444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific gas turbine MRO market represents a critical component of the region’s power generation infrastructure, encompassing comprehensive maintenance, repair, and overhaul services for gas turbine systems across diverse industrial applications. This dynamic market serves as the backbone for ensuring optimal performance, reliability, and longevity of gas turbine installations throughout the Asia-Pacific region, which includes major economies such as China, India, Japan, South Korea, Australia, and Southeast Asian nations.

Market dynamics indicate substantial growth potential driven by increasing power demand, aging turbine infrastructure, and the growing emphasis on operational efficiency. The region’s rapid industrialization and urbanization have created unprecedented demand for reliable power generation, positioning gas turbine MRO services as essential for maintaining grid stability and meeting energy security objectives. Growth projections suggest the market is expanding at a robust 8.2% CAGR, reflecting strong underlying fundamentals and increasing investment in power infrastructure maintenance.

Regional characteristics of the Asia-Pacific gas turbine MRO market include diverse regulatory environments, varying technological adoption rates, and distinct maintenance philosophies across different countries. The market encompasses both heavy-duty gas turbines used in utility-scale power plants and aeroderivative turbines employed in industrial applications, each requiring specialized maintenance approaches and technical expertise.

The Asia-Pacific gas turbine MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for gas turbine systems operating within the Asia-Pacific region’s power generation and industrial sectors. This market encompasses all activities related to preserving, restoring, and enhancing the performance of gas turbine equipment through systematic maintenance programs, emergency repairs, and major overhaul operations.

MRO services in this context include routine maintenance activities such as inspections, component replacements, and performance monitoring, as well as major overhaul operations involving complete turbine disassembly, component refurbishment, and system upgrades. The market serves various stakeholders including power generation companies, industrial manufacturers, independent power producers, and government-owned utilities across the diverse Asia-Pacific landscape.

Service scope extends beyond basic maintenance to include advanced diagnostics, predictive maintenance technologies, digital monitoring solutions, and comprehensive lifecycle management services that optimize turbine performance while minimizing operational disruptions and maintenance costs.

Strategic analysis reveals that the Asia-Pacific gas turbine MRO market is experiencing unprecedented growth driven by multiple converging factors including aging power infrastructure, increasing electricity demand, and evolving maintenance philosophies toward predictive and condition-based approaches. The market’s expansion reflects the region’s commitment to maintaining reliable power generation capabilities while optimizing operational efficiency and reducing environmental impact.

Key market drivers include the substantial installed base of gas turbines across the region, with approximately 42% of installations now requiring regular maintenance services as they approach or exceed their initial design life cycles. The shift toward digitalization and Industry 4.0 technologies is transforming traditional maintenance approaches, enabling more sophisticated monitoring and predictive maintenance capabilities.

Competitive landscape features a mix of original equipment manufacturers (OEMs), independent service providers, and regional specialists competing across different service segments. Market consolidation trends are evident as companies seek to expand their service capabilities and geographic reach to better serve the diverse Asia-Pacific market requirements.

Future outlook indicates continued market expansion supported by increasing power demand, infrastructure modernization initiatives, and the growing adoption of advanced maintenance technologies. The market is expected to benefit from increasing focus on operational efficiency and the transition toward more sustainable power generation practices.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Asia-Pacific gas turbine MRO market:

Primary growth drivers propelling the Asia-Pacific gas turbine MRO market include several interconnected factors that create sustained demand for maintenance and repair services across the region’s diverse power generation landscape.

Infrastructure aging represents the most significant driver, as a substantial portion of the region’s gas turbine fleet approaches or exceeds its original design life. Many installations from the 1990s and early 2000s now require comprehensive maintenance programs to maintain operational reliability and efficiency. This aging infrastructure creates consistent demand for both routine maintenance and major overhaul services.

Power demand growth across Asia-Pacific countries necessitates maximum availability and reliability from existing gas turbine installations. Rapid economic development, urbanization, and industrial expansion continue to drive electricity consumption, making turbine maintenance critical for meeting energy security objectives. Countries like India and Vietnam are experiencing particularly strong power demand growth, intensifying the need for reliable maintenance services.

Operational efficiency focus is driving power plant operators to invest in advanced maintenance programs that optimize turbine performance and reduce fuel consumption. Modern maintenance approaches can improve turbine efficiency by several percentage points, translating to significant cost savings and environmental benefits over the equipment lifecycle.

Regulatory compliance requirements are becoming increasingly stringent across the region, particularly regarding emissions and environmental performance. Regular maintenance is essential for ensuring turbines meet evolving regulatory standards and avoid potential penalties or operational restrictions.

Significant challenges facing the Asia-Pacific gas turbine MRO market include various constraints that may limit growth potential or create operational difficulties for service providers and customers alike.

High service costs represent a primary restraint, particularly for older turbine installations where maintenance expenses may approach or exceed the economic value of continued operation. Major overhaul costs can be substantial, leading some operators to consider equipment replacement rather than continued maintenance investment.

Skilled workforce shortages pose ongoing challenges across the region, as gas turbine maintenance requires highly specialized technical expertise that takes years to develop. The complexity of modern turbine systems and advanced diagnostic technologies demands continuous training and certification, creating workforce development pressures for service providers.

Supply chain complexities can impact service delivery, particularly for specialized components and materials required for gas turbine maintenance. Long lead times for critical parts, import restrictions, and quality control requirements can extend maintenance schedules and increase costs.

Technology transition challenges emerge as the industry adopts new maintenance technologies and approaches. Integration of digital monitoring systems, predictive maintenance tools, and advanced diagnostics requires significant investment and organizational change management, creating implementation barriers for some market participants.

Economic volatility in certain Asia-Pacific markets can impact maintenance spending decisions, as power plant operators may defer non-critical maintenance activities during economic downturns or periods of financial uncertainty.

Emerging opportunities within the Asia-Pacific gas turbine MRO market present significant potential for growth and innovation, driven by technological advancement, market evolution, and changing customer requirements.

Digital transformation initiatives offer substantial opportunities for service providers to differentiate their offerings through advanced monitoring, predictive maintenance, and performance optimization solutions. The integration of artificial intelligence, machine learning, and IoT technologies enables new service models that provide greater value to customers while improving operational efficiency.

Regional expansion potential exists in emerging markets across Southeast Asia, where power infrastructure development is accelerating. Countries such as Vietnam, Thailand, and Indonesia are investing heavily in power generation capacity, creating new opportunities for MRO service providers to establish market presence and build long-term customer relationships.

Service model innovation presents opportunities to develop new approaches to maintenance delivery, including outcome-based contracts, performance guarantees, and integrated asset management solutions. These advanced service models can create competitive advantages while providing customers with greater value and predictability.

Sustainability focus is creating opportunities for services that improve environmental performance and support decarbonization objectives. Maintenance programs that optimize turbine efficiency, reduce emissions, and enable flexible operation to support renewable energy integration are increasingly valuable to customers.

Partnership opportunities exist for collaboration between OEMs, independent service providers, and technology companies to develop comprehensive solutions that address the full spectrum of customer needs across the maintenance lifecycle.

Complex market dynamics shape the Asia-Pacific gas turbine MRO landscape, involving interactions between technological, economic, regulatory, and competitive factors that influence market behavior and evolution.

Competitive intensity varies significantly across different market segments and geographic regions, with OEMs maintaining strong positions in major overhaul services while independent providers compete effectively in routine maintenance and specialized services. Market dynamics are influenced by customer preferences for single-source solutions versus best-of-breed approaches.

Technology adoption patterns demonstrate varying rates of digitalization across the region, with developed markets like Japan and South Korea leading in advanced maintenance technologies while emerging markets focus on establishing basic maintenance capabilities. This creates diverse market dynamics and service requirements across different countries.

Customer behavior evolution reflects increasing sophistication in maintenance planning and service procurement, with operators demanding greater transparency, performance guarantees, and value-added services. Long-term service agreements are becoming more common as customers seek predictable costs and guaranteed performance levels.

Supply chain dynamics are evolving to support regional service delivery requirements, with companies establishing local parts inventory, service centers, and technical support capabilities. According to MarkWide Research analysis, regional service capabilities have improved maintenance response times by approximately 28% compared to centralized service models.

Regulatory influences create dynamic market conditions as governments across the region implement new environmental standards, safety requirements, and operational guidelines that impact maintenance practices and service demand.

Comprehensive research approach employed for analyzing the Asia-Pacific gas turbine MRO market incorporates multiple data sources, analytical methods, and validation techniques to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, maintenance managers, service providers, and technical experts across the Asia-Pacific region. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics from various stakeholder perspectives.

Secondary research methodology involves systematic analysis of industry publications, company reports, government statistics, trade association data, and regulatory filings to gather comprehensive market information and validate primary research findings.

Data analysis techniques employ both quantitative and qualitative approaches, including statistical analysis of market data, trend identification, competitive benchmarking, and scenario modeling to develop robust market projections and strategic insights.

Market segmentation analysis examines the market across multiple dimensions including service type, turbine technology, end-user industry, and geographic region to provide detailed understanding of market structure and dynamics.

Validation processes include cross-referencing multiple data sources, expert review of findings, and sensitivity analysis of key assumptions to ensure research accuracy and reliability.

Geographic distribution of the Asia-Pacific gas turbine MRO market reveals distinct regional characteristics, growth patterns, and market dynamics across the diverse countries and territories within this expansive region.

China dominates the regional market with approximately 38% market share, driven by its massive installed base of gas turbines across power generation and industrial applications. The Chinese market is characterized by strong government support for power infrastructure maintenance, increasing focus on operational efficiency, and growing adoption of advanced maintenance technologies.

India represents the second-largest market segment with significant growth potential driven by expanding power generation capacity and aging turbine infrastructure. The Indian market benefits from government initiatives to improve power sector efficiency and increasing private sector participation in power generation and maintenance services.

Japan maintains a mature but stable market characterized by high-quality maintenance standards, advanced technology adoption, and strong emphasis on operational reliability. The Japanese market leads in predictive maintenance technologies and digital monitoring solutions.

South Korea demonstrates strong market fundamentals with approximately 12% regional market share, supported by advanced manufacturing capabilities, technological innovation, and comprehensive maintenance programs across its power generation fleet.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Malaysia show the highest growth rates in the region, driven by rapid power infrastructure development and increasing maintenance requirements for new turbine installations.

Australia and New Zealand represent smaller but important market segments with emphasis on high-quality maintenance services, environmental compliance, and operational efficiency optimization.

Market competition in the Asia-Pacific gas turbine MRO sector involves diverse players ranging from global OEMs to regional specialists, each competing across different service segments and geographic markets with varying strategies and capabilities.

Leading market participants include:

Competitive strategies vary significantly among market participants, with OEMs leveraging their technical expertise and parts availability while independent providers compete on cost, flexibility, and specialized capabilities. Digital service offerings and predictive maintenance technologies are becoming key differentiators in the competitive landscape.

Market consolidation trends are evident as companies seek to expand their service capabilities and geographic reach through acquisitions, partnerships, and strategic alliances to better serve the diverse Asia-Pacific market requirements.

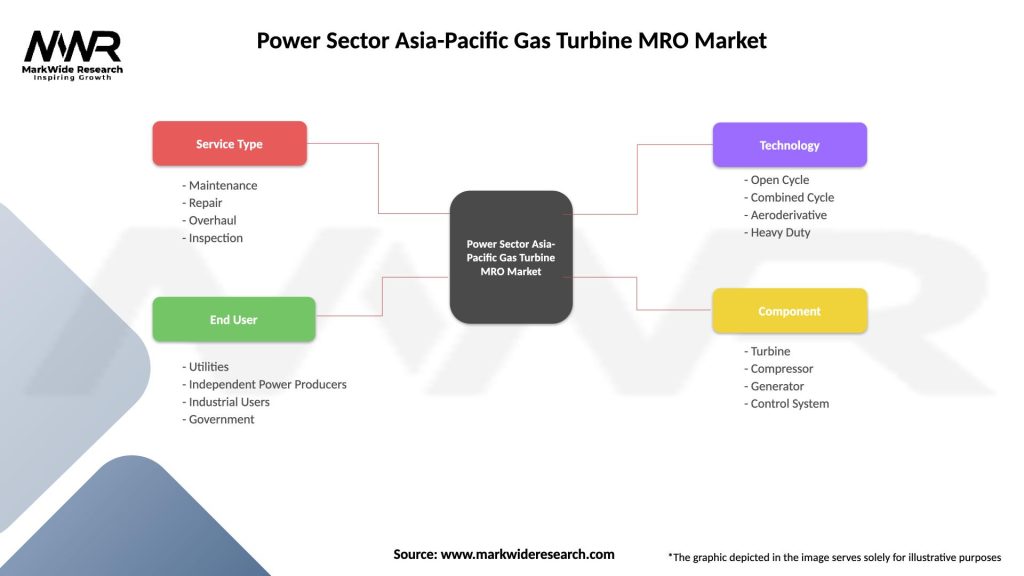

Market segmentation analysis reveals the Asia-Pacific gas turbine MRO market’s structure across multiple dimensions, providing detailed insights into service types, applications, technologies, and customer segments that define market opportunities and competitive dynamics.

By Service Type:

By Turbine Type:

By End-User Industry:

Detailed category analysis provides specific insights into different segments of the Asia-Pacific gas turbine MRO market, revealing unique characteristics, growth patterns, and competitive dynamics within each category.

Routine Maintenance Services represent the most stable and predictable market segment, with consistent demand driven by regulatory requirements and operational best practices. This category benefits from long-term service contracts and recurring revenue models, making it attractive to service providers seeking stable cash flows. Market penetration in this segment reaches approximately 78% across the region’s installed turbine base.

Major Overhaul Services constitute the highest-value segment with significant technical complexity and specialized requirements. This category is characterized by longer planning cycles, substantial customer investment, and high barriers to entry due to technical expertise requirements. Competition is intense among qualified service providers, with OEMs maintaining strong positions due to their technical knowledge and parts availability.

Digital Services and Monitoring represent the fastest-growing category, driven by increasing adoption of Industry 4.0 technologies and predictive maintenance approaches. This segment offers high margins and differentiation opportunities for service providers capable of delivering advanced analytics and performance optimization solutions.

Emergency Repair Services provide critical support for unplanned maintenance events, requiring rapid response capabilities and extensive parts inventory. This category is characterized by premium pricing but irregular demand patterns, making it challenging for service providers to optimize resource allocation.

Performance Optimization Services are gaining importance as operators focus on maximizing efficiency and environmental performance. This emerging category combines traditional maintenance with advanced engineering services to deliver measurable improvements in turbine operation.

Comprehensive benefits derived from the Asia-Pacific gas turbine MRO market extend across multiple stakeholder groups, creating value through improved operational performance, cost optimization, and strategic advantages.

For Power Plant Operators:

For Service Providers:

For Equipment Manufacturers:

Strategic analysis of the Asia-Pacific gas turbine MRO market reveals key strengths, weaknesses, opportunities, and threats that influence market dynamics and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the Asia-Pacific gas turbine MRO market reflect broader industry evolution toward digitalization, sustainability, and operational excellence, creating new opportunities and challenges for market participants.

Digital Maintenance Revolution is fundamentally changing how maintenance services are delivered and managed. Internet of Things sensors, artificial intelligence algorithms, and cloud-based analytics platforms enable real-time monitoring, predictive maintenance, and remote diagnostics that improve efficiency while reducing costs. Adoption rates for digital maintenance technologies have reached approximately 52% among major power plant operators in the region.

Predictive Maintenance Adoption is accelerating as operators recognize the value of condition-based maintenance approaches over traditional time-based schedules. Advanced analytics and machine learning algorithms can predict component failures weeks or months in advance, enabling optimized maintenance planning and reduced unplanned outages.

Sustainability Integration is becoming increasingly important as power plant operators focus on environmental performance and decarbonization objectives. Maintenance services that optimize turbine efficiency, reduce emissions, and enable flexible operation to support renewable energy integration are gaining significant market traction.

Service Model Innovation includes the development of outcome-based contracts, performance guarantees, and integrated asset management solutions that align service provider incentives with customer objectives. These advanced service models create competitive advantages while providing customers with greater value and predictability.

Regional Localization trends reflect the growing importance of local service capabilities, parts inventory, and technical support to meet customer requirements for rapid response and cultural alignment. Service providers are investing heavily in regional infrastructure and workforce development.

Significant industry developments are reshaping the Asia-Pacific gas turbine MRO landscape through technological advancement, strategic partnerships, and market expansion initiatives that influence competitive dynamics and customer value propositions.

Technology Partnerships between traditional service providers and technology companies are creating innovative solutions that combine maintenance expertise with advanced digital capabilities. These collaborations enable the development of sophisticated monitoring systems, predictive analytics platforms, and automated maintenance tools.

Regional Expansion Initiatives by major service providers include establishment of new service centers, parts distribution facilities, and technical training centers across key Asia-Pacific markets. These investments improve service delivery capabilities while reducing response times and costs for customers.

Workforce Development Programs are addressing skilled labor shortages through comprehensive training initiatives, certification programs, and partnerships with educational institutions. Companies are investing significantly in developing the next generation of gas turbine maintenance technicians and engineers.

Digital Platform Deployments enable remote monitoring, predictive maintenance, and performance optimization services that transform traditional maintenance approaches. These platforms integrate data from multiple sources to provide comprehensive insights into turbine health and performance.

Sustainability Initiatives include development of maintenance practices that support environmental objectives, reduce waste, and improve energy efficiency. Service providers are incorporating sustainability metrics into their service offerings and customer value propositions.

Strategic Acquisitions and partnerships are consolidating market capabilities and expanding service portfolios to better serve diverse customer requirements across the Asia-Pacific region.

Strategic recommendations for success in the Asia-Pacific gas turbine MRO market emphasize the importance of technological innovation, customer focus, and operational excellence in an increasingly competitive and dynamic market environment.

Invest in Digital Capabilities: Service providers should prioritize investment in digital technologies including IoT sensors, predictive analytics, and remote monitoring platforms to differentiate their offerings and improve service delivery efficiency. MWR data indicates that companies with advanced digital capabilities achieve 23% higher customer satisfaction scores compared to traditional service providers.

Develop Regional Expertise: Understanding local market conditions, regulatory requirements, and customer preferences is critical for success across the diverse Asia-Pacific region. Companies should invest in local talent, partnerships, and market intelligence to build competitive advantages in key geographic markets.

Focus on Outcome-Based Services: Developing service models that guarantee performance outcomes rather than simply providing maintenance activities can create significant competitive advantages and customer value. These approaches require sophisticated capabilities but offer higher margins and stronger customer relationships.

Build Strategic Partnerships: Collaboration with technology companies, local service providers, and equipment manufacturers can expand capabilities and market reach while sharing investment risks and costs.

Emphasize Sustainability: Incorporating environmental performance and sustainability metrics into service offerings aligns with growing customer priorities and regulatory requirements across the region.

Invest in Workforce Development: Comprehensive training and development programs are essential for building the skilled workforce required to deliver high-quality maintenance services in an increasingly complex technological environment.

Long-term projections for the Asia-Pacific gas turbine MRO market indicate sustained growth driven by fundamental market drivers including infrastructure aging, power demand growth, and technological advancement, while evolving toward more sophisticated and digitally-enabled service models.

Market expansion is expected to continue at a robust pace, with MarkWide Research projecting sustained growth rates exceeding 7.5% annually through the next decade. This growth will be supported by increasing maintenance requirements from aging turbine installations, expanding power generation capacity, and growing adoption of advanced maintenance technologies.

Technology evolution will fundamentally transform maintenance practices through artificial intelligence, machine learning, and advanced analytics that enable truly predictive maintenance capabilities. Digital twins, augmented reality, and autonomous maintenance systems will become increasingly common, improving efficiency while reducing costs and safety risks.

Service model transformation toward outcome-based contracts and integrated asset management solutions will accelerate as customers seek greater value and predictability from their maintenance investments. These advanced service models will become standard practice among leading service providers.

Regional market development will see continued expansion in emerging markets across Southeast Asia, with countries like Vietnam, Indonesia, and Thailand experiencing particularly strong growth in maintenance service demand as their power infrastructure matures.

Sustainability integration will become increasingly important as the power sector transitions toward cleaner energy sources and improved environmental performance. Maintenance services that support these objectives will command premium pricing and customer preference.

Competitive landscape evolution will feature continued consolidation as companies seek to build comprehensive capabilities and geographic reach, while new entrants with specialized digital capabilities may disrupt traditional service models.

The Asia-Pacific gas turbine MRO market represents a dynamic and rapidly evolving sector that plays a critical role in maintaining the region’s power generation infrastructure while adapting to technological advancement and changing customer requirements. The market’s strong growth trajectory reflects fundamental drivers including aging infrastructure, increasing power demand, and the growing sophistication of maintenance practices across diverse regional markets.

Key success factors for market participants include investment in digital technologies, development of regional capabilities, focus on customer outcomes, and commitment to workforce development. Companies that can effectively combine traditional maintenance expertise with advanced digital capabilities will be best positioned to capture market opportunities and build sustainable competitive advantages.

Future market evolution will be characterized by continued technological advancement, service model innovation, and increasing focus on sustainability and environmental performance. The integration of artificial intelligence, predictive analytics, and autonomous systems will transform maintenance practices while creating new value propositions for customers seeking improved reliability, efficiency, and cost optimization.

Strategic positioning in this market requires a comprehensive understanding of regional dynamics, customer requirements, and technological trends, combined with the operational capabilities to deliver high-quality services across diverse geographic markets and application segments. The Asia-Pacific gas turbine MRO market offers substantial opportunities for companies prepared to invest in the capabilities and relationships necessary for long-term success in this critical industry sector.

What is Power Sector Asia-Pacific Gas Turbine MRO?

Power Sector Asia-Pacific Gas Turbine MRO refers to the maintenance, repair, and overhaul services specifically for gas turbines used in the power generation sector within the Asia-Pacific region. This includes activities that ensure the efficient operation and longevity of gas turbines.

What are the key players in the Power Sector Asia-Pacific Gas Turbine MRO Market?

Key players in the Power Sector Asia-Pacific Gas Turbine MRO Market include General Electric, Siemens, and Mitsubishi Power, among others. These companies provide a range of services from routine maintenance to major overhauls for gas turbines.

What are the growth factors driving the Power Sector Asia-Pacific Gas Turbine MRO Market?

The growth of the Power Sector Asia-Pacific Gas Turbine MRO Market is driven by increasing energy demand, the need for efficient power generation, and the aging infrastructure of existing gas turbines. Additionally, advancements in technology are enhancing maintenance practices.

What challenges does the Power Sector Asia-Pacific Gas Turbine MRO Market face?

The Power Sector Asia-Pacific Gas Turbine MRO Market faces challenges such as high operational costs, the complexity of turbine technologies, and regulatory compliance issues. These factors can hinder the efficiency and effectiveness of maintenance operations.

What opportunities exist in the Power Sector Asia-Pacific Gas Turbine MRO Market?

Opportunities in the Power Sector Asia-Pacific Gas Turbine MRO Market include the adoption of predictive maintenance technologies and the expansion of renewable energy integration. These trends can lead to more efficient operations and reduced downtime.

What trends are shaping the Power Sector Asia-Pacific Gas Turbine MRO Market?

Trends shaping the Power Sector Asia-Pacific Gas Turbine MRO Market include the increasing use of digital technologies for monitoring turbine performance and the shift towards more sustainable energy practices. These innovations are expected to enhance maintenance strategies and operational efficiency.

Power Sector Asia-Pacific Gas Turbine MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Utilities, Independent Power Producers, Industrial Users, Government |

| Technology | Open Cycle, Combined Cycle, Aeroderivative, Heavy Duty |

| Component | Turbine, Compressor, Generator, Control System |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Power Sector Asia-Pacific Gas Turbine MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at