Key Market Insights

-

Polyolefins represent over half of the global thermoplastics market by volume, with PE leading at approximately 30 million tonnes annually.

-

LLDPE film applications are outpacing LDPE in flexible packaging due to superior tensile and puncture resistance.

-

The shift to electric vehicles is driving PP demand for under-the-hood components and battery enclosures.

-

Evolving recycling technologies—mechanical and advanced chemical recycling—are enhancing the circularity of polyolefin waste streams.

Market Drivers

-

Packaging Growth: Demand for lightweight, tamper-proof, and high-barrier films in food, personal care, and e-commerce packaging.

-

Automotive Lightweighting: Adoption of PP and LLDPE in interior and exterior components to reduce vehicle weight and improve fuel efficiency.

-

Healthcare Sterility: Use of PP in disposable syringes, diagnostic kits, and medical packaging for its sterilization compatibility and chemical resistance.

-

Construction Applications: HDPE pipes and geomembranes benefit from chemical stability, impact strength, and longevity in infrastructure projects.

-

Feedstock Integration: Vertically integrated petrochemical complexes lower raw material costs and enhance production reliability.

Market Restraints

-

Feedstock Volatility: Fluctuating crude oil and natural gas prices impact ethylene and propylene costs, affecting margins.

-

Environmental Pressure: Regulatory and consumer pushback against single-use plastics is prompting stricter restrictions and taxation in key markets.

-

recycling Challenges: Contamination and mixed‐polymer streams complicate mechanical recycling, limiting feedstock availability for recycled polyolefins.

-

Capital Intensity: High investment requirements for new polymerization plants and recycling facilities can deter expansion by smaller players.

-

Substitute Materials: Growth of alternative biopolymers and paper-based packaging in niche applications reduces polyolefin share.

Market Opportunities

-

Biobased Polyolefins: Commercialization of polyethylene and polypropylene from renewable feedstocks (e.g., bioethanol-derived ethylene) to lower carbon footprint.

-

Advanced Recycling: Scaling chemical recycling technologies (pyrolysis, depolymerization) to convert mixed plastic waste back to virgin-quality monomers.

-

High-Performance Grades: Development of specialty PP copolymers with enhanced clarity, impact resistance, and heat stability for medical and optical applications.

-

Regional Expansion: Brownfield capacity expansions in Southeast Asia and Middle East to serve growing domestic demand and export markets.

-

Circular Economy Partnerships: Collaborations between polyolefin producers, brand owners, and recyclers to establish closed-loop systems.

Market Dynamics

-

Catalyst Innovations: Continuous improvements in metallocene and single-site catalysts enable precise control over polymer microstructure and properties.

-

Digital Manufacturing: Implementation of Industry 4.0 and process analytics optimizes reactor performance, energy consumption, and product consistency.

-

Brand Sustainability Goals: Major consumer-packaged goods companies committing to 100% recyclable packaging are driving demand for mono-polyolefin solutions.

-

M&A Activity: Strategic acquisitions among petrochemical majors and specialty resin producers consolidate technology portfolios and regional footprints.

-

Regulatory Landscape: Emerging extended producer responsibility (EPR) frameworks and plastic taxes in Europe and North America influence market strategies.

Regional Analysis

-

Asia Pacific: Dominant region, accounting for over 50% of global polyolefin consumption, led by China and India’s packaging and automobile sectors.

-

North America: Mature market with integrated shale gas-based ethylene/propylene production; strong recycling infrastructure and specialty resin demand.

-

Europe: Moderate growth driven by stringent circular economy policies, high recycling rates, and innovation in chemical recycling.

-

Middle East & Africa: Rapid capacity additions in GCC countries leveraging low-cost feedstock; increasing exports to Asia and Europe.

-

Latin America: Emerging demand in packaging and construction, though net import reliance persists due to limited domestic polymer capacity.

Competitive Landscape

-

ExxonMobil: Global leader with wide range of polyolefin grades and integrated U.S. Gulf Coast and Singapore facilities.

-

LyondellBasell: Largest PE and PP producer, leveraging proprietary metallocene catalyst technologies and broad geographic footprint.

-

SABIC: Strong presence with high-performance PE and PP lines, particularly in the Middle East via fully integrated petrochemical complexes.

-

Dow: Focus on sustainable solutions, bio-PE commercialization, and advanced LLDPE/LDPE technologies for packaging.

-

INEOS: Rapid capacity expansion in North America and Europe, with agile small-scale plants and focus on specialty grades.

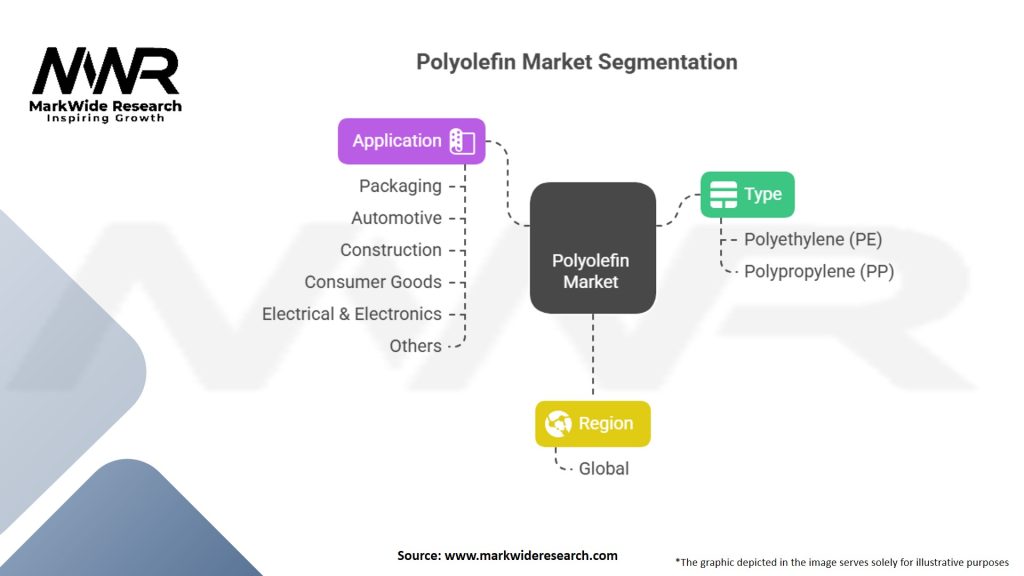

Segmentation

-

By Polymer Type: HDPE, LDPE, LLDPE, PP Homo-polymer, PP Copolymer.

-

By Application: Flexible Packaging, Rigid Packaging, Automotive Components, Construction (Pipes, Films), Healthcare, Others.

-

By Region: Asia Pacific, North America, Europe, Middle East & Africa, Latin America.

-

By Technology: Ziegler–Natta, Metallocene, Single-Site, Other Catalysts.

Category-wise Insights

-

HDPE: Preferred for blow-molded containers, piping, and geomembranes due to high strength and chemical resilience.

-

LDPE: Dominant in film applications for its flexibility and sealability; sees substitution by LLDPE in stretch wrap.

-

LLDPE: Gains share from LDPE in agricultural and stretch films, offering superior mechanical properties at similar cost.

-

PP Homopolymer: Used extensively in injection-molded automotive parts and consumer goods; high stiffness and fatigue resistance.

-

PP Copolymer: Employed in impact-resistant applications such as bumpers and medical devices; combines clarity and toughness.

Key Benefits for Industry Participants and Stakeholders

-

Cost Efficiency: Polyolefins offer lower material and processing costs compared to many engineering plastics and metal alternatives.

-

Design Flexibility: Wide range of grades enables tailored solutions for specific performance requirements—rigidity, clarity, toughness.

-

Recyclability: Monomaterial packaging streams simplify sorting and mechanical recycling, supporting circular economy initiatives.

-

Lightweighting: Significant weight reduction possibilities in automotive and packaging enhance fuel efficiency and lower transport costs.

-

Feedstock Security: Vertically integrated sites with access to ethane and propane feedstocks ensure reliable supply and price competitiveness.

SWOT Analysis

Strengths

-

Mature technologies with vast production capacities.

-

Extensive global supply chain and integrated operations.

Weaknesses

-

High sensitivity to feedstock price fluctuations.

-

Environmental concerns over single-use plastics.

Opportunities

-

Growth in bio-based and chemically recycled polyolefins.

-

Expansion into high-growth emerging markets with tailored product offerings.

Threats

-

Regulatory restrictions and taxes on plastic usage.

-

Competition from alternative sustainable materials (biopolymers, paper).

Market Key Trends

-

Mono-Material Packaging: Brands adopting pure PE or PP packaging to streamline recycling and reduce contamination.

-

Chemical Recycling Scale-Up: Investments in depolymerization and pyrolysis plants converting polyolefin waste back into virgin monomers.

-

Bioplastic Integration: Blends of bio-PE with conventional resin to offer drop-in sustainability without new processing equipment.

-

Advanced Catalyst R&D: Development of ultra-high-molecular-weight polyolefins for performance applications in pipes and cables.

-

Digital Supply Chain: Use of blockchain and IoT tracking to ensure feedstock traceability and certification of recycled content.

Covid-19 Impact

The pandemic initially disrupted supply chains and dampened packaging demand for on-premises consumption (e.g., restaurants). However, accelerated growth in e-commerce, home deliveries, and medical consumables (PPE, diagnostic kits) offset declines, resulting in an overall resilience of polyolefin markets. Companies have since enhanced supply-chain agility and diversified sourcing to mitigate future shocks.

Key Industry Developments

-

New Capacity Announcements: Major petrochemical players commissioning mega-scale PE and PP plants in the U.S., Middle East, and China.

-

M&A Activity: Consolidation among regional producers and recyclers to achieve scale and broaden product portfolios.

-

Collaborative Alliances: Partnerships between resin producers and consumer-goods companies to pilot certified recycled polyolefin packaging.

-

Technology Licensing: Spread of next-generation metallocene and single-site catalyst licenses to support local manufacturing in emerging markets.

Analyst Suggestions

-

Accelerate Circularity: Invest in chemical recycling and bio-feedstock R&D to secure long-term sustainability credentials and regulatory compliance.

-

Focus on Specialty Grades: Develop high-value, application-specific polyolefins (e.g., automotive battery casings, medical devices) to enhance margins.

-

Strengthen E-Commerce Channels: Collaborate with packaging converters to design polyolefin solutions optimized for last-mile delivery and consumer convenience.

-

Enhance Digital Traceability: Implement blockchain-based tracking for recycled content verification and supply-chain transparency.

Future Outlook

The Polyolefin market is expected to maintain robust growth, underpinned by expanding end-use applications, technological advancements in production and recycling, and increasing regulatory emphasis on sustainability. Innovation in catalyst design, advanced recycling, and bio-based feedstocks will shape the next wave of market transformation. Producers that combine scale with agility—leveraging digitalization, circular economy partnerships, and specialty product lines—will secure leadership in this evolving landscape.

Conclusion

Polyolefins remain the cornerstone of modern polymer applications, balancing performance, cost, and processability across diverse industries. As global demand for lightweight, recyclable materials intensifies, the polyolefin industry is poised for continued innovation in technology and sustainability. Through strategic investment in advanced production, circularity initiatives, and specialty markets, stakeholders can navigate challenges and harness the full potential of this dynamic market.