444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The plug-in hybrid electric vehicle battery market represents a pivotal segment within the broader automotive electrification ecosystem, experiencing unprecedented growth as manufacturers worldwide transition toward sustainable mobility solutions. This dynamic market encompasses advanced battery technologies specifically designed for plug-in hybrid electric vehicles (PHEVs), which combine traditional internal combustion engines with electric powertrains to deliver enhanced fuel efficiency and reduced emissions.

Market dynamics indicate robust expansion driven by stringent environmental regulations, consumer demand for fuel-efficient vehicles, and technological advancements in battery chemistry and energy density. The sector is witnessing significant investment in research and development, with manufacturers focusing on lithium-ion battery technologies that offer improved performance, longer lifespan, and faster charging capabilities.

Regional markets demonstrate varying adoption rates, with North America, Europe, and Asia-Pacific leading the charge in PHEV battery deployment. The market is characterized by intense competition among established automotive suppliers and emerging battery manufacturers, all vying to capture market share in this rapidly evolving landscape. Growth projections suggest the market will continue expanding at a compound annual growth rate of 12.5% through the forecast period, driven by increasing PHEV production and improving battery technologies.

The plug-in hybrid electric vehicle battery market refers to the specialized segment focused on manufacturing, distributing, and servicing battery systems specifically designed for plug-in hybrid electric vehicles that can be recharged through external power sources while maintaining conventional engine capabilities for extended range.

These battery systems typically feature lithium-ion technology with energy capacities ranging from 8 kWh to 20 kWh, enabling electric-only driving ranges of 20 to 60 miles depending on vehicle size and battery configuration. The batteries incorporate sophisticated battery management systems (BMS) that monitor cell performance, temperature, and charging cycles to optimize efficiency and longevity.

Key characteristics of PHEV batteries include their ability to support both electric-only operation and hybrid modes, integration with regenerative braking systems, and compatibility with various charging infrastructure including Level 1 and Level 2 charging stations. The market encompasses not only the battery cells themselves but also associated components such as thermal management systems, power electronics, and safety systems that ensure reliable operation across diverse driving conditions.

The plug-in hybrid electric vehicle battery market stands at the forefront of automotive electrification, representing a critical bridge technology between conventional vehicles and fully electric alternatives. This comprehensive analysis reveals a market experiencing substantial growth momentum, driven by regulatory pressures, technological innovations, and shifting consumer preferences toward sustainable transportation solutions.

Market fundamentals demonstrate strong underlying demand across key automotive markets, with PHEV adoption rates increasing by 18% annually in major regions. The competitive landscape features established automotive suppliers alongside emerging battery specialists, creating a dynamic ecosystem focused on advancing battery performance while reducing costs.

Technological developments continue to reshape market dynamics, with next-generation lithium-ion chemistries offering improved energy density, faster charging capabilities, and enhanced thermal stability. According to MarkWide Research analysis, battery energy density improvements of 8% annually are driving enhanced vehicle performance and consumer acceptance.

Strategic implications for industry participants include the need for substantial investments in manufacturing capacity, research and development, and supply chain optimization. The market presents significant opportunities for companies that can successfully navigate the complex regulatory environment while delivering cost-effective, high-performance battery solutions that meet evolving automotive requirements.

Critical market insights reveal several transformative trends shaping the plug-in hybrid electric vehicle battery landscape:

Environmental regulations serve as the primary catalyst driving plug-in hybrid electric vehicle battery market expansion. Governments worldwide are implementing increasingly stringent emissions standards, with many jurisdictions mandating significant reductions in fleet average CO2 emissions. These regulatory frameworks create compelling incentives for automakers to accelerate PHEV development and deployment.

Consumer demand for fuel-efficient vehicles continues strengthening as gasoline prices fluctuate and environmental consciousness grows. PHEV technology offers consumers the benefits of electric driving for daily commutes while maintaining the flexibility of conventional engines for longer trips, addressing range anxiety concerns that may deter fully electric vehicle adoption.

Technological advancements in battery chemistry and manufacturing processes are enabling significant improvements in energy density, charging speed, and overall performance. These innovations are making PHEV batteries more attractive to both manufacturers and consumers by delivering enhanced vehicle capabilities at increasingly competitive price points.

Government incentives including tax credits, rebates, and preferential treatment for hybrid vehicles are reducing the total cost of ownership for consumers while encouraging manufacturer investment in PHEV technologies. Many regions offer substantial financial incentives that make PHEVs cost-competitive with conventional vehicles.

Corporate sustainability initiatives are driving fleet electrification as businesses seek to reduce their carbon footprints and meet environmental, social, and governance (ESG) objectives. This trend is creating substantial demand for PHEV solutions in commercial and fleet applications.

High initial costs remain a significant barrier to widespread PHEV battery adoption, as advanced battery technologies require substantial upfront investments that can increase vehicle prices compared to conventional alternatives. Despite declining battery costs, the premium associated with PHEV technology continues to challenge mass market penetration.

Supply chain constraints for critical battery materials including lithium, cobalt, and rare earth elements create potential bottlenecks that could limit production scaling. Geopolitical tensions and resource concentration in specific regions add complexity to supply chain management and cost stability.

Charging infrastructure limitations in many regions restrict the practical benefits of PHEV technology, particularly in rural areas or regions with limited electrical grid capacity. Inadequate charging networks can diminish consumer confidence and limit market growth potential.

Technical complexity associated with integrating battery systems, power electronics, and conventional powertrains creates engineering challenges that require specialized expertise and can increase development costs and timelines for manufacturers.

Battery degradation concerns related to capacity loss over time and extreme weather conditions may influence consumer purchasing decisions, particularly in regions with harsh climates where battery performance may be compromised.

Competition from alternative technologies including fully electric vehicles and advanced conventional powertrains may limit PHEV market share as these alternatives continue improving in performance and cost-effectiveness.

Emerging markets present substantial growth opportunities as developing economies implement electrification policies and consumers gain access to PHEV technologies. Countries in Asia-Pacific, Latin America, and Africa are beginning to establish regulatory frameworks that support hybrid vehicle adoption.

Commercial vehicle applications offer significant potential for PHEV battery deployment, as fleet operators seek to reduce operating costs and meet environmental compliance requirements. Delivery vehicles, buses, and commercial trucks represent high-volume opportunities for specialized battery solutions.

Second-life applications for PHEV batteries create additional revenue streams through stationary energy storage applications once automotive service life concludes. These applications can extend battery value chains and improve overall economics for manufacturers and consumers.

Advanced battery chemistries including solid-state technologies and next-generation lithium-ion formulations present opportunities for performance breakthroughs that could accelerate market adoption and create competitive advantages for early adopters.

Wireless charging technologies and vehicle-to-grid integration capabilities offer potential for enhanced PHEV functionality that could increase consumer appeal and create new business models around energy services.

Recycling and circular economy initiatives present opportunities for sustainable battery lifecycle management while reducing raw material dependencies and creating new revenue streams from battery material recovery.

Competitive dynamics within the plug-in hybrid electric vehicle battery market are intensifying as established automotive suppliers compete with specialized battery manufacturers and technology companies. This competition is driving rapid innovation cycles and aggressive pricing strategies that benefit end consumers while challenging profit margins.

Technology convergence between PHEV and BEV (Battery Electric Vehicle) battery technologies is creating economies of scale and shared development costs, enabling manufacturers to leverage common platforms and components across multiple vehicle types. This convergence is accelerating technological advancement while reducing per-unit development costs.

Supply chain evolution is witnessing significant transformation as manufacturers pursue vertical integration strategies and develop regional supply networks to reduce dependencies and improve cost structures. MWR data indicates that 42% of major manufacturers are investing in upstream battery material processing capabilities.

Market consolidation trends are emerging as smaller players seek partnerships or acquisition opportunities with larger manufacturers to access necessary capital and technical resources for scaling operations. This consolidation is creating more integrated value chains and stronger competitive positions.

Innovation cycles are accelerating with new battery technologies, manufacturing processes, and integration approaches being developed continuously. The rapid pace of innovation is creating both opportunities for differentiation and risks of technological obsolescence for market participants.

Primary research methodologies employed in this comprehensive market analysis include extensive interviews with industry executives, technology experts, and key stakeholders across the plug-in hybrid electric vehicle battery value chain. These interviews provide critical insights into market trends, competitive dynamics, and future development priorities.

Secondary research encompasses detailed analysis of industry reports, regulatory filings, patent databases, and technical publications to establish comprehensive understanding of market fundamentals, technological developments, and competitive positioning strategies employed by major market participants.

Market modeling techniques utilize advanced statistical analysis and forecasting methodologies to project market trends, growth patterns, and segment performance across different regions and application areas. These models incorporate multiple variables including regulatory changes, technological developments, and economic factors.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, expert verification, and consistency checks across different data points and market segments. This rigorous validation approach ensures the integrity of market insights and projections.

Quantitative analysis incorporates statistical modeling, trend analysis, and correlation studies to identify key market drivers, growth patterns, and performance indicators that influence market development and competitive dynamics.

North America represents a mature and rapidly growing market for PHEV batteries, driven by strong regulatory support, established automotive manufacturing base, and increasing consumer acceptance of electrified vehicles. The region benefits from substantial government incentives and growing charging infrastructure that supports PHEV adoption. Market share analysis indicates North America accounts for 28% of global PHEV battery demand.

Europe leads global PHEV battery adoption with the most stringent emissions regulations and comprehensive policy frameworks supporting electrification. European manufacturers are investing heavily in battery technologies and local production capabilities to meet growing demand. The region’s commitment to carbon neutrality is driving aggressive PHEV deployment across multiple vehicle segments.

Asia-Pacific demonstrates the highest growth potential with rapidly expanding automotive markets, increasing environmental awareness, and substantial government investments in electrification infrastructure. China, Japan, and South Korea are leading regional development with major battery manufacturing investments and supportive policy environments.

Emerging markets including Latin America, Middle East, and Africa are beginning to show interest in PHEV technologies as economic development and environmental concerns drive policy changes. These regions present long-term growth opportunities as infrastructure development and regulatory frameworks mature.

Regional variations in battery chemistry preferences, performance requirements, and cost sensitivities create diverse market dynamics that require tailored approaches from manufacturers seeking global market presence.

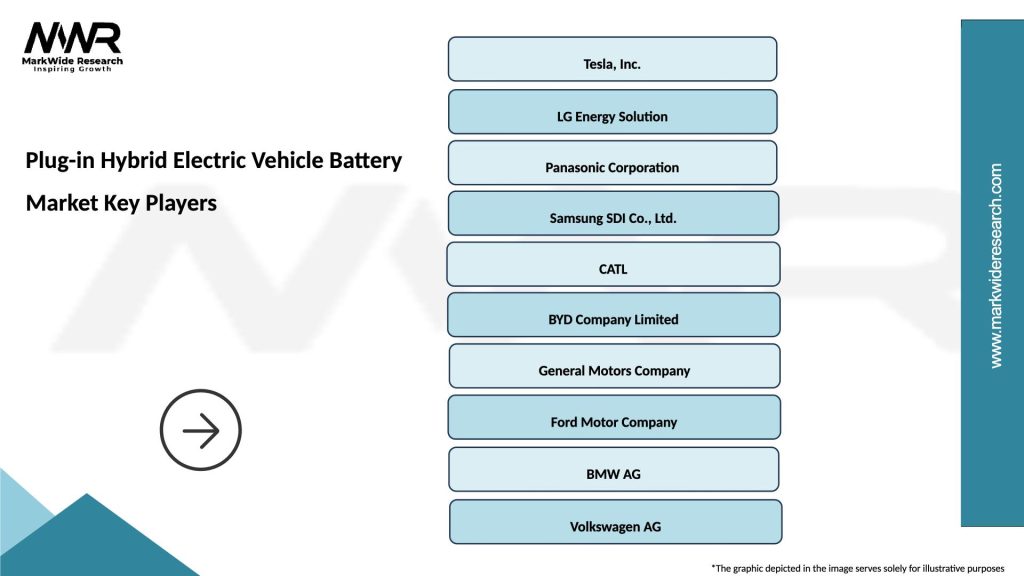

The competitive landscape features a diverse mix of established automotive suppliers, specialized battery manufacturers, and emerging technology companies competing across different segments of the PHEV battery value chain:

Competitive strategies focus on technological differentiation, cost optimization, manufacturing scale, and strategic partnerships with automotive manufacturers. Companies are investing heavily in research and development while expanding global production capacity to meet growing demand.

By Battery Type:

By Vehicle Type:

By Capacity Range:

Passenger vehicle batteries represent the largest market segment, driven by consumer demand for fuel-efficient personal transportation solutions. This category emphasizes cost optimization, reliability, and integration with existing vehicle platforms. Adoption rates in this segment are growing at 16% annually as manufacturers expand PHEV offerings across multiple vehicle classes.

Commercial vehicle applications are emerging as a high-growth segment with unique requirements for durability, fast charging, and extended operational life. Fleet operators are increasingly adopting PHEV technologies to reduce operating costs and meet environmental compliance requirements.

Luxury vehicle batteries focus on premium performance characteristics including rapid charging, extended range, and advanced thermal management systems. This segment drives innovation and technology development that eventually filters down to mainstream applications.

Battery chemistry variations within each category reflect different performance priorities, cost constraints, and regulatory requirements. NMC chemistries dominate passenger applications while LFP technologies are gaining traction in commercial segments where safety and longevity are prioritized over energy density.

Regional preferences influence category development with European markets favoring higher-capacity systems for extended electric range, while Asian markets emphasize cost-effective solutions that maximize fuel efficiency benefits.

Automotive manufacturers benefit from PHEV battery technologies through enhanced product differentiation, improved fleet fuel economy ratings, and compliance with increasingly stringent emissions regulations. These benefits enable manufacturers to meet regulatory requirements while offering consumers attractive alternatives to conventional powertrains.

Battery suppliers gain access to substantial growth opportunities in the expanding electrification market while leveraging existing lithium-ion technologies and manufacturing capabilities. The PHEV segment provides a pathway for scaling production and reducing costs across broader battery applications.

Consumers realize significant benefits including reduced fuel costs, lower emissions, potential tax incentives, and enhanced driving flexibility that combines electric efficiency with conventional range capabilities. These benefits address key concerns about electric vehicle adoption while providing immediate environmental and economic advantages.

Fleet operators achieve operational cost reductions through improved fuel efficiency, reduced maintenance requirements, and potential regulatory compliance benefits. PHEV technologies enable fleet electrification without the range limitations associated with fully electric alternatives.

Governments and regulators benefit from PHEV adoption through reduced transportation emissions, decreased petroleum dependency, and progress toward environmental objectives. PHEV technologies provide a practical pathway for achieving electrification goals while maintaining transportation system reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Battery energy density improvements continue driving enhanced PHEV performance with manufacturers achieving annual improvements of 8-10% in volumetric and gravimetric energy density. These improvements enable longer electric range and better vehicle packaging while maintaining cost competitiveness.

Fast charging capabilities are becoming standard features as manufacturers implement higher-power charging systems that can replenish PHEV batteries in 30 minutes or less. This trend addresses consumer convenience concerns and increases the practical utility of electric driving modes.

Thermal management innovations are enhancing battery performance and longevity across diverse climate conditions. Advanced cooling and heating systems maintain optimal battery temperatures while minimizing energy consumption and extending operational life.

Vehicle-to-grid integration is emerging as manufacturers develop bidirectional charging capabilities that allow PHEV batteries to supply power back to electrical grids during peak demand periods. This functionality creates additional value propositions for consumers and utilities.

Sustainable manufacturing practices are gaining prominence as manufacturers implement recycling programs, reduce material waste, and develop closed-loop supply chains for battery materials. MarkWide Research indicates that 67% of manufacturers are investing in sustainable production technologies.

Modular battery architectures are enabling manufacturers to optimize battery configurations for different vehicle applications while sharing common components and manufacturing processes across multiple platforms.

Manufacturing capacity expansions are accelerating globally as battery suppliers invest in gigafactory facilities to meet growing PHEV demand. Major announcements include multi-billion-dollar investments in North America, Europe, and Asia to establish regional production capabilities.

Strategic partnerships between automotive manufacturers and battery suppliers are deepening with joint ventures, technology sharing agreements, and long-term supply contracts ensuring stable relationships and shared development costs.

Technology breakthroughs in silicon-enhanced anodes, advanced cathode materials, and solid-state electrolytes are progressing from laboratory development toward commercial implementation, promising significant performance improvements for future PHEV applications.

Regulatory developments including updated emissions standards, safety requirements, and recycling mandates are shaping industry practices and driving investments in compliance technologies and sustainable manufacturing processes.

Supply chain diversification initiatives are reducing dependencies on single-source suppliers and geographic regions through investments in alternative material sources, processing capabilities, and regional supply networks.

Digital integration advances including cloud-connected battery management systems, predictive maintenance capabilities, and over-the-air updates are enhancing battery performance optimization and extending operational life.

Investment priorities should focus on next-generation battery technologies that offer significant performance improvements while maintaining cost competitiveness. Companies should prioritize research and development in solid-state batteries, advanced lithium-ion chemistries, and manufacturing process innovations.

Supply chain strategies require immediate attention to secure critical material supplies and reduce geopolitical risks. Vertical integration, strategic partnerships, and geographic diversification are essential for maintaining competitive positions and cost stability.

Market positioning should emphasize differentiation through technology leadership, cost optimization, and customer service excellence. Companies must develop clear value propositions that address specific customer needs while building sustainable competitive advantages.

Regional expansion strategies should prioritize high-growth markets while building local manufacturing and service capabilities. Understanding regional preferences, regulatory requirements, and competitive dynamics is crucial for successful market entry and expansion.

Sustainability initiatives should be integrated into core business strategies as environmental considerations become increasingly important for customers, regulators, and investors. Circular economy approaches and carbon-neutral manufacturing processes will become competitive necessities.

Partnership development with automotive manufacturers, technology companies, and infrastructure providers will be essential for accessing markets, sharing development costs, and creating comprehensive solutions that address customer needs across the entire value chain.

Market evolution over the next decade will be characterized by continued technological advancement, cost reduction, and expanding applications across diverse vehicle segments. The PHEV battery market is expected to maintain strong growth momentum with projected annual growth rates of 11-13% through 2030.

Technology convergence between PHEV and BEV battery technologies will accelerate, creating economies of scale and shared development benefits. This convergence will enable manufacturers to optimize production efficiency while offering diverse electrification solutions to meet varying customer needs.

Geographic expansion will continue as emerging markets develop regulatory frameworks and infrastructure to support PHEV adoption. Asia-Pacific regions are expected to drive the majority of growth with market share increasing to 45% by 2030.

Application diversification will extend beyond traditional passenger vehicles to include commercial trucks, buses, marine applications, and stationary energy storage systems. These diverse applications will create new revenue streams and market opportunities for battery manufacturers.

Competitive dynamics will intensify as new entrants challenge established players while technological innovation accelerates. Success will depend on companies’ ability to balance innovation, cost management, and market responsiveness in an increasingly complex competitive environment.

Sustainability requirements will become more stringent, driving investments in recycling technologies, sustainable material sourcing, and carbon-neutral manufacturing processes. These requirements will reshape industry practices and create new competitive differentiators.

The plug-in hybrid electric vehicle battery market represents a dynamic and rapidly evolving sector that plays a crucial role in the global transition toward sustainable transportation. This comprehensive analysis reveals a market characterized by strong growth fundamentals, technological innovation, and expanding applications across diverse vehicle segments and geographic regions.

Key success factors for market participants include technological leadership, cost optimization, supply chain security, and strategic partnerships that enable access to growing markets while managing competitive pressures. Companies that can effectively balance innovation with operational excellence will be best positioned to capture market opportunities and build sustainable competitive advantages.

Market outlook remains highly positive with continued growth expected across all major regions and application segments. The combination of regulatory support, technological advancement, and increasing consumer acceptance creates a favorable environment for sustained market expansion and industry development.

Strategic implications for industry stakeholders emphasize the importance of long-term planning, substantial investment in research and development, and proactive adaptation to changing market conditions. Success in this market requires comprehensive understanding of technological trends, regulatory developments, and evolving customer needs across diverse applications and geographic markets.

What is Plug-in Hybrid Electric Vehicle Battery?

Plug-in Hybrid Electric Vehicle Battery refers to the rechargeable battery systems used in plug-in hybrid electric vehicles (PHEVs) to store energy for propulsion. These batteries enable vehicles to operate on electric power for a certain distance before switching to a conventional internal combustion engine.

What are the key players in the Plug-in Hybrid Electric Vehicle Battery Market?

Key players in the Plug-in Hybrid Electric Vehicle Battery Market include companies like Panasonic, LG Chem, and Samsung SDI, which are known for their advanced battery technologies and production capabilities. These companies are actively involved in developing high-capacity batteries for PHEVs, among others.

What are the growth factors driving the Plug-in Hybrid Electric Vehicle Battery Market?

The growth of the Plug-in Hybrid Electric Vehicle Battery Market is driven by increasing consumer demand for eco-friendly transportation solutions, advancements in battery technology, and government incentives promoting electric vehicle adoption. Additionally, rising fuel prices and environmental concerns are encouraging the shift towards hybrid vehicles.

What challenges does the Plug-in Hybrid Electric Vehicle Battery Market face?

The Plug-in Hybrid Electric Vehicle Battery Market faces challenges such as high production costs, limited battery life, and concerns regarding the environmental impact of battery disposal. Additionally, competition from fully electric vehicles may hinder market growth.

What opportunities exist in the Plug-in Hybrid Electric Vehicle Battery Market?

Opportunities in the Plug-in Hybrid Electric Vehicle Battery Market include the development of more efficient battery technologies, expansion into emerging markets, and partnerships between automotive manufacturers and battery producers. Innovations in battery recycling and second-life applications also present significant potential.

What trends are shaping the Plug-in Hybrid Electric Vehicle Battery Market?

Trends shaping the Plug-in Hybrid Electric Vehicle Battery Market include the increasing integration of smart technologies in battery management systems, the rise of solid-state batteries, and a growing focus on sustainability in battery production. Additionally, the shift towards renewable energy sources for charging is gaining traction.

Plug-in Hybrid Electric Vehicle Battery Market

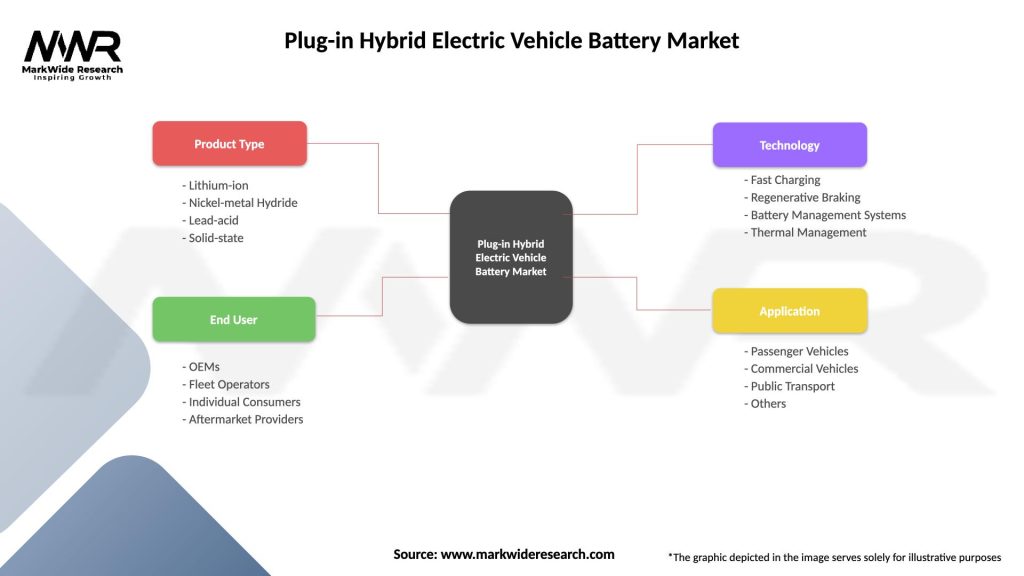

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | OEMs, Fleet Operators, Individual Consumers, Aftermarket Providers |

| Technology | Fast Charging, Regenerative Braking, Battery Management Systems, Thermal Management |

| Application | Passenger Vehicles, Commercial Vehicles, Public Transport, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Plug-in Hybrid Electric Vehicle Battery Market

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at