444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The plunger pumps market is witnessing steady growth due to the increasing demand for efficient pumping solutions across various industries. Plunger pumps, also known as reciprocating pumps, are positive displacement pumps that use a plunger or piston to displace fluid and create pressure. These pumps are widely used in applications requiring high-pressure pumping, such as oil and gas, chemical processing, power generation, water treatment, and construction.

Meaning

Plunger pumps are mechanical devices that utilize reciprocating motion to transfer fluids from one location to another. They are designed to handle a wide range of liquids, including corrosive chemicals, abrasive slurries, and viscous fluids. The plunger inside the pump creates pressure by pushing the liquid through the discharge valve, providing an efficient pumping solution for various industries.

Executive Summary

The plunger pumps market is experiencing significant growth, driven by the increasing need for high-pressure pumping solutions across multiple industries. This report provides a comprehensive analysis of the market, including key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and future outlook. It also examines the impact of COVID-19 on the market and presents key industry developments and analyst suggestions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Oil & Gas Dominance: The sector accounts for over 35% of plunger-pump revenues, driven by chemical injection, well stimulation, and hydrostatic testing.

Water Treatment Growth: Desalination and reverse-osmosis pre-pressurization applications are fueling demand for corrosion-resistant plunger pumps.

Mining & Construction: High-pressure dewatering and slurry transfer pumps are increasingly required in surface and underground operations.

Chemical Processing: Precise metering of aggressive or viscous fluids is a key growth area, with specialty coatings and seal technologies improving uptime.

Aftermarket Services: Spares, rebuild kits, and seal replacements represent 30–40% of market value, underscoring the importance of service networks and rapid-response logistics.

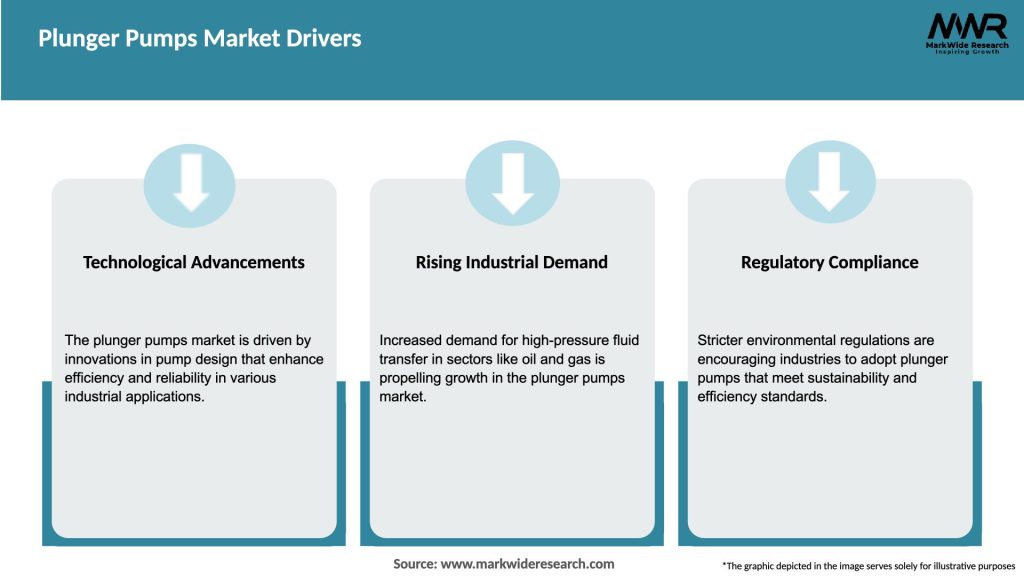

Market Drivers

High-Pressure Needs: Applications such as hydraulic fracturing, hydrostatic testing, and jet-cutting demand pressures beyond the capabilities of centrifugal pumps.

Regulatory Requirements: Stricter environmental and safety regulations compel precise chemical dosing in water treatment, mining, and oil & gas, favoring plunger-pump metering accuracy.

Infrastructure Investments: Global spending on desalination plants, wastewater treatment, and pipeline maintenance creates new installations and replacement cycles.

Technological Advancements: Introduction of smarter seal designs, ceramic plungers, and high-alloy materials extends pump lifespans and reduces maintenance frequency.

Energy Efficiency Initiatives: Adoption of VFDs and intelligent control systems optimizes power consumption, particularly in continuous-duty industrial processes.

Market Restraints

High Capital Cost: Plunger pumps typically have higher upfront investment compared to centrifugal alternatives, limiting adoption in price-sensitive segments.

Maintenance Complexity: Reciprocating design requires periodic seal and packing replacement, which can be labor-intensive and require skilled technicians.

Pulsation Management: Pulsatile flow necessitates the use of pulsation dampeners or accumulators, adding to system complexity and footprint.

Niche Alternatives: Diaphragm and progressive cavity pumps compete in chemical metering and viscous-fluid applications, especially at lower pressures.

Supply-Chain Fluctuations: Specialized materials—stainless steels, exotic alloys, ceramics—are subject to price and availability volatility.

Market Opportunities

Digital Retrofit Packages: Offering sensor-based health monitoring and remote diagnostics can help operators reduce unplanned downtime and extend service intervals.

Modular Service Kits: Pre-assembled seal and plunger kits that allow quick field replacement without full pump removal enhance uptime in remote locations.

Expanded Desalination Sales: Growth of seawater and brackish-water plants in water-stressed regions opens new high-pressure pre-pressurization pump requirements.

Customized OEM Solutions: Collaborations with end-users to engineer pumps for unique process fluids—abrasive slurries, high-temperature oils—can capture bespoke project revenue.

Emerging-Market Penetration: Infrastructure build-out in Asia-Pacific, the Middle East, and Latin America presents high-potential growth corridors for both new sales and aftermarket service.

Market Dynamics

OEM–Distributor Alliances: Strategic partnerships ensure broad geographic coverage for sales, installation, and rapid spares delivery, critical in remote or offshore operations.

Value-Added Services: Bundling routine maintenance contracts, training, and digital monitoring elevates manufacturers’ offerings from hardware suppliers to lifecycle-service providers.

Consolidation Trends: M&A activity among pump manufacturers and service specialists is streamlining product portfolios and consolidating global service networks.

Regulatory Compliance: Adherence to API (American Petroleum Institute) standards, ISO certification, and regional safety regulations influences design and material choices.

Sustainability Focus: Development of low-emission driver options (electric, natural-gas engines) and eco-friendly seal materials aligns with corporate ESG targets.

Regional Analysis

North America: Largest market, led by U.S. shale-fracturing activities and extensive downstream petrochemical infrastructure requiring high-pressure pumps.

Europe: Mature water-treatment and chemical-processing industries drive steady demand; strict environmental regulations favor accurate metering solutions.

Asia-Pacific: Fastest-growing region, powered by desalination projects in the Middle East, mining in Australia, and industrial expansion in China and India.

Latin America: Growth in oil & gas and mining sector modernization in Brazil, Mexico, and Chile supports pump sales and service.

Middle East & Africa: Infrastructure investment in water security and oilfield development underpins strong demand, though aftermarket networks remain less mature.

Competitive Landscape

Leading Companies in the Plunger Pumps Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

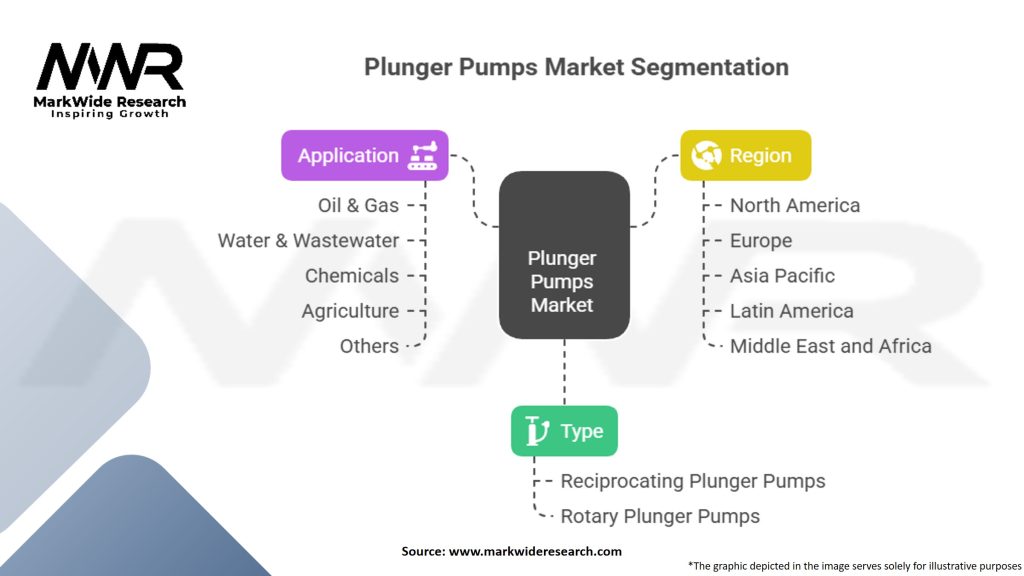

Segmentation

The plunger pumps market can be segmented based on pump type, pressure rating, end-use industry, and region. By pump type, the market can be categorized into single-acting and double-acting plunger pumps. Pressure rating segments include low pressure, medium pressure, and high pressure. End-use industries encompass oil and gas, chemical processing, power generation, water and wastewater treatment, construction, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the plunger pumps market. While some industries, such as oil and gas and construction, experienced a temporary slowdown due to restrictions and reduced demand, others, like healthcare and water treatment, witnessed increased activity. The pandemic highlighted the importance of robust and reliable pumping solutions in critical sectors, leading to a renewed focus on pump reliability and performance.

Key Industry Developments

LEWA’s Ecoflow™ Launch (2023): Introduced a diaphragm-plunger hybrid metering pump with 85% fewer dynamic seals, reducing leakage risk and maintenance.

Cat Pumps Expansion (2022): Added a new triplex series offering pressures up to 40,000 psi for deep-well testing applications.

Grundfos REACT® Integration (2021): Deployed IoT-enabled controls on plunger-based dosing pumps for remote calibration and predictive-servicing analytics.

Fristam’s Ceramic Seal Upgrade (2024): Rolled out a ceramic-plunger and ceramic-seal package for abrasive slurry handling in mining and dredging.

Analyst Suggestions

Future Outlook

The plunger pumps market is expected to grow steadily in the coming years, driven by increasing industrialization, infrastructure development, and stringent environmental regulations. Technological advancements, including IoT integration, automation, and energy-efficient designs, will further shape the market. Emerging economies, particularly in the Asia Pacific region, present significant growth opportunities. However, market players should remain vigilant about changing customer demands, regulatory requirements, and competitive dynamics to maintain a competitive edge.

Conclusion

The plunger pumps market is witnessing steady growth, fueled by the need for high-pressure pumping solutions across various industries. Manufacturers are focusing on innovation, efficiency, and customization to meet the diverse requirements of end-users. With the integration of digital technologies and the development of energy-efficient solutions, the future outlook for the plunger pumps market remains positive. However, market players must adapt to changing market dynamics, emerging trends, and customer preferences to stay competitive in this dynamic industry.

What is Plunger Pumps?

Plunger pumps are positive displacement pumps that use a plunger to move fluid through a cylinder. They are commonly used in various applications, including oil and gas, chemical processing, and water treatment.

What are the key players in the Plunger Pumps Market?

Key players in the Plunger Pumps Market include companies like Grundfos, Cat Pumps, and ARO Fluid Handling. These companies are known for their innovative solutions and extensive product lines, among others.

What are the growth factors driving the Plunger Pumps Market?

The growth of the Plunger Pumps Market is driven by increasing demand in industries such as oil and gas, water treatment, and chemical processing. Additionally, advancements in pump technology and the need for efficient fluid handling solutions contribute to market expansion.

What challenges does the Plunger Pumps Market face?

The Plunger Pumps Market faces challenges such as high maintenance costs and the need for regular servicing. Additionally, competition from alternative pumping technologies can hinder market growth.

What opportunities exist in the Plunger Pumps Market?

Opportunities in the Plunger Pumps Market include the development of energy-efficient pumps and the expansion into emerging markets. The increasing focus on sustainable practices also presents avenues for growth.

What trends are shaping the Plunger Pumps Market?

Trends in the Plunger Pumps Market include the integration of smart technology for monitoring and control, as well as the growing demand for customized pumping solutions. Additionally, there is a shift towards environmentally friendly materials and practices.

Plunger Pumps Market

| Segmentation Details | Details |

|---|---|

| Type | Reciprocating Plunger Pumps, Rotary Plunger Pumps |

| Application | Oil & Gas, Water & Wastewater, Chemicals, Agriculture, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Plunger Pumps Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at