444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Instant Redeemable Coupons (IRC) market serves as a critical component of promotional strategies, offering immediate discounts or incentives to consumers at the point of purchase. IRCs are commonly found attached to products or packaging, encouraging consumers to make on-the-spot purchases. This market’s significance lies in its ability to drive sales, enhance brand visibility, and foster customer loyalty through targeted promotions.

Meaning

Instant Redeemable Coupons (IRCs) are promotional tools designed to provide consumers with immediate incentives or discounts when purchasing a product. These coupons are typically affixed to product packaging or labels, allowing consumers to redeem them instantly at the point of purchase. IRCs serve as an effective means of stimulating impulse buys, boosting sales, and increasing brand engagement among consumers.

Executive Summary

The Instant Redeemable Coupons (IRC) market has experienced significant growth in recent years, driven by the increasing adoption of promotional strategies by businesses across various industries. This market offers numerous opportunities for brands to differentiate themselves, attract customers, and drive sales. However, it also presents challenges such as effective targeting, coupon fraud, and redemption tracking. Understanding key market insights and consumer behavior is crucial for businesses to leverage IRCs effectively and maximize their impact.

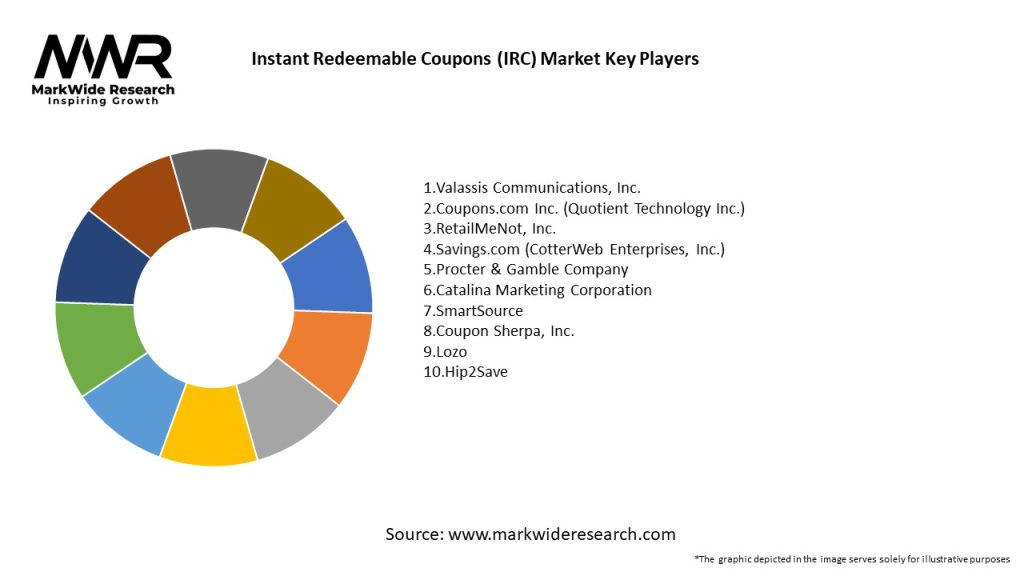

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Key insights driving the IRC market include:

Market Drivers

Drivers fueling the growth of the IRC market include:

Market Restraints

Challenges restraining market growth include:

Market Opportunities

Opportunities for growth in the IRC market include:

Market Dynamics

Dynamic factors shaping the IRC market include changing consumer preferences, technological advancements, regulatory developments, and competitive pressures. Businesses must adapt to these dynamics by leveraging data-driven insights, adopting innovative strategies, and maintaining agility in their promotional efforts.

Regional Analysis

Regional variations in consumer behavior, retail landscape, and regulatory environments influence the IRC market’s performance and growth potential. While developed markets like North America and Europe have mature couponing ecosystems, emerging markets in Asia Pacific and Latin America offer untapped opportunities for expansion.

Competitive Landscape

Leading Companies in the Instant Redeemable Coupons (IRC) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

Segmentation of the IRC market can be based on factors such as industry vertical, distribution channel, coupon type, and geographic region. Understanding the unique needs and preferences of target segments enables brands to tailor their couponing strategies for maximum effectiveness.

Category-wise Insights

IRC usage varies across different product categories and industries:

Key Benefits for Industry Participants and Stakeholders

Benefits of participating in the IRC market include:

SWOT Analysis

A SWOT analysis provides a holistic view of the IRC market’s strengths, weaknesses, opportunities, and threats, guiding strategic decision-making for industry participants.

Market Key Trends

Trends shaping the IRC market’s trajectory include:

Covid-19 Impact

The Covid-19 pandemic has influenced consumer behavior and spending patterns, impacting the IRC market in several ways:

Key Industry Developments

Recent developments in the IRC market include:

Analyst Suggestions

Recommendations for industry participants include:

Future Outlook

The IRC market is poised for continued growth, driven by factors such as consumer demand for savings, technological innovation, and evolving marketing strategies. Brands that can effectively leverage IRCs to engage with consumers and drive sales will be well-positioned to succeed in the dynamic retail landscape.

Conclusion

The Instant Redeemable Coupons (IRC) market presents significant opportunities for brands to connect with consumers, drive sales, and enhance brand loyalty. Despite challenges such as rising costs and coupon fraud, innovative strategies and technological advancements offer avenues for growth and differentiation. By staying abreast of market trends, leveraging data-driven insights, and embracing digital transformation, industry participants can capitalize on the potential of IRCs to achieve marketing objectives and drive business success.

What is Private Client Tax Services?

Private Client Tax Services refer to specialized tax advisory and compliance services tailored for high-net-worth individuals and families. These services often include tax planning, estate planning, and wealth management to optimize tax liabilities and ensure compliance with tax regulations.

What are the key players in the Private Client Tax Services Market?

Key players in the Private Client Tax Services Market include firms like Deloitte, PwC, and EY, which offer comprehensive tax solutions for affluent clients. Other notable companies include BDO and Grant Thornton, among others.

What are the growth factors driving the Private Client Tax Services Market?

The growth of the Private Client Tax Services Market is driven by increasing wealth among high-net-worth individuals, complex tax regulations, and the need for personalized tax strategies. Additionally, the rise in cross-border investments and estate planning requirements further fuels demand.

What challenges does the Private Client Tax Services Market face?

The Private Client Tax Services Market faces challenges such as evolving tax laws, increased scrutiny from tax authorities, and the complexity of international tax compliance. These factors can complicate service delivery and increase operational costs for tax service providers.

What opportunities exist in the Private Client Tax Services Market?

Opportunities in the Private Client Tax Services Market include the growing demand for digital tax solutions and the expansion of services into emerging markets. Additionally, the increasing focus on sustainable investing and ESG considerations presents new avenues for tax planning.

What trends are shaping the Private Client Tax Services Market?

Trends in the Private Client Tax Services Market include the integration of technology for tax compliance and planning, a shift towards holistic wealth management approaches, and an emphasis on personalized client experiences. These trends are reshaping how tax services are delivered to high-net-worth individuals.

Private Client Tax Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Tax Planning, Compliance, Advisory, Estate Planning |

| Client Type | High-Net-Worth Individuals, Families, Trusts, Corporations |

| Engagement Model | Retainer, Project-Based, Hourly, Subscription |

| Delivery Channel | In-Person, Online, Hybrid, Phone |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Private Client Tax Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at