444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The polybismaleimides market is witnessing substantial growth due to the increasing demand for high-performance materials across various industries. Polybismaleimides, also known as BMI resins, are a type of thermosetting resin that offers excellent mechanical and thermal properties, making them suitable for a wide range of applications. This comprehensive report analyzes the current trends, key market insights, opportunities, and challenges in the polybismaleimides market.

Meaning

Polybismaleimides, or BMI resins, are a class of high-performance thermosetting resins that exhibit outstanding thermal stability, mechanical strength, and chemical resistance. These resins are formed by reacting bismaleimide monomers with various co-monomers, such as dianhydrides, to produce a crosslinked three-dimensional network. The resulting material possesses unique properties that make it ideal for use in critical applications across aerospace, automotive, electronics, and other industries.

Executive Summary

The executive summary of the polybismaleimides market provides a concise overview of the key findings and insights presented in this report. It offers a snapshot of the market’s current state, highlighting the significant growth drivers, challenges, and opportunities. Industry participants and stakeholders can use this section to gain a quick understanding of the market’s potential and the areas of focus for strategic decision-making.

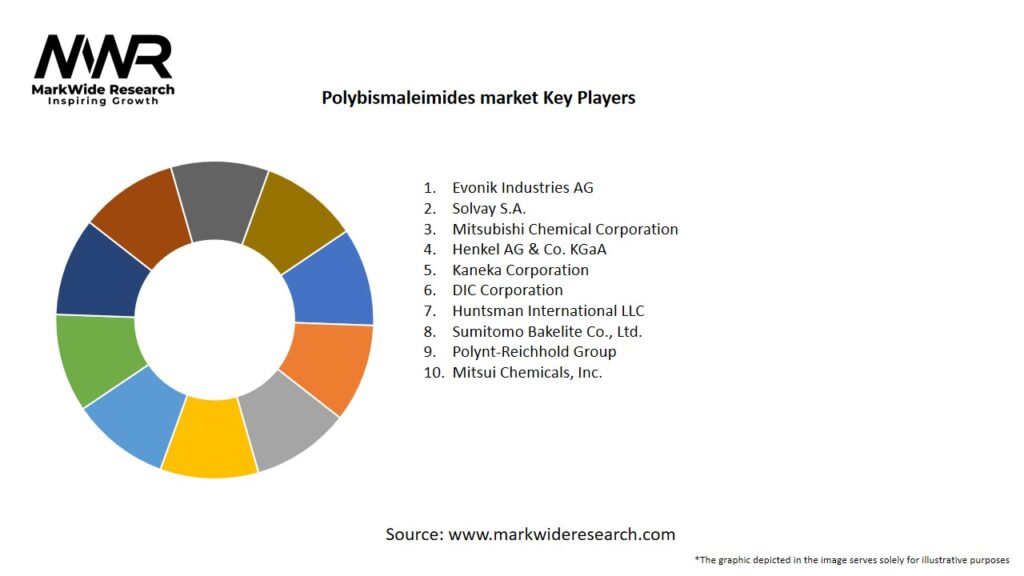

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

The Polybismaleimides market in Europe is poised for significant growth, with key industries in aerospace, automotive, and electronics leading demand. The region’s emphasis on high-performance materials in critical applications such as aerospace and electronics will drive further adoption of PBIs. Countries like Germany, France, and the UK are expected to lead in the demand for Polybismaleimides due to their well-established manufacturing sectors.

In North America, the aerospace industry, along with automotive and electronics sectors, will continue to be key drivers for PBI adoption. The rising focus on energy-efficient solutions is also expected to boost the market in the region. In Asia-Pacific, the rapid expansion of electronics and automotive industries will contribute to the growing demand for high-performance materials like PBIs.

Competitive Landscape

Leading Companies in the Polybismaleimides Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Type

By Application

By Region

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic disrupted supply chains, but the demand for high-performance materials, including Polybismaleimides, remained strong in critical sectors such as aerospace and electronics. The pandemic accelerated the adoption of durable and reliable materials in industries where failure is not an option.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook section offers a forward-looking perspective on the polybismaleimides market. It projects potential growth opportunities, technological advancements, and market trends that may shape the industry’s future trajectory. Industry participants can use this information to make long-term investment decisions and anticipate market shifts.

Conclusion

In conclusion, the polybismaleimides market is poised for significant growth, driven by increasing demand across diverse industries. The exceptional properties of BMI resins, such as thermal stability and mechanical strength, make them a preferred choice for critical applications. However, challenges like production costs and competition from alternative materials warrant strategic planning by industry players. By leveraging the opportunities, understanding market dynamics, and embracing technological advancements, stakeholders can unlock the full potential of the polybismaleimides market and ensure sustainable success.

What is Polybismaleimides?

Polybismaleimides are a class of thermosetting polymers known for their high thermal stability, excellent mechanical properties, and resistance to chemicals. They are commonly used in aerospace, electronics, and automotive applications due to their ability to withstand extreme conditions.

What are the key players in the Polybismaleimides market?

Key players in the Polybismaleimides market include companies like Huntsman Corporation, BASF SE, and Evonik Industries. These companies are involved in the development and production of advanced polymer materials for various applications, among others.

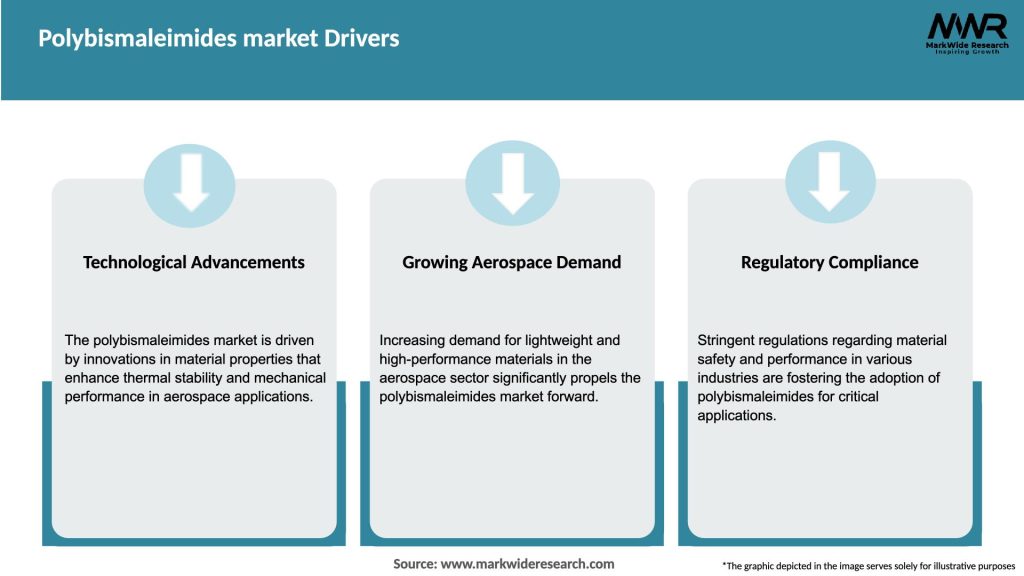

What are the growth factors driving the Polybismaleimides market?

The growth of the Polybismaleimides market is driven by the increasing demand for lightweight and high-performance materials in the aerospace and automotive industries. Additionally, the rise in electronic applications requiring durable and heat-resistant materials contributes to market expansion.

What challenges does the Polybismaleimides market face?

The Polybismaleimides market faces challenges such as high production costs and the complexity of processing these materials. Furthermore, competition from alternative materials that offer similar properties at lower costs can hinder market growth.

What opportunities exist in the Polybismaleimides market?

Opportunities in the Polybismaleimides market include the growing demand for advanced materials in renewable energy applications and the development of new formulations that enhance performance. Innovations in processing techniques also present avenues for market growth.

What trends are shaping the Polybismaleimides market?

Trends in the Polybismaleimides market include a shift towards sustainable materials and the integration of smart technologies in polymer applications. Additionally, increasing research and development efforts are focused on enhancing the properties of polybismaleimides for specialized applications.

Polybismaleimides market

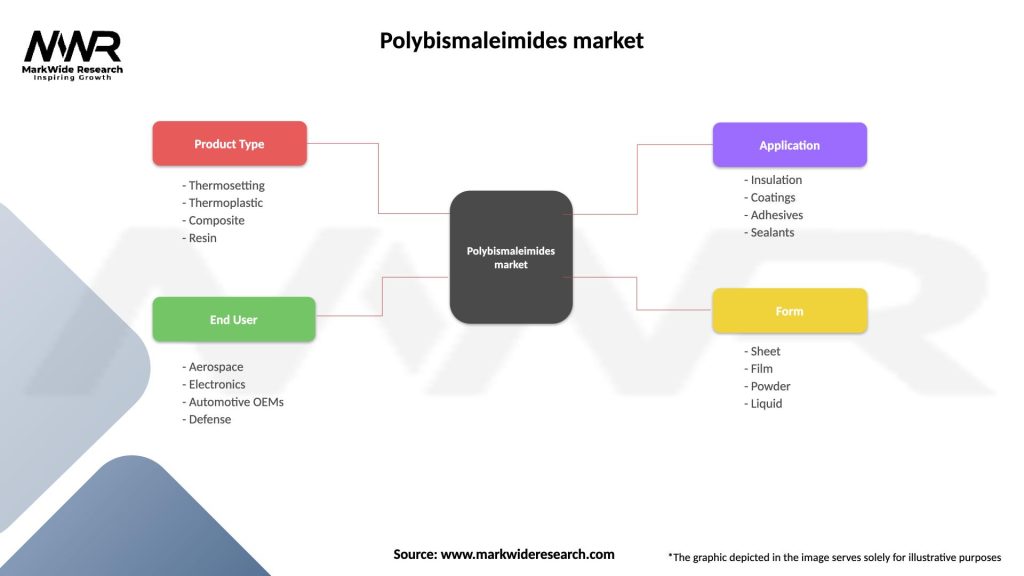

| Segmentation Details | Description |

|---|---|

| Product Type | Thermosetting, Thermoplastic, Composite, Resin |

| End User | Aerospace, Electronics, Automotive OEMs, Defense |

| Application | Insulation, Coatings, Adhesives, Sealants |

| Form | Sheet, Film, Powder, Liquid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Polybismaleimides Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at