444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America gas turbine MRO market represents a critical component of the region’s power generation infrastructure, encompassing comprehensive maintenance, repair, and overhaul services for gas turbine systems across the United States, Canada, and Mexico. This specialized market serves as the backbone for ensuring reliable and efficient power generation operations, supporting both utility-scale power plants and industrial facilities that depend on gas turbine technology for their energy needs.

Market dynamics indicate robust growth driven by the increasing deployment of natural gas-fired power plants, aging turbine infrastructure requiring enhanced maintenance protocols, and the growing emphasis on operational efficiency. The market encompasses a wide range of services including scheduled maintenance, emergency repairs, component replacement, performance upgrades, and comprehensive overhaul programs designed to extend turbine lifecycles and optimize power output.

Regional characteristics show significant variation across North America, with the United States leading in market activity due to its extensive natural gas infrastructure and large-scale power generation capacity. The market is experiencing a compound annual growth rate of approximately 4.2%, reflecting the sustained demand for reliable power generation and the critical importance of maintaining turbine fleet availability.

Technology evolution continues to shape the MRO landscape, with advanced diagnostic systems, predictive maintenance technologies, and digital monitoring solutions transforming traditional maintenance approaches. Service providers are increasingly adopting data-driven methodologies to optimize maintenance schedules, reduce downtime, and enhance overall turbine performance across diverse operating environments.

The North America gas turbine MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for gas turbine systems operating within the power generation sector across the United States, Canada, and Mexico. This market encompasses all activities related to preserving, restoring, and enhancing the performance of gas turbines used in electricity generation applications.

MRO services include preventive maintenance programs, corrective maintenance actions, major overhauls, component repairs, parts replacement, performance testing, and system upgrades. These services are essential for maintaining turbine reliability, ensuring compliance with environmental regulations, and maximizing the operational lifespan of expensive power generation assets.

Service scope extends beyond basic maintenance to include advanced diagnostics, condition monitoring, vibration analysis, thermal imaging, borescope inspections, and comprehensive performance assessments. Modern MRO operations integrate sophisticated technologies to predict maintenance needs, optimize service intervals, and minimize unplanned outages that can significantly impact power grid stability.

Market participants include original equipment manufacturers (OEMs), independent service providers, specialized repair facilities, component suppliers, and technology solution providers who collectively deliver comprehensive MRO solutions tailored to the unique requirements of North American power generation facilities.

Strategic market positioning reveals the North America gas turbine MRO market as an indispensable component of the region’s energy infrastructure, supporting the reliable operation of natural gas-fired power generation facilities that provide approximately 40% of total electricity generation across the continent. The market demonstrates resilient growth characteristics driven by the dual pressures of aging turbine fleets requiring increased maintenance attention and the continued expansion of natural gas-based power generation capacity.

Key market drivers include the retirement of coal-fired power plants, the intermittent nature of renewable energy sources requiring flexible gas turbine backup, and the increasing complexity of modern turbine systems that demand specialized maintenance expertise. Service providers are responding to these challenges by developing comprehensive maintenance programs that combine traditional mechanical services with advanced digital monitoring and predictive analytics capabilities.

Competitive landscape features a mix of established OEM service divisions and independent service providers competing on the basis of technical expertise, service quality, cost effectiveness, and response time capabilities. The market is witnessing increased consolidation as service providers seek to expand their geographical coverage and technical capabilities to serve the evolving needs of power generation customers.

Future trajectory indicates sustained market growth supported by the ongoing modernization of North America’s power generation infrastructure, the increasing adoption of advanced maintenance technologies, and the critical importance of maintaining high turbine availability rates to support grid reliability and energy security objectives.

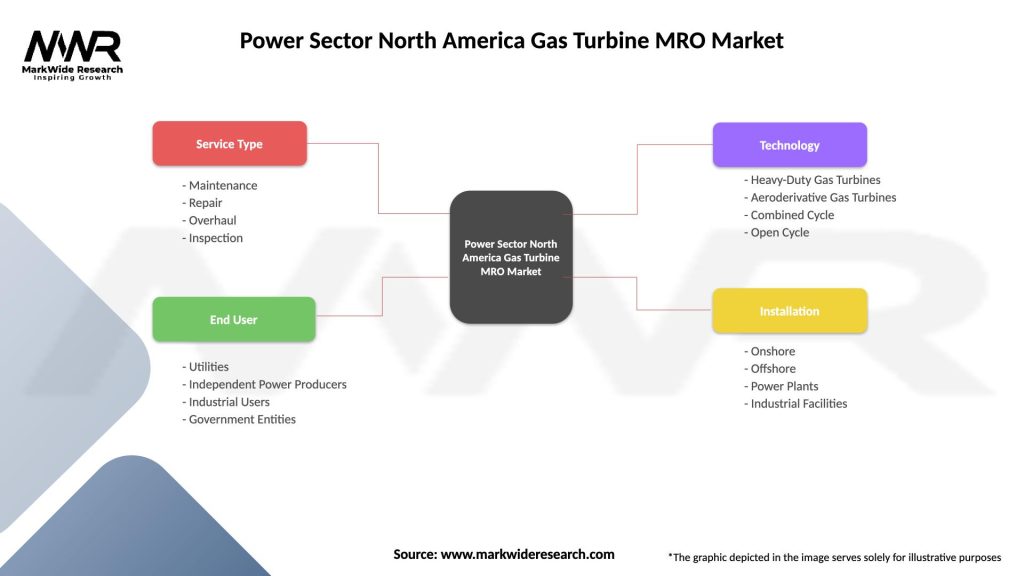

Market segmentation reveals distinct service categories that collectively define the comprehensive nature of gas turbine MRO operations:

Regional distribution shows the United States commanding approximately 75% of market activity, reflecting its dominant position in North American power generation and extensive natural gas infrastructure. Canada and Mexico represent growing market segments with increasing investments in gas turbine technology and associated maintenance services.

Infrastructure aging represents the primary driver of MRO demand, as a significant portion of North America’s gas turbine fleet approaches or exceeds design life expectations. Many turbines installed during the natural gas boom of the 1990s and early 2000s now require extensive maintenance and overhaul services to maintain operational reliability and performance standards.

Operational efficiency demands continue to intensify as power generators face increasing pressure to maximize turbine availability, optimize fuel consumption, and minimize maintenance costs. Modern MRO programs focus on predictive maintenance strategies that can reduce unplanned outages by up to 35% while extending maintenance intervals and improving overall equipment effectiveness.

Environmental compliance requirements drive the need for specialized maintenance services that ensure turbines continue to meet increasingly stringent emissions standards. Regular maintenance of combustion systems, emissions control equipment, and monitoring systems is essential for maintaining environmental permits and avoiding regulatory penalties.

Grid reliability concerns emphasize the critical importance of maintaining high turbine availability rates to support electrical grid stability. As renewable energy sources become more prevalent, gas turbines increasingly serve as flexible backup power sources that must be ready to respond quickly to grid demand fluctuations, requiring enhanced maintenance protocols to ensure rapid startup capabilities.

Technology advancement creates opportunities for MRO service providers to offer enhanced diagnostic capabilities, improved maintenance techniques, and advanced monitoring solutions that provide superior value to power generation customers seeking to optimize their operations.

High service costs represent a significant challenge for power generators, particularly smaller independent operators who must balance maintenance expenses against revenue generation capabilities. Major overhaul programs can require substantial capital investments, creating budget pressures that may lead to deferred maintenance or extended service intervals that compromise long-term turbine reliability.

Skilled labor shortages continue to impact the MRO industry, as the specialized technical expertise required for gas turbine maintenance becomes increasingly scarce. The aging workforce in the power generation sector, combined with limited training programs for new technicians, creates capacity constraints that can extend service delivery times and increase labor costs.

Supply chain complexities affect the availability and cost of critical turbine components, particularly for older turbine models where original parts may be discontinued or difficult to source. Long lead times for specialized components can extend maintenance outages and impact power plant availability, creating operational and financial challenges for facility operators.

Regulatory uncertainties surrounding the future role of natural gas in power generation create hesitation among some operators regarding long-term maintenance investments. Changing environmental policies and the push toward renewable energy sources may influence decisions about turbine lifecycle management and major capital expenditures for aging equipment.

Technology transition challenges emerge as the industry adopts new maintenance technologies and digital monitoring systems. Integration of advanced diagnostic tools with existing maintenance workflows requires significant training investments and may encounter resistance from traditional maintenance organizations accustomed to conventional approaches.

Digital transformation initiatives present substantial opportunities for MRO service providers to differentiate their offerings through advanced analytics, artificial intelligence, and machine learning capabilities. MarkWide Research analysis indicates that predictive maintenance technologies can improve maintenance efficiency by approximately 25% while reducing overall maintenance costs through optimized service scheduling and component lifecycle management.

Fleet modernization programs create demand for comprehensive upgrade services that enhance turbine performance, improve fuel efficiency, and extend operational lifecycles. Retrofit programs that incorporate advanced combustion technologies, improved cooling systems, and enhanced control systems represent significant revenue opportunities for qualified service providers.

Renewable energy integration paradoxically increases the importance of gas turbine MRO services, as these units become essential for providing grid stability and backup power capabilities. The growing emphasis on grid flexibility creates opportunities for specialized maintenance programs that optimize turbines for rapid cycling and frequent start-stop operations.

International expansion opportunities exist for North American MRO service providers to leverage their expertise in global markets where gas turbine adoption is increasing. Export of maintenance technologies, training programs, and technical expertise can create additional revenue streams while supporting international energy development initiatives.

Sustainability initiatives drive demand for maintenance services that support emissions reduction, fuel efficiency improvements, and environmental compliance. Service providers who can demonstrate measurable environmental benefits through their maintenance programs are well-positioned to capture market share from environmentally conscious power generators.

Competitive intensity continues to increase as both OEM service divisions and independent service providers compete for market share in a mature but stable market environment. Service differentiation increasingly focuses on technical capabilities, response times, cost effectiveness, and the ability to provide comprehensive solutions that address the full spectrum of turbine maintenance requirements.

Customer consolidation trends in the power generation industry create both challenges and opportunities for MRO service providers. Larger utility companies with extensive turbine fleets may negotiate more favorable service contracts and demand enhanced service capabilities, while smaller independent power producers may require more flexible and cost-effective maintenance solutions.

Technology integration accelerates as digital monitoring systems, remote diagnostics, and predictive analytics become standard components of comprehensive MRO programs. Service providers must continuously invest in technology capabilities to remain competitive and meet evolving customer expectations for data-driven maintenance solutions.

Supply chain optimization becomes increasingly important as service providers seek to reduce parts costs, improve inventory management, and minimize maintenance outage durations. Strategic partnerships with component suppliers, development of alternative sourcing strategies, and investment in parts remanufacturing capabilities represent key competitive advantages.

Regulatory compliance requirements continue to evolve, creating ongoing demand for specialized maintenance services that ensure turbines meet environmental standards, safety requirements, and operational performance criteria. Service providers who maintain current expertise in regulatory requirements can provide significant value to their customers.

Primary research activities encompassed comprehensive interviews with key stakeholders across the North America gas turbine MRO ecosystem, including power plant operators, maintenance service providers, component suppliers, and industry experts. These interviews provided insights into current market conditions, emerging trends, competitive dynamics, and future growth prospects.

Secondary research sources included industry publications, regulatory filings, company annual reports, technical journals, and government energy statistics to establish market context and validate primary research findings. Particular attention was paid to power generation capacity data, turbine installation statistics, and maintenance spending patterns across different market segments.

Market sizing methodology utilized a bottom-up approach that analyzed turbine installed capacity, maintenance requirements by turbine type and age, service pricing structures, and regional market characteristics. This approach provided comprehensive coverage of the diverse market segments that comprise the overall MRO ecosystem.

Trend analysis incorporated historical market data, current industry developments, and forward-looking indicators to identify key growth drivers, emerging opportunities, and potential market challenges. Special emphasis was placed on technology adoption patterns, regulatory changes, and evolving customer requirements that influence MRO service demand.

Competitive assessment evaluated service provider capabilities, market positioning, geographic coverage, and strategic initiatives to understand competitive dynamics and identify market leadership patterns. This analysis included both established market participants and emerging service providers who are reshaping the competitive landscape.

United States market dominates North American gas turbine MRO activity, representing approximately 75% of regional market share due to its extensive natural gas infrastructure, large-scale power generation capacity, and mature turbine fleet requiring comprehensive maintenance services. Key market centers include Texas, California, Pennsylvania, and the Gulf Coast region where significant concentrations of gas-fired power plants drive sustained MRO demand.

Texas market leadership reflects the state’s position as the largest electricity producer in the United States, with substantial natural gas generation capacity that requires ongoing maintenance support. The state’s deregulated electricity market creates competitive pressures that emphasize operational efficiency and reliability, driving demand for advanced MRO services.

Canadian market dynamics show steady growth driven by the country’s increasing reliance on natural gas for power generation, particularly in Alberta and Ontario. The Canadian market represents approximately 18% of regional activity, with growth supported by the retirement of coal-fired power plants and the need for flexible generation resources to complement renewable energy development.

Mexican market expansion reflects the country’s ongoing energy sector reforms and increasing investment in natural gas-fired power generation. Mexico accounts for approximately 7% of regional market activity, with growth potential supported by infrastructure modernization initiatives and the development of new gas-fired power plants to meet growing electricity demand.

Regional service networks continue to evolve as MRO providers establish strategic locations to serve major market centers while maintaining the technical capabilities and inventory resources necessary to support diverse turbine technologies across different operating environments and customer requirements.

Market leadership is shared among several key categories of service providers, each offering distinct capabilities and competitive advantages:

Competitive differentiation increasingly focuses on technical expertise, service quality, response capabilities, and the ability to provide comprehensive solutions that address the full spectrum of customer maintenance requirements. Service providers are investing in advanced diagnostic technologies, predictive maintenance capabilities, and digital monitoring solutions to enhance their competitive positioning.

Strategic partnerships between OEMs and independent service providers create opportunities for expanded service capabilities, improved geographic coverage, and enhanced technical expertise. These collaborations enable service providers to offer more comprehensive solutions while reducing customer costs and improving service delivery efficiency.

By Service Type:

By Turbine Class:

By Component Focus:

Scheduled maintenance services represent the largest market segment, accounting for approximately 45% of total MRO activity, driven by the critical importance of preventive maintenance in ensuring turbine reliability and avoiding costly unplanned outages. This segment includes routine inspections, component replacements, and performance testing activities performed according to manufacturer recommendations and operational requirements.

Major overhaul programs constitute approximately 30% of market activity, reflecting the substantial investments required for comprehensive turbine refurbishment. These programs typically occur every 25,000 to 50,000 operating hours and involve complete turbine disassembly, component inspection and repair, and system reassembly with updated technologies and improved components.

Emergency repair services account for approximately 15% of market activity but represent some of the highest-margin opportunities for service providers due to the urgent nature of these services and the critical importance of rapid response capabilities. Emergency services require specialized technical expertise, extensive parts inventory, and 24/7 availability to address unplanned outages.

Component repair services represent approximately 10% of market activity but demonstrate strong growth potential as power generators seek cost-effective alternatives to new component purchases. Advanced repair techniques, including additive manufacturing and advanced materials applications, enable restoration of components to like-new condition at significant cost savings compared to replacement.

Digital monitoring solutions represent an emerging segment with rapid growth potential as power generators increasingly adopt predictive maintenance strategies. MWR analysis indicates that digital monitoring adoption rates are increasing by approximately 20% annually as operators recognize the value of data-driven maintenance optimization.

Power plant operators benefit from comprehensive MRO programs through improved turbine reliability, reduced unplanned outages, optimized maintenance costs, and extended equipment lifecycles. Professional maintenance services ensure compliance with environmental regulations, safety standards, and operational performance requirements while maximizing return on turbine investments.

Utility companies gain significant advantages through strategic MRO partnerships that provide access to specialized technical expertise, advanced diagnostic capabilities, and comprehensive parts supply networks. These partnerships enable utilities to focus on their core business activities while ensuring their generation assets receive optimal maintenance support.

Independent power producers benefit from flexible MRO solutions that can be tailored to their specific operational requirements and budget constraints. Comprehensive maintenance programs help smaller operators achieve utility-scale reliability and performance standards while managing maintenance costs effectively.

Service providers benefit from stable, long-term revenue streams generated by ongoing maintenance requirements for the installed turbine base. The recurring nature of MRO services provides predictable business opportunities while advanced service capabilities create opportunities for premium pricing and market differentiation.

Component suppliers benefit from sustained demand for replacement parts, upgraded components, and specialized materials required for turbine maintenance operations. The MRO market provides opportunities for both OEM parts suppliers and aftermarket component providers to serve diverse customer requirements.

Technology providers benefit from growing demand for advanced diagnostic systems, monitoring technologies, and digital maintenance solutions that enhance MRO service delivery. The increasing adoption of predictive maintenance strategies creates substantial opportunities for companies offering innovative technology solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Predictive maintenance adoption accelerates as power generators recognize the value of data-driven maintenance strategies that can reduce unplanned outages, optimize service intervals, and improve overall equipment effectiveness. Advanced analytics, machine learning, and artificial intelligence technologies enable more accurate prediction of maintenance needs and component failures.

Digital twin technology emerges as a powerful tool for turbine maintenance optimization, enabling virtual modeling of turbine performance, simulation of maintenance scenarios, and optimization of service strategies. Digital twins provide unprecedented insights into turbine behavior and enable more precise maintenance planning.

Remote monitoring capabilities expand rapidly as turbine operators seek to minimize on-site maintenance activities while maintaining comprehensive oversight of equipment condition. Remote diagnostic systems enable continuous monitoring of turbine performance and early identification of potential problems.

Additive manufacturing applications grow in importance for component repair and replacement, enabling cost-effective restoration of complex turbine components and production of obsolete parts for older turbine models. 3D printing technologies provide new solutions for maintaining aging turbine fleets.

Sustainability focus increases as power generators seek maintenance solutions that support environmental compliance, improve fuel efficiency, and reduce emissions. Green maintenance practices and environmentally responsible service delivery become important competitive differentiators.

Service consolidation trends emerge as power generators seek to reduce the complexity of managing multiple service providers through comprehensive maintenance contracts that cover all aspects of turbine care. Single-source solutions provide operational simplification and improved accountability.

Technology partnerships between traditional MRO service providers and digital technology companies create new capabilities for predictive maintenance, remote monitoring, and data analytics. These collaborations combine deep turbine expertise with cutting-edge digital technologies to deliver enhanced service value.

Service network expansion continues as major service providers establish new facilities and capabilities to serve growing market demand and provide improved geographic coverage. Strategic investments in service infrastructure enhance response capabilities and customer support.

Workforce development initiatives address skilled labor shortages through comprehensive training programs, apprenticeships, and partnerships with technical education institutions. These programs ensure adequate availability of qualified technicians to support growing MRO demand.

Advanced materials applications enable improved component repairs and upgrades that enhance turbine performance and extend component lifecycles. New coating technologies, advanced alloys, and innovative repair techniques provide superior maintenance solutions.

Regulatory compliance solutions evolve to address changing environmental standards and safety requirements. Service providers develop specialized capabilities to ensure turbines continue to meet regulatory requirements while maintaining optimal performance.

International market expansion by North American service providers creates new revenue opportunities while supporting global energy development initiatives. Export of maintenance expertise and technologies strengthens the competitive position of regional service providers.

Investment priorities should focus on digital technology capabilities that enable predictive maintenance, remote monitoring, and data-driven service optimization. Service providers who successfully integrate advanced analytics and artificial intelligence into their maintenance programs will achieve significant competitive advantages and improved customer value.

Workforce development represents a critical success factor for sustained market growth. Companies should invest in comprehensive training programs, apprenticeships, and knowledge transfer initiatives to ensure adequate availability of skilled technicians with specialized turbine maintenance expertise.

Strategic partnerships between service providers, technology companies, and educational institutions can create synergistic capabilities that address market challenges while developing innovative solutions. Collaborative approaches enable more comprehensive service offerings and improved market positioning.

Geographic expansion opportunities exist for established service providers to extend their capabilities into underserved markets or international regions where gas turbine adoption is increasing. Strategic expansion can provide access to new customer bases and revenue growth opportunities.

Service differentiation through advanced technical capabilities, superior customer service, and innovative maintenance solutions will become increasingly important as market competition intensifies. Companies should focus on developing unique value propositions that address specific customer needs and challenges.

Supply chain optimization initiatives can provide significant competitive advantages through improved parts availability, reduced costs, and shorter maintenance outage durations. Investment in inventory management systems, supplier relationships, and logistics capabilities will enhance service delivery effectiveness.

Market growth prospects remain positive despite long-term uncertainties about the role of natural gas in power generation. The immediate need for reliable, flexible power generation resources to support renewable energy integration ensures sustained demand for gas turbine MRO services throughout the forecast period.

Technology evolution will continue to reshape the MRO landscape as digital monitoring, predictive analytics, and artificial intelligence become standard components of comprehensive maintenance programs. MarkWide Research projects that digital technology adoption in MRO applications will increase by approximately 15% annually over the next five years.

Service model transformation toward outcome-based contracts and performance guarantees will create new opportunities for service providers who can demonstrate measurable value through improved turbine availability, reduced maintenance costs, and enhanced operational performance.

Regulatory developments will continue to influence market dynamics as environmental standards evolve and grid reliability requirements become more stringent. Service providers who maintain current expertise in regulatory compliance will be well-positioned to serve evolving customer needs.

International expansion opportunities will grow as global demand for natural gas power generation increases and North American service providers seek to leverage their expertise in international markets. Export of maintenance technologies and services represents significant growth potential.

Sustainability initiatives will become increasingly important as power generators seek to minimize the environmental impact of their operations while maintaining reliable power generation capabilities. Green maintenance practices and environmentally responsible service delivery will become key competitive differentiators.

The North America gas turbine MRO market represents a critical and resilient component of the region’s energy infrastructure, providing essential maintenance services that ensure reliable power generation and grid stability. Despite long-term uncertainties about the future role of natural gas in power generation, immediate market fundamentals remain strong, supported by aging turbine fleets requiring increased maintenance attention and the growing importance of flexible generation resources for renewable energy integration.

Market evolution toward digital technologies, predictive maintenance strategies, and comprehensive service solutions creates significant opportunities for service providers who can adapt to changing customer requirements while maintaining the technical expertise necessary for complex turbine maintenance operations. The successful integration of advanced technologies with traditional maintenance capabilities will determine competitive success in this evolving market environment.

Strategic positioning for long-term success requires balanced investment in technology capabilities, workforce development, geographic expansion, and service differentiation initiatives. Companies that can demonstrate measurable value through improved turbine reliability, reduced maintenance costs, and enhanced operational performance will be well-positioned to capture market share and achieve sustainable growth in this essential industry sector.

What is Gas Turbine MRO?

Gas Turbine MRO refers to the maintenance, repair, and overhaul services for gas turbines, which are critical components in power generation. These services ensure the efficient operation and longevity of gas turbines used in various applications, including electricity generation and industrial processes.

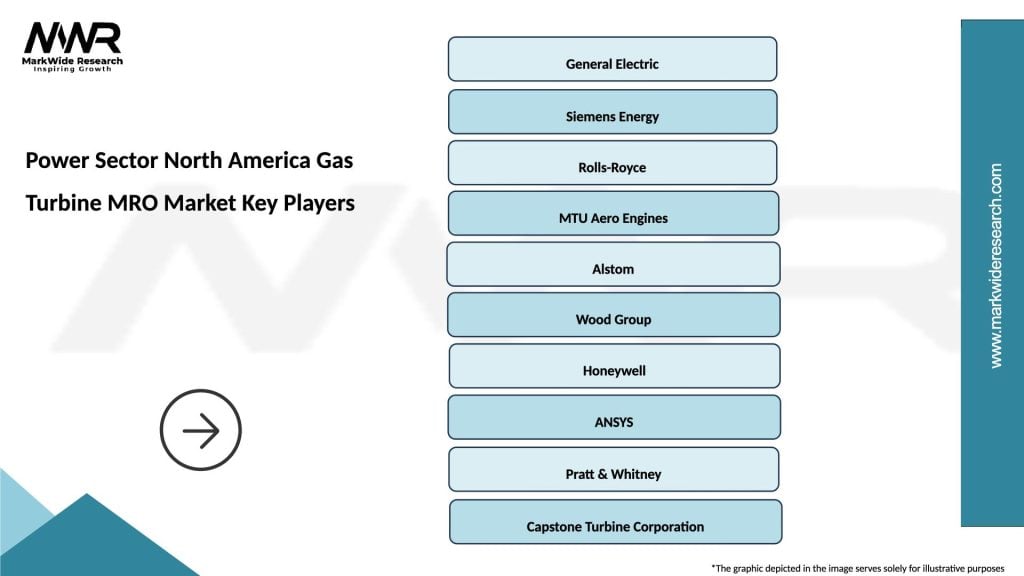

What are the key players in the Power Sector North America Gas Turbine MRO Market?

Key players in the Power Sector North America Gas Turbine MRO Market include General Electric, Siemens, and Mitsubishi Power, among others. These companies provide a range of services and solutions to enhance the performance and reliability of gas turbines.

What are the growth factors driving the Power Sector North America Gas Turbine MRO Market?

The growth of the Power Sector North America Gas Turbine MRO Market is driven by increasing energy demand, the need for efficient power generation, and the aging infrastructure of existing gas turbines. Additionally, advancements in technology and a focus on reducing operational costs contribute to market expansion.

What challenges does the Power Sector North America Gas Turbine MRO Market face?

The Power Sector North America Gas Turbine MRO Market faces challenges such as high maintenance costs, the complexity of turbine systems, and regulatory compliance issues. These factors can hinder the timely execution of MRO services and impact overall market growth.

What opportunities exist in the Power Sector North America Gas Turbine MRO Market?

Opportunities in the Power Sector North America Gas Turbine MRO Market include the integration of digital technologies for predictive maintenance and the growing trend towards renewable energy sources. These developments can enhance service efficiency and open new avenues for MRO providers.

What trends are shaping the Power Sector North America Gas Turbine MRO Market?

Trends shaping the Power Sector North America Gas Turbine MRO Market include the adoption of advanced analytics for performance monitoring and the increasing focus on sustainability practices. Additionally, the shift towards hybrid power systems is influencing MRO strategies and service offerings.

Power Sector North America Gas Turbine MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Utilities, Independent Power Producers, Industrial Users, Government Entities |

| Technology | Heavy-Duty Gas Turbines, Aeroderivative Gas Turbines, Combined Cycle, Open Cycle |

| Installation | Onshore, Offshore, Power Plants, Industrial Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Power Sector North America Gas Turbine MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at