strategies, continue to shape the Private Equity Market’s evolution. Technological advancements remain a driving force, facilitating due diligence, portfolio management, and risk assessment. The future outlook for the market remains positive, with opportunities for growth and innovation. Challenges related to regulatory complexity, risk exposure, and competition are balanced by the industry’s adaptability and commitment to sustainable and responsible investing.

In a financial landscape where innovation, entrepreneurship, and social responsibility are paramount, the Private Equity Market stands as a vital driver of economic growth and value creation. Through its diverse investment strategies, commitment to sustainability, and ability to navigate evolving market dynamics, this market will continue to shape the future of businesses and industries worldwide, fostering a culture of innovation and responsible investing.

What is Private Equity?

Private equity refers to investment funds that buy and restructure companies that are not publicly traded. These investments typically involve acquiring a significant stake in a company to improve its operations and profitability before eventually selling it for a profit.

What are the key players in the Private Equity Market?

Key players in the private equity market include firms such as Blackstone, KKR, and Carlyle Group, which manage large funds and invest in various sectors. These companies often focus on buyouts, venture capital, and growth equity investments, among others.

What are the main drivers of growth in the Private Equity Market?

The main drivers of growth in the private equity market include the increasing availability of capital, the demand for higher returns from institutional investors, and the trend of companies seeking operational improvements through private equity investments. Additionally, the rise of technology and innovation sectors has created new opportunities for investment.

What challenges does the Private Equity Market face?

The private equity market faces challenges such as regulatory scrutiny, competition from other investment vehicles, and the difficulty of sourcing quality deals. Economic downturns can also impact the performance of portfolio companies, making it harder to achieve desired returns.

What opportunities exist in the Private Equity Market for the future?

Opportunities in the private equity market include investing in emerging technologies, healthcare innovations, and sustainable businesses. As companies increasingly focus on environmental, social, and governance (ESG) criteria, private equity firms can capitalize on this trend by supporting responsible investments.

What trends are shaping the Private Equity Market today?

Current trends in the private equity market include a growing interest in impact investing, increased focus on digital transformation, and the rise of specialized funds targeting niche sectors. Additionally, the integration of data analytics in investment strategies is becoming more prevalent among private equity firms.

Private Equity Market

| Segmentation Details | Details |

|---|---|

| Type | Buyout, Venture Capital, Growth Equity, Distressed Debt, Mezzanine, Others |

| Application | Healthcare, Information Technology, Financial Services, Manufacturing, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Private Equity Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at