444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The printed electronics in healthcare market represents a revolutionary convergence of advanced manufacturing technologies and medical applications, transforming how healthcare devices are designed, produced, and deployed. This innovative sector encompasses the production of electronic components and circuits using printing techniques on flexible substrates, enabling the creation of lightweight, cost-effective, and highly adaptable medical devices. The market has experienced remarkable momentum, driven by increasing demand for wearable health monitoring devices, point-of-care diagnostics, and smart medical implants.

Healthcare providers are increasingly adopting printed electronics solutions to enhance patient care delivery while reducing operational costs. The technology enables the development of ultra-thin sensors, flexible displays, and conformable electronic patches that can seamlessly integrate with the human body. Market dynamics indicate robust growth potential, with the sector expanding at a compound annual growth rate of 18.7% as healthcare institutions prioritize digital transformation initiatives.

Key applications span across multiple healthcare segments, including continuous glucose monitoring systems, cardiac monitoring patches, drug delivery systems, and diagnostic biosensors. The technology’s ability to produce electronics on flexible, biocompatible substrates has opened new possibilities for minimally invasive medical procedures and personalized healthcare solutions. Regional adoption varies significantly, with North America and Europe leading in technological advancement and market penetration, while Asia-Pacific demonstrates the highest growth potential.

The printed electronics in healthcare market refers to the specialized sector focused on manufacturing electronic components and systems for medical applications using additive printing processes rather than traditional subtractive manufacturing methods. This technology involves depositing conductive, semiconductive, and insulating materials onto flexible substrates such as plastic films, textiles, or paper to create functional electronic devices specifically designed for healthcare applications.

Printed electronics technology encompasses various printing techniques including inkjet printing, screen printing, gravure printing, and flexographic printing. These methods enable the production of electronic circuits, sensors, displays, and batteries that are lightweight, flexible, and cost-effective compared to conventional rigid electronics. In healthcare contexts, this technology facilitates the development of wearable medical devices, implantable sensors, and diagnostic tools that can conform to body contours and provide continuous monitoring capabilities.

Healthcare applications leverage the unique properties of printed electronics to create devices that are biocompatible, disposable, and capable of real-time data collection. The technology enables mass production of medical electronics at reduced costs while maintaining high performance standards, making advanced healthcare monitoring accessible to broader patient populations.

Market expansion in the printed electronics healthcare sector is driven by converging trends in digital health, personalized medicine, and cost-effective manufacturing solutions. The industry has witnessed accelerated adoption across multiple healthcare segments, with wearable health monitors and diagnostic devices leading market penetration. Technology advancement continues to enhance device performance while reducing production costs, creating opportunities for widespread deployment in both clinical and home healthcare settings.

Key market drivers include the growing prevalence of chronic diseases requiring continuous monitoring, increasing healthcare costs driving demand for cost-effective solutions, and rising consumer awareness of preventive healthcare. The aging global population represents approximately 16.5% of the total population, creating substantial demand for remote monitoring and assistive healthcare technologies. Additionally, the COVID-19 pandemic has accelerated adoption of remote healthcare solutions, with telehealth utilization increasing by 78% during peak pandemic periods.

Competitive landscape features a mix of established electronics manufacturers, specialized printed electronics companies, and healthcare device manufacturers. Strategic partnerships between technology providers and healthcare organizations are becoming increasingly common, facilitating rapid product development and market entry. Innovation focus centers on improving device accuracy, extending battery life, and enhancing biocompatibility for long-term patient contact applications.

Technology adoption patterns reveal significant variations across different healthcare applications and geographic regions. The following key insights highlight critical market dynamics:

Market penetration varies significantly by application type, with consumer-focused wearable devices achieving higher adoption rates compared to clinical-grade implantable systems. Regulatory considerations play a crucial role in market development, with FDA approval processes influencing product development timelines and market entry strategies.

Healthcare digitization serves as the primary catalyst driving printed electronics adoption in medical applications. The increasing integration of digital technologies in healthcare delivery creates substantial demand for flexible, cost-effective electronic solutions that can seamlessly interface with existing healthcare systems. Chronic disease prevalence continues rising globally, with conditions requiring continuous monitoring affecting approximately 60% of adults in developed countries, necessitating innovative monitoring solutions.

Cost reduction pressures in healthcare systems worldwide drive adoption of printed electronics solutions that offer significant manufacturing cost advantages over traditional electronics. The technology enables mass production of disposable medical devices, reducing per-unit costs while maintaining performance standards. Personalized medicine trends create demand for customizable electronic devices that can be tailored to individual patient needs and physiological characteristics.

Aging population demographics generate increasing demand for remote monitoring and assistive healthcare technologies. Technological advancement in printing materials and processes continues improving device performance, reliability, and biocompatibility. The growing emphasis on preventive healthcare drives consumer adoption of wearable monitoring devices, while healthcare providers seek solutions that enable early intervention and improved patient outcomes.

Regulatory support for innovative medical technologies, including fast-track approval processes for breakthrough devices, facilitates market entry for printed electronics solutions. Investment growth in healthcare technology startups and established companies developing printed electronics applications provides necessary funding for research and development activities.

Technical limitations in current printed electronics technology present significant challenges for healthcare applications requiring high precision and reliability. Performance gaps compared to traditional silicon-based electronics limit adoption in critical medical applications where device failure could have serious consequences. The technology currently faces constraints in achieving the same level of processing power and signal integrity as conventional electronics.

Regulatory complexity in healthcare markets creates substantial barriers to market entry, with lengthy approval processes and stringent safety requirements increasing development costs and time-to-market. Biocompatibility concerns regarding long-term contact with human tissue require extensive testing and validation, particularly for implantable applications. The lack of standardized testing protocols for printed electronics in healthcare applications creates uncertainty for manufacturers and regulatory bodies.

Manufacturing scalability challenges limit the ability to meet growing demand while maintaining quality standards. Material limitations in available conductive inks and substrates restrict device performance and durability. The relatively immature supply chain for specialized printing materials and equipment creates cost and availability challenges for manufacturers.

Market education requirements are substantial, as healthcare providers and patients need comprehensive understanding of printed electronics capabilities and limitations. Integration complexity with existing healthcare IT systems and electronic health records presents technical and operational challenges for healthcare organizations considering adoption.

Emerging applications in personalized medicine present significant growth opportunities for printed electronics manufacturers. The development of smart contact lenses for continuous intraocular pressure monitoring and glucose detection represents a high-potential market segment with limited current competition. Implantable drug delivery systems incorporating printed electronics for controlled release and monitoring capabilities offer substantial market potential.

Geographic expansion opportunities exist in developing markets where cost-effective healthcare solutions are in high demand. Asia-Pacific regions demonstrate particular promise, with rapidly growing healthcare infrastructure and increasing adoption of digital health technologies. The expansion of telemedicine and remote patient monitoring creates new market opportunities for printed electronics solutions that enable continuous health data collection.

Partnership opportunities with pharmaceutical companies for drug delivery and patient compliance monitoring applications represent significant revenue potential. Integration possibilities with artificial intelligence and machine learning technologies can enhance the value proposition of printed electronics healthcare devices. The development of biodegradable printed electronics for temporary implantable applications presents innovative market opportunities.

Healthcare system integration opportunities include development of printed electronics solutions that seamlessly interface with electronic health records and clinical decision support systems. Consumer health market expansion beyond traditional fitness tracking to comprehensive health monitoring presents substantial growth potential.

Technology evolution continues driving market dynamics through improvements in printing processes, materials science, and device integration capabilities. Competitive pressures intensify as more companies enter the market, leading to accelerated innovation cycles and price competition. The interplay between technology advancement and regulatory requirements creates complex market dynamics that influence product development strategies and commercialization timelines.

Healthcare industry transformation toward value-based care models creates demand for printed electronics solutions that demonstrate clear clinical and economic benefits. Supply chain dynamics are evolving as specialized material suppliers and equipment manufacturers scale production to meet growing demand. The market experiences cyclical patterns influenced by regulatory approval cycles, technology breakthrough announcements, and healthcare budget allocations.

Investment patterns show increasing venture capital and corporate investment in printed electronics healthcare applications, with funding focused on companies demonstrating clear paths to regulatory approval and commercial viability. Market consolidation trends emerge as larger healthcare technology companies acquire specialized printed electronics startups to expand their product portfolios and technological capabilities.

Customer adoption patterns vary significantly between consumer and clinical markets, with consumer applications showing faster adoption rates but lower average selling prices. Seasonal variations in demand reflect healthcare budget cycles and consumer purchasing patterns, particularly for wearable health monitoring devices.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry executives, healthcare professionals, technology developers, and end-users across different geographic regions and market segments. Survey methodologies capture quantitative data on adoption rates, purchasing decisions, and market preferences from representative samples of healthcare organizations and consumers.

Secondary research encompasses analysis of industry reports, academic publications, patent filings, regulatory documents, and company financial statements. Market modeling techniques incorporate historical data analysis, trend extrapolation, and scenario planning to develop accurate market forecasts and growth projections. Data validation processes ensure consistency and reliability across multiple information sources.

Expert consultation with leading researchers, clinicians, and industry specialists provides qualitative insights into market trends, technological developments, and regulatory considerations. Competitive intelligence gathering includes analysis of company strategies, product portfolios, partnership activities, and market positioning. Technology assessment evaluates current capabilities, development pipelines, and potential breakthrough innovations that could impact market dynamics.

Regional analysis incorporates country-specific healthcare policies, regulatory frameworks, and market conditions to provide accurate geographic market assessments. Market segmentation analysis examines different application areas, technology types, and customer segments to identify growth opportunities and market dynamics.

North America maintains market leadership in printed electronics healthcare applications, accounting for approximately 45% of global market share. The region benefits from advanced healthcare infrastructure, supportive regulatory frameworks, and significant investment in healthcare technology innovation. United States dominates regional market activity, with major technology companies and healthcare organizations driving adoption of printed electronics solutions.

Europe represents the second-largest market with 32% market share, characterized by strong regulatory standards and emphasis on patient safety. Germany, United Kingdom, and France lead European adoption, with significant government support for healthcare digitization initiatives. The region shows particular strength in implantable device applications and point-of-care diagnostics.

Asia-Pacific demonstrates the highest growth potential with projected annual growth rates exceeding 25%. China and Japan lead regional development, with substantial investments in healthcare infrastructure and technology manufacturing capabilities. The region benefits from cost-effective manufacturing and growing healthcare demand from expanding middle-class populations.

Latin America and Middle East & Africa represent emerging markets with significant long-term potential. These regions show increasing adoption of cost-effective healthcare solutions, with printed electronics offering advantages in resource-constrained healthcare environments. Brazil, Mexico, and South Africa lead adoption in their respective regions, driven by government healthcare initiatives and growing private sector investment.

Market competition features diverse participants ranging from established electronics manufacturers to specialized healthcare technology companies. Leading companies have developed comprehensive product portfolios and strategic partnerships to strengthen their market positions:

Strategic partnerships between technology providers and healthcare organizations are increasingly common, facilitating product development and market entry. Innovation focus centers on improving device performance, reducing costs, and achieving regulatory approvals for new applications. Market positioning strategies vary from broad technology platforms to specialized niche applications targeting specific healthcare segments.

Technology-based segmentation reveals distinct market characteristics across different printing methodologies and applications:

By Technology:

By Application:

By End User:

Wearable health monitors represent the most mature market segment, with established supply chains and consumer acceptance. Device categories include continuous glucose monitors, cardiac rhythm monitors, and multi-parameter health tracking devices. The segment benefits from consumer familiarity with wearable technology and increasing health consciousness. Market penetration reaches approximately 28% among target demographics, with significant growth potential in underserved populations.

Point-of-care diagnostics demonstrate the highest growth potential, driven by demand for rapid testing solutions and decentralized healthcare delivery. Application areas include infectious disease testing, cardiac biomarkers, and drug screening. The COVID-19 pandemic significantly accelerated adoption of rapid diagnostic solutions, creating sustained demand for printed electronics-based testing devices.

Smart bandages and patches represent an emerging category with significant innovation potential. Advanced capabilities include wound moisture monitoring, infection detection, and controlled drug delivery. The category benefits from increasing focus on wound care management and prevention of healthcare-associated infections. Market adoption is accelerating in clinical settings with demonstrated clinical and economic benefits.

Implantable devices constitute a specialized high-value segment requiring extensive regulatory approval and clinical validation. Applications focus on chronic disease monitoring, including cardiac rhythm management, neurological monitoring, and glucose sensing. The segment faces significant technical challenges but offers substantial long-term market potential.

Healthcare providers benefit from printed electronics solutions through improved patient monitoring capabilities, reduced device costs, and enhanced care delivery efficiency. Clinical advantages include continuous patient data collection, early intervention capabilities, and reduced hospital readmission rates. The technology enables healthcare organizations to extend monitoring capabilities beyond traditional clinical settings, improving patient outcomes while reducing costs.

Patients experience significant benefits through improved comfort, convenience, and health monitoring accuracy. Wearable devices provide continuous health insights without disrupting daily activities, while disposable sensors eliminate infection risks associated with reusable devices. Patient engagement increases through real-time health data access and personalized health recommendations.

Technology manufacturers gain access to rapidly growing healthcare markets with substantial revenue potential. Manufacturing advantages include reduced production costs, scalable manufacturing processes, and opportunities for product differentiation. The healthcare market offers higher margins compared to consumer electronics applications, with opportunities for long-term customer relationships.

Healthcare systems benefit from reduced costs, improved population health management, and enhanced care coordination. Economic advantages include reduced hospital admissions, improved chronic disease management, and more efficient resource utilization. Data collection capabilities enable evidence-based care improvements and population health analytics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization trends drive development of increasingly compact and lightweight healthcare devices that can be seamlessly integrated into daily life. Advanced materials development focuses on biocompatible, biodegradable, and high-performance substrates that expand application possibilities. The trend toward multi-parameter monitoring creates demand for integrated sensor systems capable of measuring multiple health indicators simultaneously.

Artificial intelligence integration enhances the value proposition of printed electronics healthcare devices through advanced data analysis and predictive capabilities. Edge computing implementation enables real-time data processing and decision-making at the device level, reducing dependence on cloud connectivity. Energy harvesting technologies are being integrated to extend device operation without battery replacement.

Personalization trends drive development of customizable devices tailored to individual patient needs and physiological characteristics. Telemedicine integration creates demand for devices that seamlessly interface with remote healthcare delivery platforms. Preventive healthcare focus shifts market emphasis from treatment to early detection and intervention capabilities.

Sustainability considerations influence product development toward environmentally friendly materials and manufacturing processes. Regulatory harmonization efforts aim to streamline approval processes across different geographic markets, facilitating global product deployment.

Recent technological breakthroughs have significantly advanced printed electronics capabilities in healthcare applications. Material innovations include development of biocompatible conductive inks with improved electrical properties and long-term stability. Manufacturing process improvements have enhanced production yields and reduced costs, making commercial applications more viable.

Regulatory approvals for printed electronics healthcare devices have accelerated, with several breakthrough device designations granted by major regulatory agencies. Clinical validation studies demonstrate efficacy and safety of printed electronics solutions in various healthcare applications, supporting broader market adoption. Partnership announcements between technology companies and healthcare organizations indicate growing industry confidence in the technology.

Investment activities show increasing venture capital and corporate funding for printed electronics healthcare companies. Acquisition activities by larger healthcare technology companies demonstrate strategic interest in printed electronics capabilities. Patent filings in printed electronics healthcare applications have increased substantially, indicating active innovation and competitive positioning.

Market expansion activities include geographic expansion into emerging markets and development of new application areas. Manufacturing capacity investments by leading companies indicate preparation for scaled commercial production. Standards development efforts aim to establish industry guidelines for printed electronics healthcare applications.

Strategic recommendations for market participants focus on building comprehensive capabilities across the value chain while maintaining focus on specific application areas. MarkWide Research analysis suggests that companies should prioritize regulatory compliance and clinical validation to establish market credibility and accelerate adoption. Partnership strategies with established healthcare organizations can provide market access and validation while reducing development risks.

Technology development should focus on addressing current performance limitations while maintaining cost advantages over traditional electronics. Market entry strategies should consider starting with less regulated applications to establish market presence before expanding into more complex clinical applications. Supply chain development requires strategic investments in material suppliers and manufacturing capabilities to ensure scalable production.

Geographic expansion opportunities should prioritize markets with supportive regulatory frameworks and growing healthcare infrastructure. Product development should emphasize user experience, reliability, and integration capabilities to drive adoption among healthcare professionals and patients. Intellectual property protection becomes increasingly important as market competition intensifies.

Investment priorities should balance technology development with market development activities, ensuring adequate resources for both innovation and commercialization. Risk management strategies should address regulatory, technical, and market risks through diversified approaches and contingency planning.

Long-term market prospects remain highly positive, with MWR projecting sustained growth driven by healthcare digitization trends and demographic factors. Technology advancement is expected to address current limitations while expanding application possibilities into new healthcare segments. The market is projected to experience compound annual growth rates exceeding 20% over the next decade, with particularly strong growth in emerging markets and new application areas.

Innovation trajectories point toward increasingly sophisticated devices with enhanced sensing capabilities, improved biocompatibility, and extended operational life. Market maturation is expected to bring standardization, improved supply chains, and reduced costs, facilitating broader adoption across healthcare segments. Regulatory frameworks are anticipated to evolve toward more streamlined approval processes for proven technologies.

Competitive dynamics will likely intensify as more companies enter the market, driving innovation and price competition. Market consolidation may occur as successful companies acquire complementary technologies and capabilities. Geographic expansion will continue as companies seek growth opportunities in emerging markets with growing healthcare needs.

Healthcare integration is expected to deepen as printed electronics solutions become standard components of digital health ecosystems. Patient adoption will increase as devices become more user-friendly and demonstrate clear health benefits. The market is positioned for transformational growth as technology capabilities align with healthcare industry needs and demographic trends.

The printed electronics in healthcare market represents a transformative technology sector with substantial growth potential and significant implications for healthcare delivery. Market dynamics indicate strong fundamentals driven by healthcare digitization trends, demographic factors, and cost reduction pressures. While current technical limitations and regulatory challenges present near-term constraints, ongoing innovation and market development activities are addressing these barriers.

Strategic opportunities exist for companies that can successfully navigate regulatory requirements while developing commercially viable products that demonstrate clear clinical and economic benefits. Market participants must balance technology development with market development activities, ensuring adequate resources for both innovation and commercialization. The sector’s future success depends on continued collaboration between technology developers, healthcare organizations, and regulatory agencies to establish standards and accelerate adoption.

Long-term prospects remain highly favorable, with the convergence of technology advancement, market demand, and regulatory support creating conditions for sustained growth. The printed electronics in healthcare market is positioned to play an increasingly important role in the evolution of digital health and personalized medicine, offering significant value to patients, healthcare providers, and technology companies alike.

What is Printed Electronics in Healthcare?

Printed electronics in healthcare refers to the use of printing technologies to create electronic components and devices that can be integrated into medical applications. This includes sensors, diagnostic devices, and wearable health monitors that enhance patient care and streamline medical processes.

What are the key players in the Printed Electronics in Healthcare Market?

Key players in the printed electronics in healthcare market include companies like Thinfilm Electronics, PragmatIC Semiconductor, and Nano Dimension, which are known for their innovative solutions in printed sensors and flexible electronics, among others.

What are the growth factors driving the Printed Electronics in Healthcare Market?

The growth of the printed electronics in healthcare market is driven by the increasing demand for wearable health monitoring devices, advancements in printing technologies, and the need for cost-effective manufacturing processes in medical devices.

What challenges does the Printed Electronics in Healthcare Market face?

Challenges in the printed electronics in healthcare market include issues related to the durability and reliability of printed devices, regulatory hurdles for medical applications, and the need for standardization in manufacturing processes.

What future opportunities exist in the Printed Electronics in Healthcare Market?

Future opportunities in the printed electronics in healthcare market include the development of smart packaging for pharmaceuticals, integration of IoT technologies in healthcare devices, and the potential for personalized medicine through advanced printed sensors.

What trends are shaping the Printed Electronics in Healthcare Market?

Trends shaping the printed electronics in healthcare market include the rise of telemedicine, increased focus on patient-centric care, and innovations in biocompatible materials for printed devices that enhance their functionality and safety.

Printed Electronics in Healthcare Market

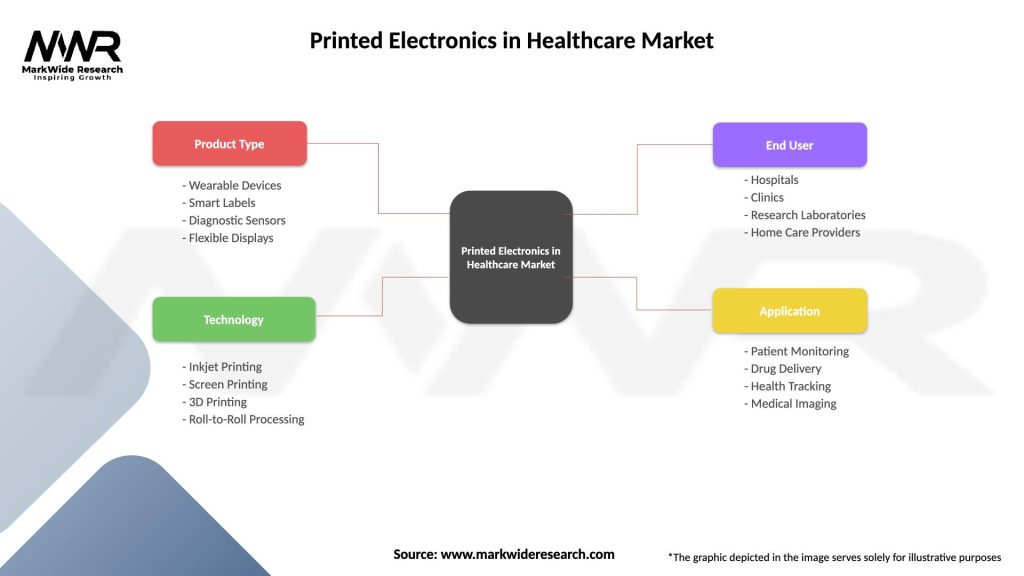

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Smart Labels, Diagnostic Sensors, Flexible Displays |

| Technology | Inkjet Printing, Screen Printing, 3D Printing, Roll-to-Roll Processing |

| End User | Hospitals, Clinics, Research Laboratories, Home Care Providers |

| Application | Patient Monitoring, Drug Delivery, Health Tracking, Medical Imaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Printed Electronics in Healthcare Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at