444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Plant Asset Management (PAM) Market is a pivotal segment within the industrial and manufacturing sectors. PAM solutions encompass software, sensors, and services that enable industries to effectively manage and maintain their assets, such as machinery, equipment, and infrastructure. This comprehensive analysis explores the intricacies of the Plant Asset Management Market, covering its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a conclusive summary.

Meaning

Plant Asset Management refers to the systematic approach of managing physical plant assets through digital tools and processes that track asset health, schedule maintenance, and analyze performance data. It encompasses a suite of solutions—such as computerized maintenance management systems (CMMS), enterprise asset management (EAM), and condition monitoring platforms—that provide a unified view of equipment status, maintenance history, and reliability metrics. By linking real-time sensor data with advanced analytics, PAM enables data-driven decision-making to extend asset life and reduce total cost of ownership.

Executive Summary

The Plant Asset Management Market is experiencing robust growth, driven by the increasing need for predictive maintenance, asset optimization, and cost reduction in industrial operations. PAM solutions offer real-time monitoring, data analytics, and maintenance scheduling, improving asset reliability and reducing downtime. However, the market faces challenges related to data security, integration complexities, and the adoption of PAM systems in smaller enterprises.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Adoption of cloud-based PAM platforms is accelerating, offering faster deployment, lower IT overhead, and seamless scalability.

Predictive maintenance—leveraging machine learning on vibration, temperature, and pressure data—is reducing unplanned failures by up to 40%.

Integration of PAM with enterprise systems (ERP, MES, SCADA) is becoming essential to break data silos and drive holistic plant optimization.

SMEs are increasingly investing in modular PAM solutions with pay-as-you-go models, lowering the entry barrier.

Market Drivers

Digital Transformation Initiatives: Industry 4.0 investments are propelling asset digitization, IoT sensor rollout, and advanced analytics use cases.

Cost Pressure: Rising maintenance budgets and the high cost of unplanned downtime are pushing organizations toward predictive and prescriptive maintenance.

Regulatory Compliance: Stringent safety and environmental regulations (e.g., OSHA, EPA, EU Machinery Directive) demand robust asset health monitoring and recordkeeping.

Aging Infrastructure: Legacy plants with aging equipment require sophisticated PAM to extend asset life and ensure reliability.

Workforce Dynamics: Skill gaps and retirement of experienced technicians are accelerating adoption of mobile-enabled PAM to guide less experienced personnel.

Market Restraints

Data Integration Challenges: Disparate OT and IT systems complicate the consolidation of asset data necessary for comprehensive analytics.

High Implementation Costs: Upfront investment in sensors, integration, and change management can deter smaller operators.

Cybersecurity Concerns: Increased connectivity of critical assets raises the risk of cyberattacks, demanding robust security frameworks.

Change Resistance: Cultural inertia and reluctance to depart from paper-based processes can hamper digital PAM rollouts.

Skill Shortage: Limited in-house expertise in data science and digital maintenance can slow adoption and realization of benefits.

Market Opportunities

AI and ML Enhancements: Incorporating deep learning models for anomaly detection and automated root-cause analysis to further reduce downtime.

Edge Computing: Deploying analytics at the edge to overcome connectivity constraints and enable real-time decision-making.

Sustainability Solutions: Extending PAM to track energy consumption and emissions, supporting corporate ESG goals.

Managed PAM Services: Offering end-to-end maintenance outsourcing and data-as-a-service models to lower customer risk.

AR/VR for Maintenance: Leveraging augmented reality guides and remote expert support to accelerate repair tasks and training.

Market Dynamics

Consolidation of Vendors: M&A activity is creating full-stack digital operations suites that blur lines between PAM, EAM, and DCS.

Move to Outcome-Based Contracts: Vendors and service providers are adopting “pay-per-uptime” and performance-based agreements.

Open-Source Initiatives: Growing interest in open protocols (e.g., OPC UA) to improve interoperability among asset management tools.

Collaborative Ecosystems: Partnerships between software vendors, sensor manufacturers, and system integrators to deliver turnkey solutions.

Continuous Innovation: Rapid feature releases—such as digital twins and prescriptive maintenance workflows—are raising customer expectations.

Regional Analysis

North America: Leads PAM adoption, driven by large oil & gas and power generation operators upgrading legacy infrastructure.

Europe: Strong growth with emphasis on sustainability and asset performance in chemical and manufacturing sectors; GDPR influences data handling.

Asia Pacific: Fastest CAGR as China, India, and Southeast Asia invest heavily in industrial automation and smart manufacturing.

Latin America: Moderate uptake in mining and oil & gas, with potential growth as companies modernize aging assets.

Middle East & Africa: Emerging interest in PAM among petrochemical giants and utilities, supported by digital transformation agendas.

Competitive Landscape

Leading Companies in Plant Asset Management (PAM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

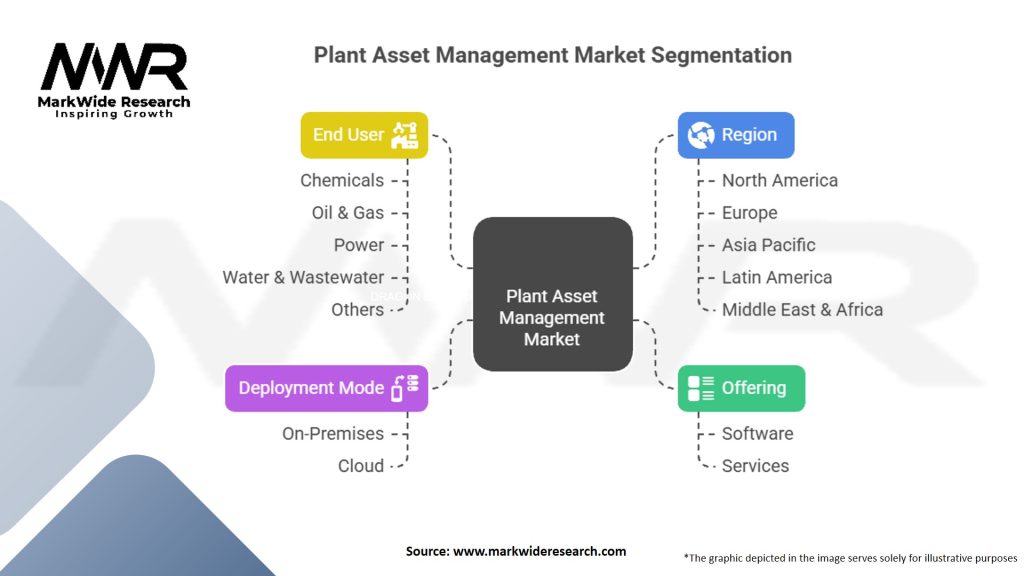

Segmentation

The Plant Asset Management Market can be segmented based on various factors, including deployment mode, industry vertical, solution type, and region.

By Deployment Mode

By Industry Vertical

By Solution Type

Category-wise Insights

Condition Monitoring: Real-time vibration, thermography, and oil analysis provide early fault detection and reduce emergency repairs.

Predictive Analytics: Machine learning models forecast remaining useful life (RUL) and recommend maintenance schedules based on risk prioritization.

Maintenance Execution: Work order management, spare-parts optimization, and mobile workforce enablement streamline maintenance workflows.

Performance Benchmarking: KPI dashboards compare asset performance across sites and identify best practices for standardization.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Digital Twin Adoption: Creation of virtual replicas of physical assets to simulate scenarios and optimize maintenance strategies.

Mobility & IoT at Scale: Widespread deployment of wireless sensors and 5G connectivity for continuous asset data streams.

Prescriptive Maintenance: Systems shifting from “what will fail” to “how to fix it” with guided repair instructions and automated work orders.

Outcome-Based Offerings: Vendors aligning revenue models to customer performance metrics, such as asset availability or throughput.

Augmented Reality Support: Field technicians using AR headsets for hands-free guidance and remote expert collaboration.

Covid-19 Impact

The pandemic underscored the need for remote asset monitoring and predictive maintenance as on-site staffing was restricted. Companies accelerated cloud migrations and embraced managed PAM services to maintain reliability with minimal personnel. Supply chain disruptions highlighted the value of spare-parts optimization analytics, prompting many organizations to prioritize PAM investments to build operational resilience.

Key Industry Developments

Honeywell’s APM 8.0 Release: Enhanced AI analytics module offering automated anomaly detection and natural-language reporting.

Siemens XHQ Cloud Launch: New cloud-native version of its operations intelligence platform for easier global rollouts.

IBM Maximo Mobile Enhancements: Introduction of offline-first capabilities and AR-assisted maintenance work instructions.

AspenTech & PTC Partnership: Integration of Aspen’s analytics with PTC’s ThingWorx IIoT platform for end-to-end asset digitization.

ABB Ability™ Edge: Edge-computing variant of its PAM suite delivering real-time analytics close to the asset.

Analyst Suggestions

Prioritize High-Risk Assets: Begin PAM deployments on critical equipment with the greatest impact on production and safety.

Adopt a Phased Rollout: Use pilot projects to demonstrate ROI, refine data integrations, and secure executive buy-in before full-scale deployment.

Hybrid Deployment Strategy: Combine on-premise and cloud solutions to balance data sovereignty requirements with scalability needs.

Invest in Data Governance: Establish clear protocols for data quality, ownership, and cybersecurity to ensure analytic reliability and trust.

Future Outlook

The PAM market will continue its rapid evolution as AI-driven diagnostics, digital twins, and outcome-based service models become mainstream. Cloud-native architectures and edge analytics will enable real-time insights at scale, while AR/VR and remote collaboration tools will empower decentralized maintenance teams. As asset-intensive industries pursue greater efficiency and sustainability, PAM solutions that deliver clear business outcomes will see the fastest uptake, cementing their role as the backbone of modern industrial operations.

Conclusion

Plant Asset Management has emerged as a cornerstone of industrial digital transformation, delivering measurable improvements in asset uptime, cost efficiency, and safety. By harnessing IoT, AI, and cloud technologies, organizations can shift from costly reactive maintenance to proactive, prescriptive strategies that extend asset life and support sustainability goals. Success in the evolving PAM landscape will hinge on strategic vendor partnerships, robust data governance, and a phased approach that aligns technology deployments with clear business objectives.

What is Plant Asset Management (PAM)?

Plant Asset Management (PAM) refers to the systematic approach to managing the lifecycle of physical assets in a plant, focusing on maximizing their value, performance, and reliability. It encompasses various processes including maintenance, operations, and asset optimization.

What are the key players in the Plant Asset Management (PAM) Market?

Key players in the Plant Asset Management (PAM) Market include companies like IBM, Siemens, and Schneider Electric, which provide software and solutions for asset management, maintenance, and operational efficiency, among others.

What are the growth factors driving the Plant Asset Management (PAM) Market?

The growth of the Plant Asset Management (PAM) Market is driven by the increasing need for operational efficiency, the adoption of IoT technologies, and the rising focus on predictive maintenance strategies across various industries.

What challenges does the Plant Asset Management (PAM) Market face?

Challenges in the Plant Asset Management (PAM) Market include the high initial investment costs for implementing PAM systems, the complexity of integrating new technologies with existing infrastructure, and the need for skilled personnel to manage these systems effectively.

What opportunities exist in the Plant Asset Management (PAM) Market?

Opportunities in the Plant Asset Management (PAM) Market include the growing demand for digital transformation in industries, advancements in AI and machine learning for predictive analytics, and the increasing emphasis on sustainability and energy efficiency in asset management.

What trends are shaping the Plant Asset Management (PAM) Market?

Trends shaping the Plant Asset Management (PAM) Market include the rise of cloud-based PAM solutions, the integration of advanced analytics for better decision-making, and the increasing use of mobile applications for real-time asset monitoring and management.

Plant Asset Management (PAM) Market

| Segmentation Details | Description |

|---|---|

| Offering | Software, Services |

| Deployment Mode | On-Premises, Cloud |

| End User | Chemicals, Oil & Gas, Power, Water & Wastewater, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Plant Asset Management (PAM) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at