444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Portugal used car market represents a dynamic and rapidly evolving automotive sector that has experienced significant transformation in recent years. Market dynamics indicate substantial growth driven by changing consumer preferences, economic factors, and technological advancements in vehicle assessment and sales platforms. The Portuguese automotive landscape has witnessed a notable shift toward pre-owned vehicles, with consumers increasingly recognizing the value proposition of quality used cars.

Digital transformation has revolutionized how Portuguese consumers approach used car purchases, with online platforms and digital marketplaces gaining 78% market penetration among potential buyers. The market encompasses various vehicle categories, from compact city cars to luxury vehicles, catering to diverse consumer segments across Portugal’s urban and rural areas. Economic considerations continue to play a crucial role in driving demand, as consumers seek cost-effective transportation solutions without compromising on quality or reliability.

Regional distribution shows concentrated activity in major metropolitan areas including Lisbon, Porto, and Braga, while smaller cities and rural regions contribute to steady baseline demand. The market benefits from Portugal’s strategic location within Europe, facilitating cross-border trade and vehicle importation from neighboring countries, particularly Spain and France.

The Portugal used car market refers to the comprehensive ecosystem encompassing the sale, purchase, and trade of pre-owned vehicles within Portuguese territory. This market includes various stakeholders such as independent dealers, franchised dealerships, online platforms, auction houses, and private sellers who facilitate the exchange of previously owned automobiles.

Market participants engage in activities ranging from vehicle acquisition and reconditioning to sales and after-sales services. The sector encompasses all vehicle categories including passenger cars, commercial vehicles, motorcycles, and specialty vehicles that have had previous ownership. Value creation occurs through professional vehicle assessment, reconditioning services, warranty provisions, and financing solutions that enhance the overall customer experience.

Digital integration has become a defining characteristic, with online platforms, mobile applications, and digital marketing strategies forming the backbone of modern used car commerce in Portugal. The market operates within established regulatory frameworks governing vehicle safety, emissions standards, and consumer protection laws.

Portugal’s used car market demonstrates robust growth potential driven by evolving consumer behavior, technological innovation, and favorable economic conditions. The sector has successfully adapted to digital transformation challenges while maintaining strong fundamentals in traditional sales channels. Market expansion is supported by increasing consumer confidence in pre-owned vehicles and growing acceptance of online purchasing platforms.

Key growth drivers include rising vehicle prices in the new car segment, improved vehicle quality and longevity, and enhanced financing options for used car purchases. The market benefits from 62% consumer preference for certified pre-owned vehicles, indicating strong demand for quality assurance and warranty protection. Technological advancement in vehicle diagnostics and history reporting has significantly improved buyer confidence and market transparency.

Competitive landscape features a mix of established automotive groups, independent dealers, and emerging digital platforms competing for market share. The sector’s resilience during economic uncertainties demonstrates its essential role in Portugal’s transportation infrastructure and consumer mobility solutions.

Consumer behavior analysis reveals significant shifts in purchasing patterns and preferences within Portugal’s used car market. The following insights highlight critical market developments:

Economic factors serve as primary catalysts driving Portugal’s used car market expansion. Rising new vehicle prices have created a significant value gap, making pre-owned alternatives increasingly attractive to cost-conscious consumers. Inflation pressures on household budgets have intensified focus on transportation cost optimization, with used cars offering substantial savings compared to new vehicle purchases.

Technological improvements in vehicle manufacturing have extended average vehicle lifespans, making older cars more reliable and appealing to buyers. Modern vehicles retain functionality and safety features for extended periods, supporting strong residual values and market demand. Digital transformation has eliminated traditional barriers to used car shopping, providing consumers with comprehensive vehicle information, pricing transparency, and convenient purchasing options.

Environmental consciousness among Portuguese consumers has created demand for fuel-efficient used vehicles as an alternative to purchasing new cars. Government incentives for vehicle modernization and emission reduction programs have stimulated market activity. Urbanization trends continue driving demand for practical transportation solutions, particularly in metropolitan areas where public transportation may be insufficient for individual mobility needs.

Regulatory challenges pose significant constraints on Portugal’s used car market development. Stringent emission standards and periodic technical inspections create compliance costs that impact vehicle values and market accessibility. Import regulations and documentation requirements for vehicles from other European Union countries add complexity and costs to cross-border transactions.

Economic uncertainties can negatively impact consumer spending on discretionary purchases, including vehicle upgrades and replacements. Interest rate fluctuations affect financing accessibility and affordability, particularly for lower-income consumer segments. Insurance costs for certain vehicle categories and age groups create additional ownership expenses that influence purchase decisions.

Market fragmentation among numerous small dealers and private sellers can limit economies of scale and professional service standards. Quality concerns regarding vehicle history, maintenance records, and hidden defects continue to challenge buyer confidence. Seasonal demand variations create inventory management challenges for dealers and can lead to pricing volatility throughout the year.

Digital marketplace expansion presents substantial opportunities for market growth and efficiency improvements. Enhanced online platforms can streamline vehicle discovery, comparison, and purchasing processes while reducing transaction costs for both buyers and sellers. Mobile commerce development offers potential for reaching younger demographics and providing convenient shopping experiences.

Cross-border trade within the European Union creates opportunities for Portuguese dealers to access larger vehicle inventories and serve international customers. Strategic partnerships with dealers in neighboring countries can expand market reach and improve inventory turnover. Certified pre-owned programs offer opportunities for premium pricing and enhanced customer satisfaction through quality guarantees and warranty coverage.

Financing innovation including flexible payment options, lease-to-own programs, and digital lending platforms can expand market accessibility to previously underserved consumer segments. Value-added services such as vehicle delivery, extended warranties, and maintenance packages create differentiation opportunities and additional revenue streams for market participants.

Supply and demand balance in Portugal’s used car market reflects complex interactions between vehicle availability, consumer preferences, and economic conditions. Inventory levels fluctuate based on new car sales volumes, vehicle retirement rates, and import activities from other European markets. The market demonstrates 43% inventory turnover improvement through enhanced digital marketing and streamlined sales processes.

Pricing dynamics respond to multiple factors including fuel prices, insurance costs, maintenance expenses, and financing rates. Seasonal variations create predictable patterns in both supply and demand, with spring and early summer periods typically showing increased market activity. Brand positioning influences pricing power, with premium manufacturers maintaining stronger residual values compared to economy brands.

Competitive intensity varies across different market segments, with luxury and specialty vehicles experiencing less price competition compared to mainstream passenger cars. Market consolidation trends show larger dealer groups acquiring independent operations to achieve scale advantages and operational efficiencies.

Comprehensive market analysis employs multiple research approaches to ensure accurate and reliable insights into Portugal’s used car market. Primary research includes structured interviews with industry stakeholders, consumer surveys, and dealer questionnaires to gather firsthand market intelligence and trend identification.

Secondary research incorporates analysis of government statistics, industry reports, trade association data, and regulatory filings to establish market baselines and historical trends. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market assessments.

Market modeling utilizes statistical analysis and forecasting techniques to project future market developments and identify emerging opportunities. MarkWide Research employs proprietary analytical frameworks to evaluate market dynamics and competitive positioning across different segments and regions within Portugal’s used car market.

Lisbon Metropolitan Area dominates Portugal’s used car market, accounting for approximately 35% of total market activity due to high population density, economic activity, and consumer purchasing power. The region benefits from extensive dealer networks, financing options, and diverse vehicle inventory catering to varied consumer preferences. Urban mobility challenges drive demand for compact and fuel-efficient vehicles suitable for city driving conditions.

Porto Region represents the second-largest market segment, contributing significant volume through both retail and commercial vehicle sales. The area’s industrial base creates demand for commercial vehicles and utility-focused passenger cars. Regional preferences show stronger demand for practical and reliable vehicles compared to luxury segments.

Central Portugal including cities like Coimbra and Leiria demonstrates steady market demand driven by university populations and regional economic activity. Rural areas throughout the country contribute to baseline demand with preferences for larger vehicles and utility-focused options. Coastal regions show seasonal variations in market activity related to tourism and vacation home ownership patterns.

Market leadership in Portugal’s used car sector is distributed among several key player categories, each serving distinct market segments and customer needs. The competitive environment features established automotive groups, independent dealers, and emerging digital platforms.

Competitive differentiation occurs through service quality, inventory selection, pricing strategies, and customer experience enhancement. Digital capabilities increasingly determine competitive advantage as consumers expect seamless online and offline integration.

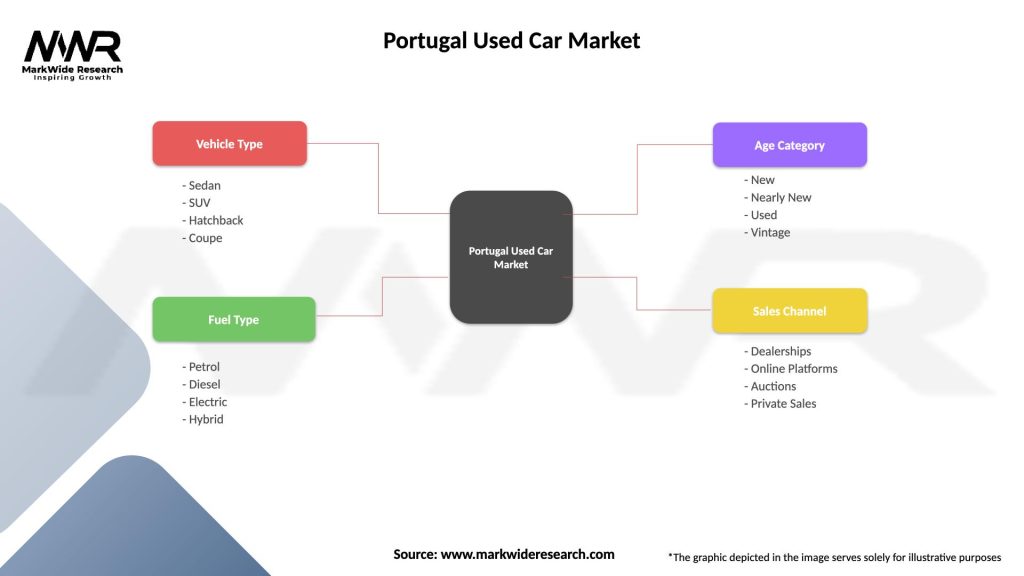

By Vehicle Type:

By Age Category:

By Sales Channel:

Compact Car Segment maintains the strongest market position due to urban driving conditions, fuel efficiency concerns, and parking limitations in Portuguese cities. Consumer preference for brands like Volkswagen, Peugeot, and Renault reflects reliability perceptions and service network availability. This category shows 52% market share among passenger vehicle sales.

SUV and Crossover Categories demonstrate rapid growth as consumers seek versatility and elevated driving positions. Family-oriented buyers increasingly choose these vehicles for their combination of passenger space, cargo capacity, and perceived safety advantages. Premium SUV models maintain strong residual values and appeal to affluent consumer segments.

Commercial Vehicle Segment serves Portugal’s business community with practical transportation solutions for goods delivery, service operations, and professional use. Light commercial vehicles dominate this category, with brands like Ford Transit, Mercedes Sprinter, and Volkswagen Crafter leading market preferences. E-commerce growth has increased demand for delivery-capable vehicles.

Luxury Vehicle Category caters to affluent consumers seeking premium brands, advanced technology, and prestige ownership. German luxury brands including BMW, Mercedes-Benz, and Audi maintain strong market positions despite higher price points and maintenance costs.

Dealers and Retailers benefit from expanding market opportunities through digital transformation and enhanced customer reach. Inventory management improvements through online platforms reduce carrying costs and accelerate vehicle turnover. Data analytics capabilities enable better pricing strategies and customer targeting, improving profitability and operational efficiency.

Consumers gain access to broader vehicle selection, transparent pricing information, and convenient shopping experiences through digital platforms. Quality assurance programs and vehicle history reporting reduce purchase risks and increase buyer confidence. Financing options expand accessibility to vehicle ownership across different income levels and credit profiles.

Financial Institutions benefit from growing demand for automotive financing products and services. Risk assessment improvements through digital tools and data analytics enhance lending decisions and reduce default rates. Partnership opportunities with dealers and online platforms create new customer acquisition channels.

Technology Providers find expanding opportunities in developing solutions for inventory management, customer relationship management, and digital marketing. Innovation demand drives development of mobile applications, virtual vehicle viewing technologies, and automated valuation systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Approach has become the dominant trend in Portugal’s used car market, with consumers increasingly beginning their vehicle search online before visiting physical locations. Virtual showrooms and augmented reality technologies enable remote vehicle inspection and comparison shopping. Social media marketing and influencer partnerships are gaining traction among younger consumer demographics.

Sustainability Consciousness drives growing demand for hybrid and electric used vehicles as consumers seek environmentally responsible transportation options. Fuel efficiency has become a primary consideration in vehicle selection, with diesel vehicles experiencing declining popularity. Government incentives for low-emission vehicles support market demand for eco-friendly options.

Subscription and Mobility Services represent emerging alternatives to traditional vehicle ownership, particularly among urban millennials. Flexible ownership models including lease-to-own programs and short-term rental options cater to changing consumer preferences. Shared mobility concepts influence individual vehicle purchase decisions and usage patterns.

Data-Driven Decision Making enables more sophisticated pricing strategies, inventory management, and customer targeting. Artificial intelligence applications in vehicle valuation and market prediction improve business efficiency and accuracy.

Platform Consolidation has accelerated as major online marketplaces acquire smaller competitors to expand market reach and enhance service offerings. Stand Virtual and OLX Carros continue investing in technology improvements and user experience enhancements to maintain competitive advantages.

Dealer Network Evolution shows established automotive groups expanding their used car operations and digital capabilities. Omnichannel strategies integrate online and offline customer touchpoints to provide seamless shopping experiences. Certified pre-owned programs expansion among franchised dealers enhances quality assurance and customer confidence.

Financing Innovation includes development of digital lending platforms and alternative credit assessment methods. Partnership agreements between dealers and financial institutions streamline the vehicle financing process and improve customer accessibility. MarkWide Research analysis indicates 67% growth in online financing applications over recent periods.

Technology Integration advances include implementation of blockchain technology for vehicle history verification and smart contracts for transaction processing. Mobile applications with advanced search filters and notification systems improve customer engagement and satisfaction.

Market participants should prioritize digital transformation initiatives to remain competitive in Portugal’s evolving used car market. Investment in technology including customer relationship management systems, inventory management platforms, and mobile applications will be essential for long-term success. Data analytics capabilities should be developed to improve pricing accuracy, customer targeting, and operational efficiency.

Quality assurance programs represent critical differentiation opportunities in building consumer trust and commanding premium pricing. Transparent vehicle history reporting and professional inspection services should be standard offerings across all market segments. Warranty programs and after-sales service capabilities will become increasingly important competitive factors.

Strategic partnerships with financial institutions, technology providers, and logistics companies can enhance service offerings and operational efficiency. Cross-border expansion within the European Union presents growth opportunities for established Portuguese dealers with strong operational capabilities.

Sustainability initiatives including promotion of fuel-efficient vehicles and environmental responsibility messaging will resonate with increasingly conscious consumers. Electric vehicle expertise development will be crucial as the used EV market expands in coming years.

Portugal’s used car market is positioned for continued growth driven by digital transformation, changing consumer preferences, and economic factors favoring pre-owned vehicle purchases. Market expansion is expected to accelerate with projected growth rates of 8.2% annually over the next five years, supported by increasing consumer confidence and improved market transparency.

Digital platforms will continue gaining market share as consumers embrace online vehicle shopping and comparison tools. Mobile commerce adoption is expected to reach 75% penetration among potential buyers, driving demand for enhanced mobile applications and services. Artificial intelligence and machine learning technologies will revolutionize vehicle valuation, customer matching, and inventory management processes.

Sustainability trends will reshape market dynamics as hybrid and electric vehicles become more prevalent in the used car segment. Government policies supporting emission reduction and vehicle modernization will influence consumer choices and market development. Cross-border trade within the European Union will expand as digital platforms facilitate international transactions and logistics coordination.

Market consolidation is expected to continue as larger players acquire smaller operations to achieve scale advantages and operational efficiencies. Service innovation including home delivery, extended warranties, and comprehensive vehicle history reporting will become standard market expectations rather than competitive differentiators.

Portugal’s used car market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation, changing consumer behavior, and favorable economic conditions. The market has successfully adapted to technological disruption while maintaining strong fundamentals in traditional automotive commerce. Digital platforms have revolutionized how consumers research, compare, and purchase used vehicles, creating new opportunities for market participants and enhanced experiences for buyers.

Key success factors for market participants include embracing digital transformation, implementing quality assurance programs, and developing comprehensive customer service capabilities. The market’s future growth will be supported by continued consumer preference for value-oriented transportation solutions, technological advancement in vehicle assessment and sales processes, and expanding cross-border trade opportunities within the European Union. MarkWide Research projects continued market expansion as Portugal’s used car sector adapts to evolving consumer needs and technological innovations, positioning the market for sustained growth and development in the years ahead.

What is Portugal Used Car?

Portugal Used Car refers to pre-owned vehicles that are available for sale in Portugal. This market includes a variety of vehicle types, such as sedans, SUVs, and hatchbacks, catering to diverse consumer preferences.

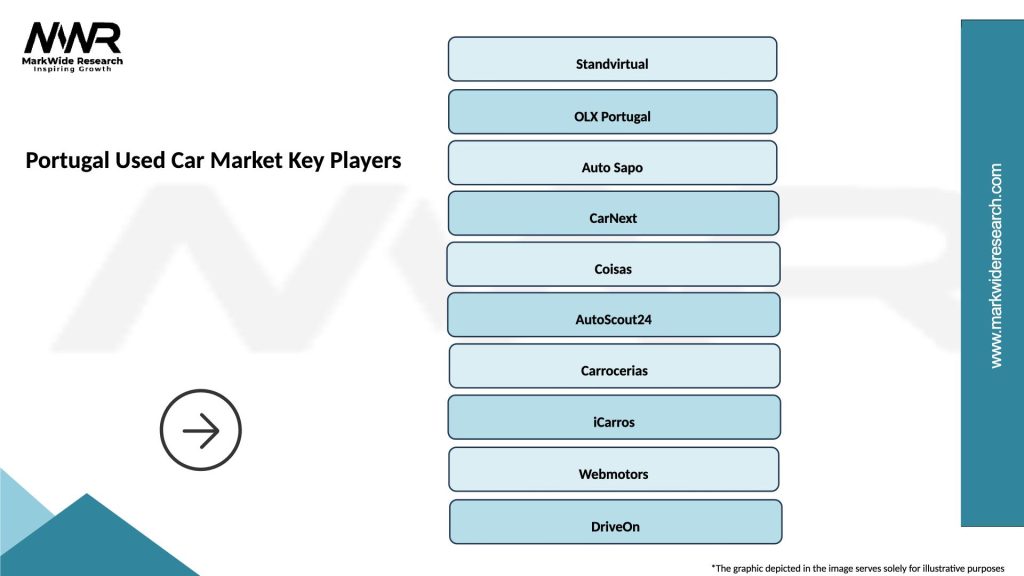

What are the key players in the Portugal Used Car Market?

Key players in the Portugal Used Car Market include companies like Standvirtual, OLX, and Auto Sapo, which provide platforms for buying and selling used vehicles. These companies facilitate transactions and offer a wide range of options for consumers, among others.

What are the growth factors driving the Portugal Used Car Market?

The growth of the Portugal Used Car Market is driven by factors such as increasing consumer demand for affordable transportation, the rising popularity of online car sales platforms, and the economic benefits of purchasing used vehicles over new ones.

What challenges does the Portugal Used Car Market face?

The Portugal Used Car Market faces challenges such as fluctuating vehicle prices, the need for stringent vehicle inspections, and competition from new car sales. These factors can impact consumer confidence and purchasing decisions.

What opportunities exist in the Portugal Used Car Market?

Opportunities in the Portugal Used Car Market include the potential for growth in online sales channels, increasing interest in electric and hybrid used vehicles, and the expansion of financing options for buyers.

What trends are shaping the Portugal Used Car Market?

Trends in the Portugal Used Car Market include a shift towards digital platforms for buying and selling cars, a growing emphasis on vehicle history transparency, and an increasing focus on sustainability with the rise of eco-friendly used vehicles.

Portugal Used Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, Nearly New, Used, Vintage |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Portugal Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at