444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Poland container glass market has experienced steady growth in recent years. Container glass refers to glass packaging used for storing various products, including beverages, food items, cosmetics, and pharmaceuticals. It is highly preferred due to its transparency, recyclability, and ability to preserve the quality of the packaged goods. Poland, with its growing economy and increasing consumption of packaged products, presents a significant market opportunity for container glass manufacturers.

Meaning

Container glass is a type of glass packaging that is primarily used for storing and transporting various products. It is produced by melting a mixture of silica sand, soda ash, limestone, and other additives at high temperatures. The molten glass is then molded into containers of different shapes and sizes. Container glass offers several advantages such as product visibility, protection from contamination, and the ability to be recycled and reused.

Executive Summary

The Poland container glass market has witnessed steady growth in recent years, driven by factors such as increasing consumption of packaged products, the demand for sustainable packaging solutions, and the growing beverage industry. The market is highly competitive, with key players focusing on product innovation and strategic collaborations to gain a competitive edge. However, the market also faces challenges in the form of high energy consumption and environmental concerns. Despite these challenges, the container glass market in Poland is expected to continue its growth trajectory in the coming years.

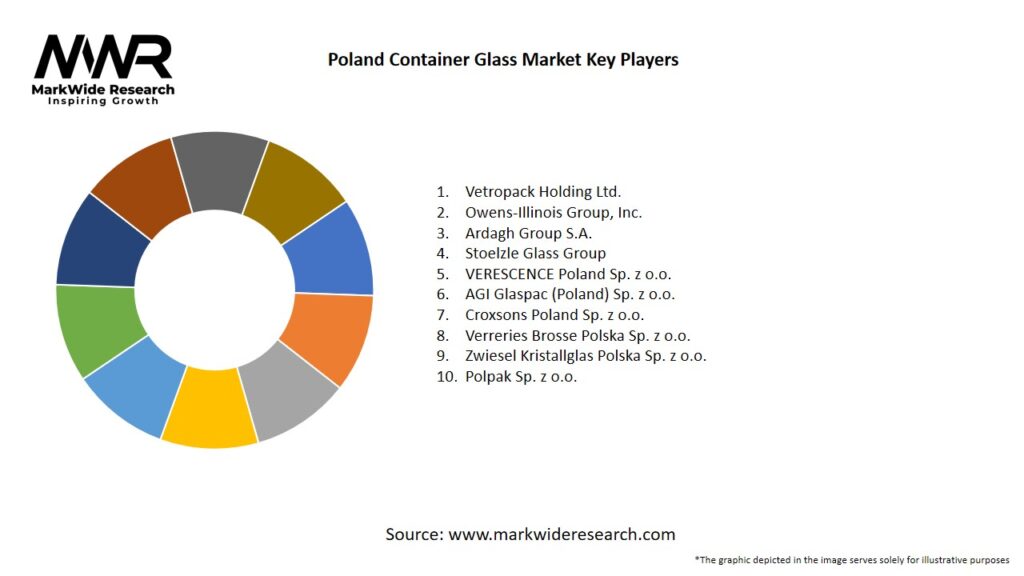

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

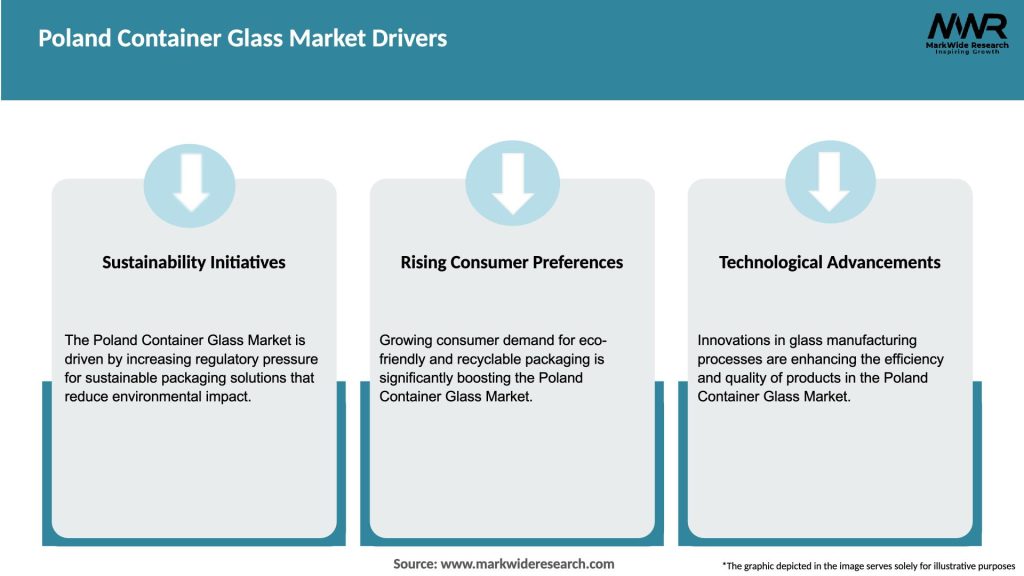

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Poland container glass market is characterized by intense competition among key players. Market dynamics are influenced by factors such as changing consumer preferences, technological advancements, and environmental regulations. The industry is continuously striving to develop innovative packaging solutions that address sustainability concerns while meeting the evolving needs of end-use sectors.

The market is also influenced by the availability and cost of raw materials, energy prices, and the overall economic climate. Fluctuations in these factors can impact the profitability and growth prospects of container glass manufacturers. Moreover, strategic collaborations, mergers, and acquisitions play a crucial role in shaping the competitive landscape of the market.

Regional Analysis

The container glass market in Poland is spread across different regions, including major cities such as Warsaw, Krakow, and Gdansk. Warsaw, being the capital and the largest city in Poland, represents a significant market for container glass packaging. The concentration of various industries and the presence of key players in these regions contribute to the growth of the market.

The regional analysis also highlights the demand for container glass in different sectors. For instance, the beverage industry, including breweries and soft drink manufacturers, is concentrated in areas like Lodz and Poznan. The food processing industry, including dairy and confectionery, is prominent in regions like Wroclaw and Lublin.

Competitive Landscape

leading companies in the Poland Container Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Poland container glass market can be segmented based on product type, end-use industry, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had both positive and negative impacts on the Poland container glass market. On one hand, the increased consumption of packaged products, including food, beverages, and pharmaceuticals, during lockdowns and restrictions led to a surge in demand for container glass. The packaging industry, including container glass manufacturers, played a crucial role in ensuring the supply of essential goods.

On the other hand, the pandemic resulted in disruptions to the supply chain, reduced production capacities, and labor shortages. The closure of hotels, restaurants, and entertainment venues also affected the demand for glass bottles and containers in the hospitality sector. However, as the situation gradually improved and economies reopened, the container glass market started to recover, driven by pent-up demand and the resumption of economic activities.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Poland container glass market appears promising. Factors such as the increasing consumption of packaged products, the demand for sustainable packaging solutions, and the growth of the beverage industry are expected to drive market growth.

The industry’s focus on innovation, product differentiation, and collaboration will play a crucial role in shaping the market’s trajectory. Technological advancements, such as the development of lightweight glass and energy-efficient manufacturing processes, will contribute to the sustainability and competitiveness of container glass packaging.

While challenges related to high energy consumption and competition from alternative materials persist, industry participants can overcome these hurdles through continuous improvement, research, and strategic investments. The Poland container glass market is poised for growth, offering opportunities for both domestic and international players in the coming years.

Conclusion

The Poland container glass market is witnessing steady growth, driven by factors such as the increasing consumption of packaged products, the demand for sustainable packaging solutions, and the growth of the beverage industry. Despite challenges related to high energy consumption and competition from alternative materials, the market presents opportunities for industry participants and stakeholders.

Innovation, collaboration, and market diversification are key strategies that can help container glass manufacturers thrive in this competitive landscape. The industry’s focus on sustainability, customization, and branding opportunities will resonate with consumers and contribute to its growth.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

What are the key players in the Poland Container Glass Market?

Key players in the Poland Container Glass Market include companies like Ardagh Group, O-I Glass, and Verallia, which are known for their extensive range of glass packaging solutions. These companies focus on innovation and sustainability in their product offerings, among others.

What are the growth factors driving the Poland Container Glass Market?

The Poland Container Glass Market is driven by increasing consumer demand for sustainable packaging solutions, the growth of the beverage industry, and a rising preference for glass over plastic due to health and environmental concerns. Additionally, the expansion of the food and beverage sector contributes to market growth.

What challenges does the Poland Container Glass Market face?

Challenges in the Poland Container Glass Market include high production costs, competition from alternative packaging materials, and the need for significant energy consumption during manufacturing. These factors can impact profitability and market dynamics.

What opportunities exist in the Poland Container Glass Market?

Opportunities in the Poland Container Glass Market include the increasing trend towards eco-friendly packaging, innovations in glass recycling technologies, and the expansion of e-commerce, which requires efficient and sustainable packaging solutions. These trends can enhance market potential.

What trends are shaping the Poland Container Glass Market?

Trends in the Poland Container Glass Market include a growing emphasis on lightweight glass packaging, advancements in design and customization, and a shift towards circular economy practices. These trends reflect the industry’s response to consumer preferences and environmental regulations.

Poland Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Jugs, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Household |

| Application | Packaging, Storage, Transportation, Display |

| Technology | Blow Molding, Pressing, Forming, Annealing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

leading companies in the Poland Container Glass Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at