444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The precious metal market stands as a cornerstone of the global economy, characterized by the trade and utilization of rare and valuable metals. These metals, including gold, silver, platinum, and palladium, hold intrinsic value and play multifaceted roles in various industries and investment portfolios. The market’s dynamics are influenced by factors such as economic conditions, geopolitical events, technological advancements, and shifting consumer preferences.

Meaning:

Precious metals, renowned for their rarity and enduring value, have been coveted throughout history for their ornamental, monetary, and industrial uses. Gold, often considered a symbol of wealth and stability, is a primary player in the precious metal market. Silver, platinum, and palladium, each possessing unique properties, find applications in industries ranging from jewelry and electronics to automotive and renewable energy.

Executive Summary:

The precious metal market has witnessed resilience amid economic uncertainties, serving as a safe-haven investment during times of volatility. While traditional uses in jewelry and coinage persist, new avenues, such as technology and green energy applications, are expanding the market’s horizons. As environmental and ethical considerations gain prominence, sustainable mining practices and recycling initiatives are reshaping the industry landscape.

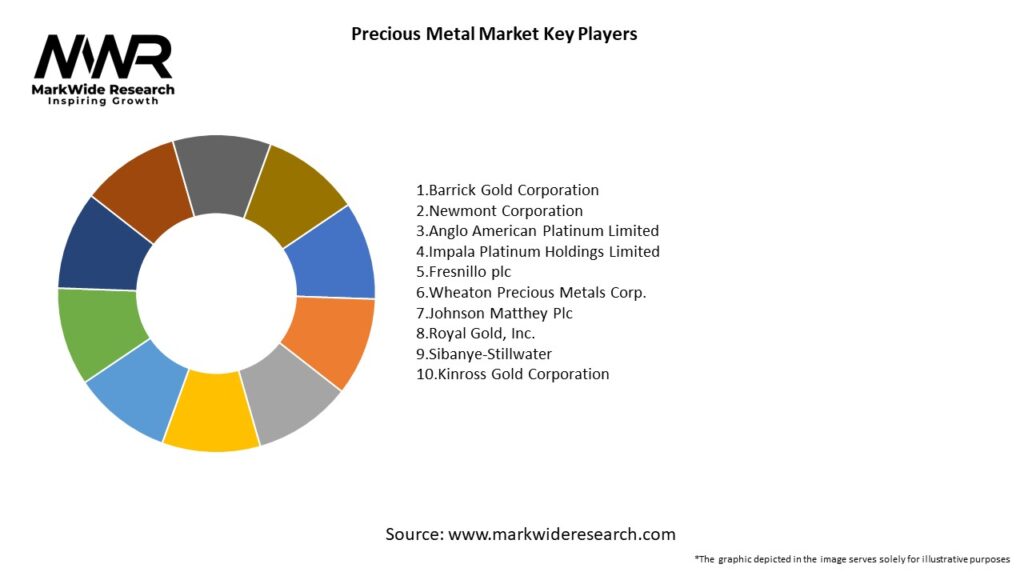

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The precious metal market operates in a dynamic environment influenced by a complex interplay of economic, geopolitical, and technological factors. The market’s dynamics include:

Regional Analysis

The Precious Metal market varies by region:

Competitive Landscape

Leading Companies in Precious Metal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Precious Metal market can be segmented by:

Category-wise Insights

Each category of precious metals offers unique characteristics and applications:

Key Benefits for Industry Participants and Stakeholders

The Precious Metal market offers several benefits:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends in the Precious Metal market include:

COVID-19 Impact

The COVID-19 pandemic has impacted the Precious Metal market in several ways:

Key Industry Developments

Recent developments in the Precious Metal market include:

Analyst Suggestions

Industry analysts recommend:

Future Outlook:

The future of the precious metal market is shaped by ongoing trends and emerging dynamics that include:

Conclusion:

In conclusion, the precious metal market remains a dynamic and integral component of the global economy. Shaped by diverse factors ranging from economic trends to technological innovations, the market offers opportunities for growth, sustainability, and responsible practices. Stakeholders across the supply chain, from mining companies to end-users, will play pivotal roles in shaping the trajectory of the precious metal market in the years to come.

What is Precious Metal?

Precious metals are rare, naturally occurring metallic elements that have high economic value. They are often used in jewelry, electronics, and as investment assets due to their durability and luster.

What are the key players in the Precious Metal Market?

Key players in the Precious Metal Market include companies like Barrick Gold Corporation, AngloGold Ashanti, and Newmont Corporation, which are involved in mining and production, among others.

What are the main drivers of the Precious Metal Market?

The main drivers of the Precious Metal Market include increasing demand for gold and silver in jewelry and electronics, as well as their use as safe-haven investments during economic uncertainty.

What challenges does the Precious Metal Market face?

The Precious Metal Market faces challenges such as fluctuating prices, regulatory changes, and environmental concerns related to mining practices, which can impact production and profitability.

What opportunities exist in the Precious Metal Market?

Opportunities in the Precious Metal Market include the growing interest in sustainable mining practices, advancements in recycling technologies, and increasing applications in renewable energy sectors.

What trends are shaping the Precious Metal Market?

Trends shaping the Precious Metal Market include the rise of digital gold platforms, increased investment in precious metals as a hedge against inflation, and innovations in extraction technologies.

Precious Metal Market

| Segmentation Details | Description |

|---|---|

| Type | Gold, Silver, Platinum, Palladium |

| Application | Jewelry, Electronics, Automotive Catalysts, Investment |

| End User | Manufacturers, Jewelers, Investors, Industrial Users |

| Form | Bars, Coins, Granules, Powder |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at