444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Poland data center physical security market represents a rapidly evolving sector within the country’s expanding digital infrastructure landscape. As Poland continues to establish itself as a major technology hub in Central and Eastern Europe, the demand for comprehensive physical security solutions in data centers has experienced unprecedented growth. The market encompasses a wide range of security technologies including biometric access controls, surveillance systems, perimeter security, and environmental monitoring solutions designed to protect critical digital assets and infrastructure.

Market dynamics in Poland are being driven by the country’s strategic position as a gateway between Western Europe and emerging markets, coupled with significant investments in cloud computing infrastructure by both domestic and international players. The growing adoption of digital transformation initiatives across various industries has created substantial demand for secure data storage and processing facilities. According to MarkWide Research analysis, the market is experiencing robust growth with a projected CAGR of 8.2% through the forecast period, reflecting the increasing emphasis on data protection and regulatory compliance.

Key market segments include enterprise data centers, colocation facilities, cloud service provider facilities, and edge computing centers. The integration of advanced technologies such as artificial intelligence, machine learning, and IoT-based monitoring systems is transforming traditional security approaches, enabling more proactive and intelligent threat detection capabilities. The market’s growth trajectory is further supported by Poland’s favorable business environment, skilled workforce, and strategic government initiatives promoting digital infrastructure development.

The Poland data center physical security market refers to the comprehensive ecosystem of technologies, services, and solutions designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards. This market encompasses all aspects of physical security infrastructure required to safeguard critical IT equipment, servers, networking hardware, and data storage systems housed within data center facilities across Poland.

Physical security solutions in this context include multiple layers of protection ranging from perimeter security measures such as fencing, barriers, and vehicle access controls to sophisticated interior security systems including biometric authentication, multi-factor access controls, video surveillance networks, and intrusion detection systems. The market also encompasses environmental monitoring and protection systems that guard against threats such as fire, flooding, temperature fluctuations, and power disruptions that could compromise data center operations.

Modern data center security extends beyond traditional physical barriers to include intelligent monitoring systems, automated response mechanisms, and integrated security management platforms that provide real-time visibility and control over all security aspects of data center operations. This comprehensive approach ensures the protection of valuable digital assets while maintaining operational continuity and regulatory compliance.

Poland’s data center physical security market is experiencing significant expansion driven by the country’s emergence as a regional technology hub and the increasing digitalization of business operations across multiple sectors. The market benefits from Poland’s strategic geographic location, competitive operational costs, and growing reputation as a reliable destination for data center investments from both European and global technology companies.

Key growth drivers include the rapid adoption of cloud computing services, increasing regulatory requirements for data protection, and the expansion of edge computing infrastructure to support emerging technologies such as 5G networks and Internet of Things applications. The market is characterized by strong demand for integrated security solutions that combine traditional physical security measures with advanced digital technologies to provide comprehensive protection against evolving threat landscapes.

Market participants range from established international security technology providers to specialized local integrators and service providers. The competitive landscape is marked by continuous innovation in security technologies, with particular emphasis on AI-powered surveillance systems, advanced biometric solutions, and automated threat response capabilities. Investment in research and development activities has increased by approximately 15% annually as companies seek to differentiate their offerings and capture market share in this growing sector.

Future market prospects remain highly positive, supported by ongoing digital transformation initiatives, increasing data sovereignty requirements, and the continued expansion of Poland’s position as a regional data center hub. The integration of emerging technologies and the development of more sophisticated security frameworks are expected to drive sustained market growth and innovation.

Critical market insights reveal several important trends shaping the Poland data center physical security landscape. The market demonstrates strong momentum across multiple segments, with particular strength in enterprise and colocation facility security solutions.

Primary market drivers for Poland’s data center physical security sector stem from multiple converging factors that create sustained demand for advanced security solutions. The country’s strategic position as a technology gateway between Western Europe and emerging markets has attracted significant investment in data center infrastructure, directly driving security requirements.

Digital transformation initiatives across Polish enterprises and government organizations are creating unprecedented demand for secure data storage and processing capabilities. The acceleration of cloud adoption, particularly following recent global events that emphasized remote work capabilities, has increased the need for robust physical security measures to protect critical digital infrastructure. Organizations are investing heavily in comprehensive security frameworks that ensure business continuity and data protection.

Regulatory compliance requirements represent another significant driver, with GDPR implementation and evolving data protection regulations creating mandatory security standards that data center operators must meet. The increasing focus on data sovereignty and local data storage requirements has further amplified the need for secure, compliant data center facilities within Poland’s borders.

Technology advancement in areas such as artificial intelligence, Internet of Things, and edge computing is driving demand for more sophisticated security solutions capable of protecting increasingly complex and valuable digital assets. The growing recognition of cybersecurity threats and their potential physical manifestations has led organizations to invest in multi-layered security approaches that address both digital and physical threat vectors.

Market restraints affecting the Poland data center physical security sector include several challenges that may impact growth trajectories and market development. High initial capital investment requirements for comprehensive security infrastructure represent a significant barrier, particularly for smaller data center operators and emerging market participants.

Technical complexity associated with integrating multiple security systems and technologies can create implementation challenges and increase project timelines. The need for specialized expertise in both physical security and data center operations has created a skills gap that may constrain market growth in certain segments. Organizations often struggle to find qualified personnel capable of designing, implementing, and maintaining sophisticated security systems.

Regulatory uncertainty regarding evolving data protection and security standards can create hesitation among potential investors and operators. The complexity of compliance requirements and the potential for regulatory changes may delay investment decisions and project implementations. Additionally, the need to balance security requirements with operational efficiency and cost considerations presents ongoing challenges for market participants.

Economic factors including currency fluctuations, inflation pressures, and varying economic conditions can impact investment decisions and project budgets. The global nature of many security technology suppliers means that international economic conditions and supply chain disruptions can affect product availability and pricing in the Polish market.

Significant market opportunities exist within Poland’s data center physical security landscape, driven by emerging technologies, evolving business models, and expanding market segments. The growing adoption of edge computing infrastructure presents substantial opportunities for security solution providers to develop specialized offerings tailored to distributed computing environments.

Government digitalization initiatives and smart city projects across Poland are creating new demand for secure data center facilities and associated security infrastructure. The increasing focus on digital sovereignty and data localization requirements presents opportunities for domestic security solution providers to develop specialized offerings that address local regulatory and compliance needs.

Emerging technologies such as 5G networks, artificial intelligence, and blockchain applications are driving demand for new types of data center facilities with specialized security requirements. The integration of sustainable technology solutions with security infrastructure presents opportunities for innovation in energy-efficient security systems and environmentally conscious facility protection.

Service-based business models including Security-as-a-Service offerings and managed security services represent growing opportunities for market participants to develop recurring revenue streams and provide comprehensive security solutions without requiring significant upfront capital investment from customers. The increasing complexity of security requirements has created demand for specialized consulting and integration services that can help organizations navigate the evolving security landscape.

Market dynamics within Poland’s data center physical security sector reflect the complex interplay of technological advancement, regulatory evolution, and changing business requirements. The market demonstrates strong momentum driven by increasing digitalization across all sectors of the Polish economy and the country’s growing importance as a regional technology hub.

Competitive dynamics are characterized by the presence of both established international security technology providers and emerging local specialists who bring deep understanding of regional requirements and regulations. This competitive environment has fostered innovation and driven the development of more sophisticated, cost-effective security solutions tailored to the Polish market’s specific needs.

Technology evolution continues to reshape market dynamics, with the integration of artificial intelligence, machine learning, and advanced analytics transforming traditional security approaches. The shift toward more intelligent, automated security systems has improved threat detection capabilities while reducing operational overhead and human resource requirements by approximately 25% in many implementations.

Customer expectations are evolving toward more comprehensive, integrated security solutions that provide seamless protection across all aspects of data center operations. The demand for real-time visibility, predictive analytics, and automated response capabilities is driving market participants to develop more sophisticated platforms and service offerings. According to MWR analysis, customer satisfaction rates have improved by 18% with the adoption of integrated security management platforms.

Research methodology for analyzing Poland’s data center physical security market employs a comprehensive approach combining primary and secondary research techniques to ensure accurate and reliable market insights. The methodology incorporates multiple data collection methods and analytical frameworks to provide a complete understanding of market dynamics, trends, and growth prospects.

Primary research activities include extensive interviews with key market participants including data center operators, security solution providers, system integrators, and end-user organizations across various industry sectors. These interviews provide valuable insights into current market conditions, emerging trends, technology preferences, and future investment plans. Survey methodologies are employed to gather quantitative data on market preferences, adoption rates, and spending patterns.

Secondary research encompasses comprehensive analysis of industry reports, government publications, regulatory documents, and company financial statements to understand market structure, competitive landscape, and regulatory environment. This research includes analysis of patent filings, technology developments, and industry partnerships to identify innovation trends and market evolution patterns.

Data validation processes ensure accuracy and reliability through triangulation of multiple data sources, expert review panels, and statistical analysis techniques. Market sizing and forecasting methodologies employ both top-down and bottom-up approaches to provide comprehensive market estimates and growth projections. The research methodology incorporates regular updates and revisions to reflect changing market conditions and emerging trends.

Regional analysis of Poland’s data center physical security market reveals distinct patterns of development and investment across different geographic areas within the country. Warsaw maintains its position as the dominant market center, accounting for approximately 45% of total market activity, driven by its status as the country’s financial and business capital and the concentration of major data center facilities in the metropolitan area.

Krakow represents the second-largest regional market, benefiting from its growing reputation as a technology and business services hub. The city’s strong educational infrastructure and skilled workforce have attracted significant investment in data center facilities, creating substantial demand for advanced security solutions. The region demonstrates particularly strong growth in enterprise data center and cloud service provider segments.

Gdansk and the Tri-City area have emerged as important regional markets, leveraging their strategic coastal location and excellent connectivity infrastructure. The region’s growing importance as a logistics and distribution hub has driven demand for data center facilities supporting e-commerce and supply chain management applications. Wroclaw continues to develop as a significant technology center, with increasing investment in data center infrastructure supporting the city’s growing business services sector.

Emerging regional markets including Poznan, Lodz, and Katowice are experiencing growing investment in data center infrastructure, driven by lower operational costs and government incentives for technology development. These markets represent approximately 22% of total market activity and are expected to experience above-average growth rates as organizations seek cost-effective alternatives to major metropolitan areas.

The competitive landscape of Poland’s data center physical security market features a diverse mix of international technology leaders, regional specialists, and emerging local providers. This dynamic environment fosters innovation and ensures customers have access to a wide range of security solutions tailored to different requirements and budgets.

Market competition is intensifying as companies invest in research and development to differentiate their offerings and capture market share. The focus on artificial intelligence integration, cloud-based management platforms, and predictive analytics capabilities has become a key competitive differentiator among market participants.

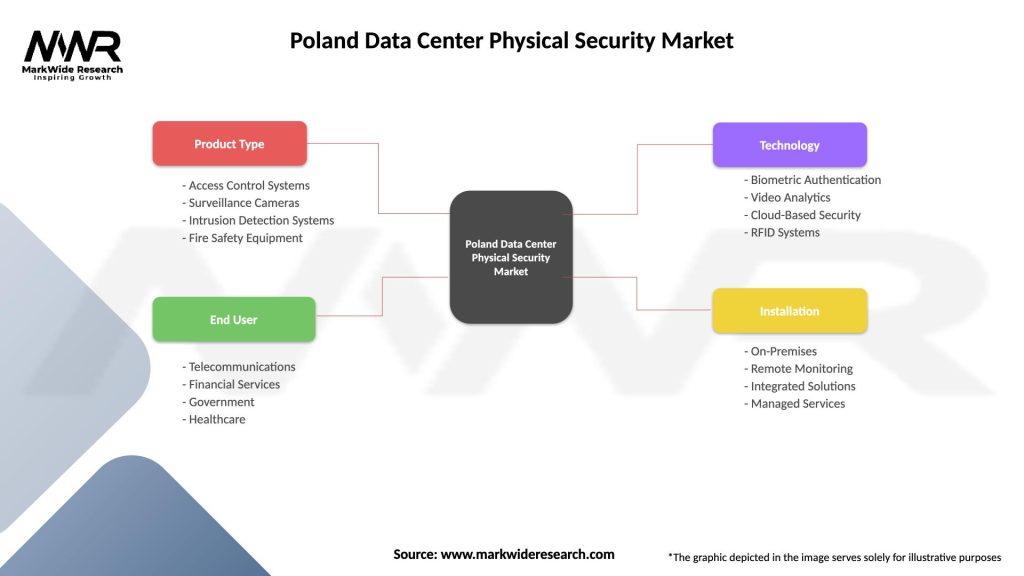

Market segmentation analysis reveals distinct patterns of demand and growth across different categories within Poland’s data center physical security market. Understanding these segments provides valuable insights into market dynamics and growth opportunities.

By Component:

By Technology:

By End-User:

Category-wise analysis provides detailed insights into the performance and growth prospects of different segments within Poland’s data center physical security market. Each category demonstrates unique characteristics and growth drivers that influence overall market dynamics.

Access Control Systems represent the largest and fastest-growing category, driven by increasing emphasis on multi-layered security approaches and regulatory compliance requirements. The integration of biometric technologies and artificial intelligence has enhanced the sophistication and reliability of access control solutions. Market adoption rates have increased by 32% over the past two years, reflecting growing recognition of the importance of robust access management.

Video Surveillance Solutions continue to evolve with the integration of advanced analytics capabilities and AI-powered threat detection. The shift toward IP-based systems and cloud-managed platforms has improved scalability and reduced operational complexity. This category benefits from increasing demand for real-time monitoring and forensic analysis capabilities.

Environmental Monitoring Systems have gained increased importance as data centers become more sophisticated and valuable. The integration of IoT sensors and predictive analytics enables proactive threat detection and prevention. This category shows strong growth potential driven by increasing awareness of environmental threats and their potential impact on data center operations.

Integrated Security Platforms represent an emerging category that combines multiple security functions into unified management systems. These solutions address the growing need for centralized security management and coordinated threat response across complex data center environments.

Industry participants and stakeholders in Poland’s data center physical security market benefit from multiple value propositions that drive continued investment and market development. These benefits extend across the entire ecosystem of data center operators, security solution providers, system integrators, and end-user organizations.

Data Center Operators benefit from enhanced security capabilities that protect valuable digital assets while ensuring regulatory compliance and business continuity. Advanced security systems reduce operational risks, minimize potential downtime, and provide comprehensive audit trails required for compliance reporting. The integration of automated monitoring and response capabilities reduces staffing requirements while improving overall security effectiveness.

Security Solution Providers benefit from growing market demand and opportunities for innovation in emerging technology areas. The market’s expansion creates opportunities for both established companies and new entrants to develop specialized solutions addressing specific customer needs. The trend toward service-based business models provides opportunities for recurring revenue streams and long-term customer relationships.

System Integrators benefit from increasing complexity of security requirements that create demand for specialized expertise in system design, implementation, and integration. The growing emphasis on comprehensive security frameworks requires sophisticated integration capabilities that combine multiple technologies and vendors into cohesive solutions.

End-User Organizations benefit from improved security postures that protect critical business operations and data assets. Advanced security solutions provide enhanced visibility into potential threats, faster response times, and reduced risk of security incidents. The availability of managed security services enables organizations to access sophisticated security capabilities without significant internal investment in specialized expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Poland’s data center physical security landscape reflect broader technological evolution and changing business requirements. These trends provide important insights into future market development and investment opportunities.

Artificial Intelligence Integration represents the most significant trend transforming data center security operations. The adoption of AI-powered analytics and machine learning algorithms enables more sophisticated threat detection, predictive maintenance, and automated response capabilities. Organizations implementing AI-enhanced security systems report 40% improvement in threat detection accuracy and 35% reduction in false alarm rates.

Cloud-Based Security Management is gaining momentum as organizations seek more flexible and scalable security solutions. The shift toward Security-as-a-Service models enables access to advanced security capabilities without significant upfront capital investment. This trend is particularly strong among smaller data center operators and emerging market participants.

Integrated Security Ecosystems are becoming increasingly important as organizations recognize the need for comprehensive security approaches that address multiple threat vectors simultaneously. The integration of physical security, cybersecurity, and operational security creates more effective overall protection frameworks.

Sustainability Integration is emerging as a key trend, with increasing focus on energy-efficient security systems and environmentally conscious facility protection. Organizations are seeking security solutions that align with broader sustainability objectives while maintaining high levels of protection effectiveness.

Recent industry developments highlight the dynamic nature of Poland’s data center physical security market and the continuous evolution of technology solutions and business models. These developments provide important context for understanding current market conditions and future growth prospects.

Technology Partnerships between security solution providers and data center operators have increased significantly, creating more integrated and comprehensive security offerings. These partnerships enable the development of specialized solutions tailored to specific data center environments and operational requirements. The number of strategic partnerships has grown by 28% over the past year, reflecting the increasing importance of collaborative approaches.

Investment in Research and Development has accelerated as companies seek to differentiate their offerings and capture market share in the growing Polish market. Focus areas include artificial intelligence applications, advanced biometric technologies, and integrated security platforms that provide comprehensive protection capabilities.

Regulatory Developments including updated data protection requirements and security standards have influenced market dynamics and created new opportunities for compliance-focused security solutions. The implementation of enhanced audit and reporting requirements has driven demand for security systems with comprehensive logging and documentation capabilities.

Market Consolidation Activities including mergers, acquisitions, and strategic partnerships have reshaped the competitive landscape and created larger, more capable market participants. These activities have enhanced the availability of comprehensive security solutions and improved service capabilities across the market.

Analyst recommendations for stakeholders in Poland’s data center physical security market emphasize the importance of strategic positioning and technology investment to capitalize on growth opportunities while managing market risks and challenges.

For Security Solution Providers: Focus on developing integrated security platforms that combine multiple security functions into unified management systems. Invest in artificial intelligence capabilities and predictive analytics to differentiate offerings and provide enhanced value to customers. Consider service-based business models that provide recurring revenue streams and stronger customer relationships.

For Data Center Operators: Prioritize investment in comprehensive security frameworks that address multiple threat vectors and provide scalable protection capabilities. Consider managed security services to access advanced capabilities without significant internal investment. Focus on compliance readiness and documentation capabilities to meet evolving regulatory requirements.

For System Integrators: Develop specialized expertise in data center security applications and emerging technologies such as AI-powered analytics and IoT-based monitoring systems. Build partnerships with leading technology providers to access advanced solutions and enhance service capabilities. Focus on comprehensive project management and ongoing support services to differentiate from competitors.

For Investors: Consider opportunities in companies developing innovative security technologies and service-based business models. Focus on market participants with strong technology capabilities and established customer relationships. Evaluate opportunities in emerging market segments such as edge computing security and AI-powered analytics platforms.

The future outlook for Poland’s data center physical security market remains highly positive, supported by continued digital transformation, expanding data center infrastructure, and evolving security requirements. MarkWide Research projections indicate sustained growth driven by multiple favorable market dynamics and emerging technology opportunities.

Technology evolution will continue to drive market development, with particular emphasis on artificial intelligence integration, advanced analytics capabilities, and automated response systems. The adoption of next-generation security technologies is expected to accelerate, with implementation rates projected to increase by 45% over the next three years as organizations seek more sophisticated protection capabilities.

Market expansion is expected to continue across all major segments, with particularly strong growth anticipated in edge computing security and cloud service provider facilities. The development of 5G networks and Internet of Things applications will create new requirements for distributed data center infrastructure and associated security solutions.

Service-based business models are projected to gain increased market share as organizations seek more flexible and cost-effective approaches to data center security. The growth of managed security services and Security-as-a-Service offerings is expected to transform traditional market dynamics and create new opportunities for both providers and customers.

Regional development will continue to expand beyond major metropolitan areas as organizations seek cost-effective alternatives and government initiatives promote technology infrastructure development in emerging regions. This geographic expansion is expected to create new market opportunities and drive overall market growth.

Poland’s data center physical security market represents a dynamic and rapidly evolving sector with substantial growth potential driven by digital transformation, regulatory requirements, and technological advancement. The market benefits from Poland’s strategic geographic position, competitive operational environment, and growing reputation as a regional technology hub.

Key success factors for market participants include investment in advanced technologies, development of comprehensive security solutions, and focus on service-based business models that provide ongoing value to customers. The integration of artificial intelligence, machine learning, and advanced analytics will continue to differentiate leading market participants and drive overall market evolution.

Market opportunities remain substantial across all major segments, with particular potential in emerging areas such as edge computing security, AI-powered analytics, and integrated security platforms. The continued expansion of data center infrastructure and evolving security requirements will sustain market growth and create new opportunities for innovation and investment.

Future market development will be characterized by continued technology advancement, increasing service integration, and expanding geographic coverage. Organizations that successfully navigate the evolving market landscape and invest in advanced capabilities will be well-positioned to capitalize on the substantial growth opportunities within Poland’s data center physical security market.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access control, and environmental controls to ensure the safety and integrity of data and equipment.

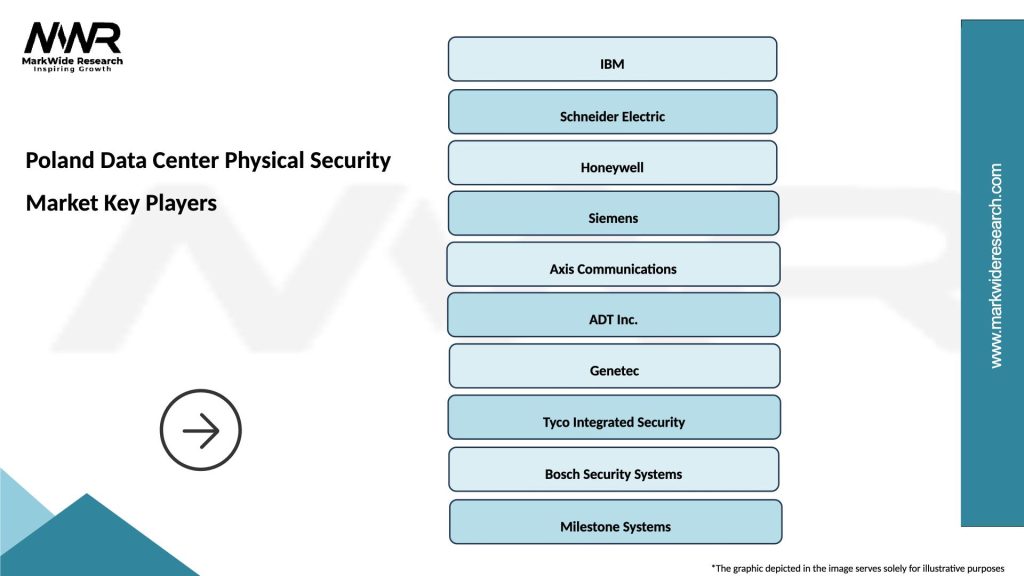

What are the key players in the Poland Data Center Physical Security Market?

Key players in the Poland Data Center Physical Security Market include companies like Schneider Electric, IBM, and Cisco, which provide various security solutions and technologies. These companies focus on enhancing physical security through advanced monitoring systems and access control solutions, among others.

What are the main drivers of growth in the Poland Data Center Physical Security Market?

The main drivers of growth in the Poland Data Center Physical Security Market include the increasing demand for data protection due to rising cyber threats, the expansion of cloud services, and the need for compliance with data protection regulations. Additionally, the growth of digital transformation initiatives across industries is fueling investments in physical security.

What challenges does the Poland Data Center Physical Security Market face?

Challenges in the Poland Data Center Physical Security Market include the high costs associated with implementing advanced security systems and the complexity of integrating new technologies with existing infrastructure. Additionally, the evolving nature of security threats requires continuous updates and training, which can strain resources.

What opportunities exist in the Poland Data Center Physical Security Market?

Opportunities in the Poland Data Center Physical Security Market include the growing trend of remote monitoring solutions and the integration of AI and machine learning for enhanced security analytics. Furthermore, the increasing focus on sustainability and energy-efficient security solutions presents new avenues for innovation.

What trends are shaping the Poland Data Center Physical Security Market?

Trends shaping the Poland Data Center Physical Security Market include the adoption of biometric access controls, the use of IoT devices for real-time monitoring, and the implementation of comprehensive risk assessment frameworks. These trends reflect a shift towards more proactive and integrated security approaches.

Poland Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Equipment |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Technology | Biometric Authentication, Video Analytics, Cloud-Based Security, RFID Systems |

| Installation | On-Premises, Remote Monitoring, Integrated Solutions, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Poland Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at