444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Portugal Mobile Payments Market refers to the use of mobile devices, such as smartphones and tablets, to make electronic transactions for goods and services. In recent years, the adoption of mobile payments in Portugal has witnessed significant growth due to technological advancements, changing consumer preferences, and an increasing number of smartphone users. Mobile payments offer convenience, speed, and security, making them a popular choice for both consumers and businesses. This article provides a comprehensive analysis of the Portugal Mobile Payments Market, including its meaning, key insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, Covid-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Mobile payments, also known as m-payments, refer to financial transactions made through mobile devices. These transactions can include various payment methods, such as mobile wallets, Near Field Communication (NFC) payments, and mobile banking applications. Essentially, mobile payments enable users to complete transactions without the need for physical cash or traditional payment methods like credit or debit cards. With the integration of secure and innovative technologies, mobile payments have become a convenient and secure alternative to traditional payment methods.

Executive Summary

The executive summary of the Portugal Mobile Payments Market provides a brief overview of the market’s key findings, growth prospects, and major trends. It summarizes the main points discussed in this comprehensive analysis, giving readers a quick understanding of the market’s current status and potential opportunities.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

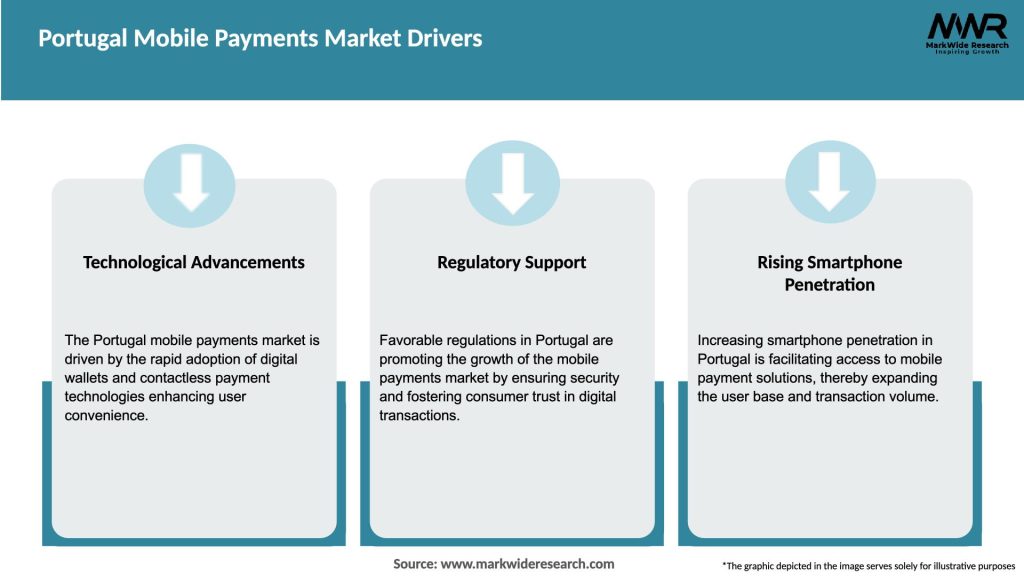

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

Portugal has a well-developed digital infrastructure, making it one of the leaders in the adoption of mobile payments in Southern Europe. The country’s high smartphone penetration and growing preference for digital services are driving the growth of mobile payments, especially in urban centers such as Lisbon and Porto. However, adoption is slower in rural areas, where infrastructure and mobile payment services are less widespread. As the government continues to invest in digital payment infrastructure and promote cashless initiatives, the overall market for mobile payments in Portugal is expected to expand significantly.

Competitive Landscape

Leading Companies in the Portugal Mobile Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Component

By Payment Type

By End-User Industry

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated the adoption of mobile payments in Portugal, as consumers have become more conscious of hygiene and safety. Contactless payments, including mobile wallet apps, have seen significant growth as people seek to reduce physical interactions. The pandemic has also underscored the importance of digital payment systems in ensuring business continuity and consumer convenience.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook section provides a forward-looking perspective on the Portugal Mobile Payments Market. It includes growth projections, anticipated technological advancements, regulatory developments, and potential challenges. A well-defined future outlook helps businesses align their long-term goals with market opportunities.

Conclusion

The conclusion summarizes the key points discussed throughout the article and emphasizes the significance of the Portugal Mobile Payments Market as a growing and dynamic sector. It reiterates the potential benefits for businesses and consumers, and the importance of adaptability and innovation in this rapidly evolving landscape. By recognizing the market’s potential and understanding its challenges, industry participants can position themselves for success in the Portugal Mobile Payments Market.

What is Mobile Payments?

Mobile payments refer to transactions made through mobile devices, allowing consumers to pay for goods and services using their smartphones or tablets. This includes various methods such as mobile wallets, contactless payments, and in-app purchases.

What are the key players in the Portugal Mobile Payments Market?

Key players in the Portugal Mobile Payments Market include companies like SIBS, MB WAY, and PayPal, which provide various mobile payment solutions and services to consumers and businesses, among others.

What are the main drivers of growth in the Portugal Mobile Payments Market?

The growth of the Portugal Mobile Payments Market is driven by increasing smartphone penetration, the rise of e-commerce, and consumer demand for convenient payment solutions. Additionally, the adoption of contactless payment technology has significantly contributed to market expansion.

What challenges does the Portugal Mobile Payments Market face?

Challenges in the Portugal Mobile Payments Market include concerns over security and privacy, regulatory compliance issues, and the need for widespread merchant acceptance of mobile payment methods. These factors can hinder consumer adoption and market growth.

What opportunities exist in the Portugal Mobile Payments Market?

Opportunities in the Portugal Mobile Payments Market include the potential for innovation in payment technologies, the expansion of digital banking services, and the increasing integration of mobile payments with loyalty programs and rewards systems. These trends can enhance user experience and drive further adoption.

What trends are shaping the Portugal Mobile Payments Market?

Trends in the Portugal Mobile Payments Market include the growing popularity of peer-to-peer payment apps, the integration of artificial intelligence for fraud detection, and the rise of cryptocurrency payments. These innovations are transforming how consumers engage with mobile payment solutions.

Portugal Mobile Payments Market

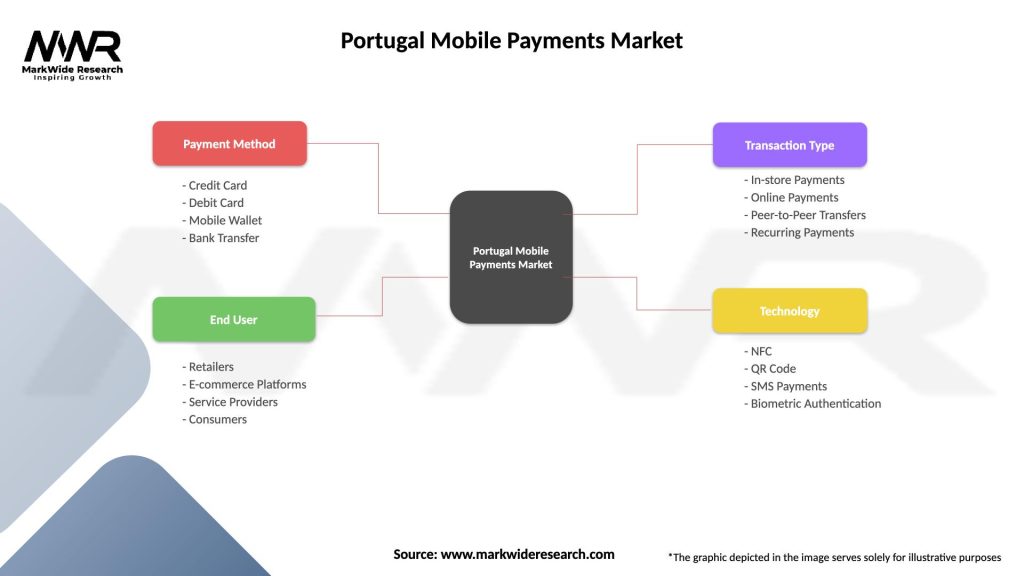

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| End User | Retailers, E-commerce Platforms, Service Providers, Consumers |

| Transaction Type | In-store Payments, Online Payments, Peer-to-Peer Transfers, Recurring Payments |

| Technology | NFC, QR Code, SMS Payments, Biometric Authentication |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Portugal Mobile Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at