444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Portugal POS (Point of Sale) Terminals Market has witnessed significant growth over the past few years. A POS terminal is an electronic device used by businesses to process payments from customers at the point of sale. It plays a crucial role in facilitating secure and efficient transactions in various industries such as retail, hospitality, healthcare, and more. The market for POS terminals in Portugal has been driven by technological advancements, the growing trend of digital payments, and the need for streamlining payment processes.

Meaning

A Point of Sale (POS) terminal is a device used by businesses to accept card payments from customers. It serves as a vital link between the customer’s payment card and the payment processing network. When a customer makes a purchase using their credit or debit card, the POS terminal securely captures the card information, verifies it, and processes the payment.

Executive Summary

The Portugal POS Terminals Market is witnessing robust growth due to the increasing adoption of digital payment methods, rising demand for contactless transactions, and a growing number of small and medium-sized businesses. The market is characterized by intense competition among key players, who are continually investing in research and development to introduce innovative and user-friendly POS solutions. The COVID-19 pandemic has also accelerated the adoption of cashless payments, further fueling the market’s growth.

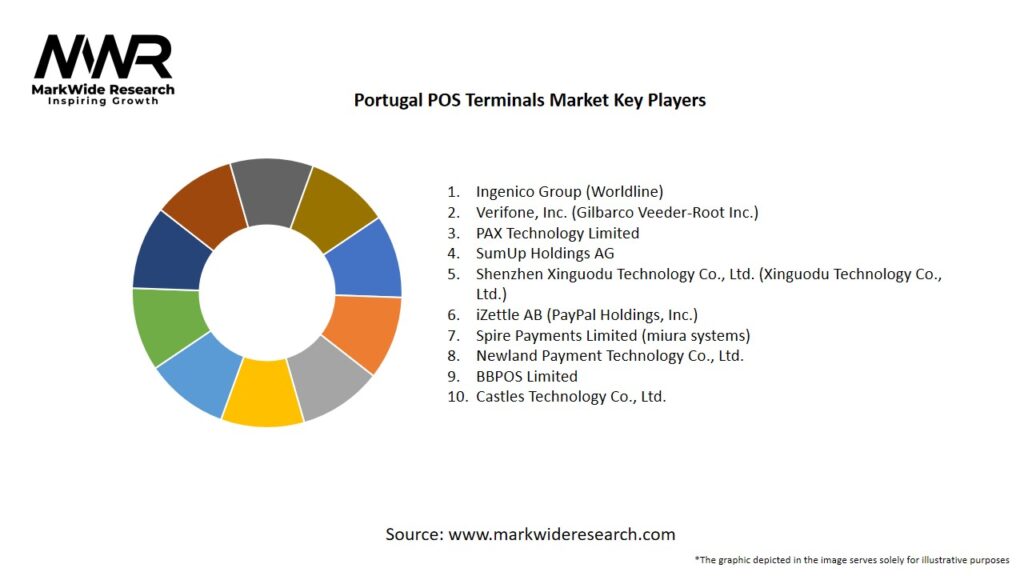

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Portugal POS Terminals Market is characterized by intense competition among vendors, driven by constant technological innovations and the evolving preferences of businesses and consumers. Key players are engaged in strategic partnerships, mergers, and acquisitions to expand their market presence and offer comprehensive payment solutions. Additionally, the market has been witnessing collaborations between POS terminal manufacturers and payment service providers to provide end-to-end payment solutions.

The COVID-19 pandemic has had a significant impact on the market dynamics. The shift towards contactless and cashless payments, driven by hygiene concerns, has accelerated during the pandemic and is expected to continue post-crisis. Businesses are increasingly focusing on digitizing their payment processes to adapt to changing consumer behavior.

Regional Analysis

The regional analysis of the Portugal POS Terminals Market reveals variations in the adoption of POS technology across different regions of the country. Urban areas, especially major cities and tourist hotspots, have witnessed higher POS terminal adoption rates due to a higher concentration of businesses and greater awareness of digital payment options. In contrast, rural regions have shown slower adoption rates, primarily due to limited access to network connectivity and a relatively higher preference for cash transactions.

Competitive Landscape

Leading Companies in the Portugal POS Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Portugal POS Terminals Market can be segmented based on several factors, including the type of terminal, end-user industry, and technology used. The primary segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly accelerated the adoption of cashless and contactless payment methods in Portugal. With a heightened focus on hygiene and safety, consumers and businesses alike have shifted towards digital payment options, including contactless cards, mobile payments, and online transactions. As a result, the demand for POS terminals that support these payment methods has soared.

Moreover, the pandemic has led to a surge in e-commerce and online shopping, further boosting the need for efficient POS solutions that seamlessly integrate with online payment gateways. The trend is expected to continue even post-pandemic, as consumers have become accustomed to the convenience and security of digital payments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Portugal POS Terminals Market looks promising, driven by factors such as continued digital payment adoption, the rise of mobile POS solutions, and the integration of advanced technologies. The market is expected to witness steady growth in the coming years, with a focus on security, convenience, and seamless integration with other payment systems.

The demand for POS terminals is also likely to be influenced by regulatory changes, government initiatives, and the overall economic outlook. As businesses and consumers continue to embrace cashless payments, the role of POS terminals in facilitating secure and efficient transactions will become increasingly pivotal.

Conclusion

The Portugal POS Terminals Market is experiencing significant growth, primarily fueled by the increasing adoption of digital payment methods, government initiatives, and the growing number of small and medium-sized businesses. POS terminal providers are continually innovating to offer secure, user-friendly, and customizable solutions that cater to the diverse needs of various industries.

The COVID-19 pandemic has accelerated the shift towards cashless and contactless payments, pushing businesses to adopt POS terminals that support these payment methods. In the future, the market is expected to witness further advancements in technology, seamless integration with online platforms, and a continued focus on data security.

What is POS Terminals?

POS Terminals, or Point of Sale Terminals, are electronic devices used to process card payments at retail locations. They facilitate transactions by reading credit and debit cards, enabling businesses to accept payments efficiently.

What are the key players in the Portugal POS Terminals Market?

Key players in the Portugal POS Terminals Market include companies like Ingenico, Verifone, and SumUp, which provide a range of payment solutions and technologies for various retail environments, among others.

What are the growth factors driving the Portugal POS Terminals Market?

The growth of the Portugal POS Terminals Market is driven by the increasing adoption of cashless payments, the rise of e-commerce, and advancements in payment technologies such as contactless payments and mobile wallets.

What challenges does the Portugal POS Terminals Market face?

Challenges in the Portugal POS Terminals Market include the high costs of advanced terminal technologies, security concerns related to data breaches, and the need for continuous updates to comply with evolving regulations.

What opportunities exist in the Portugal POS Terminals Market?

Opportunities in the Portugal POS Terminals Market include the expansion of digital payment solutions, the integration of AI and machine learning for enhanced customer experiences, and the growing demand for mobile POS systems in small businesses.

What trends are shaping the Portugal POS Terminals Market?

Trends in the Portugal POS Terminals Market include the shift towards omnichannel retailing, the increasing use of biometric authentication for secure transactions, and the rise of subscription-based payment models for businesses.

Portugal POS Terminals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mobile Terminals, Fixed Terminals, Self-Service Kiosks, Integrated Terminals |

| End User | Retail, Hospitality, Transportation, Healthcare |

| Technology | Contactless, Chip & Pin, Magnetic Stripe, NFC |

| Deployment | On-Premise, Cloud-Based, Hybrid, Managed Services |

Leading Companies in the Portugal POS Terminals Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at