444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The private blockchain distributed ledger market is witnessing substantial growth and garnering significant attention in recent years. Blockchain technology, known for its decentralized and immutable nature, has gained popularity across various industries. Private blockchain distributed ledgers, specifically designed for restricted access and control, have emerged as a preferred solution for organizations seeking secure and efficient data management systems. This market overview provides a comprehensive analysis of the private blockchain distributed ledger market, highlighting its meaning, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits, SWOT analysis, market key trends, the impact of Covid-19, key industry developments, analyst suggestions, future outlook, and a conclusive summary.

Meaning

Private blockchain distributed ledger refers to a decentralized digital ledger technology that enables organizations to record, validate, and manage data securely within a closed ecosystem. Unlike public blockchains that are open to anyone, private blockchains are permissioned networks where access is limited to authorized participants. This controlled access ensures increased privacy, confidentiality, and restricted governance within the network. Private blockchain distributed ledgers often find applications in industries such as finance, supply chain, healthcare, and government, where data security and trust are of utmost importance.

Executive Summary

The private blockchain distributed ledger market has witnessed remarkable growth in recent years due to the increasing need for secure and efficient data management systems across industries. The technology offers advantages such as enhanced data integrity, improved transparency, and reduced costs, driving its adoption. Organizations are recognizing the potential of private blockchains in streamlining operations, eliminating intermediaries, and mitigating risks. This executive summary provides a concise overview of the market, highlighting key trends, market drivers, and opportunities for industry participants.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The private blockchain distributed ledger market is experiencing dynamic changes driven by various factors. Technological advancements, regulatory developments, industry collaborations, and market competition significantly influence the market dynamics. Organizations must stay abreast of these dynamics to make informed decisions regarding private blockchain adoption and implementation.

Regional Analysis

The private blockchain distributed ledger market exhibits regional variations in terms of adoption, regulations, and industry focus. The analysis of regional markets provides insights into the current landscape and potential growth opportunities. Key regions considered in this analysis include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in Private Blockchain Distributed Ledger Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The private blockchain distributed ledger market can be segmented based on various factors such as industry verticals, end-users, and applications. Common segments include finance, healthcare, supply chain, government, and manufacturing. Segmenting the market allows for a deeper understanding of specific industry requirements and tailor-made solutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

The SWOT analysis provides an evaluation of the private blockchain distributed ledger market’s strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the private blockchain distributed ledger market. While it initially led to disruptions and uncertainties, it also highlighted the importance of secure and efficient data management systems. Organizations realized the need for resilient and transparent supply chains, secure healthcare data sharing, and efficient government services, driving the adoption of private blockchain distributed ledgers.

The pandemic accelerated digital transformation efforts across industries, leading to increased interest in blockchain technology. Organizations sought ways to enhance data security, streamline processes, and build trust among stakeholders. Private blockchain distributed ledgers, with their inherent benefits of security, transparency, and efficiency, emerged as a viable solution for post-pandemic recovery and resilience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the private blockchain distributed ledger market is optimistic, with significant growth potential across industries. As organizations recognize the advantages of enhanced data security, improved transparency, and streamlined processes, the adoption of private blockchain distributed ledgers is expected to increase.

Emerging technologies, such as AI and IoT, will further augment the capabilities of private blockchain distributed ledgers, enabling advanced analytics, automation, and interoperability. Standardization efforts and collaborations among industry players will drive innovation and facilitate seamless integration between different private blockchain networks.

Moreover, the post-pandemic recovery and the focus on resilient supply chains, secure healthcare data management, and efficient government services will continue to drive the demand for private blockchain distributed ledger solutions.

Conclusion

The private blockchain distributed ledger market is witnessing significant growth, driven by the need for secure and efficient data management systems. Private blockchains offer enhanced data security, streamlined transactions, cost reduction, and increased trust and transparency. While scalability, interoperability, and integration complexities pose challenges, the market presents opportunities in emerging economies, healthcare, government sectors, and supply chain management.

Industry participants and stakeholders can benefit from improved data security, efficiency, regulatory compliance, and enhanced collaboration through private blockchain adoption. The market’s future outlook is promising, with continued growth expected, driven by technological advancements, regulatory developments, and industry collaborations. Organizations should stay informed about market trends, evaluate use case suitability, and actively engage in standardization efforts to leverage the full potential of private blockchain distributed ledgers.

What is Private Blockchain Distributed Ledger?

Private Blockchain Distributed Ledger refers to a type of blockchain technology that restricts access to a select group of participants, allowing for greater control and privacy. It is commonly used in industries such as finance, supply chain management, and healthcare for secure and efficient data sharing.

What are the key companies in the Private Blockchain Distributed Ledger market?

Key companies in the Private Blockchain Distributed Ledger market include IBM, R3, Hyperledger, and ConsenSys, among others.

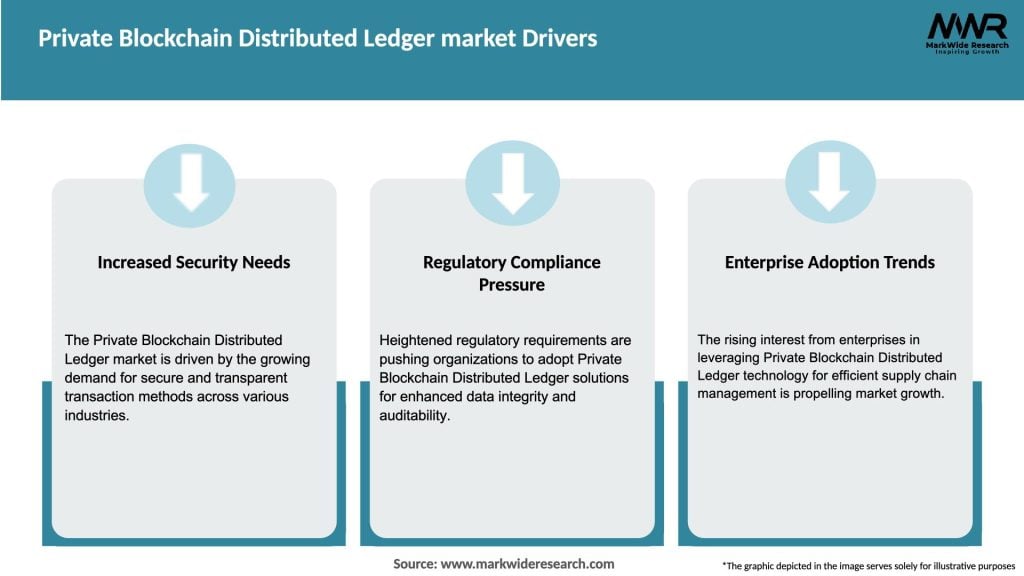

What are the main drivers of growth in the Private Blockchain Distributed Ledger market?

The main drivers of growth in the Private Blockchain Distributed Ledger market include the increasing demand for secure transactions, the need for transparency in supply chains, and the rising adoption of digital currencies across various sectors.

What challenges does the Private Blockchain Distributed Ledger market face?

Challenges in the Private Blockchain Distributed Ledger market include regulatory uncertainties, interoperability issues with existing systems, and the need for significant investment in technology and infrastructure.

What opportunities exist in the Private Blockchain Distributed Ledger market?

Opportunities in the Private Blockchain Distributed Ledger market include the potential for enhanced data security in financial services, the ability to streamline operations in logistics, and the growing interest in decentralized applications across various industries.

What trends are shaping the Private Blockchain Distributed Ledger market?

Trends shaping the Private Blockchain Distributed Ledger market include the integration of artificial intelligence for improved data analysis, the rise of consortium blockchains among businesses, and the increasing focus on sustainability and energy efficiency in blockchain solutions.

Private Blockchain Distributed Ledger market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Multi-Cloud |

| End User | Financial Services, Supply Chain, Healthcare, Government |

| Technology | Smart Contracts, Consensus Mechanisms, Cryptography, Tokenization |

| Application | Asset Management, Identity Verification, Payment Processing, Data Sharing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Private Blockchain Distributed Ledger Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at