444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Poland rigid plastic packaging market represents a dynamic and rapidly evolving sector within the broader European packaging industry. Market dynamics indicate substantial growth potential driven by increasing consumer demand, technological advancements, and evolving regulatory frameworks. The market encompasses diverse applications including food and beverage packaging, pharmaceuticals, personal care products, and industrial applications.

Growth projections suggest the market is expanding at a compound annual growth rate (CAGR) of 6.2%, reflecting strong domestic consumption patterns and export opportunities. Manufacturing capabilities in Poland have strengthened significantly, with local producers investing heavily in advanced production technologies and sustainable packaging solutions. The market benefits from Poland’s strategic location within the European Union, providing access to broader regional markets.

Industry transformation is evident through increased adoption of recyclable materials and circular economy principles. Consumer preferences are shifting toward environmentally responsible packaging solutions, driving innovation in bio-based plastics and enhanced recycling technologies. The market demonstrates resilience through diversified application segments and strong domestic manufacturing base.

The Poland rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of inflexible plastic containers and packaging solutions within Poland’s borders. This market encompasses various plastic materials including polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), and polystyrene (PS) used in creating bottles, containers, trays, and specialized packaging formats.

Rigid plastic packaging maintains its shape and structural integrity without external support, distinguishing it from flexible packaging alternatives. The market includes primary packaging that directly contacts products, secondary packaging for protection and branding, and tertiary packaging for logistics and transportation. Applications span across food preservation, beverage containment, pharmaceutical protection, cosmetic presentation, and industrial component storage.

Market participants include raw material suppliers, packaging manufacturers, brand owners, retailers, and recycling companies. The ecosystem supports both domestic consumption and export activities, contributing significantly to Poland’s manufacturing economy and employment generation.

Strategic analysis reveals the Poland rigid plastic packaging market as a cornerstone of the country’s manufacturing sector, demonstrating consistent growth and innovation. Market penetration across diverse industry verticals has reached 78% adoption rate among major consumer goods companies, indicating mature market development and widespread acceptance.

Technological advancement drives market evolution through implementation of Industry 4.0 principles, automated production systems, and smart packaging technologies. Sustainability initiatives have gained momentum with 45% of manufacturers implementing circular economy practices and investing in recycled content integration. The market benefits from strong domestic demand coupled with growing export opportunities to neighboring European markets.

Competitive landscape features both international corporations and domestic specialists, creating a balanced ecosystem that fosters innovation and competitive pricing. Regulatory compliance with European Union standards ensures product quality and market access, while environmental regulations drive sustainable packaging development. The market demonstrates resilience through diversified customer base and adaptive manufacturing capabilities.

Market intelligence reveals several critical insights shaping the Poland rigid plastic packaging landscape:

Economic growth in Poland continues to fuel demand for rigid plastic packaging across multiple sectors. Rising disposable income drives increased consumption of packaged goods, particularly in urban areas where convenience and product safety are prioritized. The expanding middle class demonstrates growing preference for branded products requiring sophisticated packaging solutions.

Industrial expansion creates additional demand for specialized packaging applications. Manufacturing sector growth in automotive, electronics, and chemical industries requires protective packaging for components and finished products. The development of logistics and e-commerce infrastructure necessitates durable packaging solutions for product protection during transportation and storage.

Regulatory support for domestic manufacturing through favorable policies and EU structural funds enables capacity expansion and technology upgrades. Food safety regulations mandate proper packaging standards, driving demand for compliant rigid plastic solutions. Environmental regulations, while challenging, also create opportunities for innovative sustainable packaging development.

Technological advancement enables production of lighter, stronger, and more functional packaging solutions. Consumer lifestyle changes toward convenience foods, ready-to-eat meals, and on-the-go consumption patterns support market growth. The aging population increases demand for pharmaceutical packaging with enhanced safety and accessibility features.

Environmental concerns regarding plastic waste and pollution create significant challenges for market growth. Public awareness of environmental impact leads to consumer resistance and regulatory pressure for alternative packaging materials. Single-use plastic restrictions and extended producer responsibility regulations increase compliance costs and operational complexity.

Raw material price volatility affects production costs and profit margins throughout the supply chain. Petroleum price fluctuations directly impact plastic resin costs, creating uncertainty in pricing strategies and long-term planning. Supply chain disruptions can cause material shortages and production delays.

Competition from alternative materials including glass, metal, and biodegradable options challenges market share in certain applications. Paper-based packaging gains popularity for specific products where plastic alternatives are perceived as more environmentally friendly. Advanced barrier coatings on alternative materials improve their performance characteristics.

Recycling infrastructure limitations create challenges in achieving circular economy objectives. Consumer behavior regarding proper disposal and recycling practices affects the sustainability narrative. High capital investment requirements for advanced recycling technologies may limit smaller manufacturers’ participation in sustainable initiatives.

Sustainability innovation presents significant opportunities for market expansion through development of eco-friendly packaging solutions. Circular economy initiatives create demand for recycled content packaging and closed-loop systems. Bio-based plastic development offers potential for market differentiation and premium pricing opportunities.

Smart packaging technologies enable value-added solutions including freshness indicators, tamper evidence, and consumer engagement features. Internet of Things (IoT) integration creates opportunities for connected packaging that provides supply chain visibility and consumer information. Active and intelligent packaging systems offer enhanced product protection and shelf-life extension.

Export market expansion leverages Poland’s competitive manufacturing costs and strategic location within Europe. Eastern European markets present growth opportunities as economies develop and consumer spending increases. Partnership opportunities with international brands seeking cost-effective European manufacturing solutions.

Pharmaceutical sector growth driven by aging population and healthcare advancement creates demand for specialized packaging solutions. E-commerce expansion requires protective packaging for product integrity during shipping. Customization capabilities for small and medium enterprises seeking differentiated packaging solutions.

Supply chain integration characterizes the Poland rigid plastic packaging market through vertical and horizontal consolidation strategies. Manufacturer relationships with raw material suppliers have strengthened through long-term contracts and strategic partnerships. Downstream integration with brand owners and retailers creates value-added service offerings and customer loyalty.

Technology adoption accelerates through digital transformation initiatives and Industry 4.0 implementation. Production optimization through artificial intelligence and machine learning improves efficiency and reduces waste. Predictive maintenance systems minimize downtime and extend equipment lifecycle.

Market consolidation occurs through mergers and acquisitions as companies seek scale advantages and market expansion. International investment brings advanced technologies and global market access to domestic manufacturers. Strategic alliances enable knowledge sharing and joint development of innovative solutions.

Consumer influence on packaging design and material selection increases through social media and environmental awareness campaigns. Brand owner requirements for sustainable packaging drive innovation and investment in alternative materials. Regulatory evolution continues to shape market dynamics through environmental and safety standards.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, manufacturers, suppliers, and end-users across various market segments. Survey methodology captures quantitative data on market trends, preferences, and growth projections.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements. Market intelligence gathering includes monitoring of regulatory developments, technological innovations, and competitive activities. Database analysis provides historical market data and trend identification.

Expert consultation with industry specialists, academic researchers, and technology providers validates findings and provides forward-looking insights. Field research includes facility visits and production process observation to understand operational dynamics and capacity utilization. Supply chain analysis examines material flows and value creation throughout the market ecosystem.

Data validation through triangulation of multiple sources ensures research reliability and accuracy. Statistical analysis employs advanced modeling techniques to project market trends and growth scenarios. Peer review processes maintain research quality and objectivity throughout the analysis.

Warsaw metropolitan area serves as the primary market hub, accounting for 34% of national consumption due to high population density and industrial concentration. Manufacturing facilities in this region benefit from proximity to major transportation networks and skilled workforce availability. The region demonstrates strong growth in pharmaceutical and personal care packaging applications.

Silesia region represents a significant manufacturing center with 26% market share in production capacity. Industrial heritage provides established infrastructure and technical expertise supporting packaging manufacturing. The region benefits from proximity to Czech and Slovak markets, facilitating export activities and cross-border collaboration.

Greater Poland demonstrates rapid growth in food and beverage packaging, driven by agricultural processing industries and retail distribution centers. Logistics advantages from central European location support both domestic distribution and export activities. The region shows increasing investment in sustainable packaging technologies and circular economy initiatives.

Coastal regions including Pomerania focus on export-oriented manufacturing and port-related logistics applications. Maritime access enables efficient raw material imports and finished product exports. The region demonstrates specialization in industrial packaging and chemical industry applications.

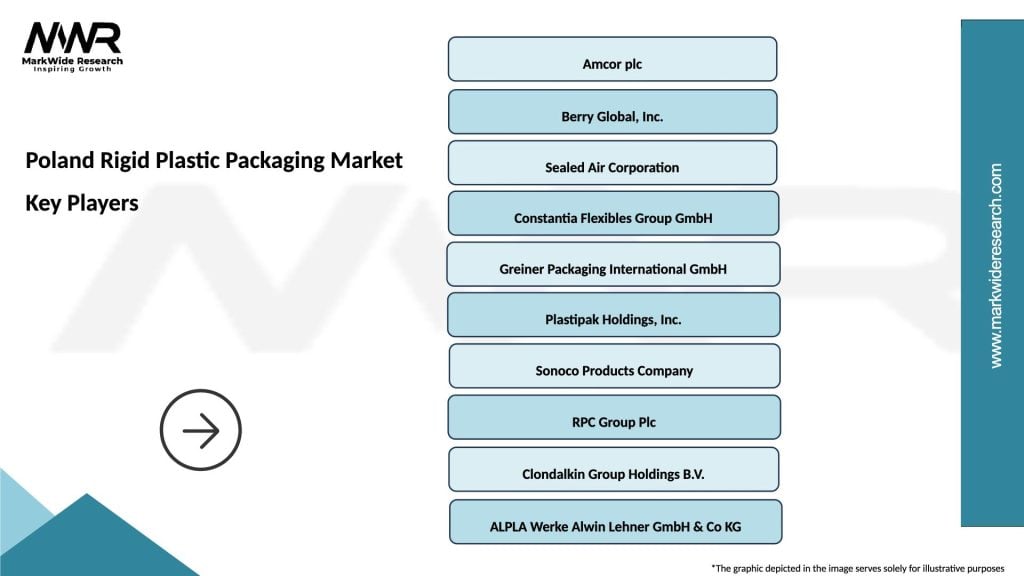

Market leadership is distributed among several key players, each contributing unique strengths and market positioning:

Competitive strategies focus on technological innovation, sustainability leadership, and customer service excellence. Market differentiation occurs through specialized applications, custom design capabilities, and integrated service offerings. Strategic partnerships enable access to new technologies and market expansion opportunities.

By Material Type:

By Application:

By End-Use Industry:

Food packaging category demonstrates consistent growth driven by changing consumer lifestyles and convenience food popularity. Barrier technology advancement enables extended shelf life and improved product protection. Microwave-safe containers and portion control packaging address evolving consumer needs.

Beverage packaging shows innovation in lightweight design and enhanced recyclability features. Sports and energy drinks drive demand for specialized bottle designs and functional closures. Water packaging emphasizes sustainability through increased recycled content and lightweighting initiatives.

Pharmaceutical packaging requires stringent quality standards and regulatory compliance. Child-resistant closures and tamper-evident features ensure safety and regulatory adherence. Serialization and track-and-trace capabilities address anti-counterfeiting requirements.

Personal care packaging emphasizes aesthetic appeal and premium positioning. Sustainable luxury concepts combine environmental responsibility with attractive design. Refillable and reusable packaging systems gain popularity among environmentally conscious consumers.

Industrial packaging focuses on durability and chemical compatibility. Hazardous material containment requires specialized barrier properties and safety features. Bulk packaging solutions optimize logistics efficiency and cost management.

Manufacturers benefit from economies of scale, technological advancement, and market diversification opportunities. Production efficiency improvements through automation and process optimization reduce costs and improve competitiveness. Access to European markets through Poland’s EU membership provides export opportunities and regulatory harmonization.

Brand owners gain access to cost-effective packaging solutions with reliable supply chain support. Customization capabilities enable product differentiation and brand positioning. Sustainability initiatives support corporate environmental goals and consumer expectations.

Consumers receive improved product protection, convenience features, and safety assurance. Innovation in packaging enhances user experience through easy-open features, portion control, and freshness preservation. Environmental improvements address sustainability concerns and social responsibility.

Investors find attractive opportunities in a growing market with technological innovation potential. Stable demand from essential applications provides revenue predictability. Sustainability trends create opportunities for premium pricing and market differentiation.

Government stakeholders benefit from job creation, export revenue, and industrial development. Environmental initiatives support national sustainability goals and EU compliance requirements. Technology transfer and innovation contribute to economic competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation dominates market trends through increased adoption of recycled content and bio-based materials. Circular economy principles drive design for recyclability and closed-loop systems. Extended producer responsibility regulations influence packaging design and end-of-life management strategies.

Lightweighting initiatives reduce material usage while maintaining performance characteristics. Advanced barrier technologies enable thinner walls and reduced plastic consumption. Optimization of packaging-to-product ratios improves sustainability metrics and cost efficiency.

Smart packaging integration incorporates digital technologies for enhanced functionality. QR codes and NFC tags enable consumer engagement and supply chain traceability. Temperature and freshness indicators provide real-time product status information.

Customization and personalization trends drive demand for flexible manufacturing capabilities. Digital printing technologies enable small-batch customization and rapid design changes. On-demand production reduces inventory requirements and enables market responsiveness.

E-commerce optimization influences packaging design for shipping protection and unboxing experience. Damage reduction through improved design reduces returns and customer dissatisfaction. Sustainable e-commerce packaging addresses environmental concerns in online retail.

Investment announcements in recycling infrastructure demonstrate industry commitment to sustainability. Major manufacturers have announced capacity expansions for recycled content production and advanced recycling technologies. Government support through grants and incentives accelerates sustainable technology adoption.

Technology partnerships between packaging manufacturers and technology providers advance smart packaging capabilities. Collaboration initiatives with research institutions develop innovative materials and production processes. International technology transfer agreements bring advanced manufacturing capabilities to Poland.

Regulatory developments including plastic waste reduction targets and extended producer responsibility create market transformation pressure. Industry associations work with government agencies to develop practical implementation strategies. Voluntary industry initiatives demonstrate proactive environmental stewardship.

Merger and acquisition activity consolidates market structure and creates scale advantages. International expansion through strategic partnerships and joint ventures access new markets and technologies. Vertical integration strategies secure supply chain control and value capture opportunities.

Sustainability certifications and standards development provide market differentiation opportunities. Life cycle assessment methodologies enable quantification of environmental impact improvements. Third-party verification systems build consumer trust and regulatory compliance.

MarkWide Research recommends that industry participants prioritize sustainability innovation as a core competitive strategy. Investment in recycling technologies and bio-based materials will become essential for long-term market success. Companies should develop comprehensive sustainability roadmaps with measurable targets and timelines.

Technology adoption should focus on automation and digitalization to improve efficiency and competitiveness. Smart manufacturing systems enable real-time optimization and predictive maintenance capabilities. Investment in employee training and development ensures successful technology implementation.

Market diversification across application segments and geographic regions reduces risk and captures growth opportunities. Export market development leverages Poland’s competitive advantages and EU market access. Strategic partnerships enable market entry and technology sharing.

Customer relationship management should emphasize value-added services and technical support. Co-development partnerships with brand owners create innovation opportunities and customer loyalty. Supply chain integration improves service levels and operational efficiency.

Regulatory compliance requires proactive monitoring and preparation for evolving environmental standards. Industry collaboration through associations and consortiums enables collective problem-solving and standard development. Government engagement ensures industry voice in policy development.

Market evolution toward sustainability and circularity will accelerate over the next decade. MWR analysis projects continued growth driven by innovation in recycled content and bio-based materials. Regulatory pressure will intensify, creating both challenges and opportunities for market participants.

Technology advancement will enable new packaging functionalities and improved environmental performance. Artificial intelligence and machine learning will optimize production processes and supply chain management. Digital technologies will enhance customer engagement and supply chain transparency.

Market consolidation is expected to continue as companies seek scale advantages and technology capabilities. International expansion will accelerate through strategic partnerships and direct investment. Vertical integration strategies will become more common to secure supply chain control.

Consumer preferences will increasingly influence packaging design and material selection. Environmental consciousness will drive demand for sustainable packaging solutions across all market segments. Premium pricing for sustainable packaging will become more widely accepted.

Innovation focus will shift toward multifunctional packaging with enhanced barrier properties and smart capabilities. Collaboration between packaging manufacturers, brand owners, and technology providers will accelerate development of breakthrough solutions. Investment in research and development will become critical for competitive advantage.

The Poland rigid plastic packaging market stands at a critical juncture where traditional manufacturing excellence meets evolving sustainability requirements and technological innovation. Market fundamentals remain strong with consistent demand growth across diverse application segments and expanding export opportunities leveraging Poland’s strategic European location.

Sustainability transformation represents both the greatest challenge and most significant opportunity facing market participants. Companies that successfully integrate circular economy principles, invest in recycling technologies, and develop bio-based alternatives will capture premium market positions and customer loyalty. The transition requires substantial investment but offers long-term competitive advantages.

Technology adoption will separate market leaders from followers through improved efficiency, quality, and customer service capabilities. Smart packaging integration and Industry 4.0 implementation provide opportunities for differentiation and value creation. Digital transformation enables new business models and enhanced customer relationships.

Future success depends on balancing traditional strengths in cost-effective manufacturing with innovation in sustainable solutions and advanced technologies. Strategic partnerships and international collaboration will accelerate capability development and market access. The market outlook remains positive for companies that embrace change and invest in future capabilities while maintaining operational excellence and customer focus.

What is Rigid Plastic Packaging?

Rigid Plastic Packaging refers to containers and packaging materials made from rigid plastics that maintain their shape and structure. This type of packaging is commonly used for food, beverages, personal care products, and household items due to its durability and versatility.

What are the key players in the Poland Rigid Plastic Packaging Market?

Key players in the Poland Rigid Plastic Packaging Market include companies like Amcor, Berry Global, and RPC Group, which are known for their innovative packaging solutions and extensive product ranges. These companies focus on sustainability and meeting consumer demands for convenience and safety, among others.

What are the growth factors driving the Poland Rigid Plastic Packaging Market?

The growth of the Poland Rigid Plastic Packaging Market is driven by increasing consumer demand for packaged food and beverages, the rise of e-commerce, and a growing focus on sustainable packaging solutions. Additionally, innovations in packaging technology are enhancing product shelf life and safety.

What challenges does the Poland Rigid Plastic Packaging Market face?

The Poland Rigid Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste and recycling, competition from alternative packaging materials, and fluctuating raw material prices. These factors can impact production costs and market dynamics.

What opportunities exist in the Poland Rigid Plastic Packaging Market?

Opportunities in the Poland Rigid Plastic Packaging Market include the development of biodegradable and recyclable packaging solutions, as well as the expansion of e-commerce, which requires efficient and protective packaging. Companies are also exploring smart packaging technologies to enhance consumer engagement.

What trends are shaping the Poland Rigid Plastic Packaging Market?

Trends in the Poland Rigid Plastic Packaging Market include a shift towards sustainable materials, increased use of lightweight packaging, and the adoption of advanced manufacturing techniques. Additionally, there is a growing emphasis on consumer convenience and product differentiation.

Poland Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Trays, Films |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household |

| Packaging Type | Flexible, Rigid, Resealable, Tamper-Evident |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Poland Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at