444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Power and Utilities MLCC Market represents a critical segment within the global electronics industry, focusing on multilayer ceramic capacitors specifically designed for power generation, transmission, and distribution applications. Multilayer ceramic capacitors (MLCCs) serve as essential components in power systems, providing energy storage, voltage regulation, and signal filtering capabilities across various utility infrastructure projects. The market encompasses applications ranging from renewable energy systems and smart grid technologies to traditional power generation facilities and electrical distribution networks.

Market dynamics indicate robust growth driven by increasing global energy demands and the transition toward sustainable power solutions. The sector benefits from growing investments in renewable energy infrastructure, modernization of aging power grids, and the implementation of smart utility systems. Current market trends show a 12.5% annual growth rate in MLCC adoption within utility applications, reflecting the industry’s commitment to enhancing power system reliability and efficiency.

Regional distribution reveals significant market concentration in Asia-Pacific regions, particularly in countries with extensive power infrastructure development programs. North America and Europe maintain substantial market shares, driven by grid modernization initiatives and renewable energy integration projects. The market demonstrates strong correlation with global electrification trends, with emerging economies contributing approximately 38% of total market demand for power and utilities MLCCs.

The Power and Utilities MLCC Market refers to the specialized segment of multilayer ceramic capacitors designed and manufactured specifically for power generation, transmission, distribution, and utility management applications. These components feature enhanced voltage ratings, temperature stability, and reliability characteristics essential for critical power infrastructure operations.

MLCCs in power applications provide crucial functions including power factor correction, harmonic filtering, voltage regulation, and energy storage in various utility systems. Unlike standard ceramic capacitors, power and utilities MLCCs undergo rigorous testing and certification processes to meet stringent industry standards for electrical safety, environmental durability, and operational longevity in demanding power system environments.

Market scope encompasses various capacitor configurations, voltage ratings, and specialized designs tailored for specific utility applications. The segment includes high-voltage MLCCs for transmission systems, medium-voltage units for distribution networks, and specialized components for renewable energy systems, smart meters, and grid automation equipment.

Strategic market positioning reveals the Power and Utilities MLCC Market as a fundamental enabler of modern electrical infrastructure development. The sector demonstrates exceptional growth potential driven by global energy transition initiatives, increasing power consumption demands, and technological advancement in utility systems. Key market drivers include renewable energy integration requirements, smart grid deployment projects, and regulatory mandates for power system modernization.

Competitive landscape features established ceramic capacitor manufacturers alongside specialized power component suppliers, creating a dynamic market environment focused on technological innovation and application-specific solutions. Market leaders concentrate on developing high-reliability MLCCs with enhanced performance characteristics suitable for critical utility applications.

Growth projections indicate sustained market expansion with particular strength in emerging economies implementing large-scale electrification programs. The market benefits from increasing adoption of renewable energy technologies, which require specialized capacitor solutions for power conditioning and grid integration applications. Industry analysis suggests 65% of market growth stems from renewable energy and smart grid applications.

Primary market insights reveal several critical trends shaping the Power and Utilities MLCC Market landscape:

Global energy transition serves as the primary catalyst driving Power and Utilities MLCC Market expansion. Worldwide initiatives to reduce carbon emissions and increase renewable energy adoption create substantial demand for specialized capacitor solutions capable of supporting variable power generation and grid integration requirements. The transition from fossil fuel-based power generation to renewable sources necessitates advanced power conditioning equipment incorporating high-performance MLCCs.

Infrastructure modernization programs across developed and emerging economies generate significant market opportunities. Aging power grid systems require comprehensive upgrades incorporating smart grid technologies, automated control systems, and enhanced monitoring capabilities, all of which depend on reliable MLCC components. Government investments in electrical infrastructure modernization projects create sustained demand for power and utilities MLCCs.

Electrification initiatives in developing regions drive substantial market growth as countries expand electrical grid coverage to previously unserved populations. These large-scale electrification programs require extensive power infrastructure development, creating opportunities for MLCC suppliers to provide components for generation, transmission, and distribution systems.

Technological advancement in power electronics and utility equipment creates demand for increasingly sophisticated MLCC solutions. Development of wide bandgap semiconductors, advanced inverter systems, and high-efficiency power conversion equipment requires MLCCs with enhanced performance characteristics and improved reliability specifications.

High development costs associated with specialized power and utilities MLCCs present significant market challenges. The extensive testing, certification, and qualification processes required for utility applications result in substantial investment requirements, potentially limiting market entry for smaller manufacturers and constraining product development timelines.

Stringent regulatory requirements create barriers to market participation and increase compliance costs for MLCC manufacturers. Utility industry standards demand rigorous testing protocols, extensive documentation, and ongoing quality assurance programs that may discourage some suppliers from entering the power and utilities segment.

Long product qualification cycles in utility applications slow market adoption of new MLCC technologies. Power system operators require extensive field testing and validation periods before approving new components for critical infrastructure applications, creating delays in market penetration for innovative MLCC solutions.

Raw material price volatility affects MLCC manufacturing costs and market pricing stability. Fluctuations in ceramic materials, precious metals, and other key components impact production economics and may influence utility operators’ procurement decisions, particularly in price-sensitive market segments.

Renewable energy expansion creates substantial opportunities for specialized MLCC solutions designed for solar, wind, and energy storage applications. The growing deployment of distributed energy resources requires advanced power conditioning equipment incorporating high-performance MLCCs capable of handling variable power conditions and grid synchronization requirements.

Smart grid implementation presents significant market opportunities as utilities worldwide invest in intelligent electrical infrastructure. Advanced metering systems, grid automation equipment, and real-time monitoring technologies require reliable MLCC components, creating sustained demand for power and utilities applications.

Electric vehicle infrastructure development generates new market opportunities for MLCCs in charging station equipment and grid integration systems. The rapid expansion of EV charging networks requires specialized power electronics incorporating high-performance capacitors for efficient power conversion and grid compatibility.

Energy storage deployment creates opportunities for MLCCs in battery management systems, power conversion equipment, and grid integration applications. Large-scale energy storage projects require sophisticated power electronics incorporating reliable capacitor solutions for optimal system performance and safety.

Supply chain dynamics in the Power and Utilities MLCC Market reflect the specialized nature of these components and the critical importance of reliability in power applications. Manufacturers maintain dedicated production lines for utility-grade MLCCs, implementing enhanced quality control processes and specialized testing protocols to ensure consistent performance in demanding power system environments.

Demand patterns demonstrate strong correlation with global power infrastructure investment cycles and renewable energy deployment schedules. Market demand typically follows utility capital expenditure trends, with peak periods corresponding to major grid modernization projects and renewable energy installation campaigns. According to MarkWide Research analysis, demand fluctuations show seasonal variations of approximately 25% aligned with utility construction schedules.

Technology evolution drives continuous market transformation as MLCC manufacturers develop advanced materials and manufacturing processes to meet evolving power system requirements. Innovation focuses on improving voltage ratings, temperature stability, and reliability characteristics while reducing component size and cost for utility applications.

Competitive dynamics feature intense competition among established capacitor manufacturers and specialized power component suppliers. Market participants differentiate through technical expertise, application support, and reliability track records rather than price competition alone, reflecting the critical nature of power system applications.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for the Power and Utilities MLCC Market. Primary research activities include extensive interviews with utility operators, power system engineers, MLCC manufacturers, and industry experts to gather firsthand market intelligence and validate market trends.

Secondary research components encompass analysis of industry publications, technical standards, regulatory documents, and utility procurement specifications to understand market requirements and competitive dynamics. Research methodology incorporates examination of patent filings, technology roadmaps, and industry conference proceedings to identify emerging trends and innovation directions.

Data validation processes ensure research accuracy through cross-referencing multiple information sources and conducting follow-up interviews with key market participants. Market sizing and growth projections undergo rigorous validation through comparison with related market segments and historical trend analysis.

Analytical frameworks include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning studies to provide comprehensive market understanding. Research methodology incorporates both quantitative and qualitative analysis techniques to deliver actionable market insights for industry stakeholders.

Asia-Pacific region dominates the Power and Utilities MLCC Market, accounting for approximately 45% of global market share driven by extensive power infrastructure development in China, India, and Southeast Asian countries. The region benefits from large-scale electrification programs, renewable energy investments, and manufacturing capacity for MLCC production, creating a comprehensive ecosystem supporting market growth.

North American market demonstrates strong demand for high-performance MLCCs in grid modernization projects and renewable energy integration applications. The region’s focus on smart grid deployment and aging infrastructure replacement creates sustained opportunities for specialized MLCC solutions. Market growth benefits from supportive regulatory frameworks and utility investment in advanced power technologies.

European market emphasizes renewable energy integration and energy efficiency improvements, driving demand for advanced MLCC solutions in wind power, solar installations, and grid automation systems. The region’s commitment to carbon neutrality goals creates substantial opportunities for power and utilities MLCCs in clean energy applications.

Emerging markets in Latin America, Africa, and Middle East regions show increasing adoption of power and utilities MLCCs as countries expand electrical infrastructure and implement rural electrification programs. These markets present significant growth potential despite current smaller market shares, with projected growth rates exceeding 15% annually in several countries.

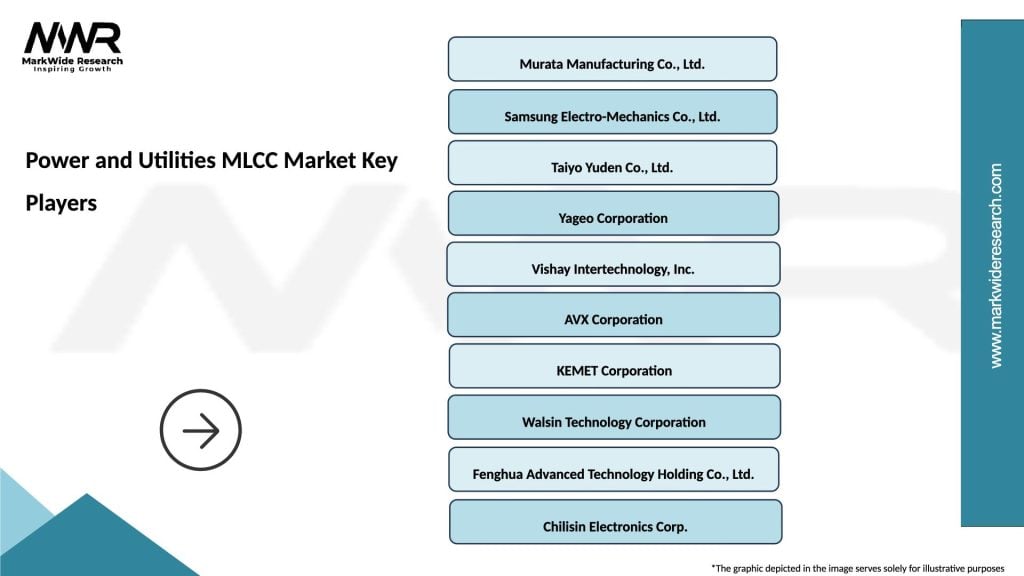

Market leadership in the Power and Utilities MLCC Market features several established manufacturers with specialized expertise in power applications:

Competitive strategies focus on technological innovation, application-specific product development, and comprehensive customer support services. Market participants invest heavily in research and development activities to advance MLCC performance characteristics and meet evolving power system requirements.

By Voltage Rating:

By Application:

By Technology:

Renewable Energy Applications represent the fastest-growing category within the Power and Utilities MLCC Market, driven by global clean energy initiatives and declining renewable technology costs. Solar inverter systems require specialized MLCCs for DC-AC conversion, power factor correction, and grid synchronization functions. Wind power applications demand robust capacitors capable of handling variable power conditions and harsh environmental exposures.

Smart Grid Technologies create substantial opportunities for advanced MLCC solutions in automation, monitoring, and control systems. Advanced metering infrastructure requires reliable capacitors for power supply circuits, communication systems, and data processing equipment. Grid automation applications demand MLCCs with enhanced reliability and long-term stability characteristics.

Energy Storage Systems generate increasing demand for specialized MLCCs in battery management systems, power conversion equipment, and grid integration applications. Utility-scale storage projects require high-performance capacitors for efficient power conversion and system protection functions.

Traditional Power Applications maintain steady demand for MLCCs in conventional power generation, transmission, and distribution systems. Modernization and maintenance of existing infrastructure create ongoing opportunities for replacement and upgrade applications requiring proven MLCC technologies.

Utility Operators benefit from enhanced power system reliability, improved efficiency, and reduced maintenance requirements through deployment of high-quality MLCCs in critical applications. Advanced capacitor technologies enable utilities to optimize power factor correction, reduce harmonic distortion, and improve overall system performance while minimizing operational costs.

Equipment Manufacturers gain competitive advantages through incorporation of specialized MLCCs in power system equipment, enabling development of more efficient, compact, and reliable products. Partnership opportunities with MLCC suppliers provide access to advanced technologies and application-specific solutions supporting product differentiation strategies.

MLCC Manufacturers benefit from stable, long-term demand patterns in utility applications and opportunities for premium pricing based on performance and reliability requirements. The power and utilities segment offers higher profit margins compared to consumer electronics applications due to specialized requirements and longer product lifecycles.

End Users experience improved electrical service reliability, enhanced power quality, and reduced energy costs through deployment of advanced power systems incorporating high-performance MLCCs. Smart grid technologies enabled by reliable capacitor solutions provide consumers with better service monitoring and energy management capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization and Integration trends drive development of compact MLCC solutions enabling space-efficient power system designs. Utility equipment manufacturers increasingly demand smaller capacitor packages without compromising performance characteristics, leading to innovations in ceramic materials and manufacturing processes.

Enhanced Reliability Requirements reflect the critical nature of power system applications and increasing emphasis on grid resilience. MarkWide Research indicates that utility operators now specify reliability standards exceeding 99.9% for critical MLCC applications, driving manufacturers to implement advanced quality control processes and testing protocols.

Environmental Sustainability considerations influence MLCC design and manufacturing processes as utilities prioritize environmentally responsible component sourcing. Green manufacturing practices and recyclable materials become increasingly important factors in utility procurement decisions.

Digitalization and IoT Integration create opportunities for smart MLCCs with embedded monitoring capabilities and predictive maintenance features. Connected capacitor solutions enable real-time performance monitoring and proactive replacement scheduling, reducing system downtime and maintenance costs.

Customization and Application-Specific Solutions become increasingly important as power systems become more specialized and complex. MLCC manufacturers develop tailored solutions for specific utility applications, providing enhanced performance and competitive differentiation.

Advanced Material Innovations continue to drive MLCC performance improvements with development of new ceramic formulations offering enhanced temperature stability, higher voltage ratings, and improved reliability characteristics. Recent breakthroughs in dielectric materials enable MLCCs to operate effectively in increasingly demanding power system environments.

Manufacturing Process Enhancements focus on improving production efficiency and quality consistency for power and utilities MLCCs. Implementation of automated testing systems and advanced quality control processes ensures consistent performance characteristics and reduces manufacturing variations.

Strategic Partnerships between MLCC manufacturers and power equipment suppliers create opportunities for collaborative product development and market expansion. These partnerships enable development of integrated solutions optimized for specific power system applications and customer requirements.

Certification and Standards Development activities ensure MLCC products meet evolving utility industry requirements and safety standards. Industry organizations work to establish comprehensive testing protocols and performance specifications for power and utilities MLCC applications.

Global Expansion Initiatives by leading MLCC manufacturers target emerging markets with growing power infrastructure development programs. These expansion efforts include establishment of local manufacturing facilities and technical support centers to serve regional utility customers effectively.

Investment Prioritization should focus on renewable energy and smart grid applications, which demonstrate the strongest growth potential within the Power and Utilities MLCC Market. MWR analysis suggests that companies allocating 60% or more of development resources to these high-growth segments achieve superior market performance and competitive positioning.

Technology Development efforts should emphasize reliability enhancement, temperature stability improvement, and voltage rating advancement to meet evolving power system requirements. Research and development investments in advanced ceramic materials and manufacturing processes provide sustainable competitive advantages in demanding utility applications.

Market Entry Strategies for new participants should consider partnership approaches with established power equipment manufacturers rather than direct utility sales efforts. Collaborative relationships provide market access, application expertise, and customer credibility essential for success in the power and utilities segment.

Geographic Expansion opportunities exist primarily in emerging markets with active power infrastructure development programs. Companies should prioritize markets with government-supported electrification initiatives and growing renewable energy deployment to maximize growth potential.

Product Portfolio Optimization should balance standardized solutions for common applications with specialized products for unique power system requirements. Application-specific development programs enable premium pricing and customer loyalty while standard products provide volume and manufacturing efficiency.

Long-term market prospects for the Power and Utilities MLCC Market remain highly favorable, driven by global energy transition initiatives, infrastructure modernization requirements, and increasing electrification trends. Projected growth rates indicate sustained expansion with particular strength in renewable energy and smart grid applications over the next decade.

Technology evolution will continue advancing MLCC performance characteristics with focus on higher voltage ratings, improved temperature stability, and enhanced reliability specifications. Material science innovations and manufacturing process improvements will enable MLCCs to meet increasingly demanding power system requirements while reducing costs and improving availability.

Market consolidation trends may emerge as smaller manufacturers struggle to meet the substantial investment requirements for power and utilities MLCC development and certification. Strategic acquisitions and partnerships will likely reshape the competitive landscape, creating opportunities for market leaders to expand capabilities and market reach.

Regional market development will continue favoring Asia-Pacific regions due to extensive power infrastructure investments and manufacturing capabilities. However, emerging markets in other regions present significant growth opportunities as countries implement large-scale electrification and renewable energy programs.

Application diversification will create new opportunities for power and utilities MLCCs in electric vehicle infrastructure, energy storage systems, and advanced grid technologies. These emerging applications may eventually represent 40% or more of total market demand as power systems become increasingly sophisticated and interconnected.

The Power and Utilities MLCC Market represents a critical and rapidly evolving segment within the global capacitor industry, driven by fundamental changes in power generation, transmission, and distribution systems worldwide. Market dynamics reflect the essential role of MLCCs in enabling reliable, efficient, and sustainable power infrastructure while supporting the global transition toward renewable energy sources and smart grid technologies.

Growth prospects remain exceptionally strong, supported by sustained investments in power infrastructure modernization, renewable energy deployment, and grid automation systems. The market benefits from long-term trends including electrification of emerging economies, replacement of aging power infrastructure, and implementation of advanced power management technologies requiring specialized capacitor solutions.

Competitive positioning favors manufacturers with proven expertise in power applications, comprehensive product portfolios, and strong customer support capabilities. Success in this market requires substantial investments in research and development, quality assurance, and application engineering to meet the demanding requirements of utility customers and power system applications.

Future market development will be shaped by continued technology advancement, evolving regulatory requirements, and changing power system architectures driven by renewable energy integration and digitalization trends. Companies that successfully navigate these market dynamics while maintaining focus on reliability, performance, and customer service will capture the substantial opportunities presented by the growing Power and Utilities MLCC Market.

What is Power and Utilities MLCC?

Power and Utilities MLCC refers to multi-layer ceramic capacitors used in power and utility applications, providing essential functions such as energy storage, filtering, and voltage regulation in electrical systems.

What are the key companies in the Power and Utilities MLCC Market?

Key companies in the Power and Utilities MLCC Market include Murata Manufacturing Co., Ltd., TDK Corporation, and KEMET Corporation, among others.

What are the growth factors driving the Power and Utilities MLCC Market?

The growth of the Power and Utilities MLCC Market is driven by the increasing demand for renewable energy sources, advancements in smart grid technology, and the rising need for efficient energy management solutions.

What challenges does the Power and Utilities MLCC Market face?

Challenges in the Power and Utilities MLCC Market include the high cost of raw materials, competition from alternative capacitor technologies, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the Power and Utilities MLCC Market?

Opportunities in the Power and Utilities MLCC Market include the expansion of electric vehicle infrastructure, the integration of energy storage systems, and the growing trend towards smart home technologies.

What trends are shaping the Power and Utilities MLCC Market?

Trends in the Power and Utilities MLCC Market include the miniaturization of components, the development of high-capacitance MLCCs, and the increasing focus on sustainability and eco-friendly manufacturing practices.

Power and Utilities MLCC Market

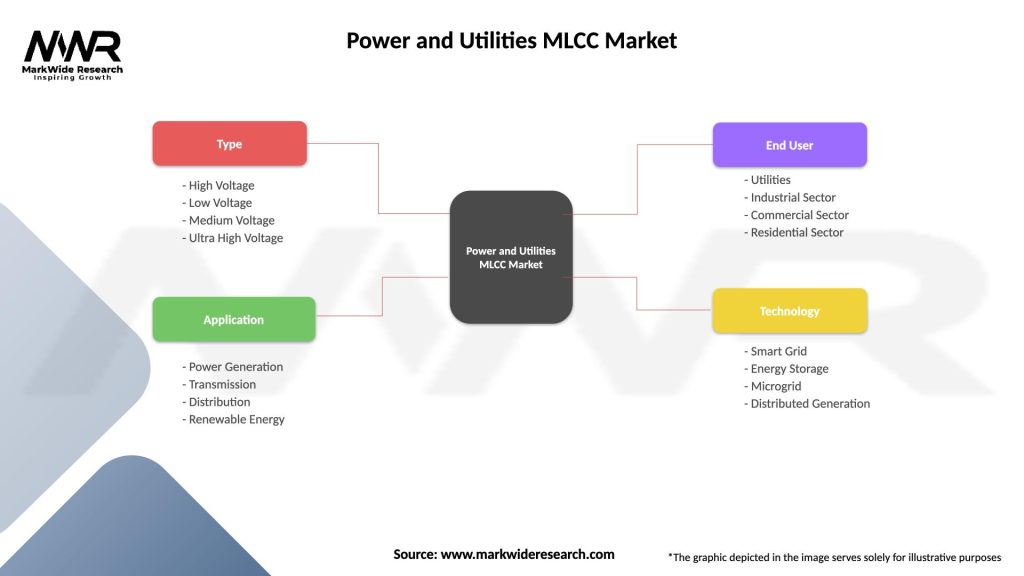

| Segmentation Details | Description |

|---|---|

| Type | High Voltage, Low Voltage, Medium Voltage, Ultra High Voltage |

| Application | Power Generation, Transmission, Distribution, Renewable Energy |

| End User | Utilities, Industrial Sector, Commercial Sector, Residential Sector |

| Technology | Smart Grid, Energy Storage, Microgrid, Distributed Generation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Power and Utilities MLCC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at